Futures are sliding lower into the opening bell here in the USA. The selling waves began shortly after the Euro-Zone announced their CPI data and unemployment rate. CPI was worse than expected and they had a slight downtick in unemployment and the markets sold off. We have factory orders at 10 am but an otherwise quiet docket for our session.

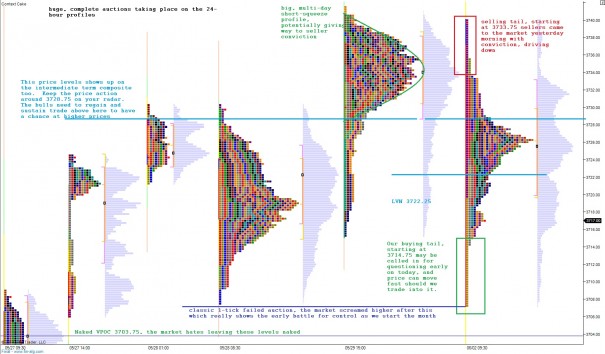

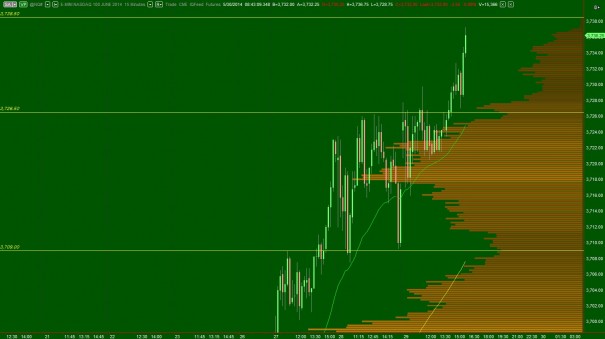

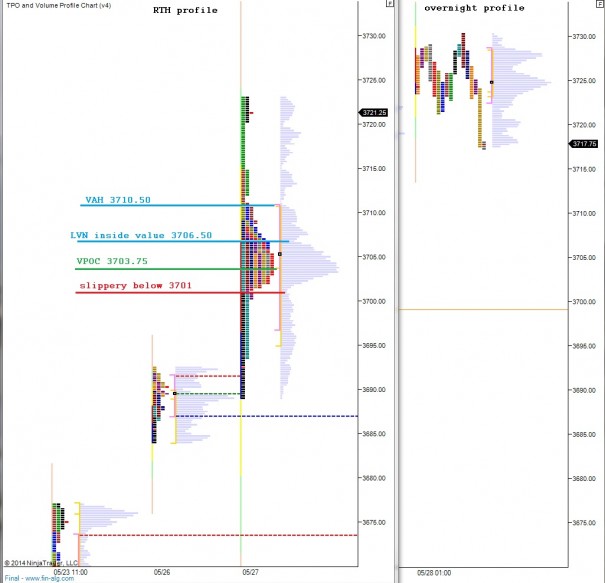

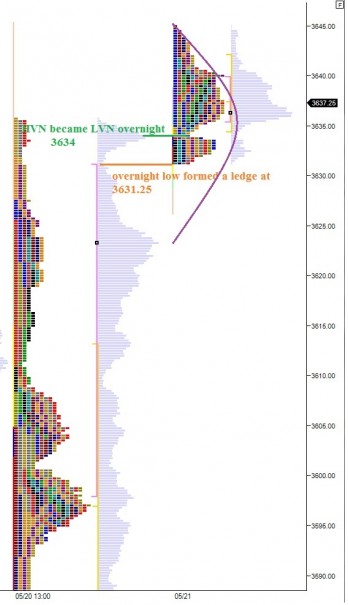

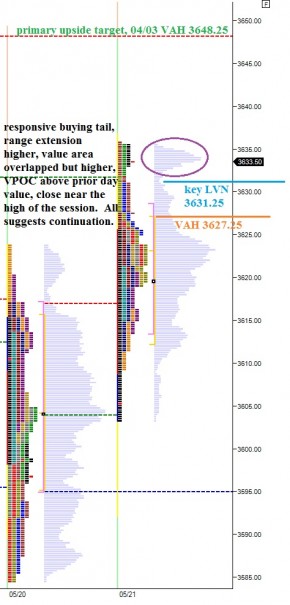

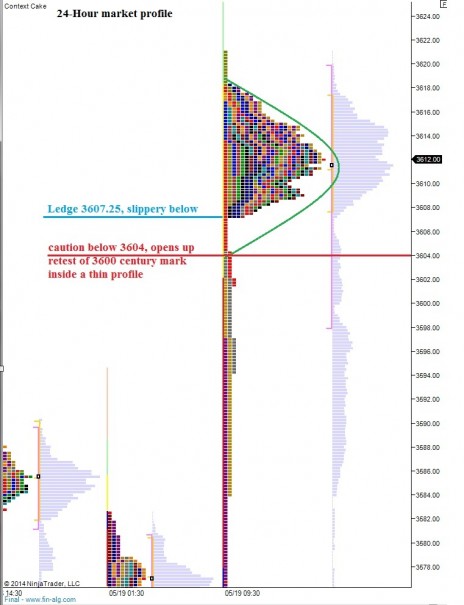

The overnight profile is toothy and printing value down near the low of the globex session. However, what I find most interesting is the large profiles we have built over the last 5-6 days. When observing the 24-hour profiles, which encompass all tradable hours of the contract, we can redistribute the market action not based on time, but instead on relevance to each distribution. By chopping up the price action into the relevant distributions we obtain a transparent view of the current auction. See below:

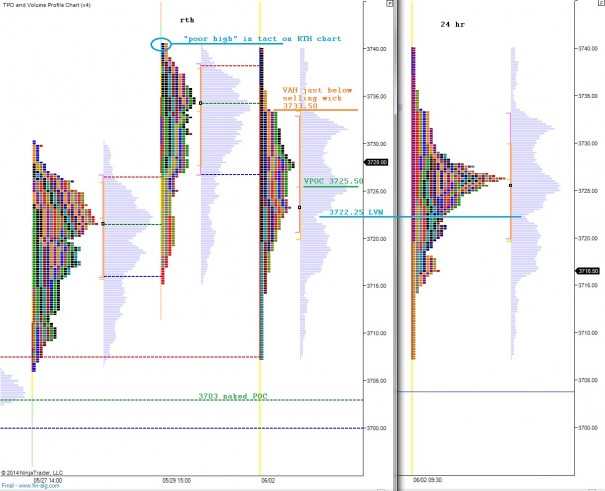

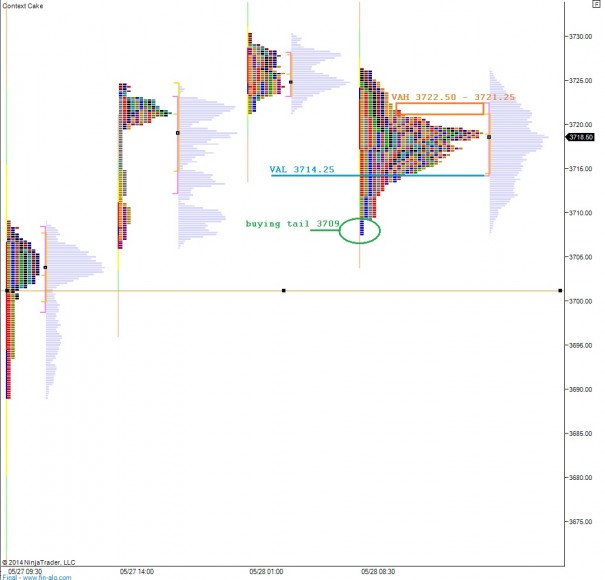

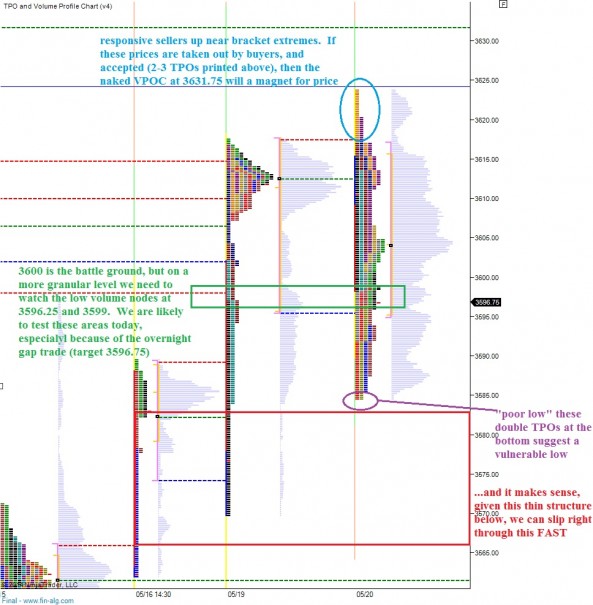

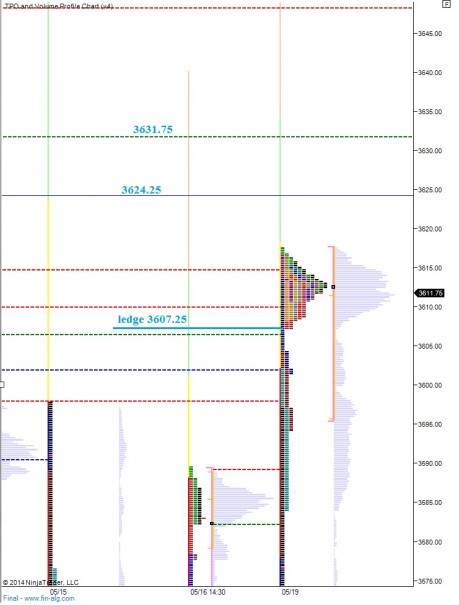

Some similar observations, as well as the relevant value zones can be seen on the regular trading hours market profiles. Interesting context to note, the poor high still exists on the regular trading hours chart. It was eliminated on the globex profiles. A poor high is where two or more TPOs print at the swing high. This is uncommon and often settled before abandoning a swing high. As is always the case with market profile context, it is not a timing tool, but only a contextual caveat as you go about your trading. See below:

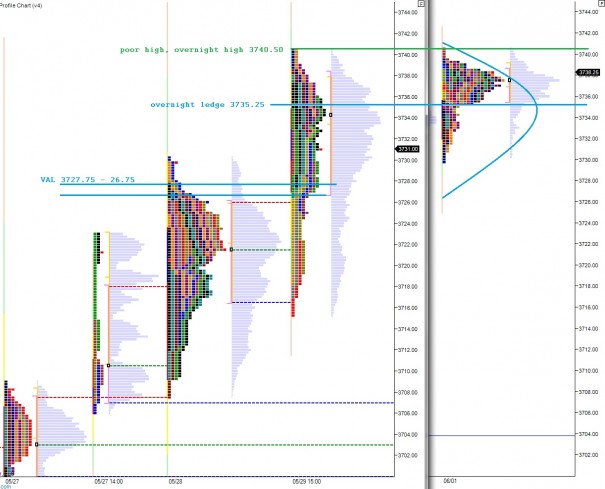

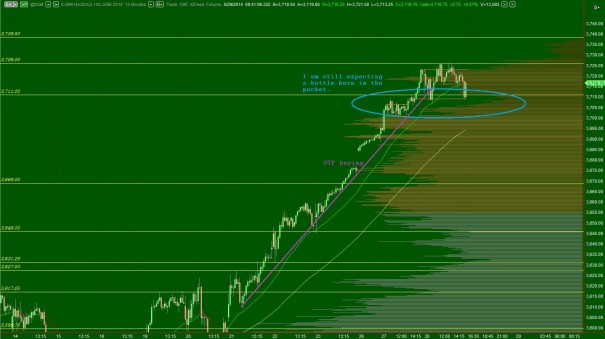

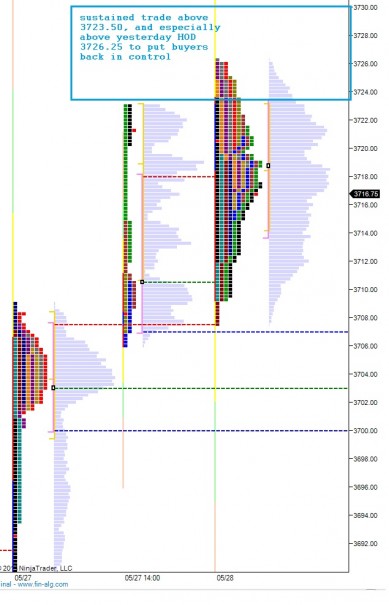

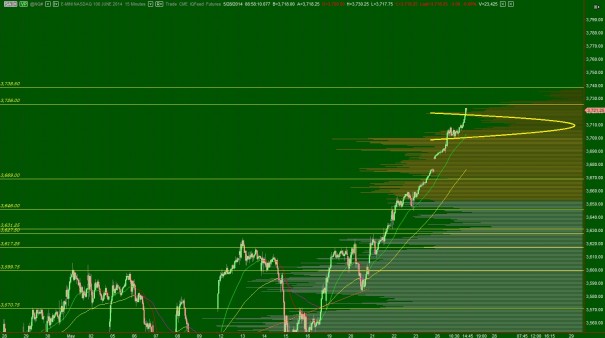

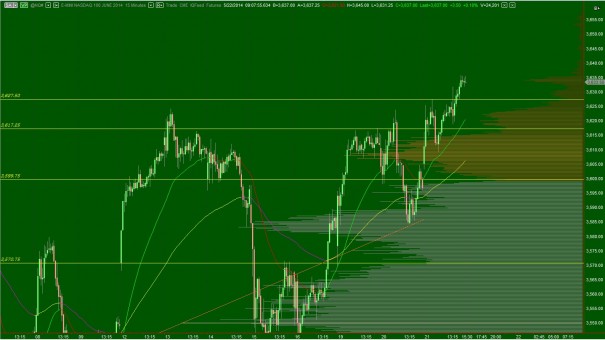

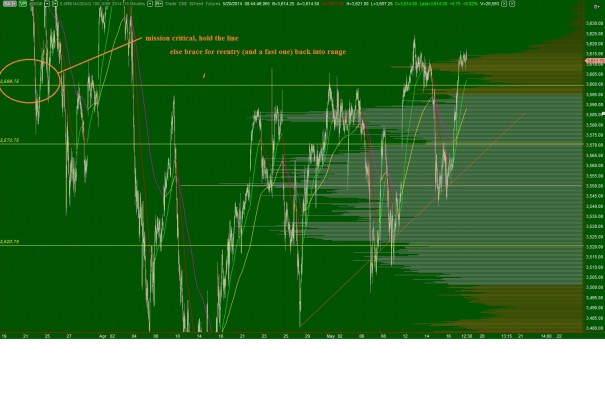

Taking our attention to a higher level, we can see the market coming into balance on the intermediate timeframe after yesterday’s price action. The balance spans nearly 5 days and the action has a near-perfect symmetry. The VPOC is about 1.75 points below the midpoint at 3723.875. There is a well defined LVN at 3727.25, just below yesterday’s close. The two price levels just above yesterday’s close are of huge importance. Essentially, if the Nasdaq goes red-to-green today, pay very close attention to the price action at these levels as the volume/market profile context is big:

Comments »