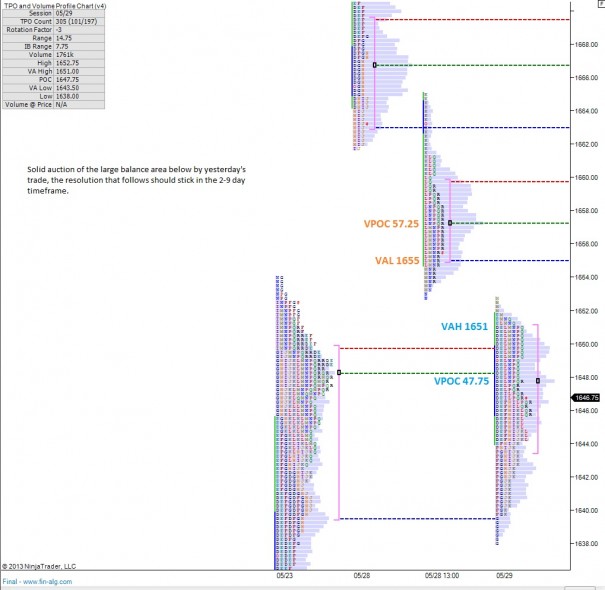

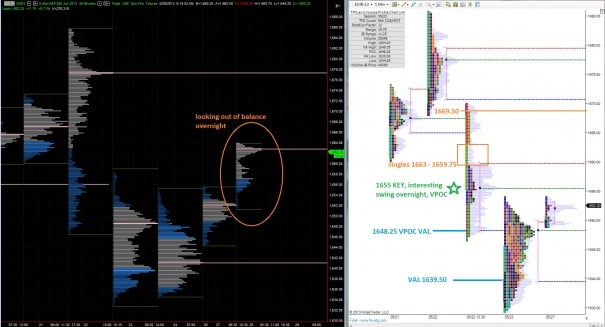

The overnight session has so far done very little except drift a bit higher and shows balance. As we continue to trade above this key support, it becomes increasingly important that price make a decision, whether to go higher or lower. The migration and acceptance of value will build some clues.

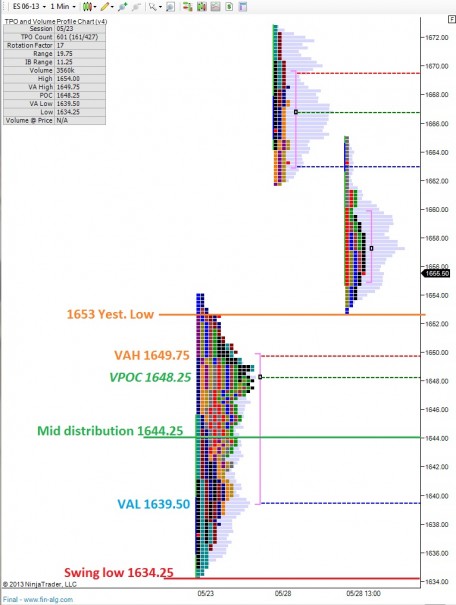

Yesterday’s profile reflects an opening drive lower by the sellers which had follow through. Then, what resembles a steady accumulation occurred, closing us out near the high of the day.

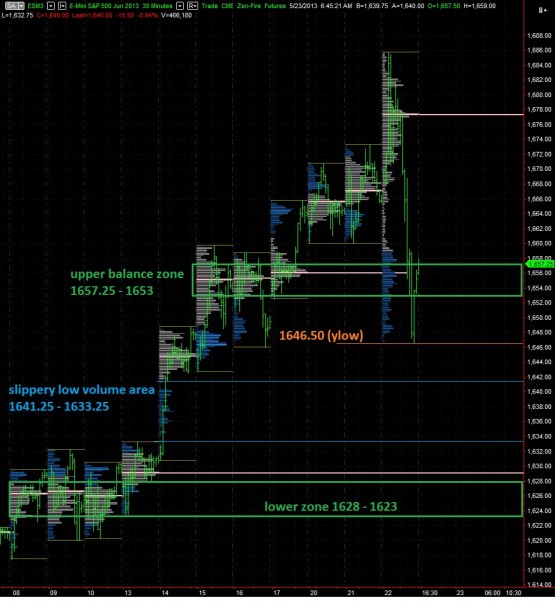

Early on, I’m curious to see if sellers can push us back into yesterday’s value from 1634 -1625 and if so, how the market behaves.

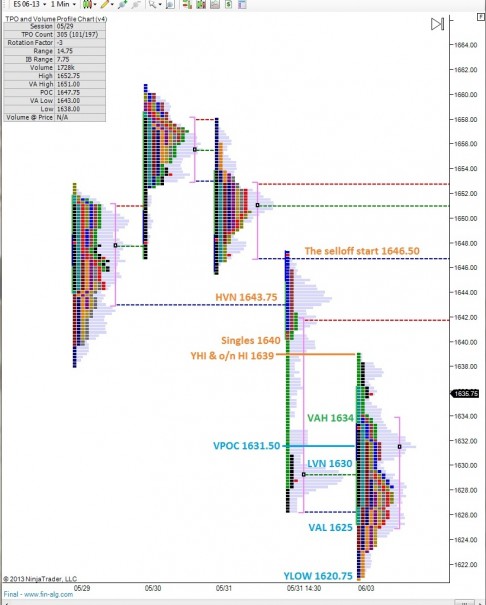

It still looks like we could run higher to 1640 then 1641.75 and ultimately 1646.50 to see if it brings the same selling tenacity into the market as we saw last week.

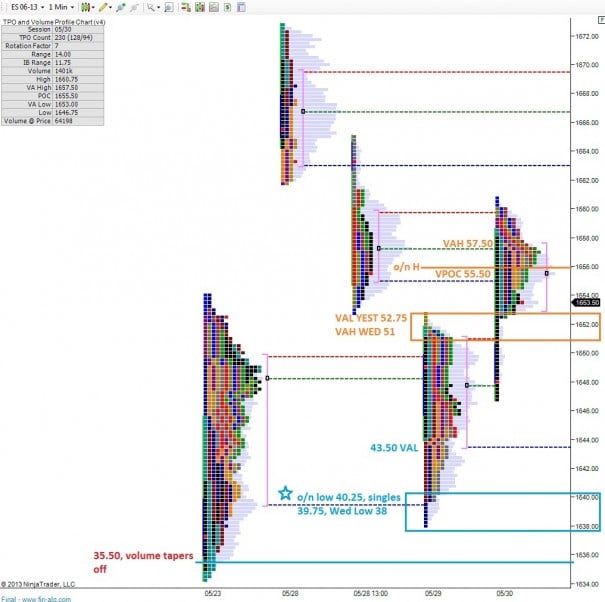

Here’s the levels I’ll be watching:

Comments »