While I would never expect most market participants to willingly admit the market has confused them lately, it has undoubtably done so to many traders. I too have experienced this confusion during times in the past, and I know that at best, it can lead to a loss of confidence. At worst, confusion can lead one to more existential issues, such as, “Is this trading thing a waste of my time and money? Is this my calling? What was I thinking when I thought I could actually beat the markets!”

I know of only a few ways to recover from this confusion and crisis of confidence. The easiest way (and least beneficial to the ultimate success of any trader) is to experience a run of profitable trades. This typically rejevunates the trader to the point where he forgets all about his previous crisis (and therefore probably learns very little in the process).Â

Rather than wait for their luck to turn around (and chance blowing their accounts up in the process), professional traders will typically cut their bets down to very small sizes until they begin to regain their confidence. They may examine their past trades to determine if something about their strategy has changed. Professionals may even examine their personal lives to determine what effect their lives away from the markets are having on their trading.

What I believe makes the recovery process difficult for a lot of traders is that they cannot truly articulate any strategy. To make matters worse, I feel fairly certain most do not keep good records of their trades. Without any strategy to examine, how can one figure out what is wrong? And without good records, how does one really know if their trading was EVER very good? Having harvested good profits in the past, or just not losing their initial investment will not be proof enough should most traders find themselves confused with their confidence shaken.

With this in mind, I would like to suggest a very simple way for traders (especially those who do not like to keep records or tend to shy away from systems or strategies) to build a strong foundation for their confidence. This foundation will provide a good place to fall back on in times of confusion, and should be able to provide objective feedback should their discretionary trades just seem to quit working.

All that is needed is for every trade’s gross profit or loss to be recorded.

Depending on the frequency of trades, most traders should soon be able to develop some very simple statistics which will help build the foundation I speak of. Some traders who have kept good records will have plenty of data to work with.

Meet Joe Sixpack

Joe has been a little confused lately. He is losing confidence in his skills, and is wondering if he should not just give up.

We’ll build some statistics for our trader, Joe Sixpack. As most visitors to this site seem to trade actively, we’ll take a hypothetical period of 1 month and figure that on the average, Joe makes 1.5 trades a day. With approximately 20 trading days in a month, J6P will have made 30 trades.

Now J6P will have to add up his gross profits and gross losses. Joe had a so-so month, with gross profits of $5500.00 and gross losses of $4750.00. This means his net profit (not including commissions) was $750.00

Determining Profit Factor and Win/Loss Pecentage

Profit Factor is determined by dividing the gross profit by the gross loss. J6P then has a profit factor of 1.16 [ 5500.00/4750.00=1.157 ] Any profit factor greater than one means the trades have a positive net profit.

Out of Joe’s 30 trades, 15 were losers, and 15 were winners, giving Joe a win percentage of 50%.

Now, we have everything we need to evaluate Joe’s performance, and help him to build his foundation.

Uh-oh, Here Comes the Spreadsheet

No really, this is the easy, and fun part.

All we have to do is input the win percentage and profit factor, and the spreadsheet will create the equity curve. Even better, it will create another random equity curve every time you hit F9. Go here to check out the spreadsheet: Equity Curve GeneratorÂ

This spreadsheet on Google docs will not generate a new equity curve every time you hit F9. I gave the link to show simple the spreadsheet is. However, I will be happy to email the sheet to anyone that is interested.

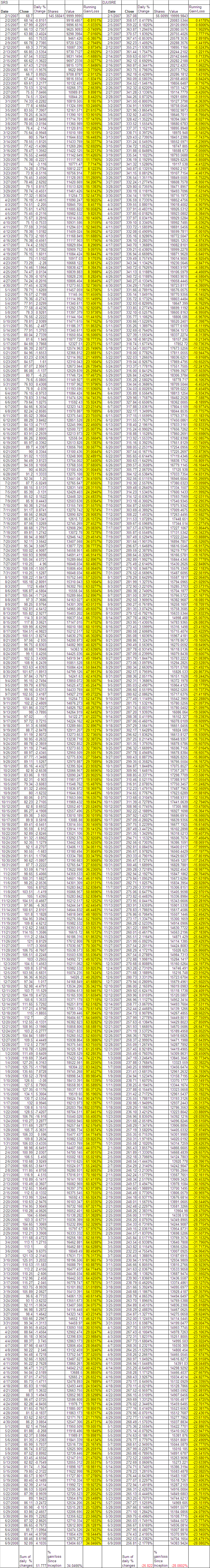

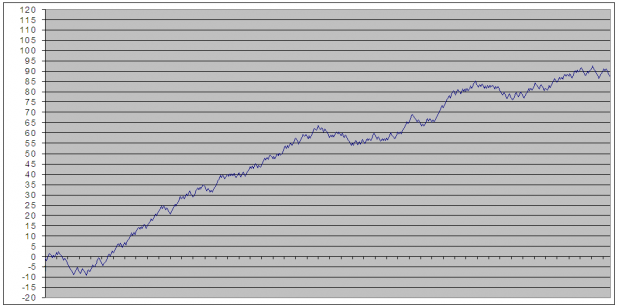

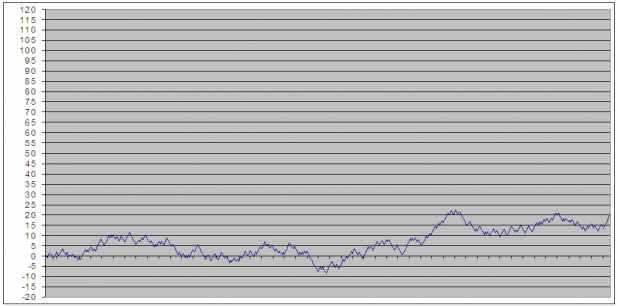

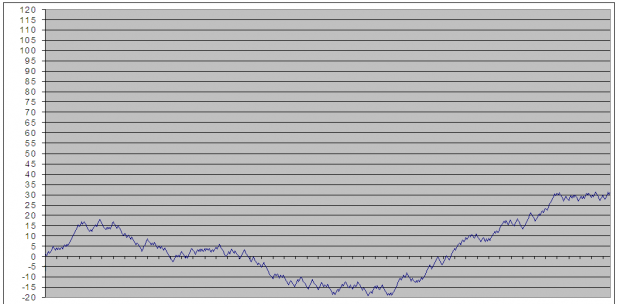

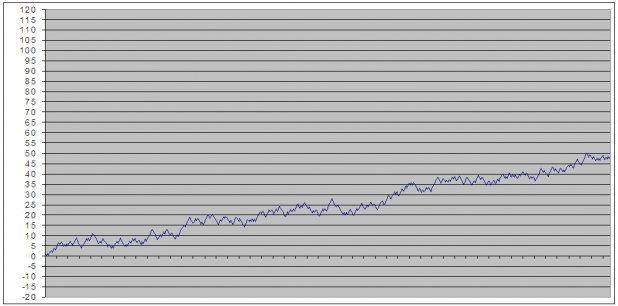

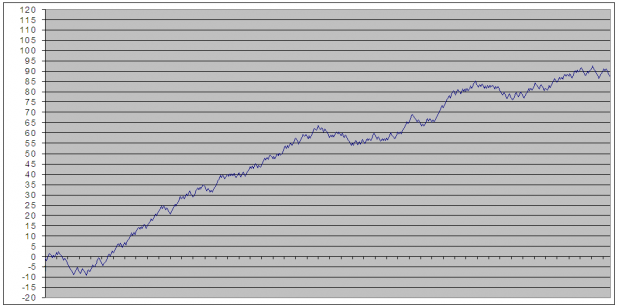

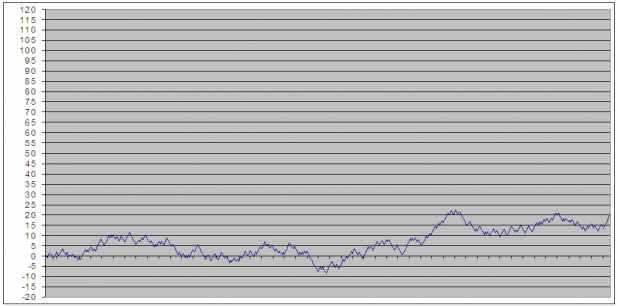

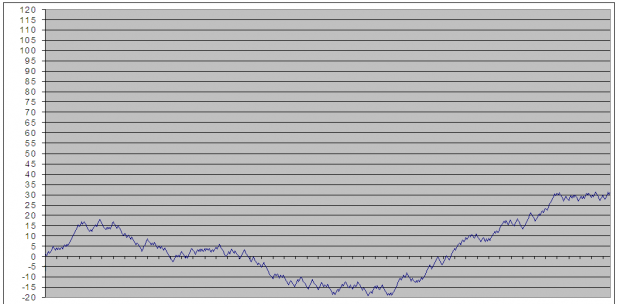

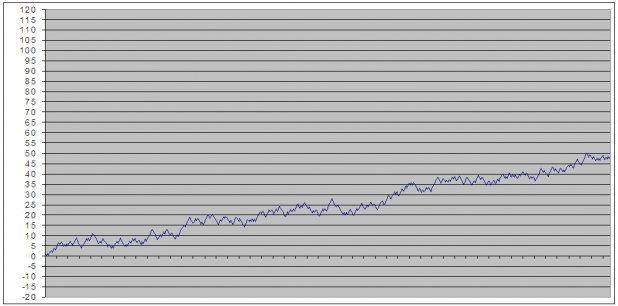

Now I know you probably need your appetite whetted a bit more before you are ready to figure up your statistics and plug them into the spreadsheet. So let me give you a few equity curves based on the statistics from Joe Sixpack’s trades:

Above, we see J6PÂ has a fairly nice curve. There are a few drawdowns, including one at the very beginning, but it is decent overall.

The above chart shows the same statistics: 50/50 win rate and 1.16 Profit Factor. Does not look so good, huh?

This one has a substantial drawdown.

And this one shows a slowly uptrending, rolling, equity curve.

Knowing that these charts represent 4 random generations of J6P’s win percentage and Profit Factor, if you were Joe, would you be very confident? Probably not. Granted, I passed over several more charts to find curves that were more interesting. However, once you play with the win % and PF, you can begin to get a sense of what kind of statistics would make you feel confident.

Ideally, to build a foundation, traders need to trust that, barring really bad luck, their trades will generate steady profits. Drawdowns are part of every system, discretionary or mechanical, and this spreadsheet will give some idea of what drawdowns might be like in worst and best case scenario.

Once the trader has embraced the many different random possibilities his statistics will generate, periods of losing can be viewed objectively as just another drawdown in the equity curve, rather than the beginning of a blow up. If the equity curves are less that desirable, then the trader must accept the limitations and weaknesses of his trades, and begin work on developing a better strategy.

Granted, this is a very basic method of evaluating trades, and there are many more variables that will have to be considered, in the long run. However, thinking of trades in these terms should give most traders a way to build confidence, assuming their win % and profit factor is healthy.

Credit Where Credit is Due

bhh from IBD Index (a fantastic and highly recommended blog) originally sent me the spreadsheet. However, it came to him from John Ehlers. John’s website is Mesa Software. The documentation for the spreadsheet, including instructions for building it, can be found here: System Evaluation

Comments »