Well, did you abandon ship today? Are you cash heavy? Do you know the circuit breaker rules? Let’s crash the market.

The Dow was down 800 points as you all know, and the 2s & 10s got a little inverted, giving us an early signal that a recession is on the horizon. The futures are up a bit this evening, but it is a long night. I myself have a nice cash position and find myself patiently waiting in the bushes.

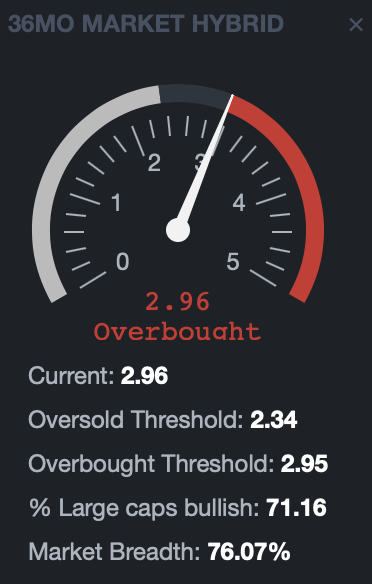

I do think we need to see some more extremes before we bottom, and the 200 day moving average seems to be in trader’s sight for the S&P 500. That said, I don’t believe this is the end of the cycle. This move lower will be the fuel we need for the Euphoria rally that you don’t want to miss. I can only pray we are down big tomorrow at the open as my shopping list is just about complete.

One stock that I really want to bulk up on in a panic situation is $DIS. What are your go-to stocks here? You need to be thinking about them, because when we turn it will be lightening fast– be ready.

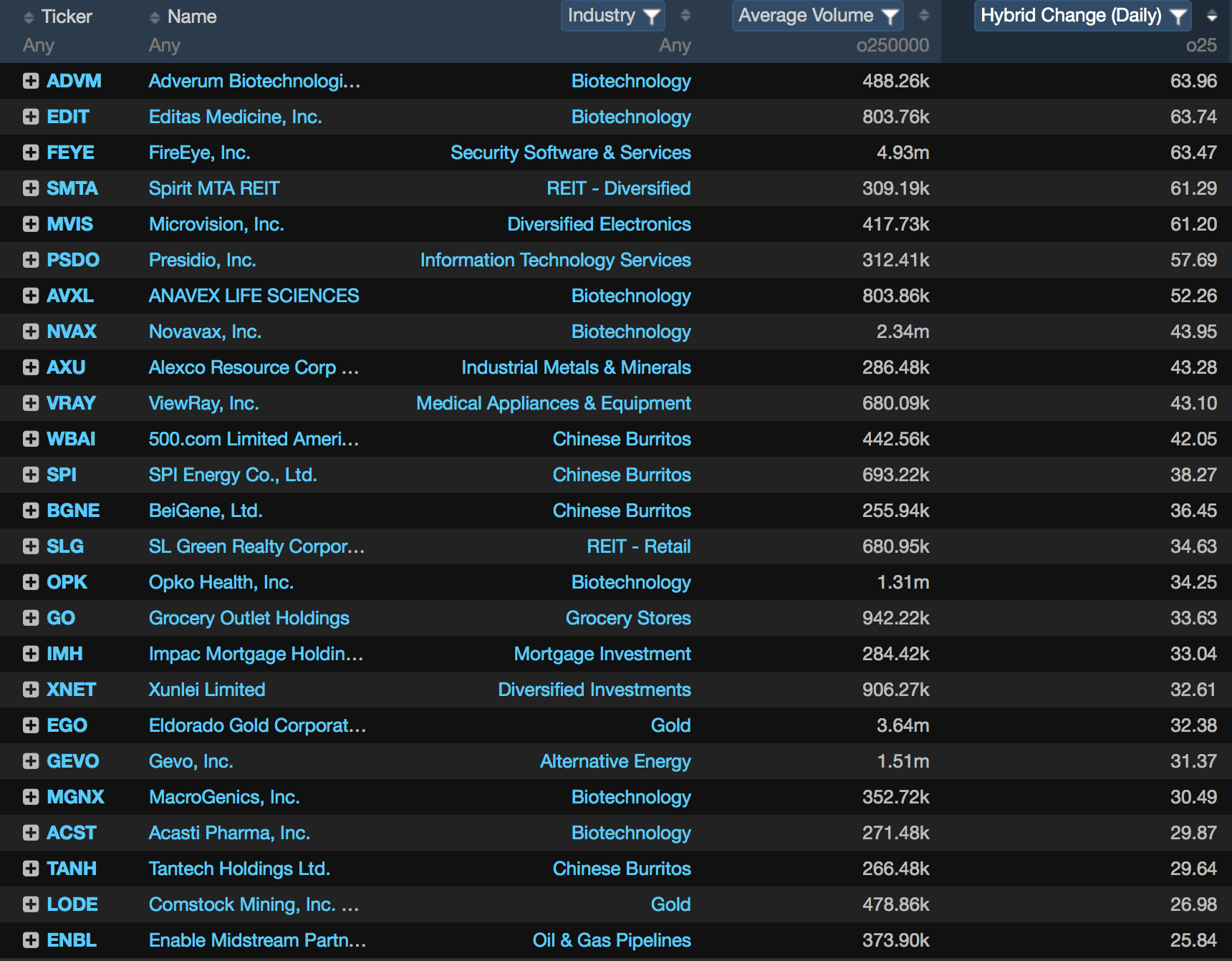

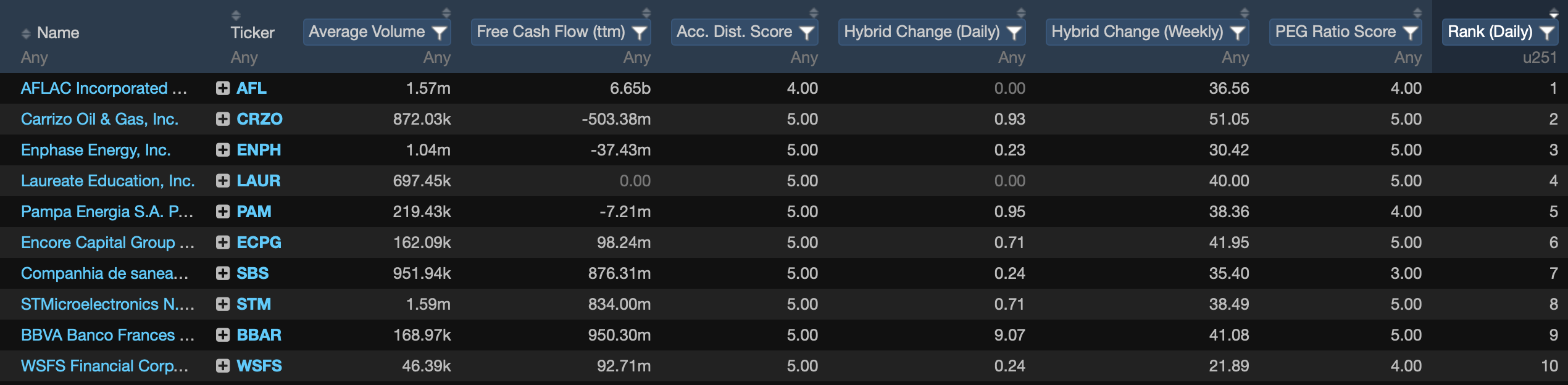

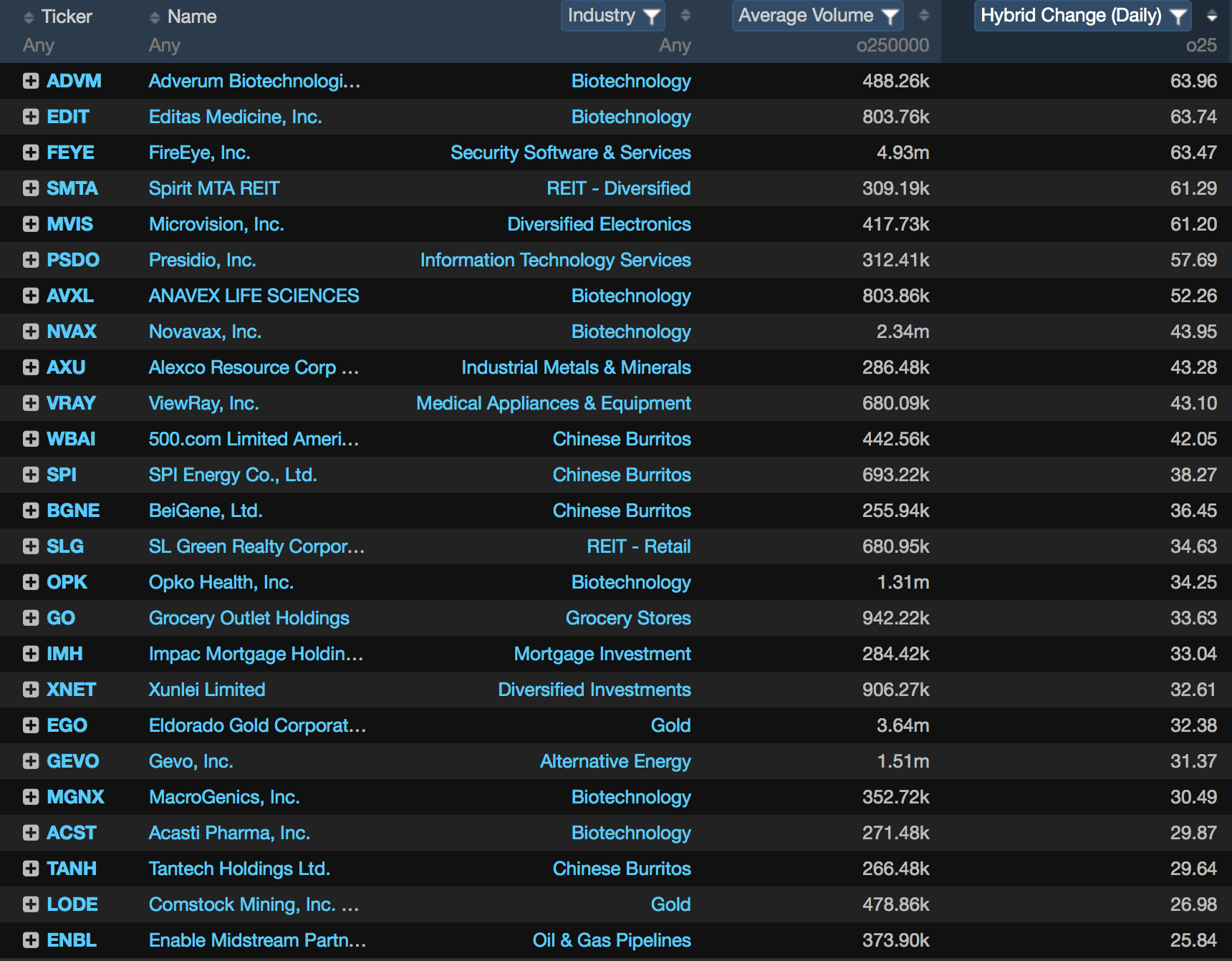

On a big down day, here are your top hybrid movers to review from Exodus. As always you can follow along with my trades in the Exodus chat room. The Fly has been absolutely on fire there with his overnight hold selections. You should be there.

Comments »

__

__

____

____