Take your fancy words like masochist and stow them under your chair. I don’t want to hear them.

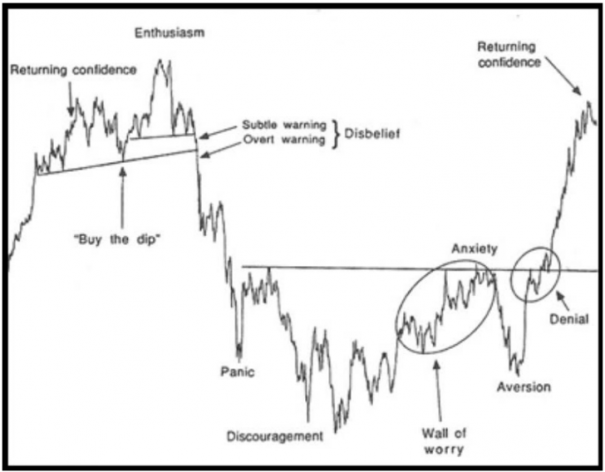

YOU SHOULD SEE MY PERFORMANCE CHART OVER THE LAST 3 MONTHS, IT LOOKS LIKE THIS:

///////// \\\\\\\\\\ ////////// \\\\\\\\\\\\\\\\\\

That’s literally how it looks if only to see the chop a bit more pronounced. MY WHEELS are spinning, you see?

LED stocks as a whole are retracing their 2013 gains after the tepid Q1 forecast from CREE. To call the move in CREE a retracement however, may be an understatement. This is panic and margin calls rolled into a giant blunt and smoked, like a clown, by yours truly.

Of course I bought some more CREE today, adding to my [still] green core. I bought some into the closing bell for $58.85 #timestamp. Even if only for a trade, I can’t stand by idle and watch my ‘ace boon coon’ CREE get bludgeoned by panicking idiots. Oh and believe me, I have more bullets to fire at these bitches while they’re concentrated in this back ally trough.

I’m telling you now, send CREE lower, I want it lower.

Send RVLT down too, I’m patient.

I have zero edge trading earnings let’s make that clear as crystal, which it already should be. I’m building investments here…they’ll make fine x-mas presents.

MOVING ON, AGAIN

I cut some small names off my books because the /ES was trading in a downdraft. I cut PBF, KWK, and ONVO. I made a killing in ONVO, BTW. The other two, not so much…

Speaking of the /ES: There’s simply no way for me to broadcast my strategy out to the world. Back testing and optimizing has created a medium frequency beast that even I can be overwhelmed by. I took ten trades in the /ES today, 7 were winners and I made 160 bucks trading a 1 lot. When this system is making 160-250 bucks per contract 4-5 days/week, which it will, it can be scaled to as many contracts are needed to sustain my lifestyle. Cool, yes? Then I can abandon this corporate hole and go work for Cree or something.

I’m down a percent and a half today. My cash is nearly 40 percent partially because of a series of decockings and partially due to the aforementioned sales. Why the silver trade is back on, I have no idea. When I return to winship lane I will be wearing an undersized tunic so you can admire my cajonies.

I want you to take that thought and hold it close this evening.

http://youtu.be/G8rGNk6vkM4

Comments »