It’s easy to form an opinion in this type of environment, but mother market could careless about your opinion. Josh brown spelled it out perfectly today during the closing bell, don’t get chopped to pieces:

.@ReformedBroker is our guest host for the 3p hour. Here's his quick take on the market! pic.twitter.com/mbS0E024Qi

— CNBC's Closing Bell (@CNBCClosingBell) October 8, 2019

__

Then Josh gave us this gem, and his $NVDA analysis:

Into the close! @ReformedBroker's last chance trade is $NVDA pic.twitter.com/mgQQlodMrr

— CNBC's Closing Bell (@CNBCClosingBell) October 8, 2019

__

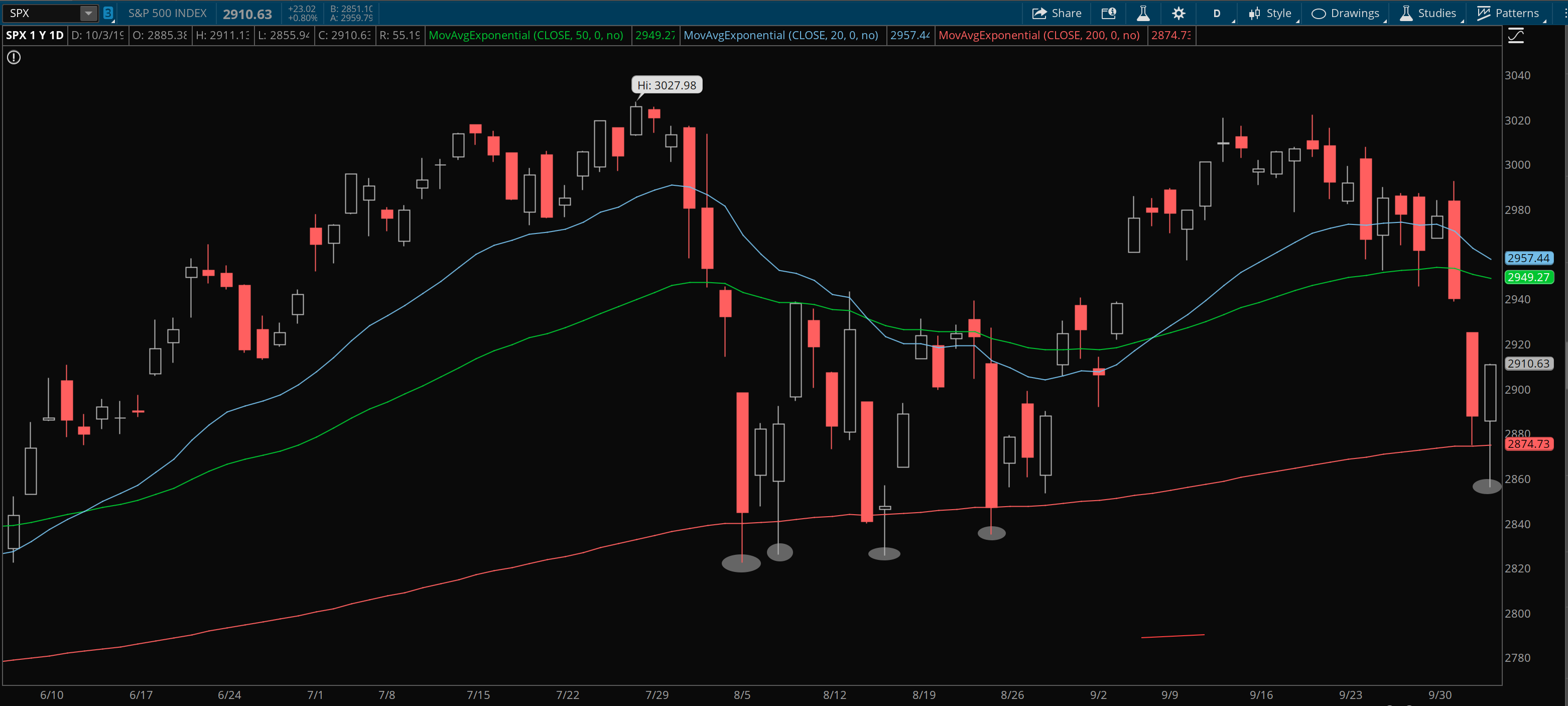

As Josh mentioned in the above clip, we are right in the middle of the 50 & 200 day moving average for the S&P 500. Piercing the 200 day moving average has been kind to the bulls 5 times in a row, since August. My guess is if we break below it again, mother market won’t be so kind. We’ll see….

Try not to make any opinions. Anything can happen here.

Comments »

__

__ ___

___ __

__

__

__ __

__ __

__