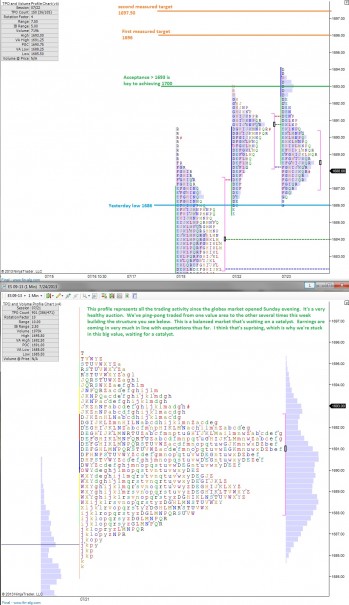

Well here we are on another Friday, the first of its kind for August, and the market has confidently settled into the 1700 handle, using the overnight session to familiarize itself with the price level and digest the progress made.

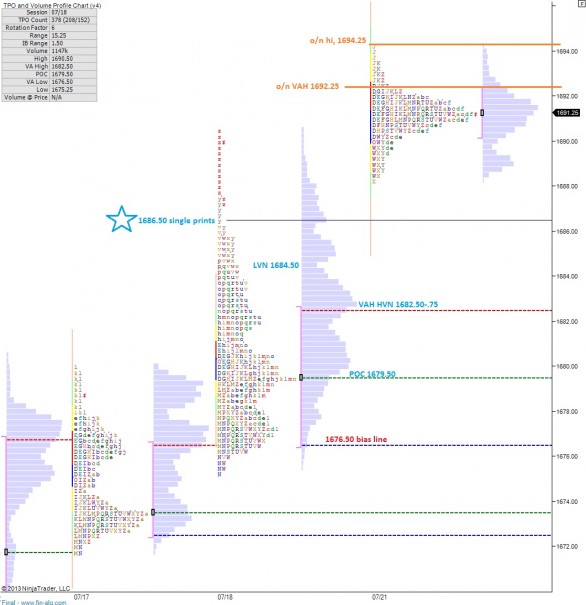

The markets took a pause overnight, printing a quiet and balanced session. We have payroll data out in about 20 minutes, and I suspect we’ll see some action leading into the announcement.

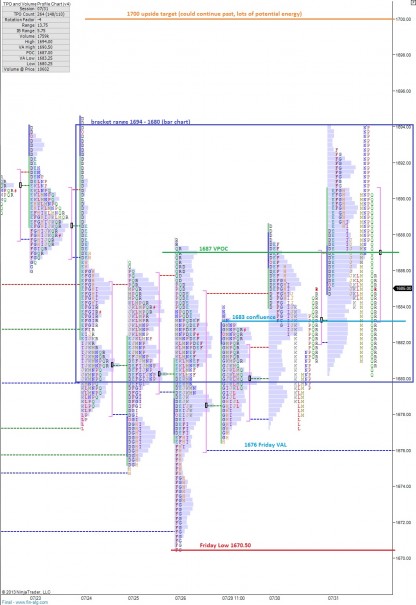

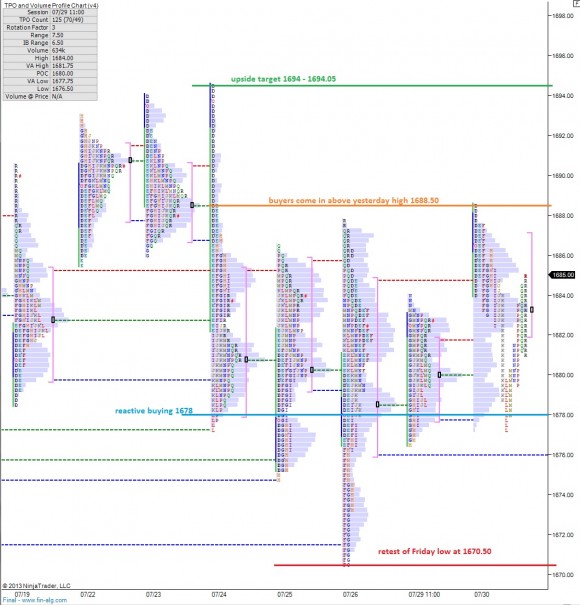

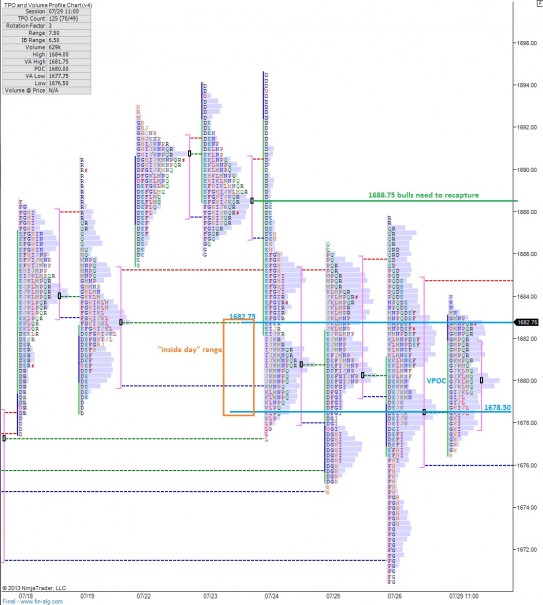

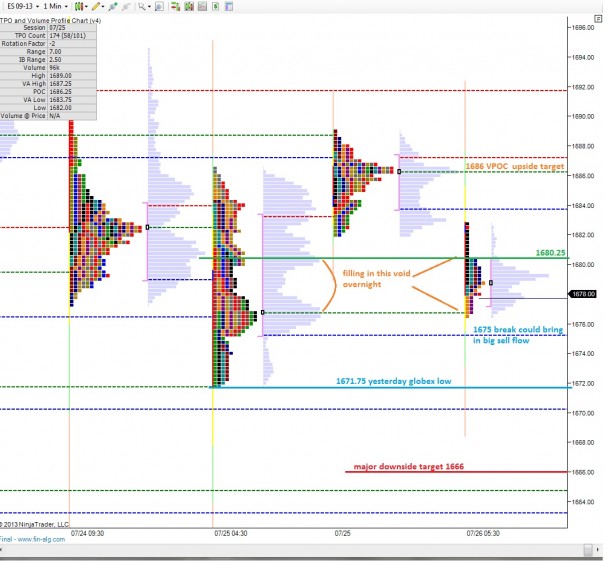

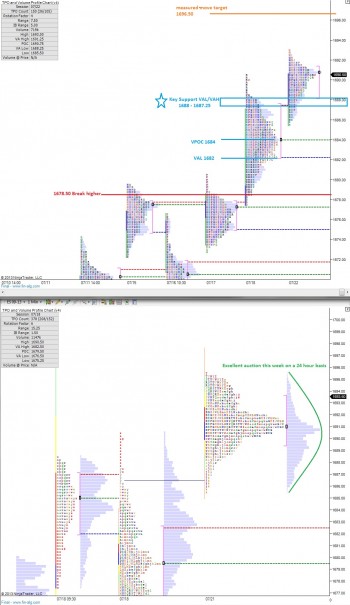

Yesterday was an upward auction all day after gapping higher, the market never suggested a gap fill to be in the cards, thus we’ve left a large gap open. It’s not clear on the profile because we closed near the low of the day on Wednesday and the market came down and tested the high-of-Wednesday to the tick before proceeding higher, but a gap in fact does still exist. And I have a strong feeling there are participants looking to buy that gap down at 1681.50. However, they may not see the level print before confidence resumes in the marketplace.

The market is extended, but it’s Friday and we could enter the realm of irrational. Again, I suspect we’ll have more visibility of the rotations after the data at 8:30.

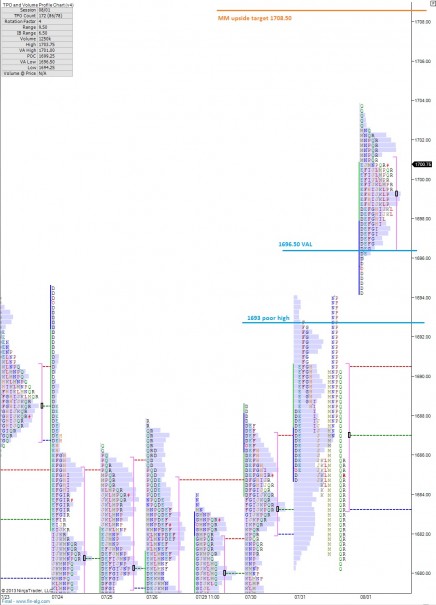

On any pullbacks, I’ll be looking for signs of buyers at 1696.50 than 1693. The measured move upside target is 1708.50.

I’ve highlighted these observations on the following market profile chart:

Comments »