The market held up relatively well today giving us a solid setup as we close the week. Today’s action blessed us with an inside day on the $SPX, all while holding the 20 day moving average.

A break below today’s low, breaches the 20 day MA (and some heavy support), and likely starts an avalanche of selling into the weekend. On the flip side, a move above today’s high, puts us back in breakout territory. Let’s see if the bulls hold support here.

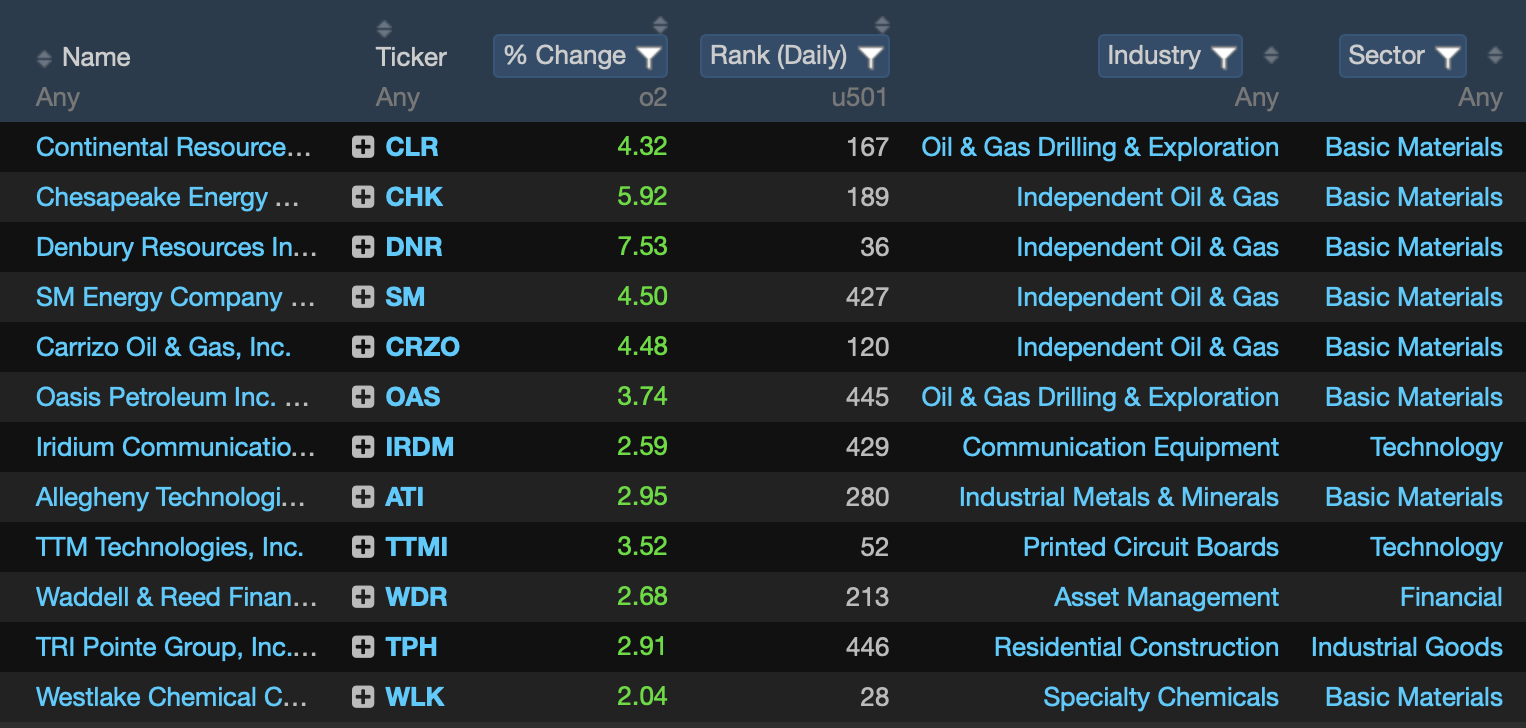

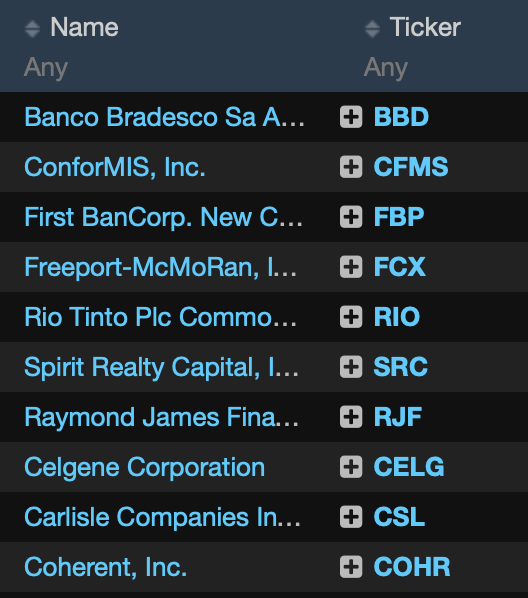

On strength tomorrow, I will look to pick a few names from our Momentum screen in Exodus. At the close, there were 100+ names to sort through. If you feel like doing some chart surfing, I’ve imported the tickers HERE.

Oil & gas names have the best setups leading into a big breakout in Crude Oil. Should oil bust through $60, here are a few tickers to keep an eye on: SWN, DNR, SLB (I own the SLOB), RRC, NOG, DO, CLR, & SLCA

On China strength: CTRP, CIFS, QD, HUYA, & BZUN (all from screen above).

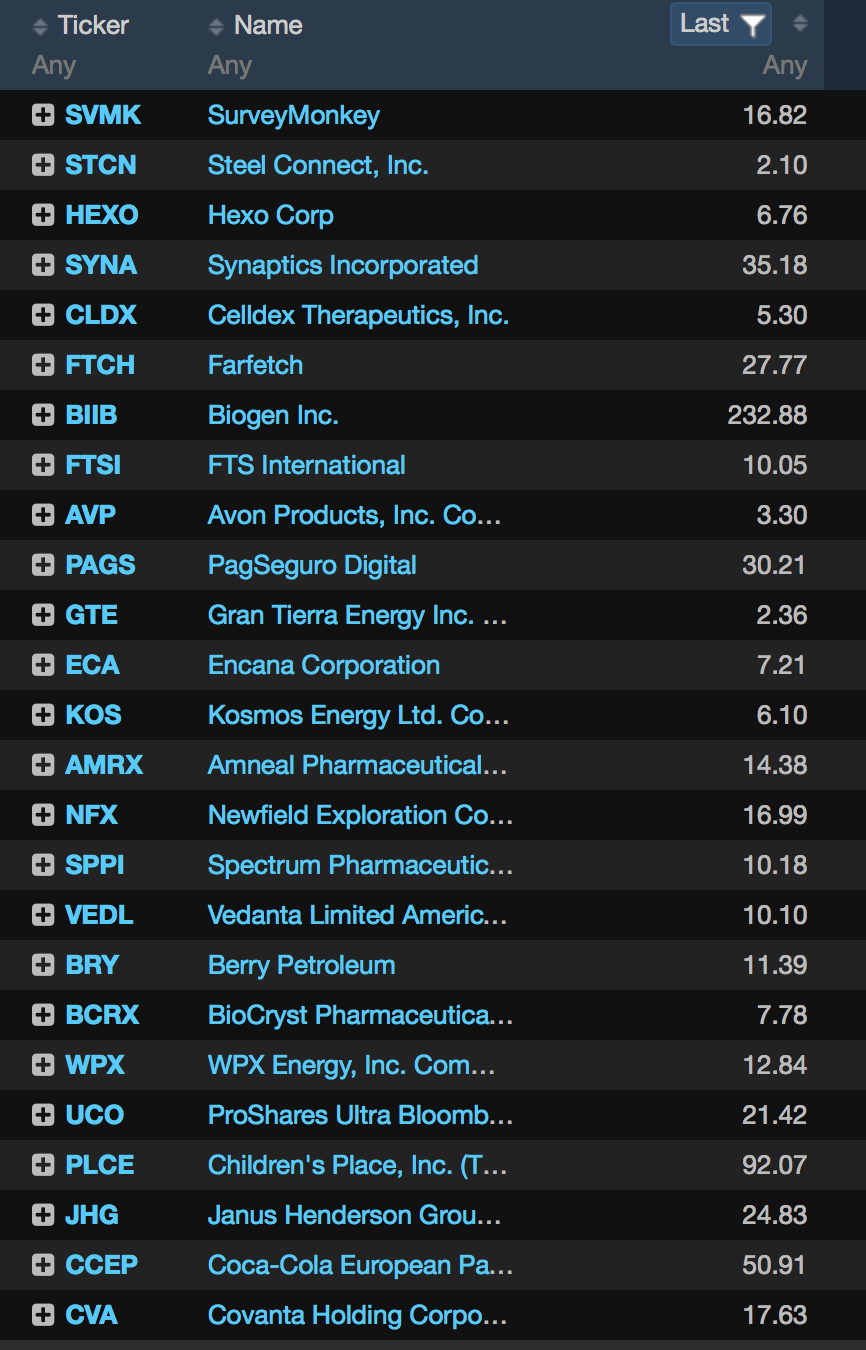

And, for you lotto lovers. Here are some small caps moving on above average volume:

__

__

And, for the elite eight matchup going on right now, it will come down to the final minutes for a few. Who will make it to the FINAL FOUR? Click here for our IBC Stock Madness Bracket.

Comments »

__

__ __

__ __

__ __

__

__

__

__

__

__

__

_____

_____