Cree shares are in the toilet after reporting soft guidance after the bell. I can only see this as a buying opportunity. If it presses my RVLT shares lower, I’ll be looking to buy more of their shares too. Listen to me very carefully: LEDs are coming in a big way. There are hundreds of millions of light bulbs that will be updated to LED technology.

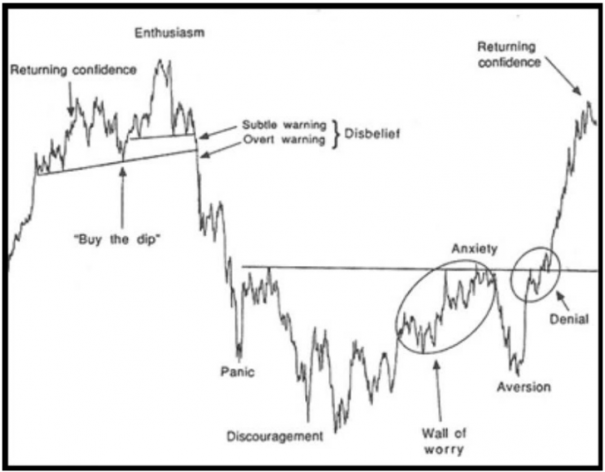

Cree was priced for perfection going into earnings, it worried me. I could have lightened my shares, but then I risked having to buy them higher on a positive reaction. I’ve been biding my time with CREE, letting it effervesce for months, hoping for an opportunity to add exposure into some blood.

It appears I have my opportunity.

Shares are down nearly 15 percent on the news. My cost basis is much lower so the market will have to do worse to shake me. I’m a buyer down here, but I intend to do so with laser like precision.

The CREE chart has needed to reset since February. This isn’t a trade. It’s a multiyear thesis that will crush. The numbers out of CREE look great to my eye.

MOVING ON…

There’s nothing you can do, sans having illegal insider information, to avoid the type of loss I was forced to take in OCZ today. Sometimes you get unexpected news, especially when you’re digging through dumpsters looking for winners. You have to cut the names as gracefully as possible and take precautionary measures to protect your emotional capital or avoid tilt as some say. I should have probably sold on the first bounce, instead of nursing the position late into the afternoon.

I am experiencing winship in the AIXG today, I’ve waited quite some time for this name to get active, and it will be interesting to see if CREE is a negative contagion tomorrow.

My peanut gallery of stocks were mostly down today with the exception of ONVO and IMMR.

Tonight I’ll be formulating plans to accumulate the blood in LED and I will burn thickets of sage to cleanse these demonic losses out of my home.

Comments »