After the last 2 crazy days in the market, I’m going to bang out a few more studies to try and figure out what is going on. This study builds on tonight’s previous study – $SPY Gains More than 4% in 2 Days. Bullish or Bearish?

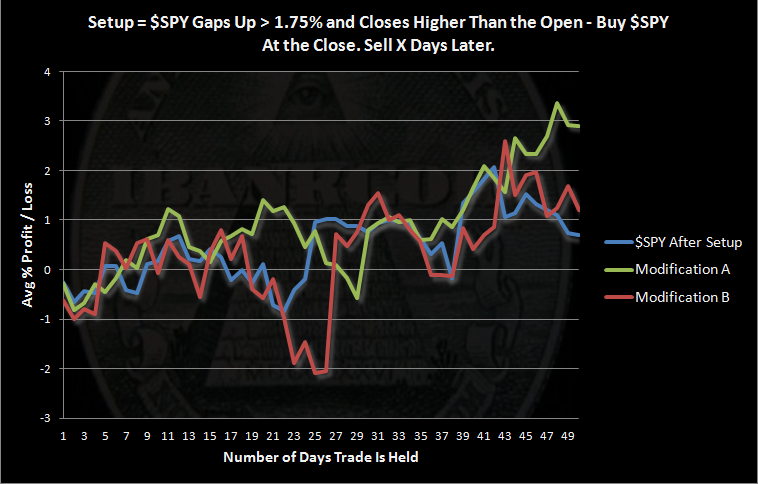

The setup is simple enough. $SPY gaps up more than 1.75% above the previous close, and then closes higher than the open. I added 2 modifications to that setup, which I’ll discuss below.

The Rules:

- Buy $SPY at the close after the open gapped up more than 1.75% above the previous close and the close is higher than the open.

- Sell $SPY at the close X days later.

- No commissions or slippage included.

- All $SPY history used.

The Results:

First we’ll discuss the results of the setup (blue line). There were 38 occurrences of this setup, with 19 held the full 50 days. Sample size should be a concern. On average, we have gapped down the next day after the setup. Over the next several days, $SPY has tended to trade beneath the gap-day close. Ignoring the small sample size, this setup has yield neutral results over the next month and would not beat the average $SPY buy and hold trade over 50 days.

Modification A: This is modification removes the requirement that the gap day closes higher than the open. I included the mod to get more samples. There were 56 occurrences of this setup, with 25 held the full 50 days. Modification A is also a neutral setup over the first month. Not requiring the gap day to close higher than the open included some trades which pushed the results up to bullish levels after 50 days.

Modification B: This modification is a nod to the previous study. It requires the setup from Modification A and that $SPY has gained more than 4% in 2 days. Because of the specificity of the setup (we are basically modeling almost exactly the last two day’s trading), the sample size is small. There were 22 occurrences of Modification B with 11 trades held the full 50 days. The results are bearish over the next month.

As often is the case, the situation is murky. On average, $SPY has retraced a large gap / large gain over the next few days. Thus, I am looking for a small retrace in the next day or so of less than 1%, and then a higher high. After the higher high is made, I expect that a gap-fill process will begin.

Traders who have not chased here may want to consider waiting a bit longer before getting in, or at the very least, entering in small positions.

Previous and Related Post: $SPY Gains More than 4% in 2 Days. Bullish or Bearish?

For more on gaps, check out Quantifiable Edges recent post: 1% Gaps Higher to Start the Month.

This is a very interesting study. Coincidentally, Peter Brandt (peterlbrandt.com) posted today that this might be a breakaway gap, which would be really something to see. Wonder which of the various scenarios we will see in 2013?

Thanks for posting that. Good stuff from Brandt.

I think equities are one of the only safe havens from a central bank and fed. gov’t gone crazy with spending.

I should add that a gap down takes us back into Brandt’s symmetrical triangle – probably leading to a quick drop to the lower boundary at around S&P 1380.

Good stuff — inneresting.

I caught this move pretty good but now I’m sitting here leveraged long worrying about a pullback. If it’s not one thing it’s another.

BTW I always try to ignore Brandt’s mumbo jumbo. He is pretty convincing with his made up stuff.

I respectfully disagree. He admits that less than 50% of his patterns run to completion, but when they do he makes a lot of money. He is the most disciplined trader I follow regarding risk management and analysis of bad trades. I’m not a chartist but I respect his abilities because his returns have been outstanding.