My book is down over two and a half percent today and as you may imagine I am a bit salty today. There was a broad market selloff last quarter when CREE disappointed. It tends to exacerbate this brutality. Thus my best line of defense right now is to sit on my hands and brood. The broad sell off inflicting pain upon all LED stocks is completely without merit and reflects the irritating nature of humans to overreact.

Have you ever gone around a left-hand curve on a freeway during rush hour? If one person overreacts in the fast lane (and they always do) then the entire fast lane comes to a halt. Then the contagion spreads to the next lane over. Now you have the two ‘fast’ lanes parked on the freeway while Raul zips by in the slow lane at posted highway speeds. This is humans overreacting. Bad humans, smack yourselves on the nose with a newspaper.

Sometimes even with clever tricks you get swept up in mess overreacting humans create. Such is the case today with LEDS. It is best to breath, stay calm, do not get angry, and simply waiting things out like a gentleman. Perhaps call an old friend and catch up. Eat some good food. Do whatever it takes to stay calm.

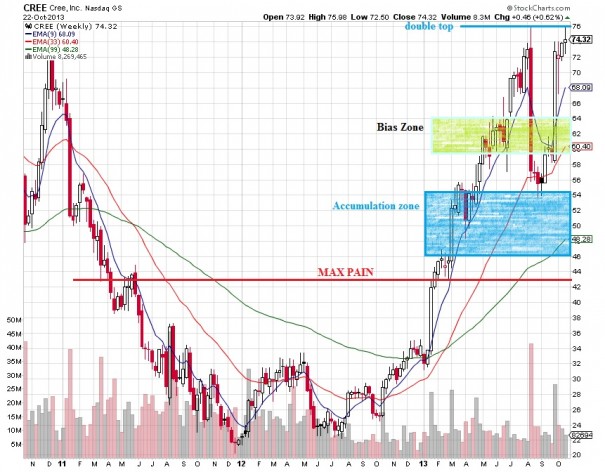

I want more CREE shares because they are a fantastic company and their positioning in the marketplace is divine as leaders. But I am waiting.

The pain I am experiencing in the LED trade isn’t bothering me. It is more like being sore after a heavy workout. It’s good pain that will make me stronger.

On the other hand I have let two trades get away from me: PPC and ADHD. I am down nearly 20% on ADHD. What was once a ¾ position has become a half position and I have no intention of buying more. This Israeli pharmaceutical company trades like complete crap intraday and it’s putting any and all chasers in the ringer for the sake of punishing their gluttony. I have been punished my whole live for being hyperactive so this feels natural to me. I will keep taking pain and eventually scratch this dumper for break even. It is too bad they aren’t cooking stimulants in their lab because that would make everyone more bullish.

PPC is being beaten so other bigger players can back the truck up at lower prices. This is the overplay for the underlay. I have never been more certain in my life. Holding.

LO put out solid earnings and I like where this company is focused. They acquired a British e-cigarrette business this month and blue Cigs have established a 49% share of the market place. First-to-market edge FTW.

I can’t trade futures in this salty mood and the only adjustment I have made is buying SLW. I have a half position and will trade this slowly.

Now I am off to read Department of Energy documents to affirm the LED edge further. Good day

Comments »