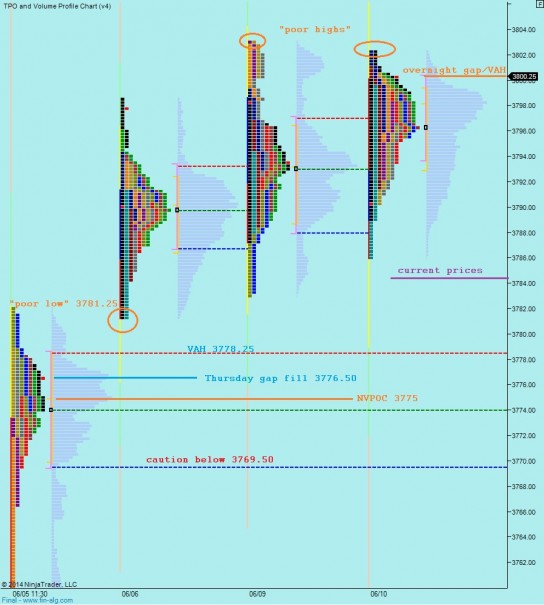

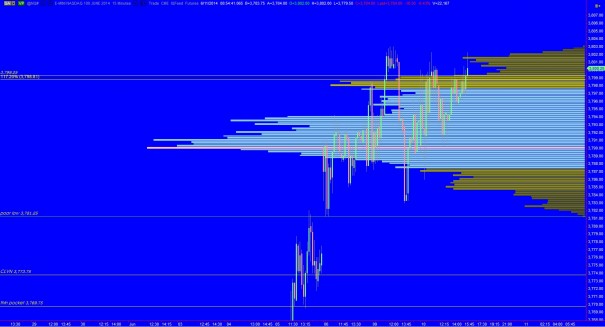

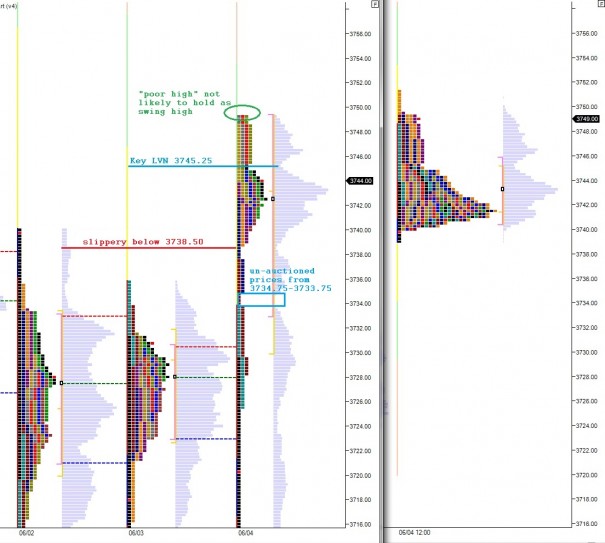

Nasdaq futures are trading flat overnight on a balanced session of trade. A bit of selling came in on the PPI data at 8:30am and was soon met with responsive buying. The net of the actions is prices trading near unchanged as we approach cash open. We have Consumer Sentiment coming out of University of Michigan at 9:55am but an otherwise quiet economic calendar on this Friday.

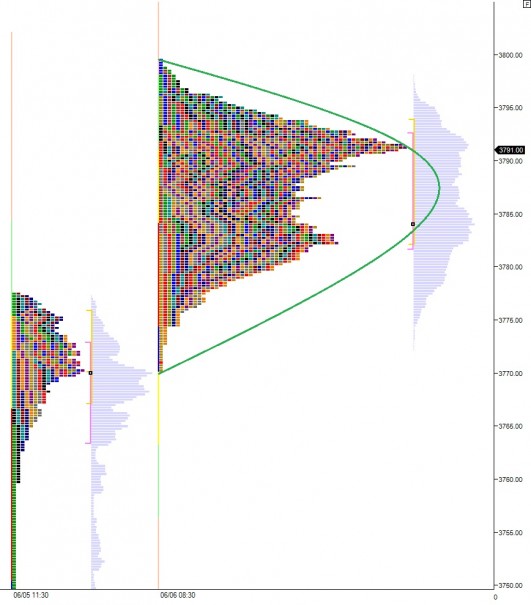

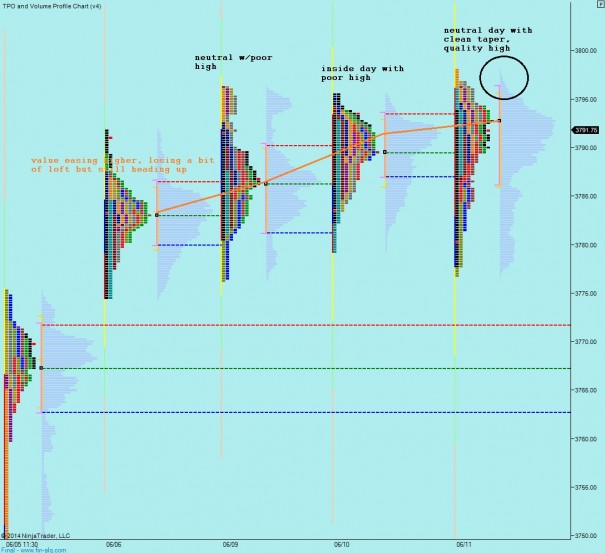

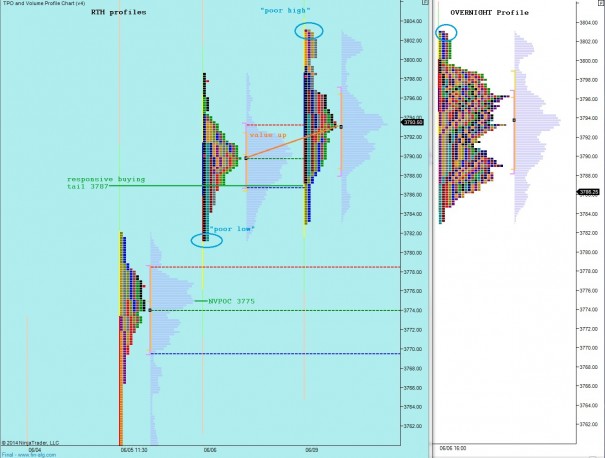

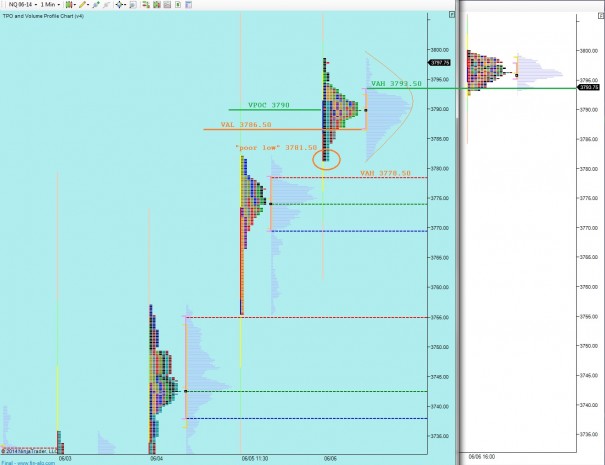

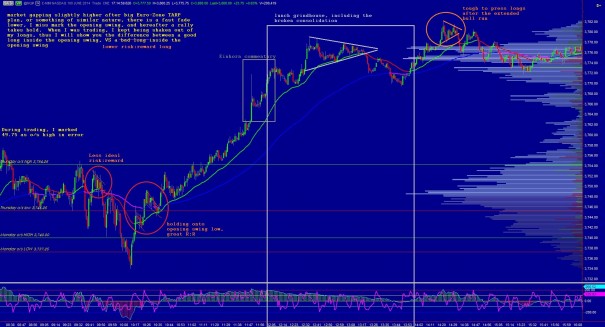

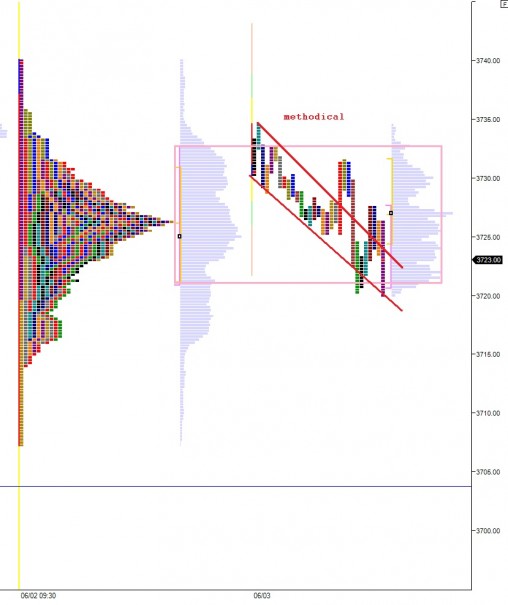

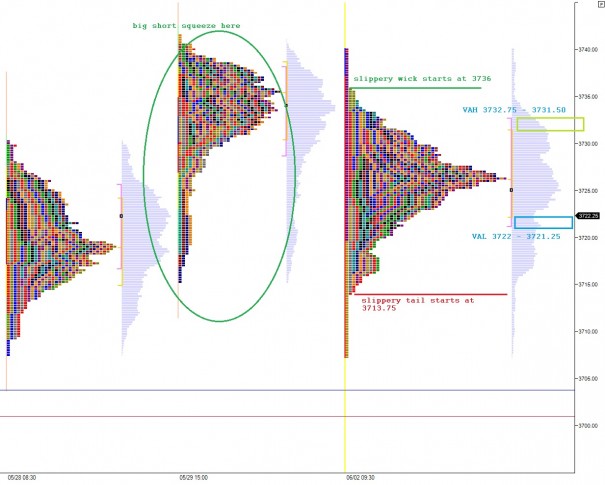

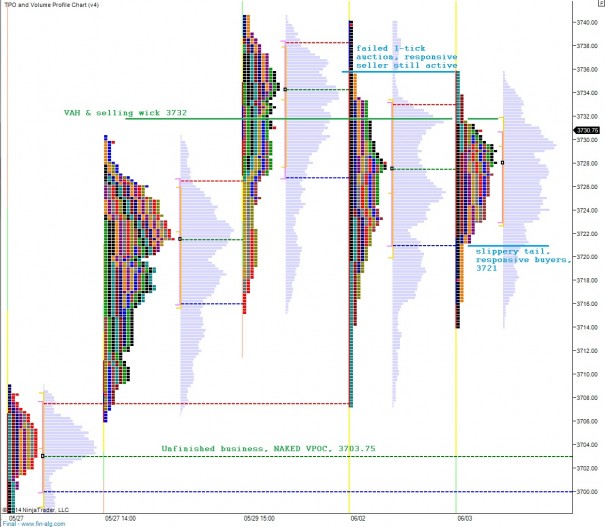

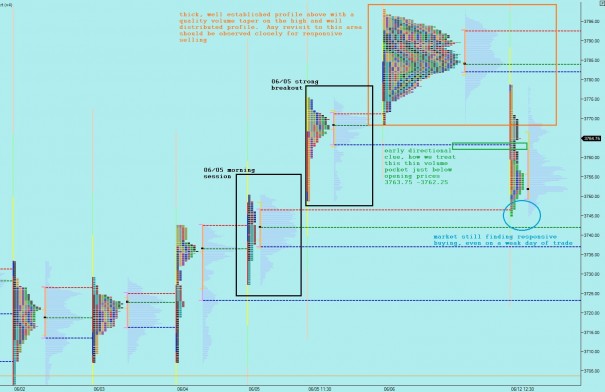

Sellers grabbed the reigns yesterday and pressed the short term auction out of balance and into their control. They were able to drive down through the thin volume structure below our upper balance before ultimately finding some responsive buying at the value area high of 06/05 trade. To be more granular, the responsive buyers were found just below where prices initially launched from late on the morning of 06/05. The event was a catalyst of change, which is why I had to split the 06/05 market profile in half to present a clear picture. I have highlighted this event below, and how we found responsive buyers again at this level:

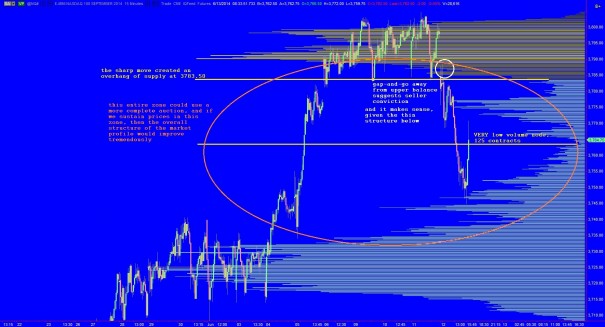

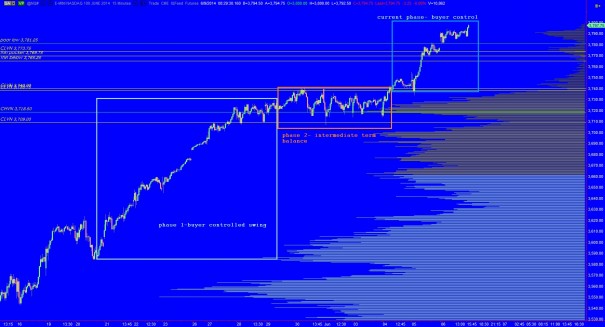

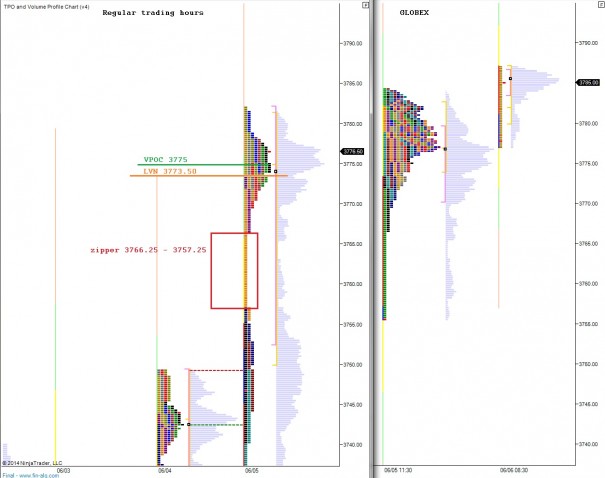

The intermediate term picture shows we are now trading out of balance and inside a thin volume zone. Price is likely to move faster in this zone and that presents greater opportunity for intraday trades. We have a sharp overhang of supply above, and whether buyers can push back into the supply will be a big clue going forward. My expectation is to find responsive selling on our next probe above 3783.50, however anything is possible given the overarching uptrend on the long term. I have highlighted this supply overhang below:

Comments »