Does this low volatility, low volume melt-up have you a tad concerned? Me too. I suspect we are going to see an uptick in both volume and volatility, soon. Until then, these high tight flags are worth watching.

Comments »Fourth Chance to Ride the $SNFCA Rocket?

There are 3 high tight flags tonight, 2 of which have previously broken out and are now consolidating…

The $100,000 question is will $SNFCA breakout again and continue its path to a double?

Comments »Checking In on the Asset Class Rotational Model

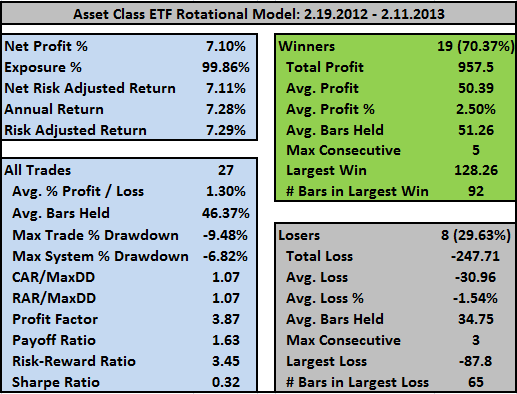

Almost one year ago, I wrote about an Asset Class Rotational Model that trades ETFs. I recently got an email from someone asking me about it, and the email reminded me that it would be a good time to check in on how the system has performed over the past year.

The quickest way to understand how the system works is to read Mebane Faber’s article: A Simple Momentum System for Beating the Market.

I have re-run the test, with the same rules as when I ran it last on 2.19.12.

- Commissions and slippage were not included

- No implementation of a moving average filter

- No return on cash

- The top 5 ETFs were held

Results:

With $SPY achieving an 11% return over the same time frame, results are not stellar.

However, if we look at the Asset Class ETF Rotational System 2012 results (assuming the system ran without stopping since beginning in 2003), it returned 10.6% vs. 11.47% for $SPY. This is not quite as bad, but once commissions and slippage are factored in, we could safely shave another 1% off the return. All the caveats of the original post still apply.

The good news is that the system appears to be working fine; it just couldn’t beat its benchmark.

Later this week I’ll add a moving average filter and then use Faber’s suggestion of limiting total positions to 3 rather than 5. One addition I would really like to test is to make sure the system is not picking ETFs that are highly correlated. I’m not sure how to implement this in AmiBroker, so if anyone wants to work with the code to implement it, send me an email to woodshedder73 at gmail.

Comments »High Tight Flag for Monday

There is only one candidate today, but that is primarily because the HTFs have been breaking out very quickly. After a breakout, they are no longer counted as high tight flags.

Have a great week trading!

Comments »Dr. Benjamin Carson’s Amazing Speech at the National Prayer Breakfast

I’ve been struggling this morning to find good articles to include in my weekend What I’m Reading post. There seems to be a dearth of good system trading articles written this past week. If you know of any that you think I might enjoy, please leave a link in the comments section.

In the meantime, I encourage watching the video below. Dr. Carson attacks political correctness, the dumbing-down of education, the tax code, and health care reform. It is truly amazing, and even more so, when you consider that Obama is sitting fewer than 20 feet from the man. If nothing else, watching Obama squirm is quite enjoyable.

Comments »Fidelity Sector Funds Top 5 Ranked Funds

The Fidelity Sector Fund Rotational System purchased 2 funds on January 9th. Today makes 30 days since they were purchased, so they are eligible to be sold and new ones purchased.

The system is currently holding FSAIX (Air Transportation), FSLBX (Brokerage and Investment Management), and FSHOX (Construction and Housing). The first two have met the 30 day minimum hold requirement.

The top five ranked funds are

- FSAIX

- FSRFX (Transportation)

- FSLBX

- FSAVX (Automotive)

- FSLEX (Environment and Alternative Energy)

Since the 2 funds eligible to be sold are still in the top three, they will not be sold. This means that every evening I will re-rank all the funds until FSAIX and/or FSLBX move out of the top three. Then one or both will be replaced.

I’m intrigued by FSLEX moving into the top 5. Perhaps the recent surge of solar has something to do with the fund moving up in the rankings. Also worth noting is that FSHOX has moved out of the top 5 and is currently ranked 8th.

Comments »High Tight Flags for Thursday

While I have my doubts about the market making new highs here, the High Tight Flags continue to work very well. See $NFLX for an example.

There are two valid HTFs for Thursday.

and $TSL is still within its flag stage.

Comments »