The market balanced out overnight after an early evening of weakness perhaps spurred on by the weak numbers out of tech giants Google and Microsoft. Therefore, we should be cognizant of the market’s reaction to these afterhours moves early on today.

We have giants GE, SLB, and HON set to report any minute which could get things moving.

All this is important but shouldn’t take our attention too far from the broad S&P and how it behaves today.

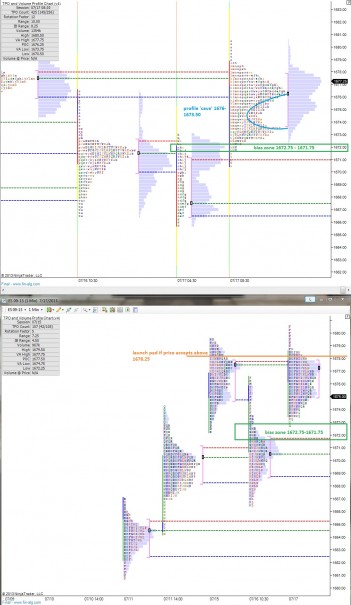

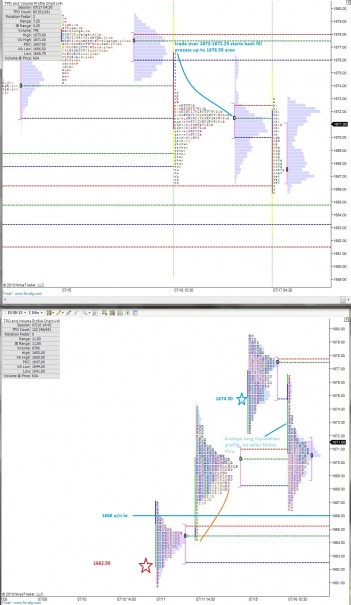

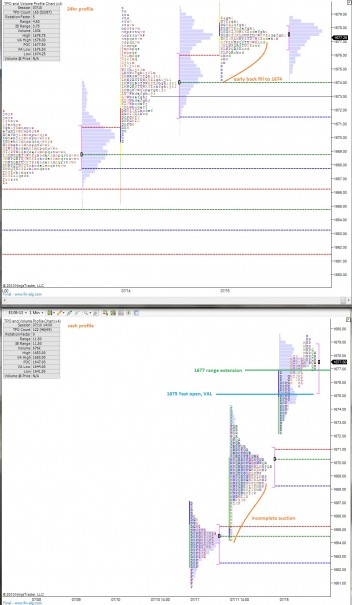

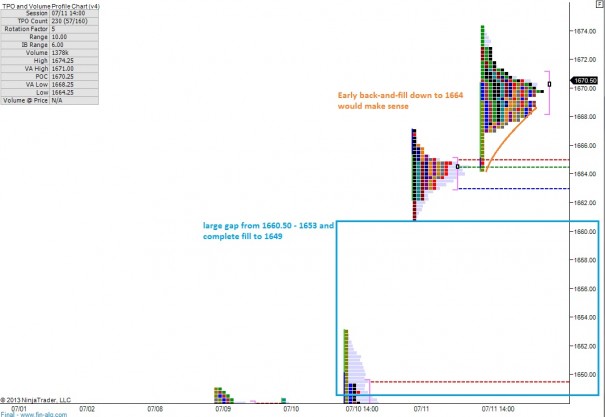

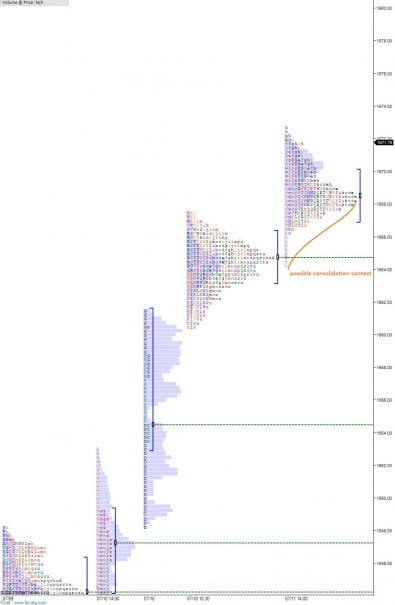

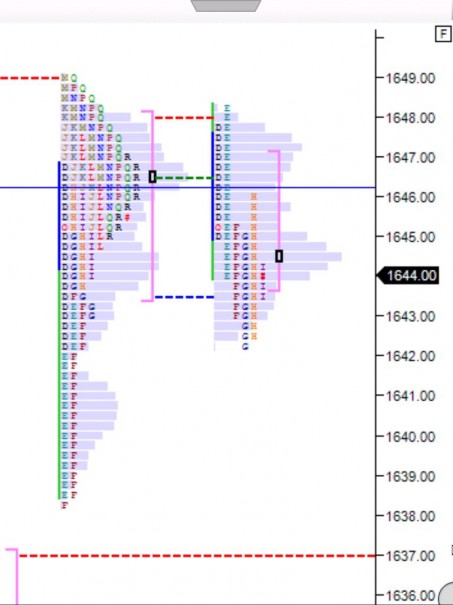

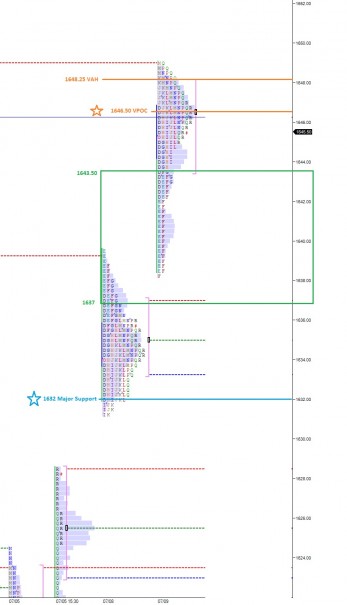

Many of the Chicago traders are pleased with the recent market activity as it’s auctioning very neatly within the confines of the market profiles. It’s also doing so in a very slow manner. Therefore, it’s more important than ever to know their relevant levels as their confidence in the tape increases.

I’ve highlighted this week’s levels of key market activity in the following profile charts. The ‘Launch Pad’ was discussed yesterday morning, and essentially represents the key accomplishment of the bulls this week. We want to see them defending 1678.25 early on.

Comments »