Focusing on The Auctions Only

The markets auctioned very methodical all week ahead of what is likely to be an interesting Friday. We tracked the control of sellers which began on Monday and came into question Wednesday with a violent neutral session. Thursday the market told us it accepted the current prices by balancing out inside of the large neutral day and is waiting for new information before exploring elsewhere.

Overnight the NASDAQ divided itself into three micro sessions by auctioning then breaking a bit higher, auctioning then breaking higher, and finally auctioning as the USA come online. The action overnight suggests buyers have the early edge. However they have also pressed us into very short term overbought conditions.

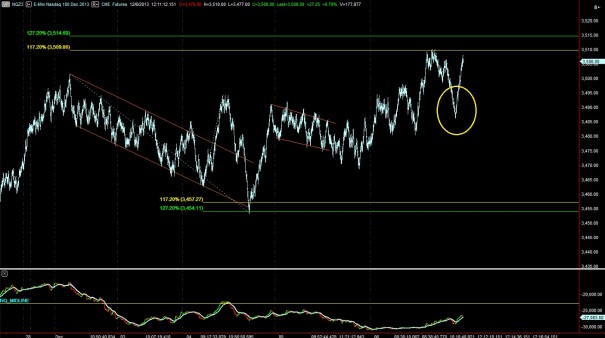

Taking a look at the longer term via value migration, you can see the relative strength of the NASDAQ verses the S&P:

Early on we have employment data which may better set the tone for our session, but the following reference points will still be relevant in determining whether the market is breaking out of balance to the upside or the downside:

Comments »

High Stakes Battle for Control

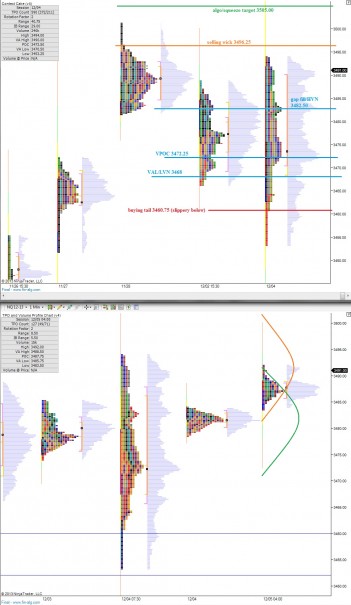

When we examined the forest tree-by-tree yesterday, it was evident risk appetite was strong. After two days of sustaining control in the marketplace, sellers were countered by aggressive buy flow Wednesday. The action started with a strong opening drive. All of my upside targets were met by 10:15 AM. It was at this point I hypothesized a trend day was setting up.

The trend context made sense at the time, but it also made it difficult for me to palate the sharp selling reversal. My thoughts became jumbled and I missed the opportunity to fade the second range extension on the day. The aggressive selling push was futile because we had already made range extension higher after a strong opening drive.

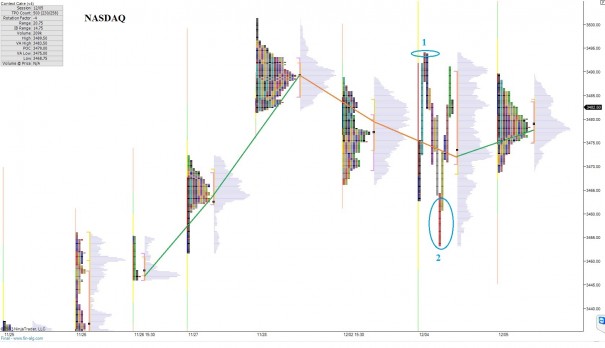

The very fact that we set such a wide initial balance higher, driven by the buyers was strong indication of their returning confidence and control. Taking the net sum of the market profile pieces, we can see the buyers gained almost complete control:

Our value area is overlapping/higher

Our close was higher

There is a large buying tail

The only piece missing is a migration of volume point of control higher. This point of contention is critical today. Will price revert back to value lower, or will value migrate higher with prices?

As of 8:15am, we are set to open outside of value on the upside. Overnight, buyers gained control after a balanced session of trade and the result was a higher distribution. This is a high risk environment where price can move beyond what we often consider normal. Therefore it is vital we have price levels in mind to guide our context.

I have highlighted key support zones on the following market profile chart:

Comments »Sellers Still Driving

The overnight markets were relatively solid for most of the session, but as USA comes online we are seeing selling pressure on the tape. The sell flow started at 7:30am and swiftly brought prices to new overnight lows and back to the bottom end of yesterday’s value area on both the S&P 500 and NASDAQ indices.

As I write, the markets are becoming oversold on a very short term horizon although given the velocity of this selling we may see follow though lower. The economic calendar is busy today including ADP employment data and International Trade numbers.

Putting all of that aside, we are coming into Wednesday and the sellers continue to retain control of the short-term auction. They gained control on Monday, showed follow though and initiative action Tuesday, and overnight they are again in control. This is all taking place in an aged long term auction controlled by buyers.

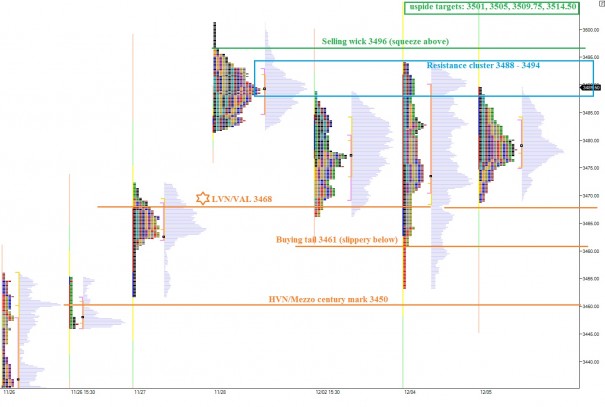

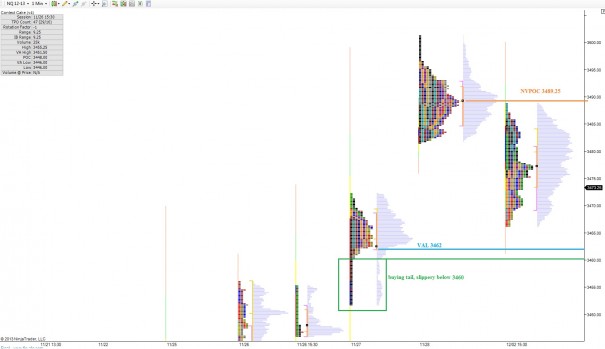

Focusing on the NASDAQ futures via /NQ, it will be interesting to see if the buyers can come in early on and work though this overnight gap. Buyers will be targeting a gap fill to 3475.25 and perhaps yesterdays VPOC at 3480. If buyers can turn momentum around, we have upside targets of 3484.25 (VAH) and 3489.25 (upper most distributions NVPOC).

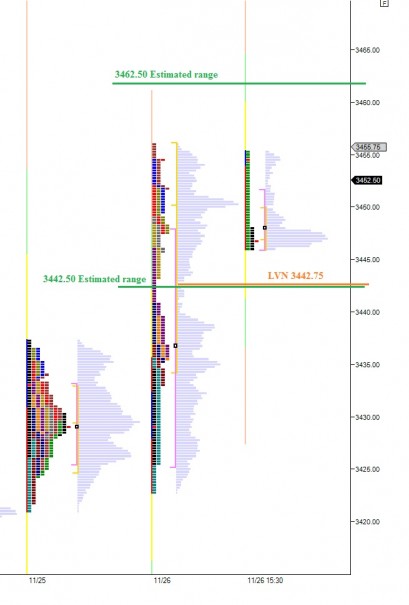

If sellers continue to build on their momentum, they will look to trade through last Wednesday’s range and target the value area low at 3462. Not too far below this price is a string of single prints which indicates a strong buyer was present at the levels. Should that same buyer not present herself on a retest, it would suggest a shift in sentiment and downside action could accelerate.

I have highlighted these levels on the following market profile chart:

Comments »Sellers’ Targets

The index futures are lower overnight, with the marquee S&P 500 weaker than the NASDAQ composite. Early on the momentum favors the short side, especially given the gap below in the NASDAQ. My expectation is for an early probe lower by sellers into the gap. I will look for buyers about half way into the gap from 3475 to 3473.75. Should they not present themselves, I expect trade down to 3472.25 (11/25 high) then 3469.25 (11/25 VAH).

At some point the gap trade higher may come into play, perhaps fueled by shorts in the hole. The overnight gap higher target is 3483.50. If the algorithms decide to run stops on any newly minted shorts, my algo upside target is 3489.50.

Long term auction is still in the control of the buyers but is aged. Yesterday was controlled by the sellers, and overnight the sellers retained control.

I have highlighted the day how I envisioned it above on the following market profile chart:

Comments »Morning Index Glance

The NASDAQ continued displaying relative strength verses the S&P 500 overnight, albeit mildly. The composite index was able to make new swing highs during the overnight session where sellers were quick to greet the move.

As we work into the early hours of USA time, prices have balanced out and are slightly higher than last week’s close.

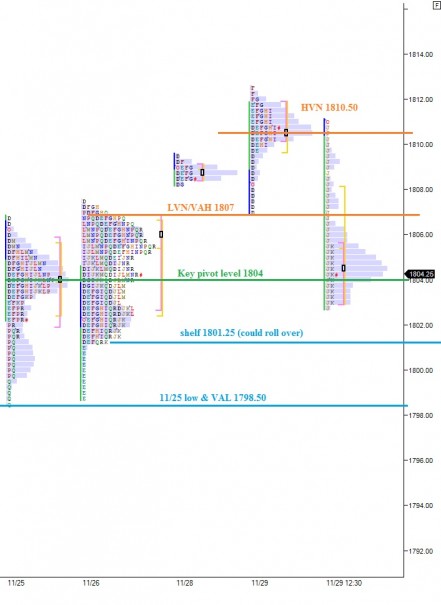

During today’s session, I am interested to see whether or not the lagging S&P breaks recent lows or instead continues consolidating/grinding higher. Put quite simply, I will be monitoring the 1800 price level. Should we sustain trade below 1800 for a prolonged period of time, I may reduce select long exposure.

I do not want to see the NASDAQ (as represented by the /NQ contract) below 3488 for a prolonged period either.

I have highlighted the levels I will be observing on the S&P today on the following market profile chart:

Comments »What About That Afternoon Spike Lower?

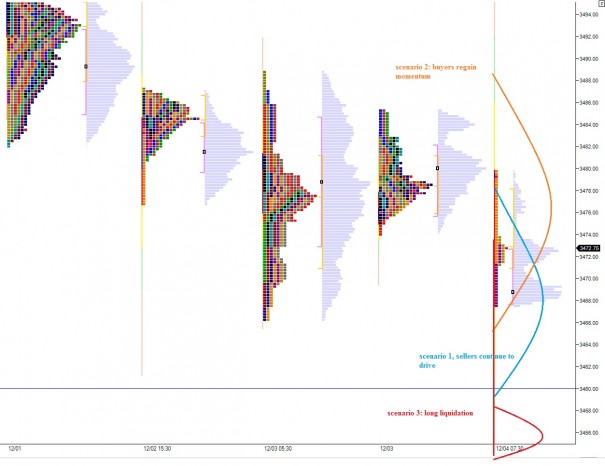

There was a bit of chatter afterhours about the spike lower on the indices shortly before the closing bell. As we drift into a holiday, many will likely dismiss the action and continue preparing a warm home for their families. However, the spike is a useful bit of context, and we can use it to frame some expectations for the day.

The spike lacked time. The selling began so late in the day there was no time for us to gauge the momentum of the sellers. Coming into RTH, we are set to open within the range of the spike on both the S&P and the NASDAQ and our analysis will focus on the Nazzy.

An opening within the spike indicates the market is balancing. The other two scenarios are an open outside the range of the spike either lower or higher. An open above the spike range indicates a complete rejection of the move and invalidates it entirely. An opening below the spike indicates the market accepted the move and is still out of balance and we are likely to continue exploring lower until we reach balance.

Returning to our situation, opening within the spike, our expectation is for two-way trade to ensue as the market balances out. We can use the range of the spike to estimate today’s daily range. This will be incredibly important on a light holiday session where less is certainly more. If we get a solid idea that one range extreme will hold, we have a target in mind for the auction.

I have used the spike to envision a scenario on the following market profile chart. Remember not to lose sight of the big picture, where bulls have rallied strong all year long and we are heading into the weekend already, ahead of mutual fund Monday.

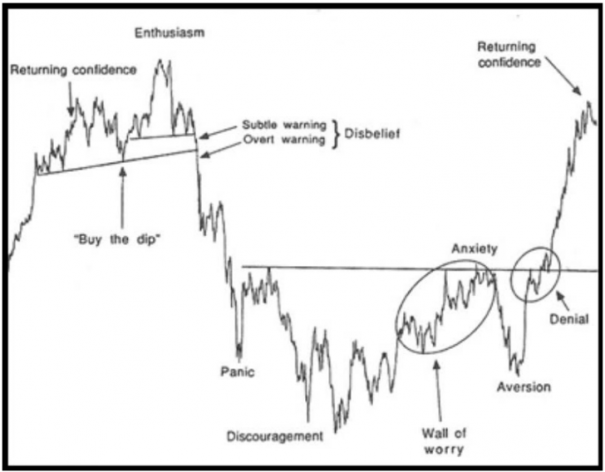

Comments »A Different Way of Correcting

We hear the word correction often in the stock market, and as prices become elevated we here more participants expressing their reluctance to increase exposure before a correction occurs. It is important to keep in mind however that corrections are not only price going down.

There are time corrections. These are the juicy consolidation patterns we often hunt. We see price basing out of several periods and we get an established zone to trade within. We experienced a rare form of correction yesterday when the market profile printed a normal day.

Although the NASDAQ traded higher than last week’s closing prices, when you peer into the structure of the day session you can see the correction taking place. We had a large gap higher to start the week, and when the RTH bell rang we saw a long initial balance form when reactive sellers began taking profits. The first hour of trade was dynamic selling. This was a form of correction. We did not reenter yesterday’s value, though. Instead, fresh initiating buys came in and back-and-forth auction ensued.

Overnight the back-and-forth continued and on the bar chart we can see the familiar consolidation pattern we know and love occurring since trade opened Sunday. We are correcting, even though the prices on the teevee may suggest otherwise. It is important to monitor the consolidation, and which party can successfully drive price away from it. You can see the pattern here:

I have split open the RTH profile on the following chart to more easily display the normal day and I have also listed key price levels:

Comments »Overnight Strength

Last week’s momentum carried over into last night’s globex session where we saw the indices continuing to rise. The push higher occurred mostly during the first hour of trade Sunday evening, after which we balanced out and accepted the prices.

I find myself stating this bit of context often although it is by no means an effective timing tool but, index markets rarely print swing high outside of regular trading hours. Thus we can assume the overnight high is vulnerable.

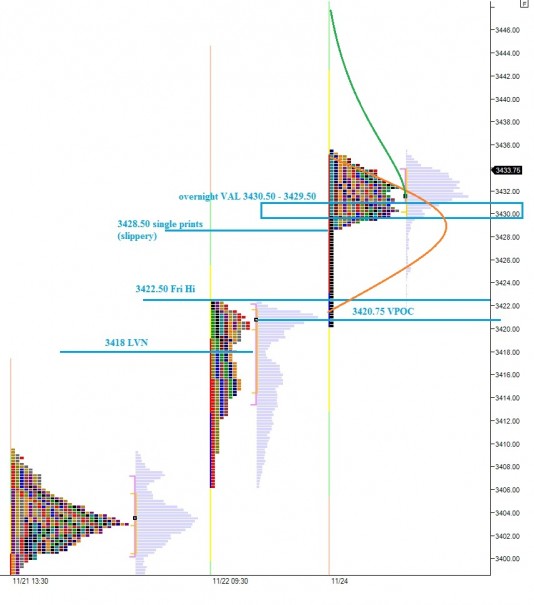

The question this morning is whether the sellers will make an attempt to fill the overnight gap or if we will instead “gap-and-go” which is a distinct possibility given the holiday week context. Turning our attention to the NASDAQ composite, sellers need to first push through the overnight value area low zone from 3430.50 – 3429.50. If sellers can breach this zone and press down to 3428.50 we are well on our way to filling the gap.

Should the sellers succeed, downside targets are 3422.50 (Friday high), 3420.75 (VPOC), and ultimately the low volume node at 3418. This level is of particular interest because it represents the price moment when sentiment suddenly shifted optimistic Friday. Sustaining trade below 3418 may suggest a shift in sentiment.

To the upside, we are working with measured moves. I show a buyer target zone from 3437.50 – 3436.75.

I have highlighted the above levels on the following 24-hour Market Profile chart:

Comments »NASDAQ In The Zone

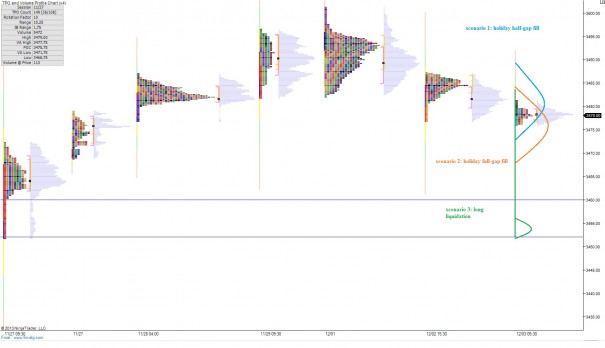

Price in the NASDAQ futures is nearing the zone where we saw the large breakout last week. Last Wednesday, just before ramping higher, the market printed a well-defined low volume cave surrounding 3360. To my eye, if the market accepts price below this level (spends an hour or more below and builds volume-at-price) then the sentiment introduced to the market last week is gone, and we should adjust accordingly.

Keep in mind however, that a mere breach of this level is not your tell. Instead price needs to sustain below for a reasonable duration. A VPOC establishment below the reference point would support the case for lower prices even further.

Up above we have a wonderful confluence of low volume and value area high at 3390. This is the sellers’ stronghold, a level they defended well yesterday after thrusting us lower. Trade above these levels would represent a bull victory as the market attempts to regain balance.

Overnight we were fairly balanced with a bit of sell flow which was faded this morning. In determining whether the bulls can sustain control of this aged trend, I want to see the velocity of the market slow. If we can consolidate sideways a bit slower then yesterday’s violent indecision, then that slowing of the market in and of itself would be constructive.

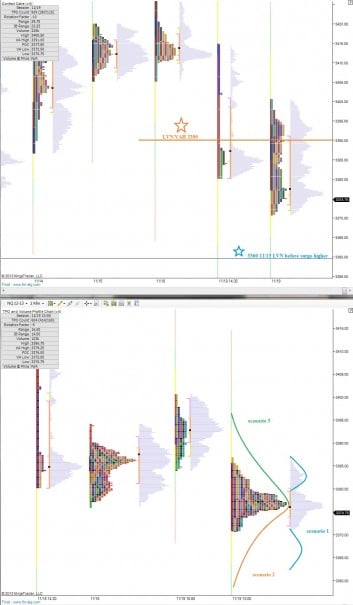

I have highlighted the above price levels, as well as drawn out a few normal scenarios on the following market profile charts. Remember, normal does not always mean right, and a different type of day development would be another clue:

Comments »