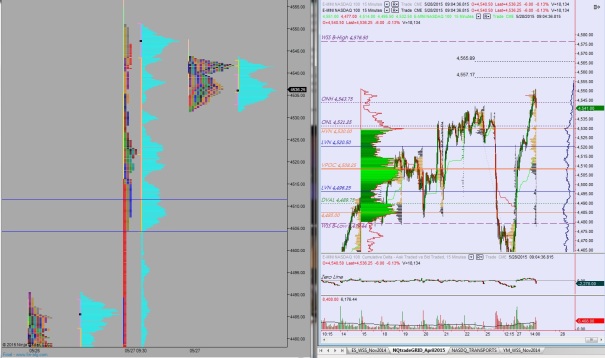

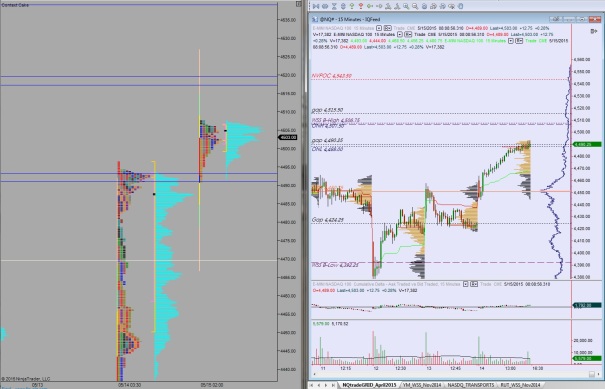

Nasdaq futures are coming into the new week (and new month) gap up. The globex session featured an abnormal range on high-end normal volume. The defining feature of the session was a large rotation up, nearly 30 points, that occurred from about 7am to 7:45am. The move is being attributed to rumors of a Greek accord coming out.

We had Personal Consumption data out at 8:30am which came in softer than expected. It introduced a bit of selling into the market. We also have Markit Manufacturing PMI at 9:45am, and Construction Spending/ISM Manufacturing at 10am.

Last week was a holiday shortened week. We came into Tuesday gap down and trended lower most of the session before finding buyers in the former resistance zone from back on 5/8-5/13. They worked price nearly 30 points off the lows Tuesday which led to Wednesday when buyers became initiative and trended price higher all day. Thursday and Friday we chopped about in Wednesday’s upper half range.

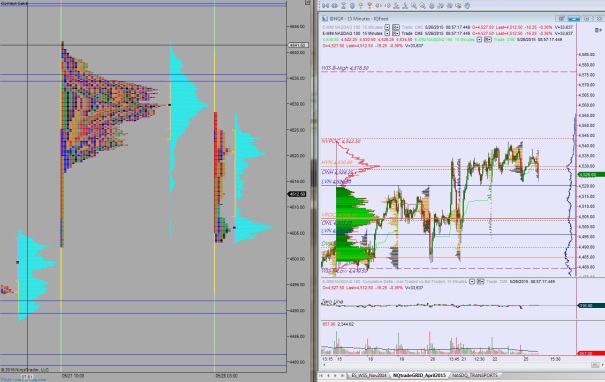

Heading into today, my primary expectation is for sellers to work into the overnight inventory. The push to green was rumor driven and may stick, but I will look for sellers to attempt a gap fill down to 4516.75. From there I will look for buyers to come in and work higher to target the open gap at 4543.25 then a test of Wednesday’s high 4547.50.

Hypo 2 buyers gap-and-go higher, take out the gap up at 4543.25 before stalling out and rolling over to chop around 4520.50 for the rest of the session.

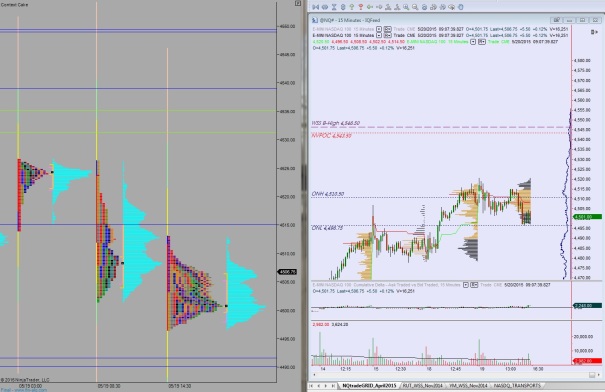

Hypo 3 gap-and-go higher, take out and sustain trade above 4543.25 to set up a leg higher to new swing high. Measured move targets are 4557, 4560.75, and 4565.75.

Hypo 4 sellers fade the overnight move, take out overnight low 4506.50 and undo Wednesday’s trend day by testing below it 4497.25.

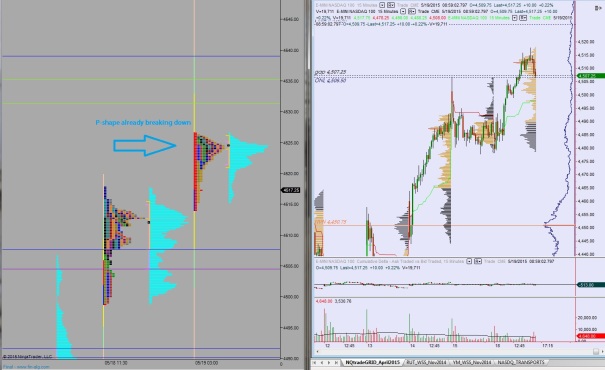

Levels:

Comments »