If the market turned south when you were 70% or higher loaded in equities, paper losses were forgone conclusion. However, you could manage your portfolio so that the losses would be controlled if the carnage continued.

I was fortunate to have the gut to chase $DUST by Friday close; thus, I was able to gain the profit to offset the losses I took this morning. I made several calls last week and only $DUST saved the day. The others were either going nowhere ($CERS, $APRI) or took the other direction of my calls ($PPC, $DNDN, $PACB). Was I upset?

Not really.

That was because I knew I was not a prophet who could foresaw price movements 100% of the time. My intuition, at best, would give me 51% win ratio. But the point here is not about how much winning picks versus losing picks. If you can accept this simple truth that none of us has the divine crystal ball to work with; then you can stop chastising yourself for not seeing the current carnage. Instead, spend the energy to manage your trades so you can prevent your portfolio from bleeding further.

As I had discussed this before, I used the “thought” of buying back my positions I sold today at a cheaper price later to give me the confidence to execute my trades to cut losses. Yes, I may be selling at the bottom but you cannot allow this “ego” thought to freeze you like a deer facing the headlight. You have to be “OK” to miss the “possible” late rally so that you will allow yourself to cut losses. Take a look at my $SZYM today. If I hadn’t taken my losses in the morning time, I would be sitting in a much bigger losses. Instead, I’m now salivating while waiting for the right time to buy back in for a much cheaper price.

Take heed to The Fly warning about averaging down today. If today down day is just a prologue; averaging down will be like opening your spigot to allow more of your blood to come out faster.

I’m not suggestion going all cash here. Portfolio management is simply a process to minimize the risk by reducing the hi-beta or non-performance stocks so that cash will be available to buy back stocks at cheaper price if ones are fully loaded.

Go with the flow, my friends, go with the flow.

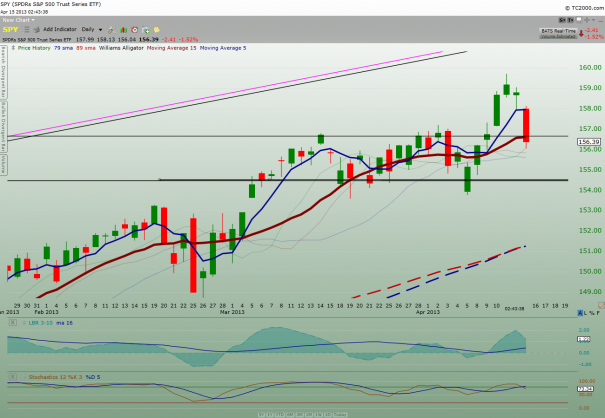

Now that I’ve done my mumble jumble on trade management. let’s take a look at the $SPY daily chart:

As you can see, today down day penetrates the support from year 2007 high. The next level of major support is the year 2000 high. If this 2000 high can hold the downdraft, we may still be stuck in a consolidation stage with the previous rally as an aberration. However, if the 2000 high fails to support price; further downdraft will be quite ugly. Yes, there is a lot of “ifs” here. This beg the question, why will you want to be fully loaded when there is a lot of “if’s” in the face of the current downside storm?

Do some of us forget that the beauty of the stock market is that you can open and close your positions at any times in the day when the stock market is opened? Why do you worry about holding stocks the way people are holding gold bar right now? For crying out loud, stocks are liquid and you can always buy back.

This post is meant for people who are having a hard time deciding what to do with the fully loaded position and is gnawing their teeth right now. If you are already managing your portfolio accordingly, my hat off for you.

Currently 57% cash.

My 2 cents.

If you enjoy the content at iBankCoin, please follow us on Twitter