Last time, in Osho’s essay, he postulated that The Mind is nothing more than a continuous thought process.

Key components: continuous + thought + process

Let’s start with thought.

What is thought, really?

The moment you utter a word in any language in your head, you have thought.

Why do we have thought?

I believe the three items below encompass the majority of the reasons

- we want something

- we describe something

- intuition

1) We want something

You are walking in the woods and you feel an urge to pee. “I’ve got to find a place to pee.” becomes your thought.

2) We describe something

While looking for a place to pee, you’re thinking, “there are some tall bushes over there I can hide while I pee”.

3) Intuition

“Wait a minute, something doesn’t feel right over there,” becomes your thought as you approach the area.

I’m sure you can come with some other reason why we have thought; but most likely they can fall into one of the three categories above.

What if I’m solving a problem?

This is an interesting question! You know why? Because the thought involves in solving a problem can morph from one of the three to another.

First, you describe the problem, then you want the problem solves. Later, your answer to the problem comes from your intuition.

While the three examples above are in extreme simple form, these three drivers of our thought are able to weave a continuous complex thought process in our head that gives birth to our mind.

Now, we have body and mind.

What is the deal with body and mind?

Well, our mind, being a complex thought process we weave together in the language of our creation, happens to be “floating like a cloud” as a result of the neuron firing process in our brain which is the command center of our body.

So, when the mind says jump, our body jumps. When the mind says cry because it is thinking of a painful situation, tears come out of our eyes.

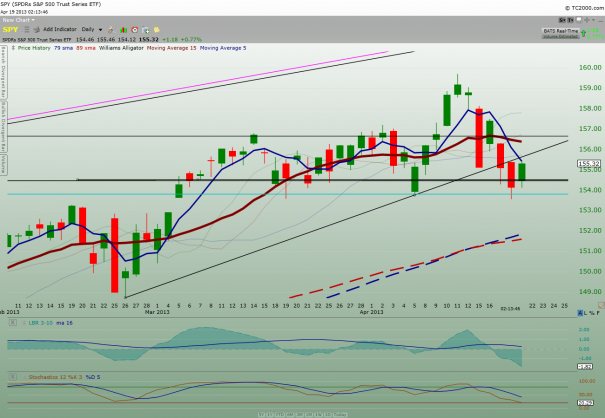

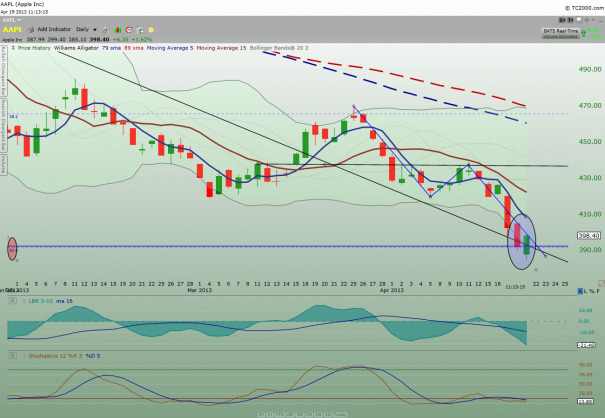

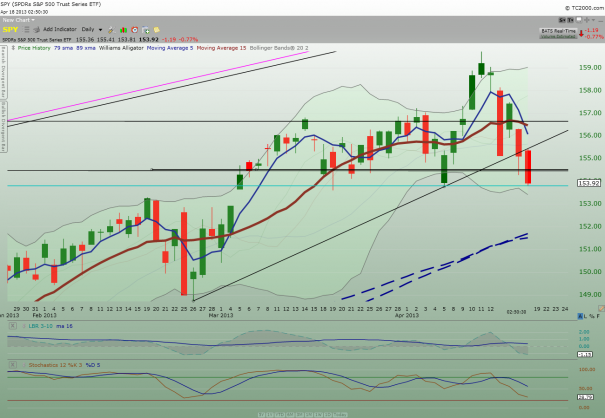

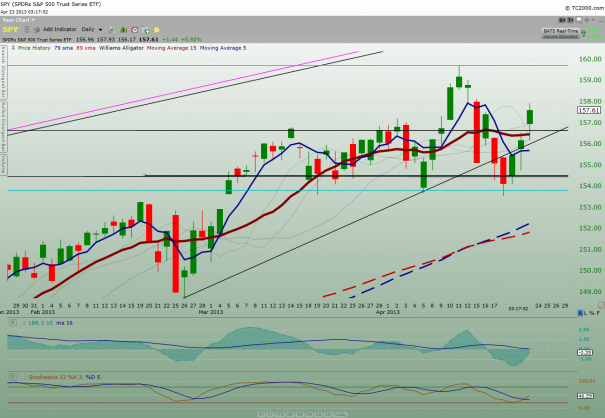

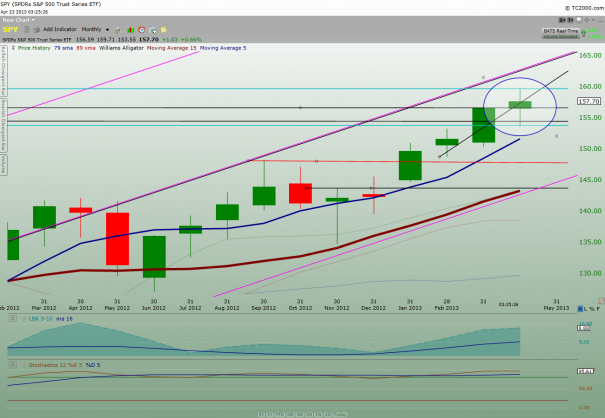

“Impossible! This sure-winner stock dropped like a rock right after I bought!” When you think this, your body goes through the emotional state of disbelief and even anger and yet you decide to buy more to average down.

Here is another way to express your thought in the same situation, “Jeez stock dropped like a rock after I bought, I’m getting out right now!” Your body goes through the emotion of relief for getting out of the stock pronto.

You can obviously see the big difference between the two thoughts above.

How do one ends up picking either one of the above thoughts then?

Excellent question!

This is where your ego comes into the picture.

Before moving on with the discussion of ego, remember this from Osho?

If somebody is controlling the mind, then it will only be only a part, a fragment of the mind controlling another fragment of the mind. That is what the ego is.

So you have a thought process that creates a mind that says “this stock has to go up because my analysis of the fundamental is corrected” even though the stock price has been declining for the last month. This mind creates stubbornness in you..

Meanwhile, you have another set of thought process that creates a separate mind that says, “OMG! How can it be? My money is losing fast and I may be getting a margin call soon if I don’t do something!” This mind creates fear in you.

Now, you have “a fragment of the mind controlling another fragment of the mind”

– I am right against fear of loss

or

– stubbornness against fear.

When these two minds in us collide with equal force, you have created a “deer in the headlights” situation- you are effectively frozen in action.

Going back to the two earlier examples:

“Impossible! The sure-winner stock dropped like a rock right after I bought!” When you think this, your body goes through the emotional state of disbelief and even anger and yet you decide to buy more to average down.

Which part of the mind has control in the above example? Yes, the “I am right” mind.

Here is another way to express thought in the same situation, “Jeez stock dropped like a rock after I bought, I’m getting out right now!” Your body goes through the emotion of relief for getting out of the stock pronto.

Which part of the mind has control in the above example? Yes, the “fear of loss” mind.

So, at the end of the day, it is all depended on which part of the mind has more juice to back it up. In other words, the mind with more training and exposure usually win the day.

And which of the the mind do you think usually has control during the day?

You’ve got it, the “I am right” mind.

You know why?

It is how we are programmed to think by our society. We mimic the “I am right” mind of our parents, the school teachers, and all authority figures we want to become when we grow up.

While this “I am right” mind works wonderfully in our society and in the business world, it can be a hindrance when it comes to trading.

Therefore, our task as a trader/investor is to train our thought process in the direction of “fear of loss” mindset along with the art of following price action. In other words, we have to train this mindset so it becomes the dominant mind (aka ego) when it comes to making a final decision on the trade.

But it’s easier said than done.

Let me show you how I make it works for me.

Overtimes, I’ve engineered my “I am right” mind to work on my position trades and keep it busy there while I train my “fear of loss” mind to cut losses during swing trading. Yes, I disable the ability of the “I am right” mind to average down. To do a conditional average down, my “fear of loss” mind will be the one to take that trade.

So far so good.

The beauty is that my “I am right” mind is not dominating 100% of my portfolio which will be quite dangerous if it is.

That is all for today.

Btw, I did not come up with all the above thought process on my own. Since I’ve read many books in the past, I’m simply putting together thought processes from others in a way that works for me.

My 2 cents.

Comments »

![[Brcm]](http://stockcharts.com/images/minilink_sc.gif)