Today was a day to roll-the-dice.

Market opened down and then forged ahead with a hiccup during the day.

Meanwhile, I was, again, shaken out 80% of my $GLUU position when it turned south on the get go. Out of pure habit, I just dumped my $GLUU in block as price tanked. Later on, when I wasn’t looking, price action took off to the upside. Not to be cheated out of my position, I bought back 80% of my original position at a higher price. I like $GLUU as a potential long-term position; but I’ve yet to make up my mind. The future is all about tablets and mobile phones; I don’t see it any other way. $GLUU is all about gaming in mobile devices. The other side of the coin is that competition is fierce; nevertheless, $GLUU has a brand and experience.

I’ve a hard stop on my $KERX position and it was taken out. Glad to rid of it ’cause I don’t like to see my swing trade position to be in red for too many days.

$MNKD finally made my “chase” two days ago worth the effort. It took off big and I added more after it took out the $5 resistance. When the normal retracement after the initial burst was done, I added some more in the low $5.xx area. $MNKD is a high risk trade at this point for it is still waiting for FDA approval for its insulin inhaler. This could be a big winner if they can get FDA approval; who want to use needle for insulin if they can inhale instead?

$FB is reminding me of $SZYM. Price just would not take traction on the upside. When price took out the low of two days ago, I put a stop below the intra-day low to cut losses if the bounce failed. The bounce failed and I was stopped out. Moving on.

$NVAX was also another one that went the wrong way. Instead of putting a stop near intra-day low which would guarantee a filled, I decided to give this one a bit more time by placing a GTC stop below the trendline. If it bounces tomorrow, I will be fine.

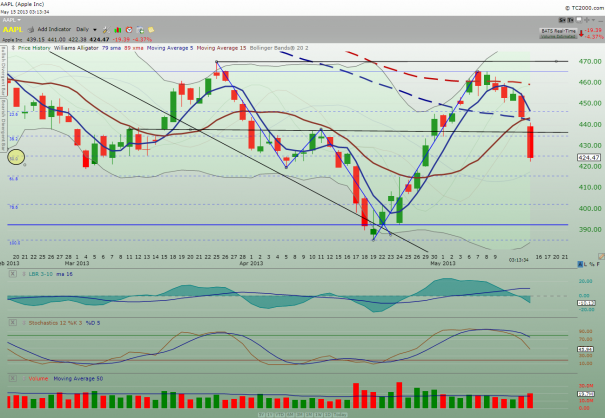

I was watching $AAPL waterfall and kept telling myself it was too late to short. However, when price took out the 50% fib retracement, I decided to short since my risk would be above $425.00, a tight stop literally. Well, to my surprise, price took out the $425 level and I was stopped out. When price continued upward, I took that the $425 Fib 50% line support was still in effect. So I bought some with a stop below $425.00. By market close, seeing that price did not do a waterfall, I added more hoping for a big bounce tomorrow.

Well, $AMRN had a hiccup today and my portfolio suffered a minor bump as a result. Oh well… I can’t help but notice that my portfolio contains quite a bit of high beta positions. Eventually, I will either get to see my stock god with my head on the block or sit on the white cloud with a big smile on my face. Hmmm….

Current holdings:

AMRN, LRAD, TINY, CERS, MNKD, GLUU, AAPL, NVAX and 30% cash.

@tradingmy2cents

The trades I made in the journal were time-stamped in twitter

Comments »