The market is having yet another solid Green Day as men who got short start covering bets. Earnings continue to help the bullish picture, but also make for a dangerous playing filed. I find myself sitting idle for the most part, giving time for more chart patterns to setup.

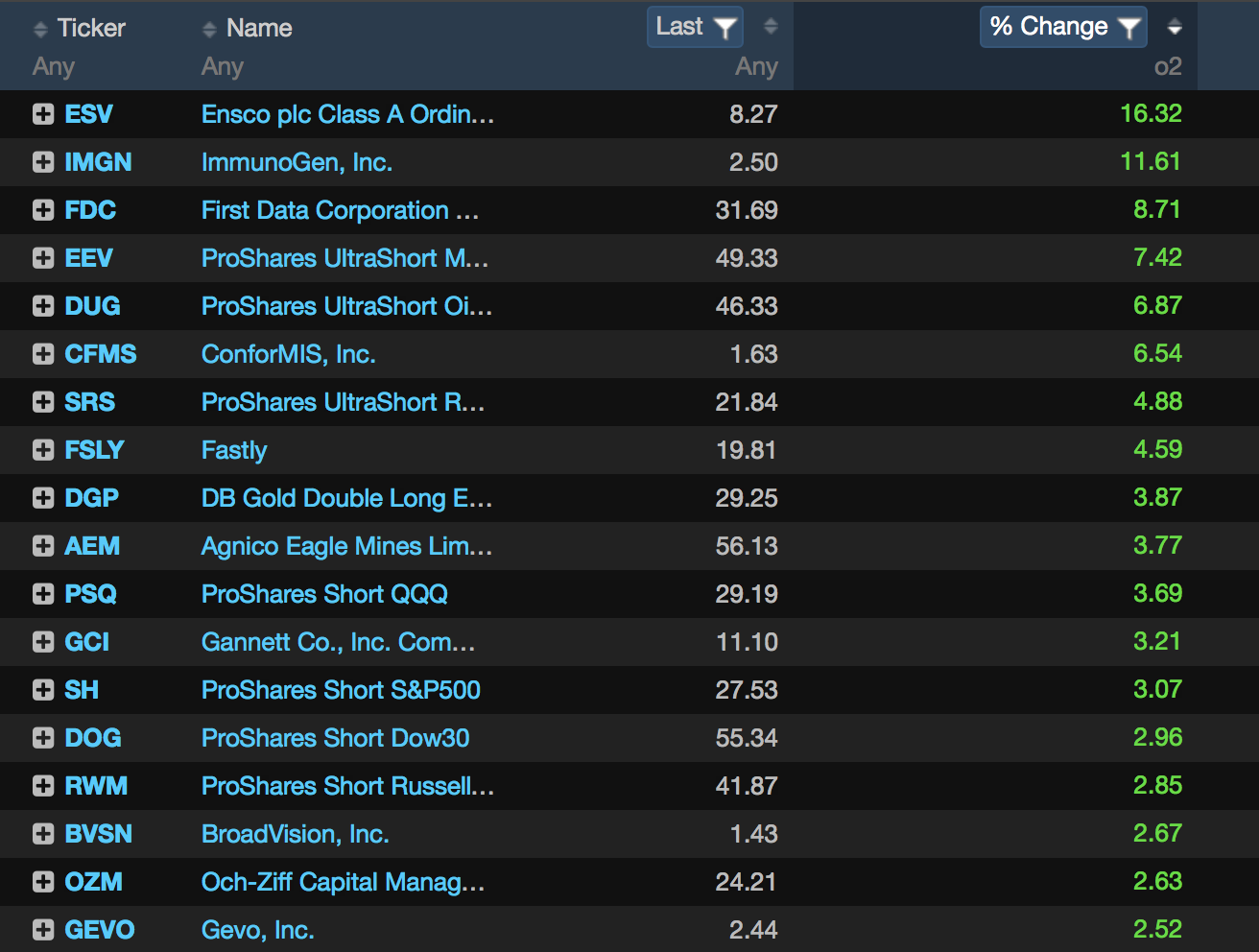

While I wait, here’s a look at the momentum screen inside Exodus. I’ve imported today’s full list to finviz for your viewing pleasure: CLICK HERE FOR CHARTS

Tickers of interest here include: FB, JD, NVDA, TSLA, STNE, & ERX

As always, you can follow my intraday activity inside our Exodus chat room. And, don’t forget, $TTD, $UBER, $DBX earnings after the bell.

Comments »

_

_