Today was a wake-up call day.

Market opened higher and I saw $FB opened higher as well. I’ve been watching $FB for the last few days but decide to hold off buying until earning comes out. With good positive AD revenues increase, price action may as well begin an uptrend from here. Giving positive price action today, I bought a starter position in the morning and added more later.

$AAPL was looking strong so I bought a starter position. With trend continuing on the upside, I added more later. However, by end of day, I’m back to breakeven position. I’ll see what happen tomorrow before deciding to keep or sell.

I think I’ve a fixation on $BCRX. Somehow, I keep thinking that this one will just blow up to the upside one day without warning; so I keep looking for reason to buy back shares I’ve sold to cut losses. I added a few times again today ’cause price was acting like it wanted to go up all morning. I’m still holding the positions I added today.

$GLUU gapped down and continued to go lower until it bounces off the support level at $2.75. I bought starter position and later added more. However, by market close, I got nervous over the earnings announcement (thanks to $MELA), I decided to unload 70% of my holdings from today purchase just to be on the safe side.

I was stopped out of my $$RBCN today for small losses.

$SZYM was acting very strong near the end of the day and I bought more when price went over $9.00. This stock is now my third largest position in the portfolio.

After reviewing the smart money top pick list, I found $CVI to be an attractive buy; therefore, I bought a starter position to see if price can climb back up to the $60 area. I’ll add more if price action continue to climb.

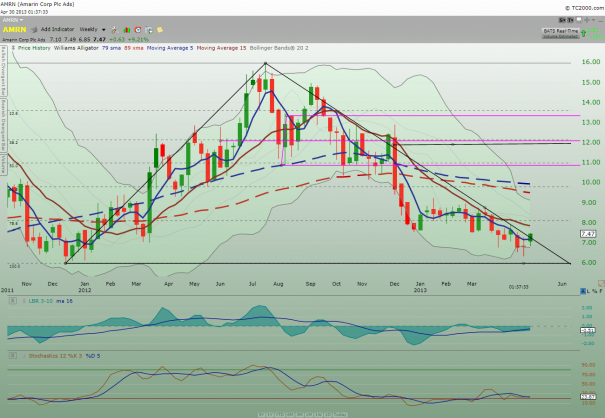

$AMRN was the big elephant today. Practically, the gain for the last three days was completely removed today. Pretty soon, I will have to face the prospect of selling out my swing trade position. What I had forgotten was that while I bought the swing trade position at the $6.4x area, I didn’t sell the swing trade position for profit when price action started to turn from $7.5x.. There is always the danger of mixing the swing trade with long-term position trade. I tend to get a bit more “greedy” to ride the swing trade beyond the proper swing trade protocol. Looking back, if I never have any position trade, I’ll be doing really good for the year. But then, I won’t be hitting any big win anytime soon either. It is so easy for my mind(s) to play the doubting game; thus it is important that I write down all my thought here so that I can see what is going on here.

Anyway, the focus is on what I need to do when $AMRN continues to head lower. I need to protect myself by getting out of my swing trade when my stops are hit. This is the wake-up call.

Current holdings:

AMRN, LRAD, SZYM, TINY, AAPL, FB, BCRX, CVI, GLUU and 26% cash.

The trades I made in the journal were time-stamped in twitter

Comments »