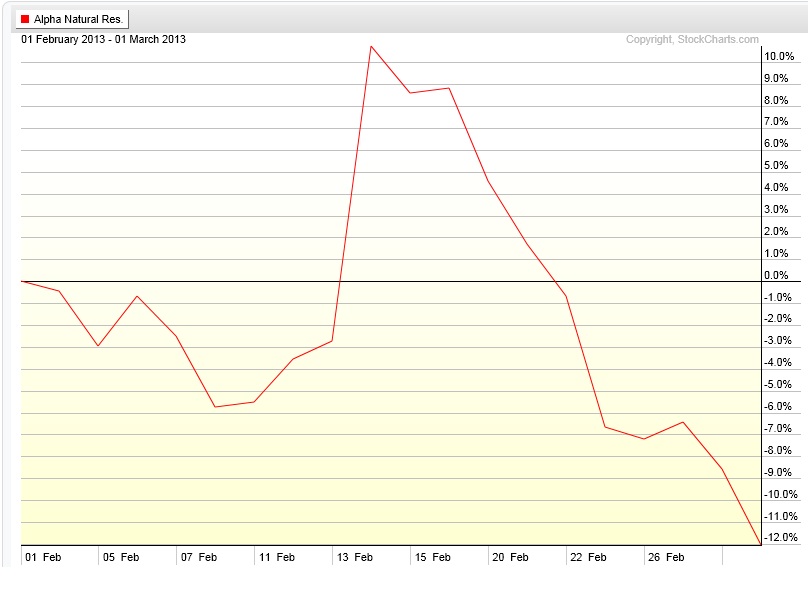

I went back to the seasonality analysis I performed at the beginning of February to reexamine how wrong of a conclusion I was able to draw from it. I knew it was going to be ugly because my top pick from the data dig was ANR. Have a look at ANR’s February performance:

I actually lost some money on that play, taking my third and final attempt at buying ANR as it tried to negate the head and shoulders pattern. I sold around February 8th aka the trough before their earnings announcement spike, then subsequent melt lower.

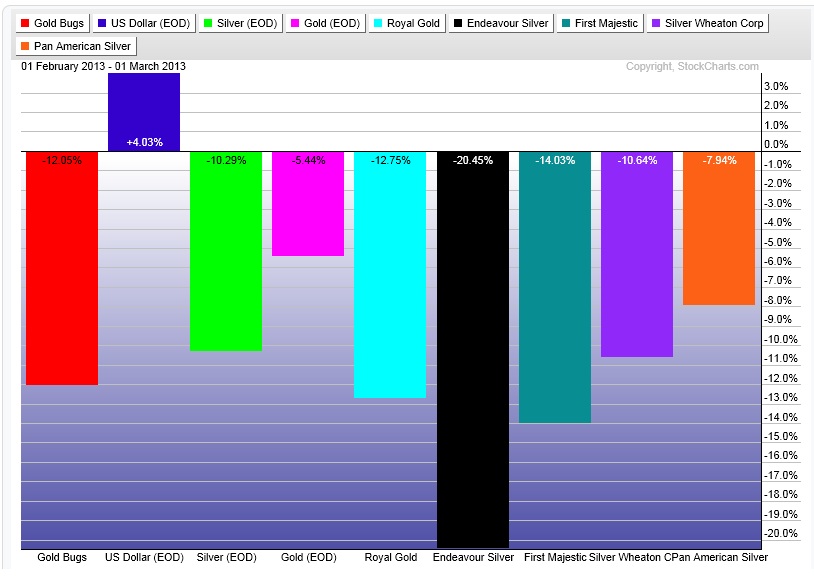

The wrongness of my analysis extended further when I predicted it would be a “very shiny February” because my seasonality interpretation supported the idea that miners would be strong in February. BIG TIME WRONG, check out how awesomely wrong I was on this call:

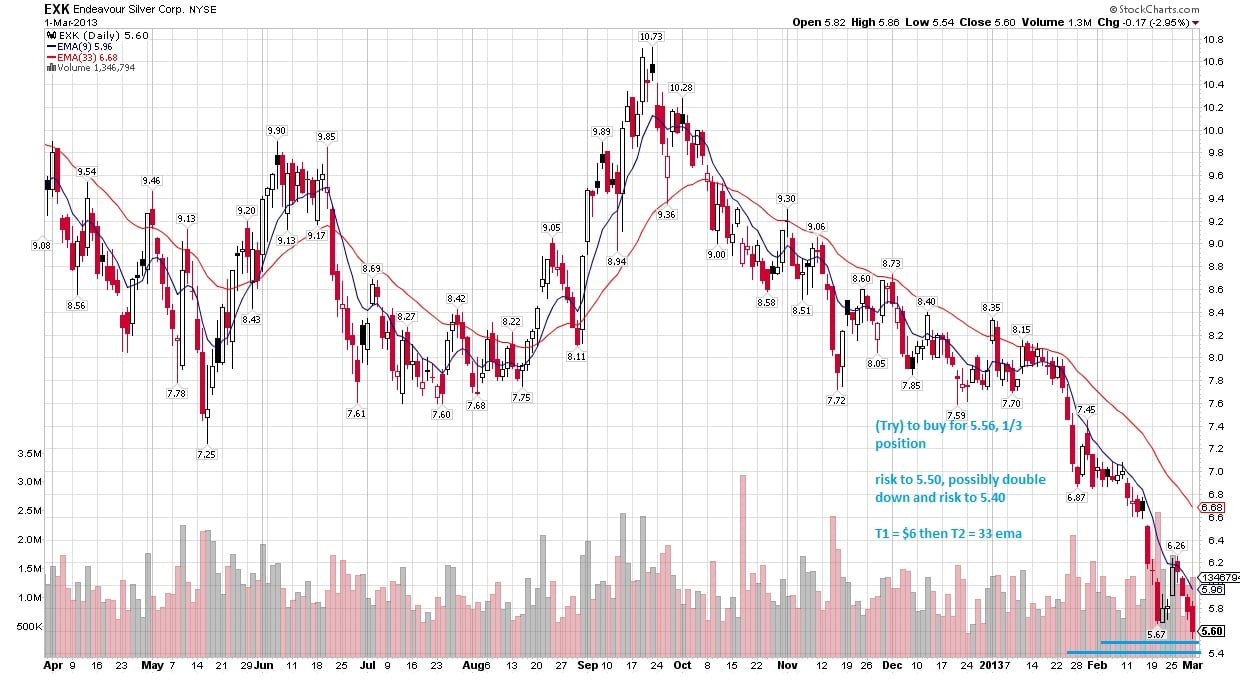

Fortunately, I never committed any money to this call, I simply observed the play. Every single chart in the space looked weak which made it easy to avoid. ANR at least had a semblance of hope setting up in the price. If you have a dog’s brain worth of technical analysis understanding and aren’t a long term investor, you would have stayed out of the miners this month. You downright love losing money if you parked your stupid money in EXK for the month. F-

Please accept my apologies if my seasonality data put a bug in your ear that was whispering false promises about the miners. If you read along you would have stayed clear, but I understand how people can make rash financial decisions based on other people’s internet decisions. Don’t do it.

With all of that in mind and because my access to The PPT has been revoked, there will be no March seasonality data dig. This is likely better for everyone. I don’t like to waste my time or yours by not adding value to your trading day.

I can’t tell you what will happen tomorrow, and I most certainly can’t predict what will happen over the course of a month. I work in probabilities. My probabilities are most reliable in the intraday to 3-12 day swing environment.

I posted all my thoughts on the #socials and their charts if you want some value added. If you’re over 47.5 and don’t see that the word #socials is a hyperlink, let me be the first to tell you that if you click it you will be taken to a spectacle of charts. Get excited you fossil.

Finally, I am not a huge fan of knife catching, but the rubber band is stretched out more than my nephew’s tee shirt after a trampoline wrestling match on a few of the miner charts. I may dabble in the circus arts this week. Similar setup on both of the following charts (click the charts to HUGE size them)

Comments »