For most of my tenure as a trader stocks have been treated like a singular asset class and thus tightly correlated to other macro instruments like bonds, the US dollar, gold, and oil. The binary nature drove me to studying futures because if all stocks were hell-bent on moving as one, I might as well trade them all simultaneously with an ass load of leverage.

I love the futures markets. They are pure order flow with no dependence on a company and their decisions. But seeing good companies and more importantly good charts succeed even while the market chops around is exciting.

It makes me want to concentrate more funds into stock trading.

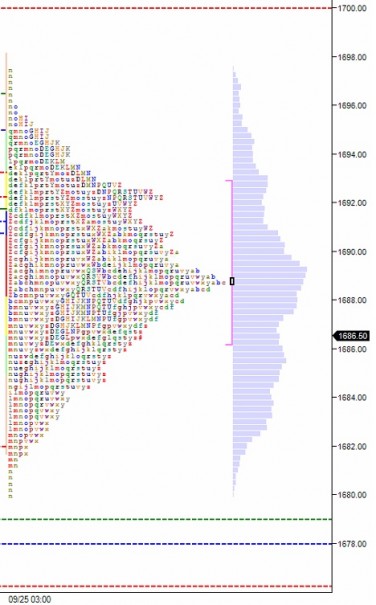

I got caught on the wrong side (the long side) of the quick drop this morning. Even though I preach plan adherence, I deviated and had to take a ton of heat on my trade. The poor entry, paired with a non-market related event which shall not be mentioned but which has officially created a rule, caused me to shake out of my long—I shit you not—one tick off the morning swing low (about 11am). No less than five minutes later, what I had expected—a bit of a bounce to cut my loss into—occurred.

This was a huge setback to my futures trading, huge. I am so sick of setbacks incurred from plan deviation. They are huge drains on emotional capital.

I went and had some tacos with a friend. We talked about hunting mushrooms and it was quite the stimulating conversation and helped clear my mind to assess everything. Trading structure will be restored for tomorrow’s action and it is good to make these mistakes while trading small, believe me.

Focusing so much energy on work and trading futures allows me to think much more slowly about stocks. The more I learn from the excellent traders and stock pickers here at iBankCoin the better this approach feels. My book is up 2.5% today while the Big Board chops the UNCH.

RVLT is a big part of the green portfolio, but it is getting plenty of help from IMMR, MHR, YGE, BALT, and FB. My account is straight crack rock and ripping.

I see a huge consolidation occurring, as if we are waiting for news flow to get this party started. Bull or bear, a party is near—I can hear the bass rumbles in the distance. Until this decision is clearly made, I will hold the line, 90% long.

My slow money is in AIXG, LO, RVLT, MJNA, FB, O, F, and CREE

My fast money is in AMBA, IMMR, MHR, YGE, BALT, RBCN, and CLF

I still hold a sharp edge in the futures market and my win/loss ratio shows it. The p/l however does not yet because of setbacks. This isn’t over until I win which is simply a matter of time, not if. This week however, my stock gains are casting a bright glow on my futures losses.

Pro Tip: Like any business, be sure you are sufficiently capitalized. Better yet, have other revenue streams so this learning process doesn’t come with the added stress of keeping a roof over your head.

http://youtu.be/cJT1xvDOMB0

Comments »