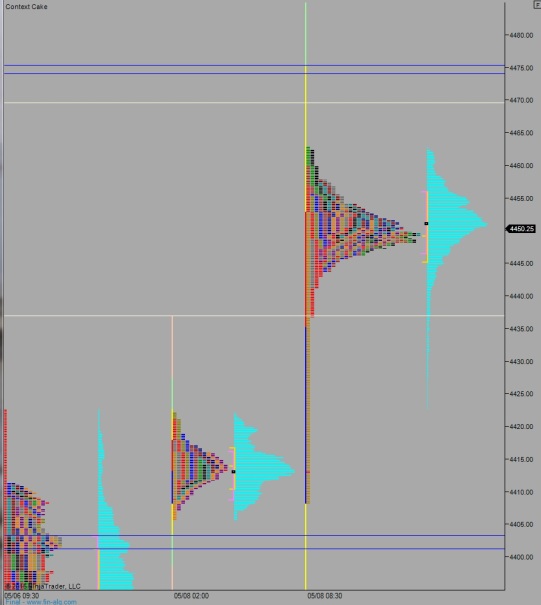

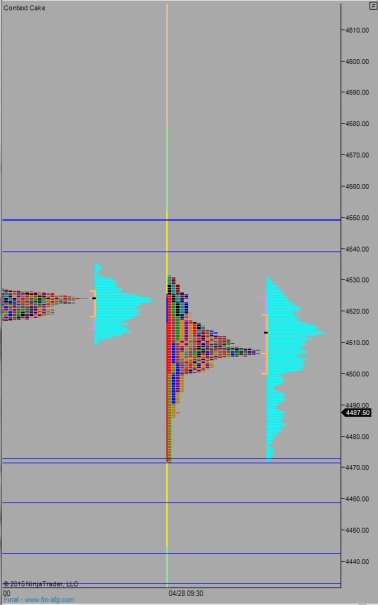

Nasdaq futures are up a touch as we head into cash open. The index spent most of the evening trading up following yesterday’s strong reactive buying. Range overnight managed to press 2nd sigma while volume stayed compressed into its normal range.

On the economic calendar we saw Advance Retail Sales at 8:30am which solicited a choppy but ultimately sideway reaction. We also have Business Inventories at 10am and Crude/Distillate Inventories at 10:30am.

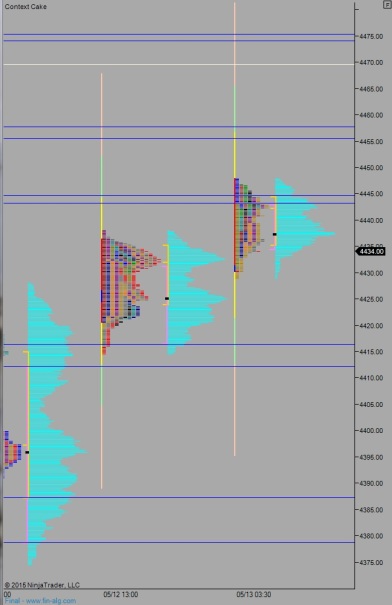

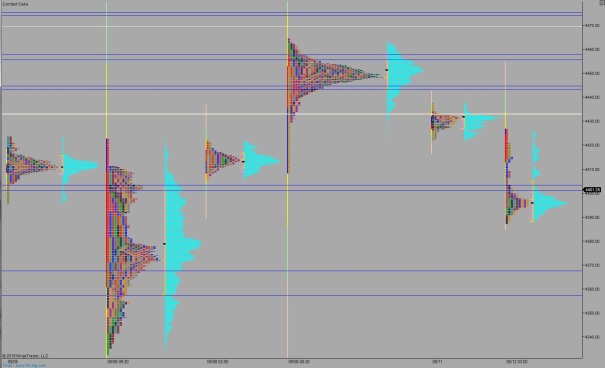

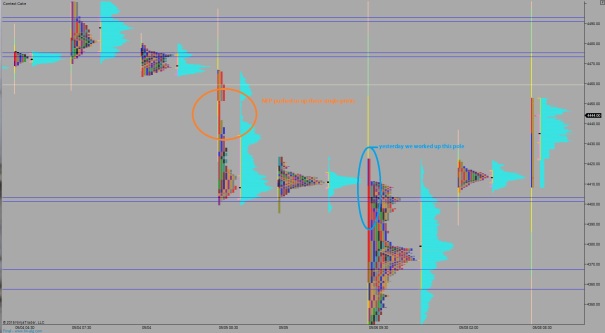

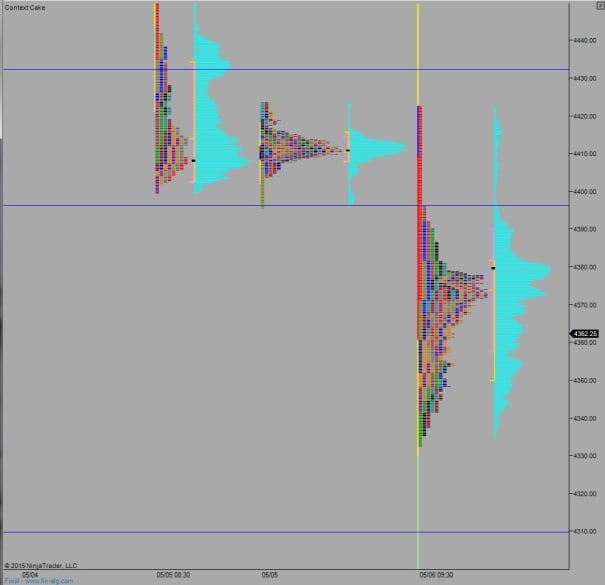

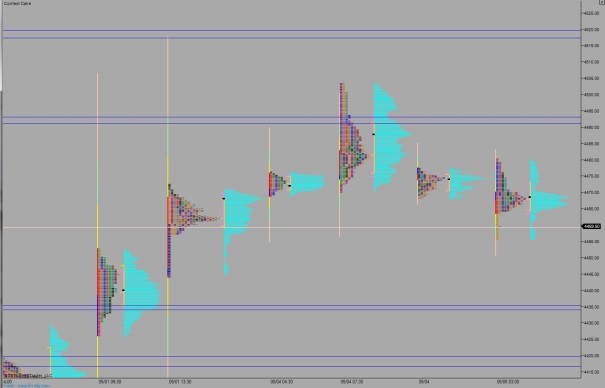

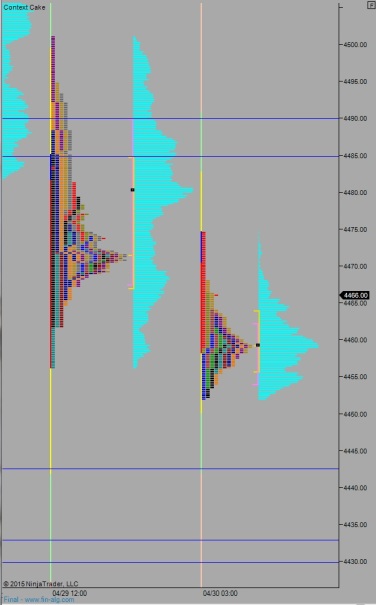

Going back to the charts, yesterday we opened pro gap down and drove lower from the opening bell. The range was enough to expand volatility for a third week. It also managed to fill last Thursday’s pre NFP gap. The auction ultimately stalled out and found responsive buyers. We then worked higher to close the overnight gap up to 4431. A few attempts were made to reenter Monday’s range but ultimately we traded lower into the bell as the market was tasked with absorbing a heavy amount of supply in the final hour and a half of trade.

Heading into today, we are priced to open on the high-end of yesterday’s range. My primary expectation is for seller to push into the overnight inventory and trade down to 4420.50 to close the overnight gap. This market has demonstrated a strong proclivity to close gaps lately so it might as well continue doing so. From there sellers may continue pushing to 4416 where I will look for signs of buyers and then two way trade ensues.

Hypo 2 buyers push off the open to take out overnight high 4447.75 to target 4455.50 where sellers come in and two way trade ensues.

Hypo 3 buyers take out 4455.50-4457.75 and continue higher to target the open gap up at 4476.25.

Hypo 4 breakdown below 4416.25-4412 opening us up to trade down to 4395.50.

Levels:

Comments »