Before we begin the discussion of ego and how we can make it work with us instead of against us, let me present a philosophical discussion by one of our deep thinker below regarding our mind:

What is mind?

Mind is not a thing, but an event. A thing has substance in it, an event is just a process. A thing is like a rock, and event is like a wave- it exists, but is not substantial. It is just the event between the wind and the ocean, a process, a phenomenon.

This is the first thing to be understood, that mind is a process like a wave or like a river, but it has no substance in it. If it has substance, then it cannot be dissolved. If it has no substance, it can disappear without leaving a single trace behind.

When a wave disappears into the ocean, what is left behind? Nothing, not even a trace. So those who have known, they say mind is like a bird flying into the sky- no footprints are left behind, not even a trace. The bird flies but leaves no path, no footprints.

The mind is just a process. In fact, mind doesn’t exist- only thoughts, thoughts moving so fast that you think and feel that something exists there in continuity. One thought comes, another thought comes, another, and they gone… the gap is so small you cannot see the interval between one thought and another. So two thoughts become joined, they become a continuity, and because of that continuity you think there is a mind.

There are thoughts- no “mind.” Just as there are electrons- no “matter.” Thought is the electron of the mind. Just like a crowd… a crowd exists in a sense, doesn’t exist in another. Only individuals exist, but many individuals together give the feeling as if they are one. A nation exists and exists not- only individuals are there. Individuals are the electrons of a nation, of a community, of a crowd.

Thought exist- mind doesn’t exist; mind is just the appearance. And when you look into the mind deeper, it disappears. Then there are thoughts, but when the “mind” has disappeared and only individual thoughts exist, many things are immediately solved. The first thing is that immediately you come to know that thoughts are like clouds- they come and go, and you are the sky. When there is no mind, immediately the perception comes that you are no longer involved in the thoughts- thoughts are there, passing through you like clouds passing through the sky, or the wind passing through the trees. Thoughts are passing through you , and they can pass because you are a vast emptiness. There is no hindrance, no obstacle. No wall exists to prevent them; you are not a walled phenomenon. Your sky is the infinitely open; thoughts come and go. And once you start feeling that thoughts come and go, and you are the watcher, the witness, the mastery of the mind is achieved.

Mind cannot be controlled in the ordinary sense. In the first place, because it is not, how can you control it? In the second place, who will control the mind? Because nobody exists beyond the mind- and when I say nobody exists, I mean that nobody exists beyond the mind, a nothingness. Who will control the mind? If somebody is controlling the mind, then it will only be only a part, a fragment of the mind controlling another fragment of the mind. That is what the ego is.

Mind cannot be controlled in that way. It is not, and there is nobody to control it. The inner emptiness can see but cannot control. It can look but cannot control- but the very look is the control, the very phenomenon of observation, of witnessing, becomes the mastery because the mind disappears.

Mind is nothing but the absence of your presence. When you sit silently, when you look deep into the mind, the mind simply disappears. Thoughts will remain, they are existential, but mind will not be found.

But when the mind is gone, then a second perception becomes possible: you can see that thoughts are not yours. Of course they come, and sometimes they rest a little while in you , and then they go. You may be a resting place, but they don’t originate in you. Have you ever noticed that not even a single thought has arisen out of you? Not a single thought has come through your being; they always come from the outside. They don’t belong to you- rootless, homeless, they hover. Sometimes they rest in you, that’s all, like a cloud resting on top of a hill. Then they will move on their own; you need not do anything. If you simply watch, control is attained.

The word control is not very good, because words cannot be very good. Words belong to the mind, to the world of thoughts. words cannot be very, very penetrating; they are shallow. The word “control” is not good because there is nobody to control and there is nobody to be controlled. But tentatively, it helps to understand a certain thing that happens: when you look deeply, mind is controlled- suddenly you have become the master. Thoughts are there, but they are no longer masters of you. They cannot do anything to you, they simply come and go; you remain untouched just like a lotus flower amidst rainfall. Drops of water fall on the petals but they go on slipping, they don’t even touch. The lotus remains untouched.

That’s why in the East the lotus became so significant, became so symbolic. The greatest symbol that has come out of the East is the lotus. It carries the whole meaning of the Eastern consciousness. It says, “Be like a lotus, that’s all. Remain untouched and you are in control. Remain untouched and you are the master.”

So from one standpoint, the mind is like waves- a disturbance. when the ocean is calm and quiet, undisturbed, the waves are not there. When the ocean is disturbed in a tide or strong wind, when tremendous waves arise and the whole surface is just a chaos, the mind from one standpoint exists. These are all metaphors just to help you to understand a certain quality inside, which cannot be said through words. These metaphors are poetic. If you try to understand them with sympathy, you will attain an understanding, but if you try to understand them logically, you will miss the point. They are metaphors.

Mind is a disturbance of consciousness, just as waves are a disturbance of the ocean. Something foreign has entered- the wind. Something from the outside has happened to the ocean, or to the consciousness- the wind, or the thoughts, and there is chaos. But the chaos is always on the surface. The waves are always on the surface. There are no waves in the depths- cannot be, because in the depths the wind cannot enter. So everything is just on the surface. If you move inward, control is attained. If you move inward from the surface you go to the center- suddenly, the surface may still be disturbed but you are not disturbed.

The whole of the science of meditation is nothing but centering, moving toward the center, getting rooted there, abiding there. And from there the whole perspective changes. Now the waves may still be there, but they don’t reach you. And now you can see they don’t belong to you, it is just a conflict on the surface with something foreign.

And from the center, when you look, by and by the conflict ceases. By and by you relax. By and by you accept that of course there is a strong wind and waves will arise, but you are not worried, and when you are not worried, even waves can be enjoyed. Nothing is wrong in them.

The problem arises when you are also on the surface. You are in a small boat on the surface, and a strong wind comes and it is high tide and the whole ocean goes mad- of course, you are worried, you are scared to death! You are in danger; any moment the waves can overturn your small boat; any moment death can occur. What can you do with your small boat? How can you control anything? If you start fighting with the waves, you will be defeated. Fight wont’ help; you will have to accept the waves. In fact, if you can accept the waves and let your boat, however small, move with them and not against them, then there is no danger. Waves are there; you simply allow. You simply allow yourself to move with them, not against them. You become part of them. Then tremendous happiness arises.

That is the whole art of surfing- moving with the waves, not against them. With them- so much so, that you are not different from them. Surfing can become a great meditation. It can give you glimpses of the inner because it is not a fight, it is a let-go. Once you know that, even waves can be enjoyed… and that can be known when you look at the whole phenomenon from the center.

Just as if you are a traveler in the forest and clouds have gathered, and there is much lightning, and you have lost the path and you are trying to hurry toward home. This is what is happening on the surface- a traveler lost, many clouds, much lightning; soon there will be a tremendous rain. You are seeking home, the safety of home- then suddenly you reach there. Now you sit inside, now you wait for the rains- now you can enjoy. Now the lightning has a beauty of its own. It was not so when you were outside, lost in the forest, but now, sitting inside the house, the whole phenomenon is tremendously beautiful. Now the rain comes and you enjoy. Now the lightning is there and you enjoy, and great thunder in the clouds, and you enjoy because now you are safe inside.

Once you reach the center, you start enjoying whatsoever happens on the surface. So the whole thing is not to fight on the surface, but rather slip into the center. Then there is mastery, and not a control that has been forced, a mastery that happens spontaneously when you are centered.

Centering in consciousness is the mastery of the mind.

So don’t try to “control the mind”- the language can mislead you. Nobody can control, and those who try to control will go mad; they will simply go neurotic, because trying to control the mind is nothing but a part of the mind trying to control another part of the mind.

Who are you, who is trying to control? You are also a wave- a religious wave of course, trying to control the mind. And there are irreligious waves- there is sex and there is anger and there is jealousy and possessiveness and hatred, and millions of irreligious waves. And then there are religious waves- meditation, love, compassion.But these are all on the surface, of the surface, and on the surface. Religious or irreligious makes no difference.

Real religion is at the center, and in the perspective that happens through the center. Sitting inside your home, you look at your own surface- everything changes because your perspective is new. Suddenly you are the master. In fact, you are so much in control that you can leave the surface uncontrolled. This is subtle- you are so in control, so rooted, not worried about the surface, that in fact you can enjoy the waves and the tides and the storm. It is beautiful, it gives energy, it gives a strength- there is nothing to be worried about it. Only weaklings worry about thoughts. Only weaklings worry about the mind. Stronger people simply absorb the whole, and they are richer for it. Stronger people simply never reject anything.

If you have read all the way here, I congratulate you. You have the motivation and interest to learn.

If you’ve skipped the reading, either half-way or from the beginning, then you are impatient and is only looking for quick fix that interest you. From my experience, you may not have the commitment to improve yourself in a way that you can master the skill you need to trade successfully.

If you’ve skipped the material above because you already know the material (either from a book you own or borrow), a big congratulation is in order.

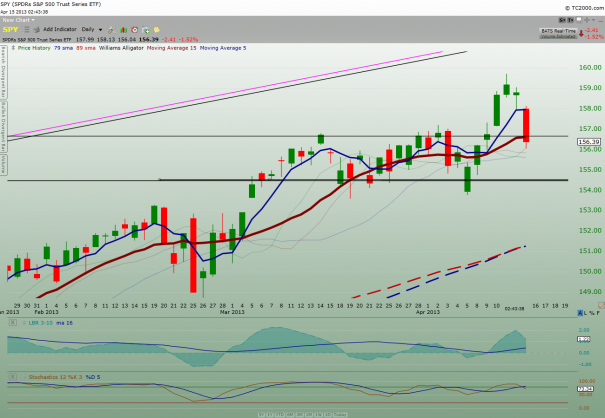

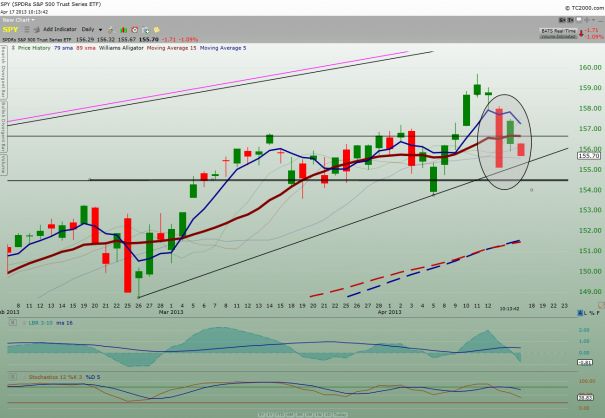

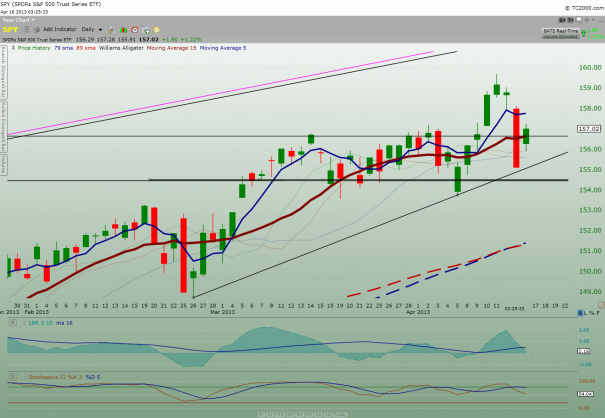

Remember the part about centering? That where we all want to go as a trader. When you are centered, you look out the window and you see all the volatile price action; so, instead of being in the middle of a storm where you will be subjected to all sort of emotional responses which can prevent you to make the right decision, you are in the perfect calm stage to make the right decision by getting out when you see price action is going against your entry point. In other words, you will be in a state of mind that allows you to cut your losses quickly.

I will discuss more of how we can approach our center in the future “Where Ego Dares” series. Yes, I borrow the title from the movie called “Where Eagles Dare” starring Richard Burton, Clint Eastwood.

And for those who are interested, the philosophical discussion of the mind is an excerpt from a book by Osho.

![[Muse]](http://stockcharts.com/images/minilink_sc.gif)