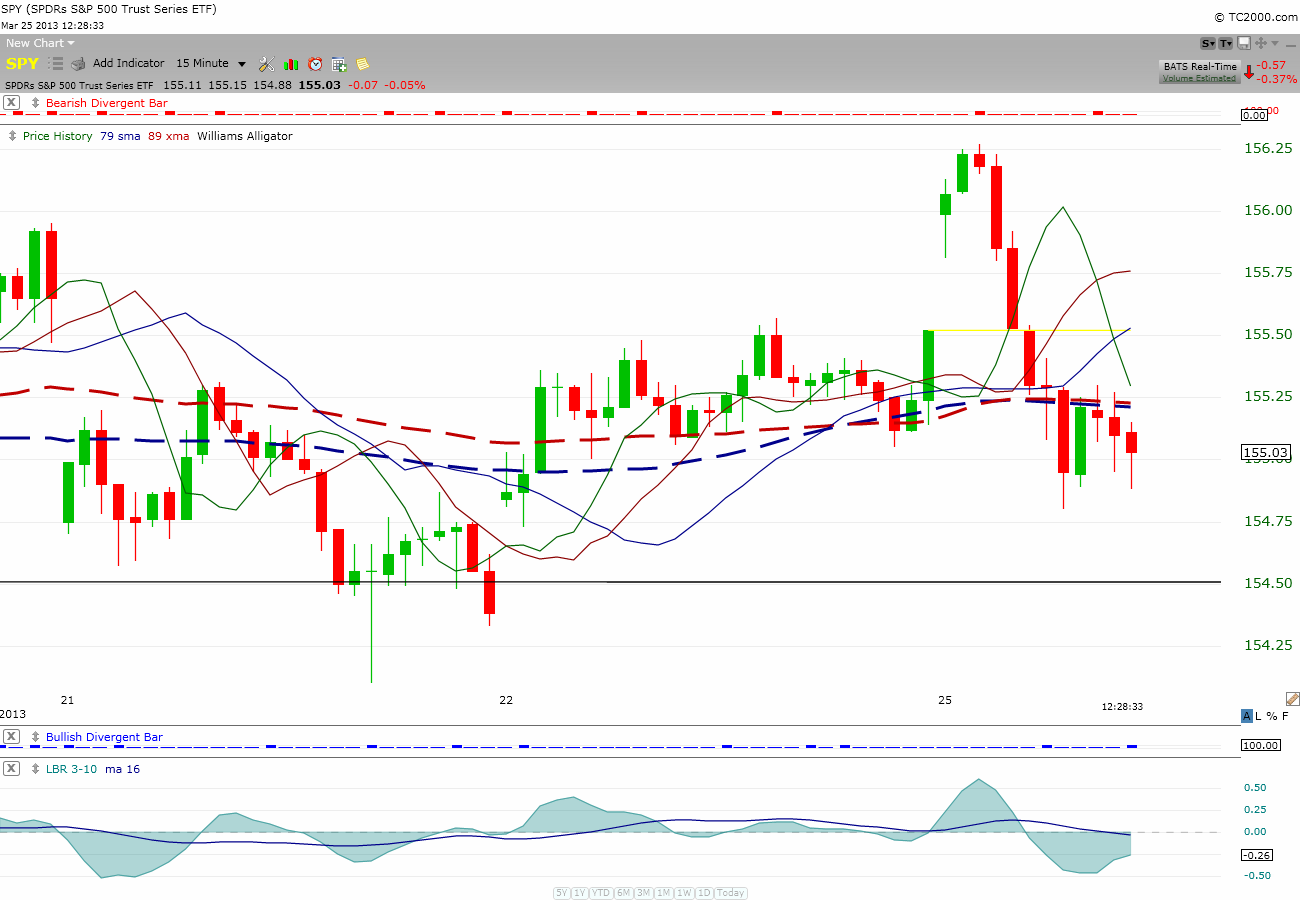

Wait a minute, wasn’t there supposed to be bear around here? Where did it go?

If the Bull can continue to piss on the bear then the bear may finally get the message- the BULL will take the GW2 by end of this week!

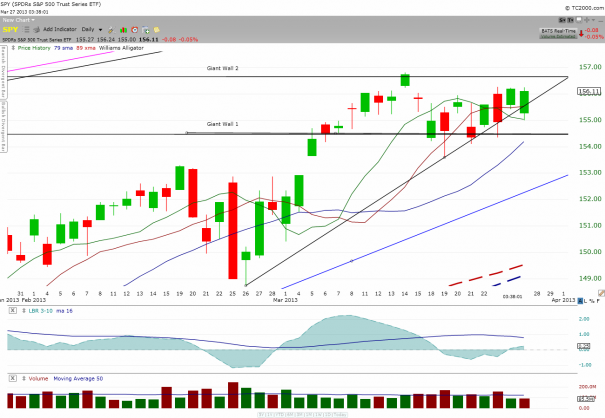

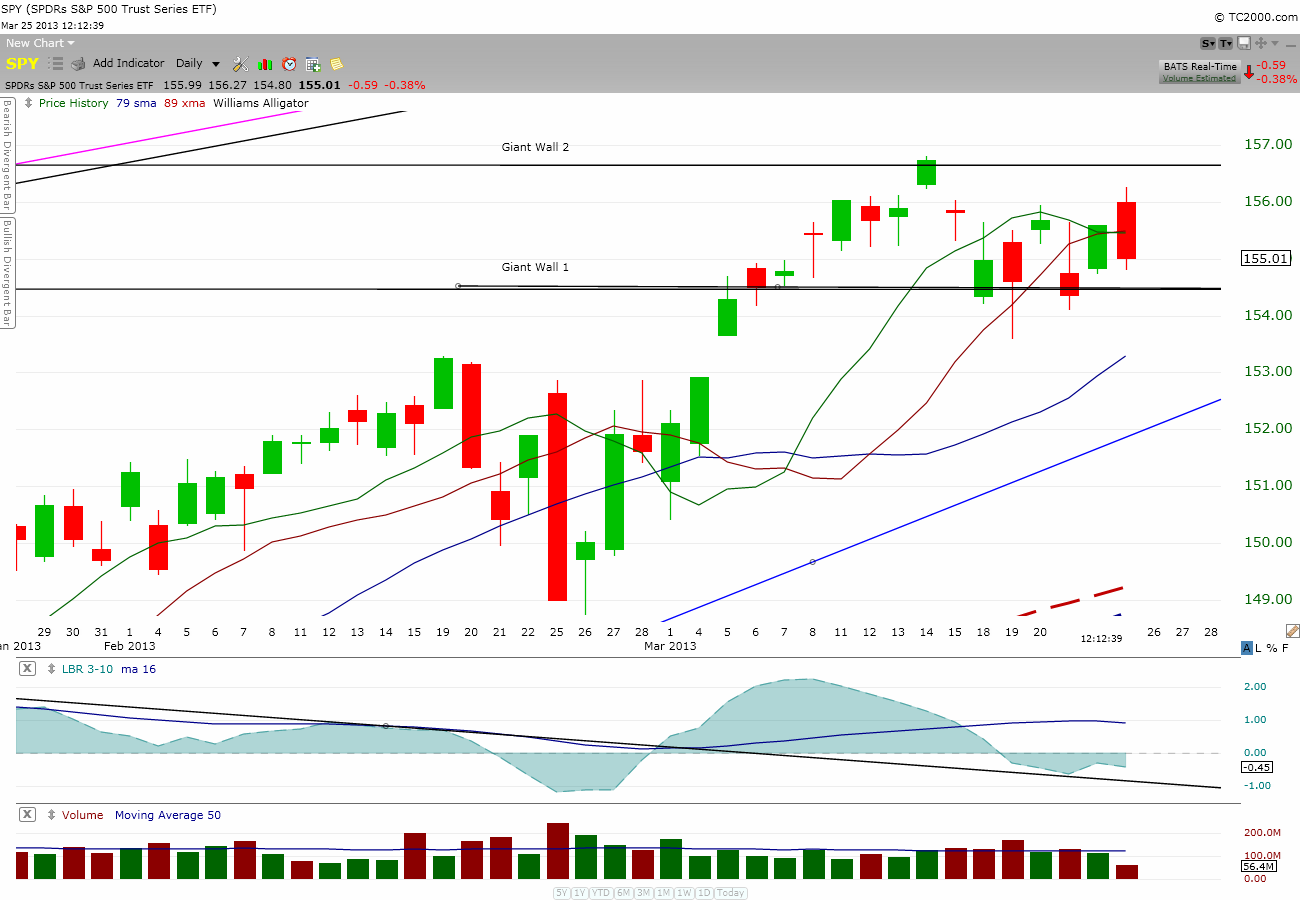

Take a look at the $SPY daily chart below:

Does it look like the bear is in control? No? I see more green bars than red. Not only that, I see the uptrend is still inside the uptrend line. On closer look, we are ALMOST there at GW2!

Get ready to celebrate an historical event of our mankind driving the stock market into an historical high again.

Yipee YapaDoo!

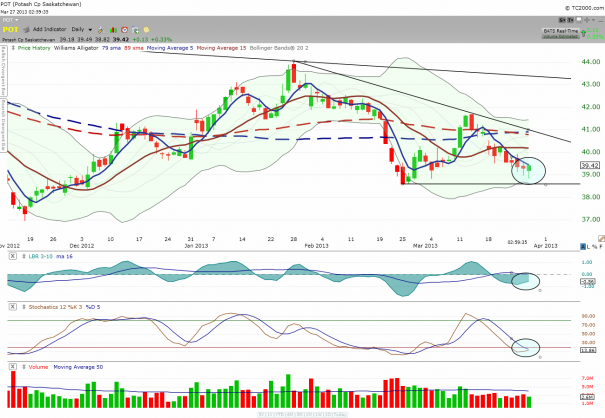

Oh, don’t mind me, I’ve been smoking too much $POT…

My 2 cents.

Comments »