At the open, SP500 was down only -14 when the night before it was -22+; therefore, it was actually a bullish open if you compared to last night. Nevertheless, after watching for a few minutes, I decided to sell the uranium based stocks first because these are usually the most susceptible during an international crisis.

Then I sold $HW simply because I believed the odd of profit-taking was high on this one during a general market correction.

Next, I put a protective stop on $BBRY under the Friday low but it got stopped out in no time.

$CGEN had been weak since I bought so I didn’t want to hold this one any longer especially in a market correction; thus, I just placed my sell order in pieces to sell the rest but was surprised I got some good fills as opposed to tanking the price.

Figuring that since I sold $CGEN, I might as well lighten up my biotech holding by selling $PACB as well.

I also felt I was over-weighted on $SYZM, carrying $CDXS seemed excessive so out it went.

$SZYM rallied first and I was impressed; then later it began to sell off back to even for the day. I decided it was time to lighten up so I could buy it back cheap later; so I sold 38% of my position.

Slowly the market began to turn.

Seeing that there was no 200 pts drop and that the SPY was actually moving up, I decided to buy back my $DNN for a price below my sales price this morning.

Then I saw the bounce on $DCTH and thought it was a good time to jump back in. There is only about a month and a half before FDA result, so I figured that this bounce could be the start of the next rally.

$CUR also looked good on the chart so I bought.

$IMUC was struggling but it still looked solid; so I leave it alone.

$BBRY went over $15 after I was stopped out so I bought back starter position after it came back to low $15.

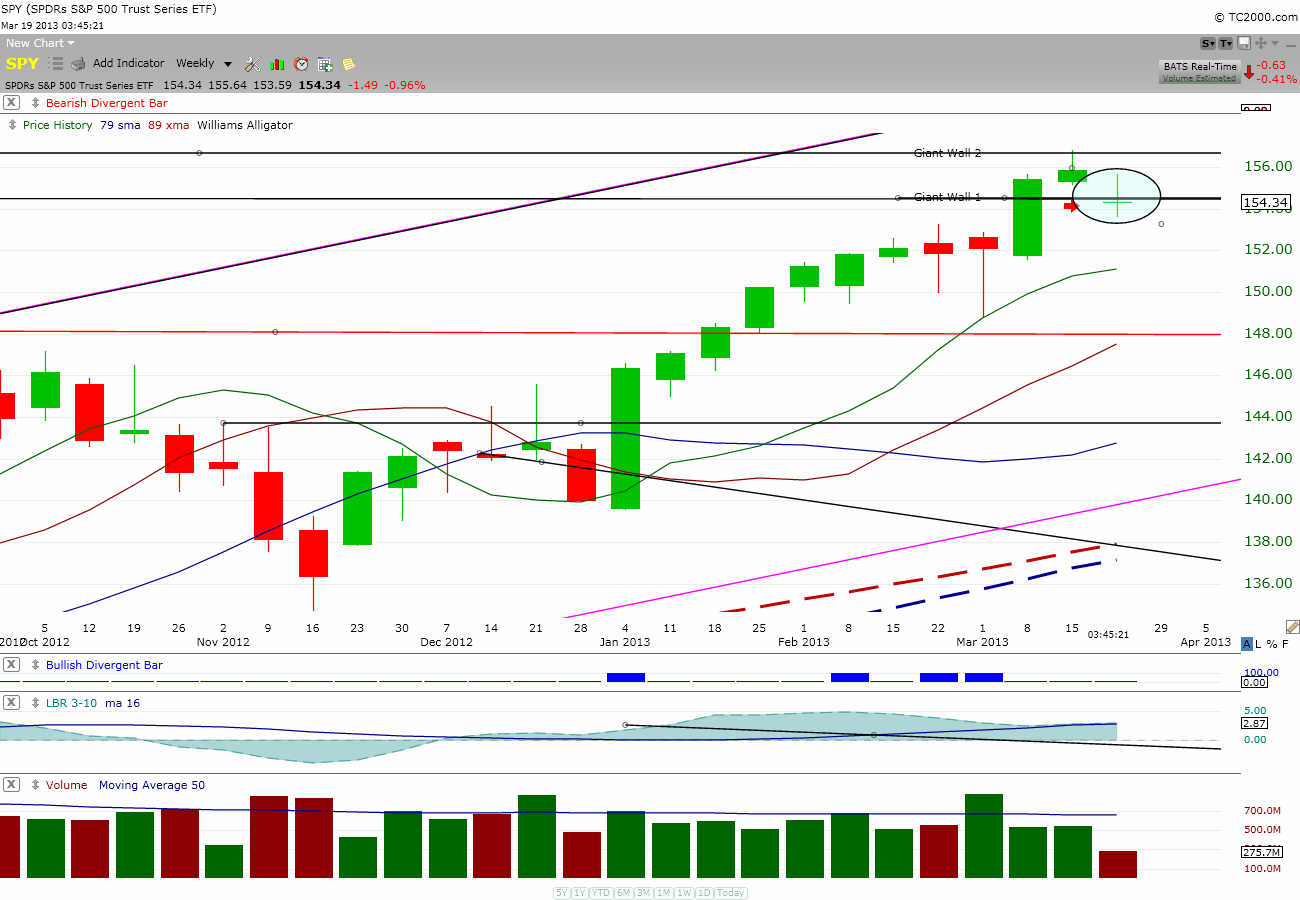

I was half expecting $PACB to collapse but it didn’t; so I bought it back since it was forming a doji bar. A doji bar on top of the 79 & 89 ma looks like a possible turning point to me.

I read up some documents over the weekend on $TINY and I’m convinced that this may be the year for $TINY to shine. Thus, I increased my position size by 62%. Basically, the money I salvaged from my sales of $USU was piled into $TINY.

$AAPL is the only shining stock in my portfolio today.

Today down market is not a good day for my two large position trades ($LRAD & $AMRN); thus, my portfolio is now taking heat. However, I usually don’t pay much attention to my portfolio balance when it is the position trades that drag it down since I consider it as an expected draw-down.

However, I’ll have major issue if my portfolio is dragged down by my swing trades position. If this is the case, that means I’m not cutting loss when I should be. Since I don’t have any expectation of my swing trades making killer move, so I don’t try to hold it when I’m losing.

On the other hand, I expect that when my position trades make the big move, it will more than cover all the paper loss and more.

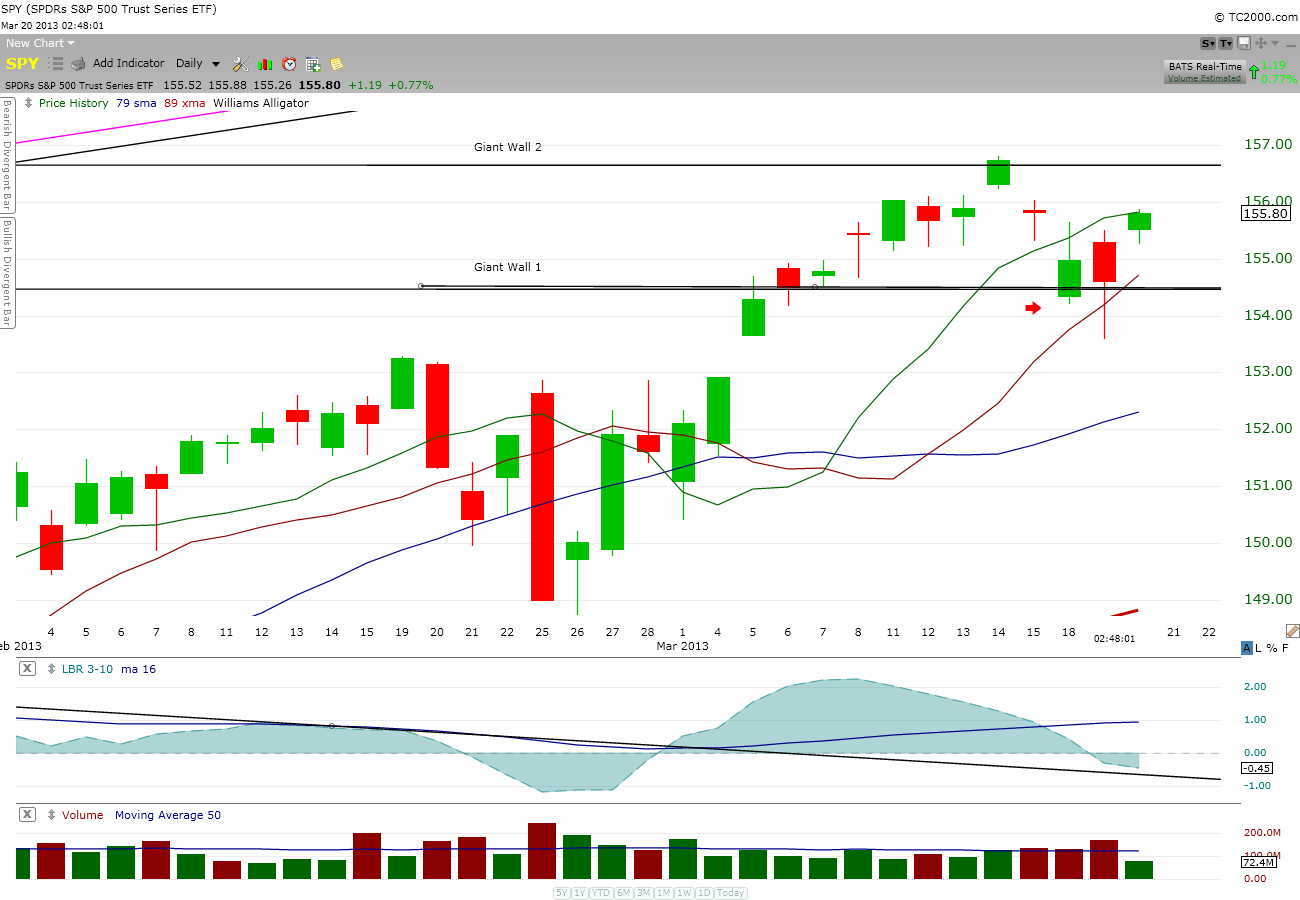

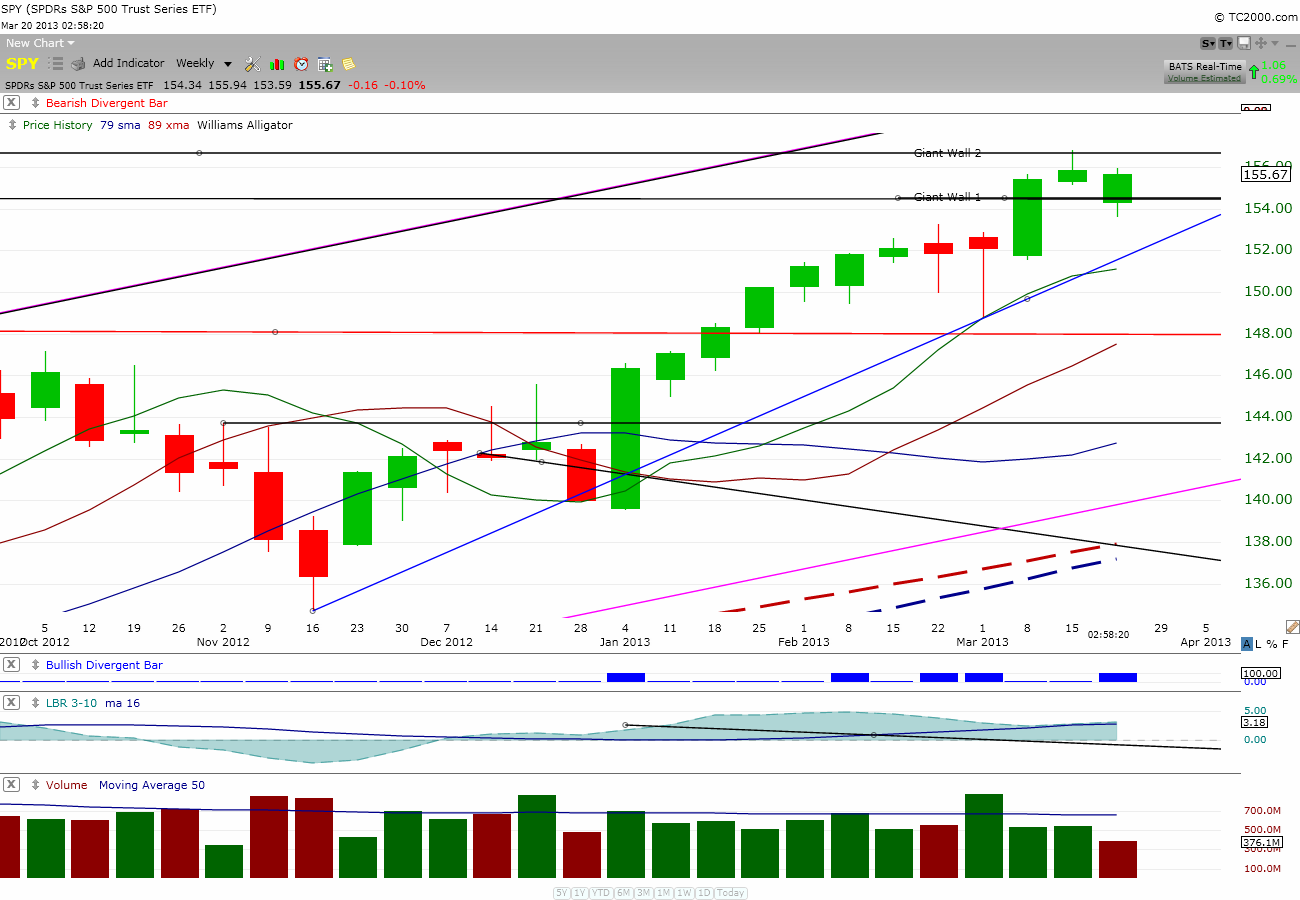

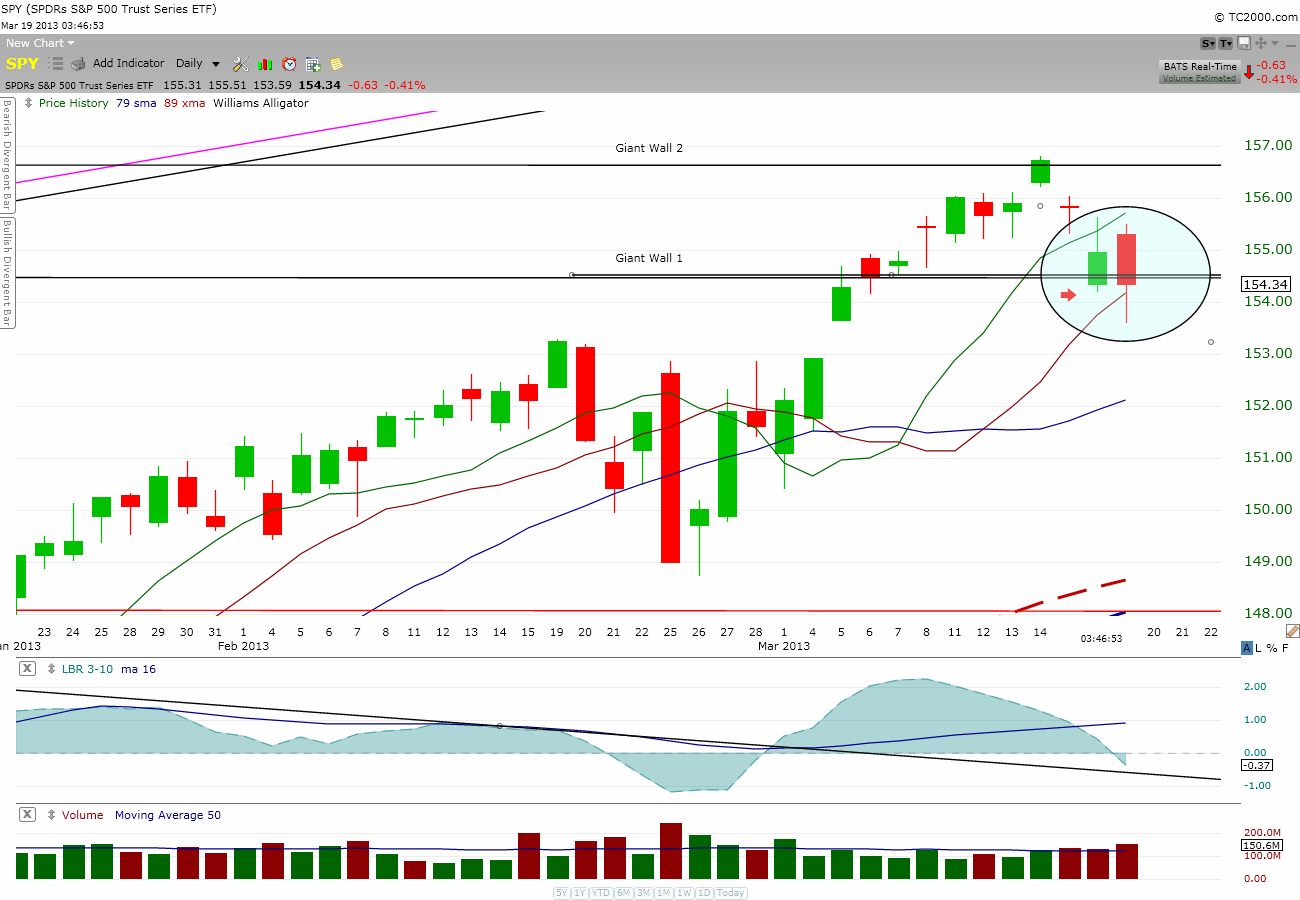

With the Dow closing less than 100 points today, I think we have a healthy correction. so, let’s get on with taking out the Giant Wall 2 please.

Currently holding $LRAD, $AMRN, $AAPL, $TINY,$SZYM, $DCTH, $DNN, $IMUC, $CUR, $PACB, $BBRY and 25% cash.

My 2 cents.

Comments »