Today was a happy shopping day.

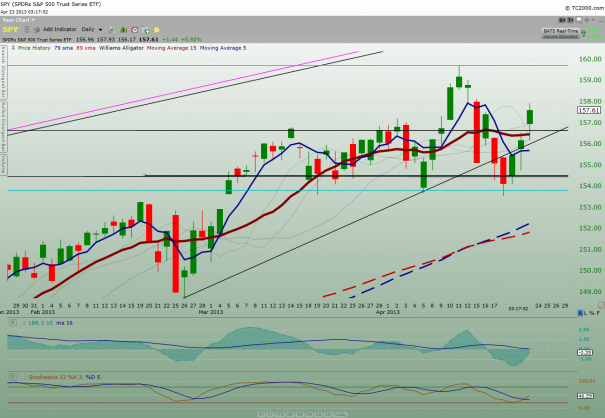

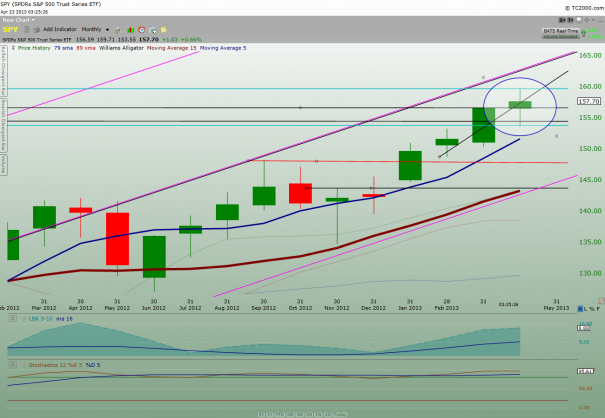

Market opened positive but slid into yoyo action b/w positive and negative during the first few hours.

Meanwhile, my first order of business was to watch $AAPL. I had my position that turned from a healthy profit after earnings announcement into a loss before market open this morning. Instead of dumping at market open which is my usual MO, I decided to wait and find a point to put my stop loss below overnight or intraday low. Lo and behold, $AAPL took off after a few hiccups and I immediately moved my trailing stop along so as to protect myself from any sudden downside reaction. Luckily, price continued upward and I used the 3min chart to guide me on the trailing stop. By the time I was stopped out, not only did I not have to take a loss but ended the day taking home a decent profit. Afterward, I left $AAPL alone because this stock still has issues for people to deal with.

$AMRN was my other stock I was keeping a close look because I bought add’l shares for my swing trade yesteraday and I didn’t want it to exacerbate my current drawdown. Unfortunately for me, prices continued to head south so I dumped my swing trade position plus some that would reduce my core position by 30%. I then watched $AMRN to settle down on the falling prices. When it looked like it was about to bounce, I pounced back in. I bought back my 30% and later on added more at price seemed to stabilize. Yes, there are shares that are meant to be swing trades in the portfolio.

I moved my stop on $GLUU to breakeven since price took out half-way point of yesterday bar. I was stopped out. Later, when prices looked bouncy, I bought back half the shares. Near the end of day, prices were showing strength so I bought back the other half I sold earlier plus some. I added more because today recovery strengthened yesterday breakout pattern.

While watching $AAPL and $AMRN in the early morning hours, I also paid attention to $BCRX. Although price action had not taking off at the time I was watching it, I sensed the underlying energy behind $BCRX and I just had to buy it. Without hesitation, I bought some and when prices started to move, I added more. I kept on adding until I got to the position size I wanted to be in. I didn’t hesitate because the chart looked mighty good on the symmetrical triangle breakout.

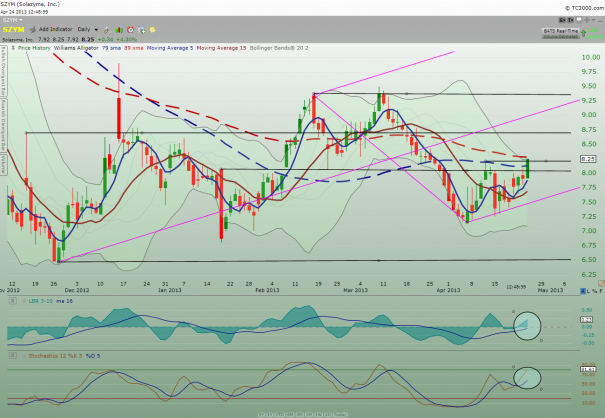

Meanwhile, I was happy to see $SZYM price action staying above the $8 price support. As price continued to struggle b/w $8.08 and $8, I continued to watch. The next time price get near the $8.08 again, I added to my $SZYM position. Price did not start the strong rally then but I l was too occupied with other stocks that I left it alone. Lo and behold, $SZYM turned out later to be one of the strongest stock to rack up a nice percentage gain (the other two are $BCRX and $RBCN). I was glad to add $SZYM.

I saw $CHK chart and price action broke out of the downtrend line so I bought a starter position.

Later, I also bought $WPRT to complement my purchase of $CHK.

Seeing $CCJ had a strong rally, I decided to buy $DNN instead since it has a tendency to run faster than $CCJ.

I saw The FLY post on $RBCN and decided to look at the chart. I like what I saw and bought a starter position. Later on, seeing that prices weren’t retracing much, I decided to add more instead of waiting around for a cheaper price.

Vertigo alerted me again on $PPC and after watching it a bit, I decided to buy a starter position. The size is smaller than the first time I bought not too long ago. I wanted to see if there is any follow thru before adding more.

All in all, today is a good day for my portfolio with $SZYM and $BCRX gaining a lot of ground for me. Because I got in late on $RBCN, I will have to wait for follow-thru price action to rack up gain. I’m satisfied with my new $AMRN position size and look forward for price action to bottom out from here so I don’t have to pare down my position size on $AMRN to get rid of the swing trade.

Current holdings:

AMRN LRAD, SZYM, TINY, RBCN, GLUU, BCRX, CHK, WPRT, DNN, PPC and 25% cash.

@tradingmy2cents

The trades I made in the journal were time-stamped in twitter

Comments »