In the morning, I bought a starter position on $BBRY below $15 and put a stop below the low of the day; so far, I haven’t been stopped out yet. This is good news. If it starts to move up next week, I’ll add more. For some reason, I believe in the come-back of $BBRY; maybe because Blackberry products has always been a quality products used by millions before $AAPL iphone dethrones them.

$AAPL was strong all day despite the Samsung Galaxy S4 fanfare. That suit me just fine since I’m already long. I actually added more since price action took out the $439 previous 3/11 pivot high. Will I be able to ride this one all the WAY up this time? Hmmm… I’ll be bringing my trailing stop with me on this one.

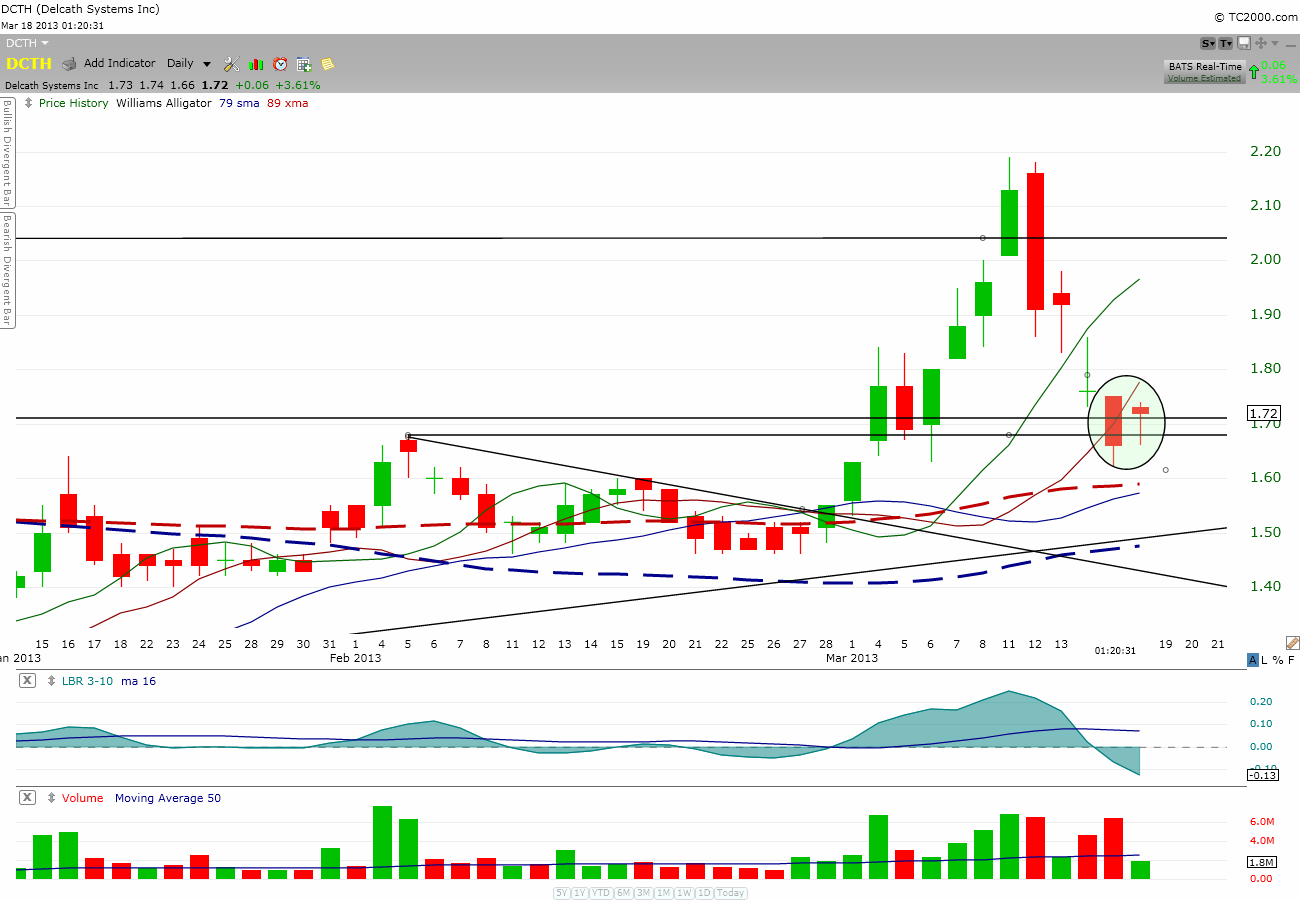

I also bought back $PACB since I saw the bounce on the chart. Unlike $DCTH which continues to head south due to the heavy burden of dilution, $PACB doesn’t have that baggage.

There were some bids at CGEN so I peeled another layer off by selling some more to reduce my position size. Yes, I took loss on that as well.

Remember, to take loss on your own term means you are salvaging back your cash for other opportunities. By taking loss on both $DCTH & $PACB yesterday, I save myself from further grief with $DCTH but still have the ability to get back in $PACB for the bounce.

Did you see how $USU tanked deeper in the last hour today? This is further proof that taking loss earlier can save your ass big times. Stop worry about selling at the bottom because you can always buy back (albeit a bit higher price, so what?). Learn to worry how much more you can get hurt; by thinking this way, you can move quickly to cut your loss sooner.

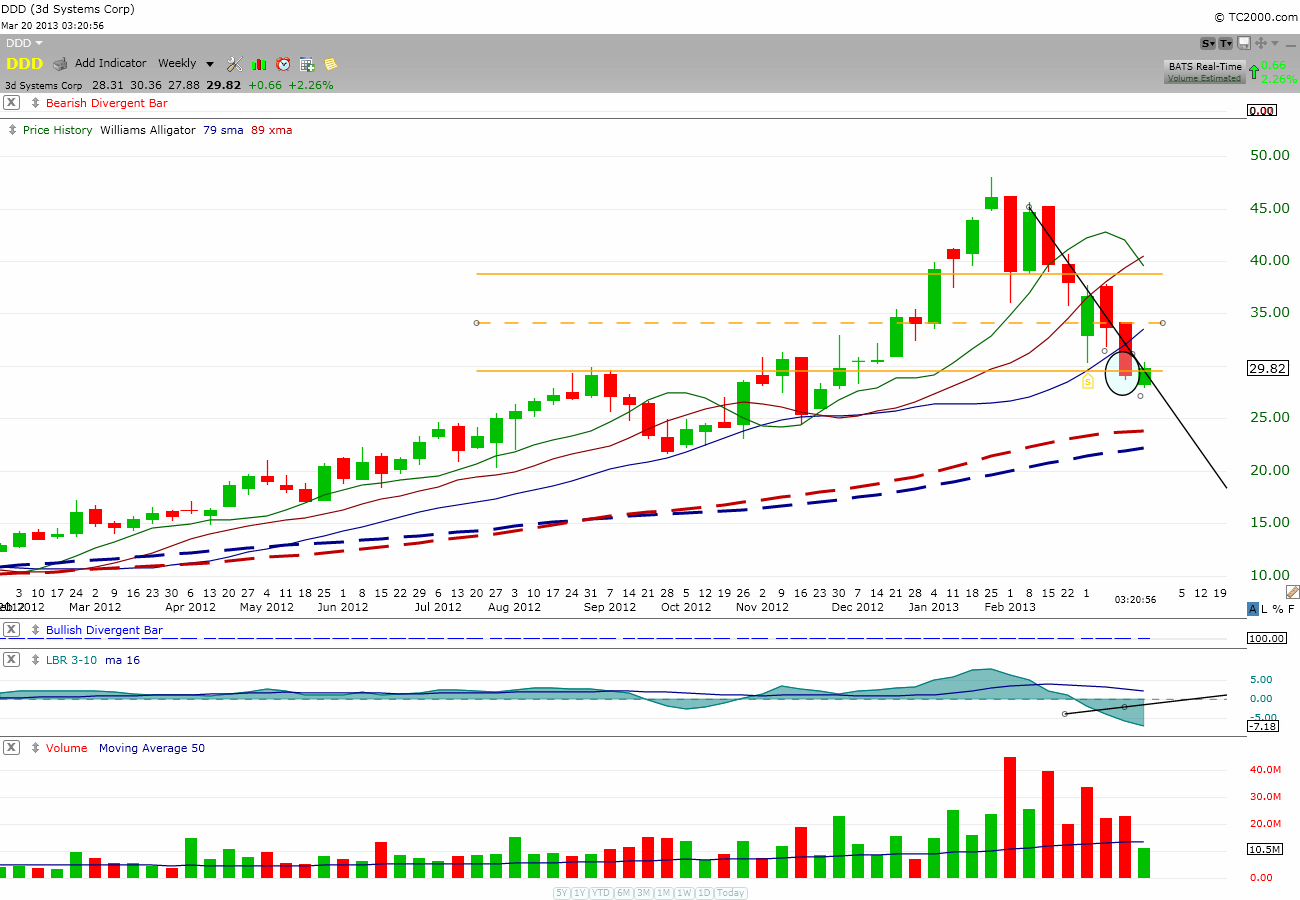

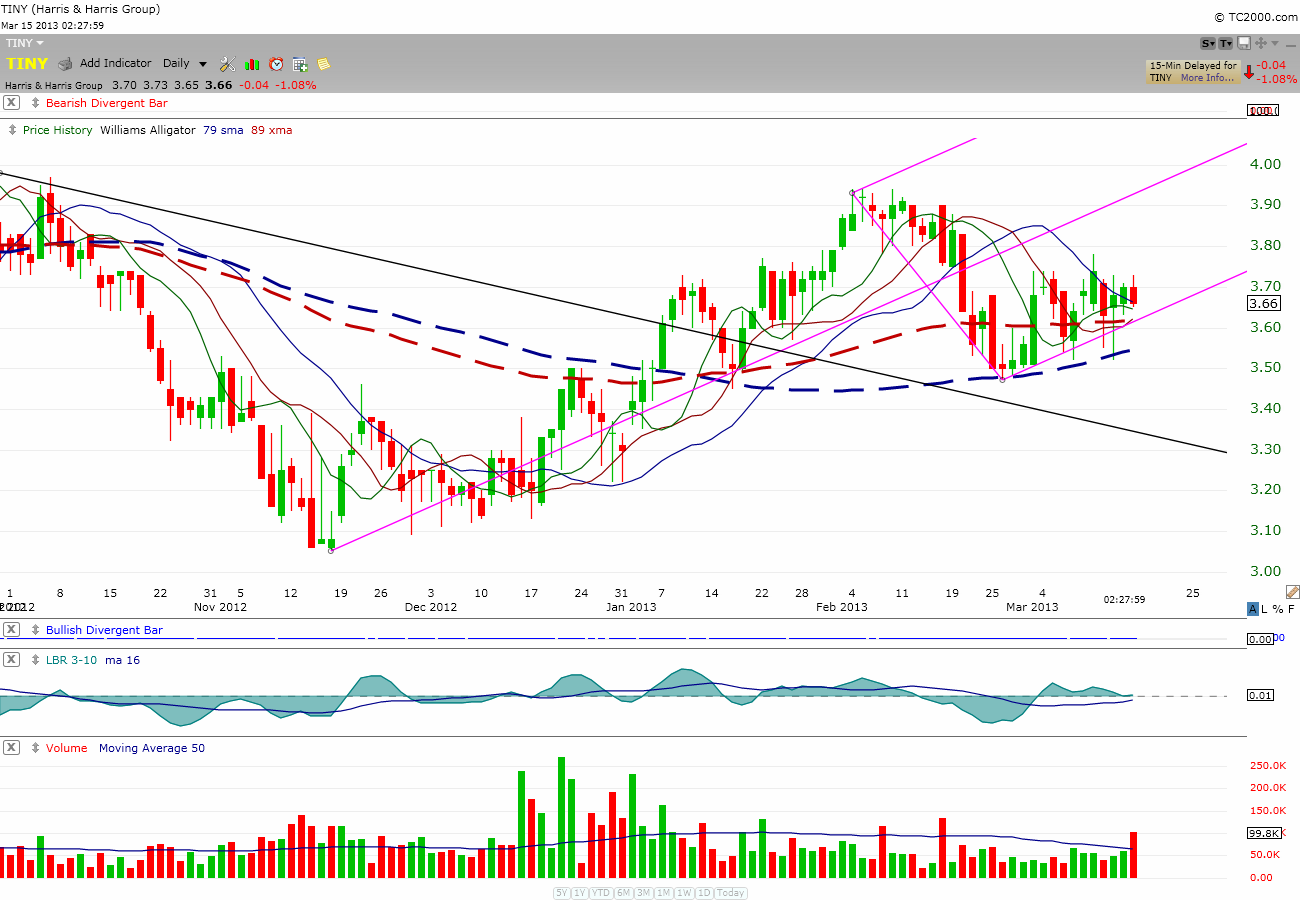

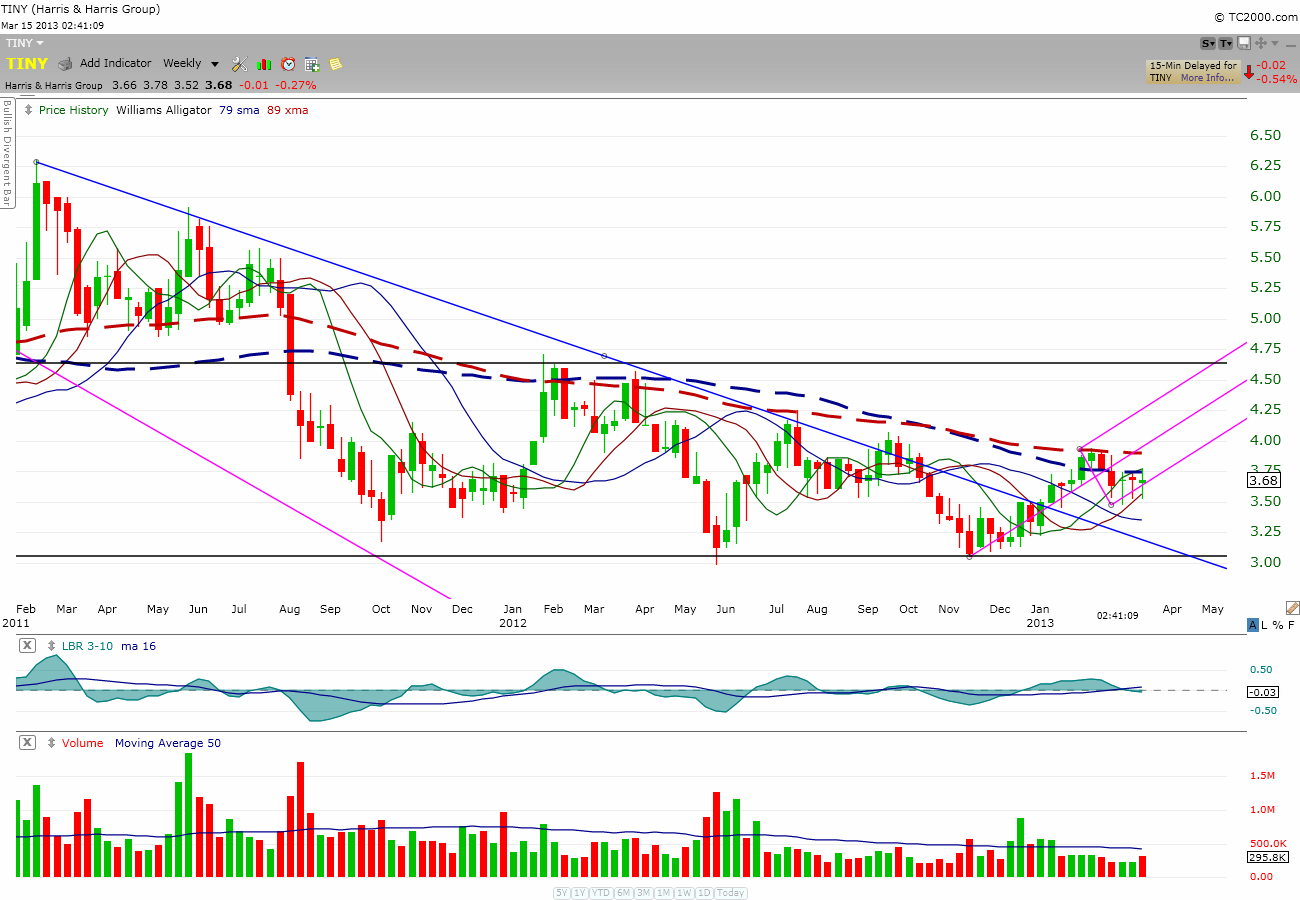

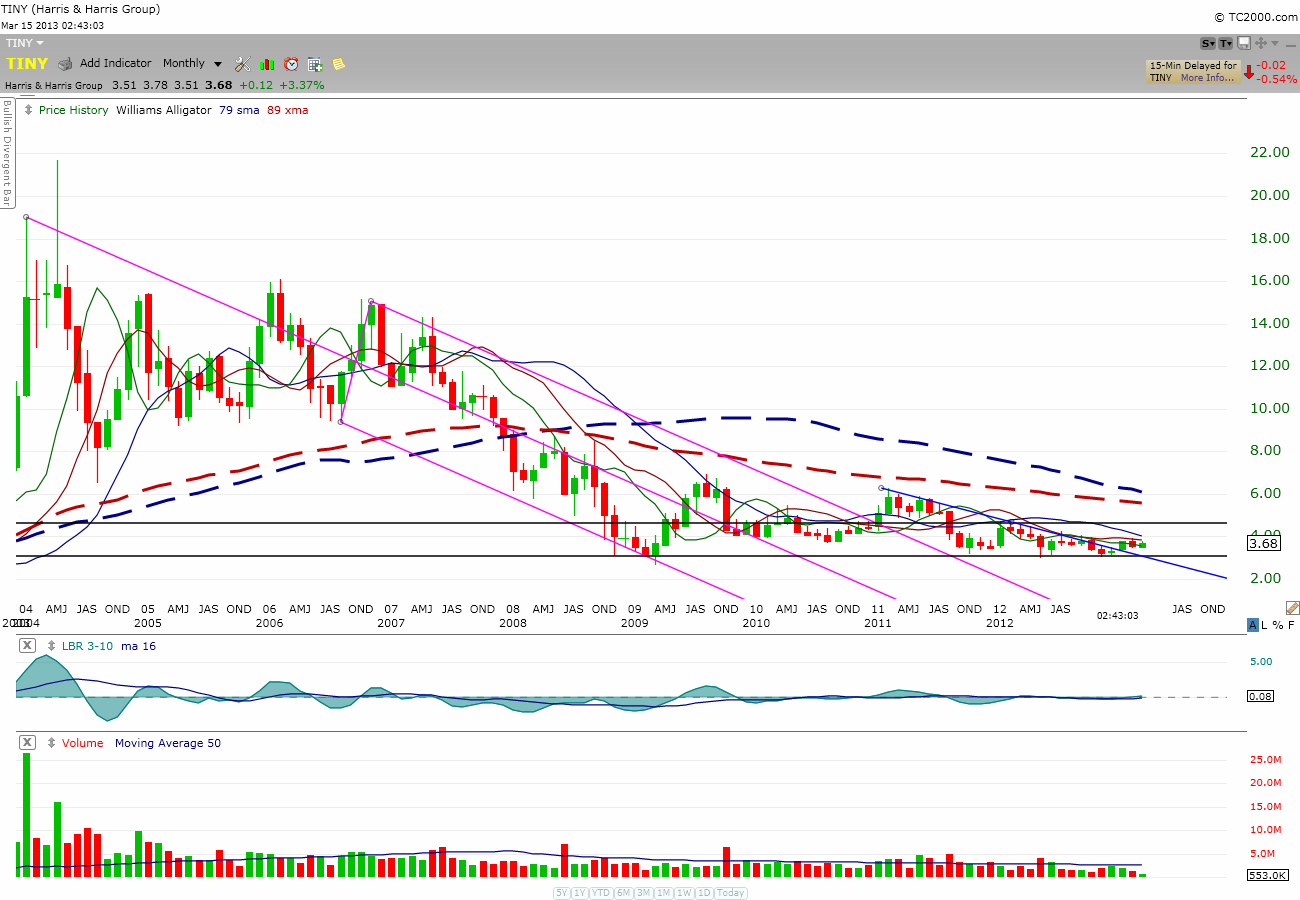

And I started to build my position on $TINY. I believe nanotechnology may be replacing the 3D printer as the next popular science focus. Did you see how $DDD fall from the grace. Ouchie for those who still holds it.

I’m thinking of replacing my former $USU position play with $TINY. Let see how it goes.

Since $CDXS is related to $SZYM, both were disappointing today but I can understand the hesitation of the market participants in this sector. More patience is needed. I’ve learned my lesson in trading this one too often. Now, these two “may” be another longer term hold. Not because I don’t want to take loss (my loss is insignificant at this point) but to allow more room for this to move. The more we move into the future, the more REAL $SZYM is. This is due to the availability of facilities coming online to produce the bio-fuel in size. In other words, I’m going to sit through the volatility for the coming wake-up call to higher price.

$HW continues its slow ascend; therefore no action is required.

All uranium positions are doing great today, especially $DNN, so no action is required.

Both $LRAD & $AMRN are up; so my portfolio are coming back up slowly.

Currently holding:

LRAD, AMRN, SZYM, AAPL, HW, TINY, DNN, IMUC, PACB, CCJ, CDXS, URA, CGEN, BBRY and 17% cash.

My 2 cents.

Comments »