For the second time in four weeks the IndexModel, which is prepared every Sunday as part of the Exodus Strategy Session, is signalling bearish. Before we go into how I will trade the signal, lets discuss the purpose of the Exodus Strategy Session.

Financial markets never truly sleep. In our quasi-free-market society money is always moving around the world, 24/7. This is facilitated in a number of ways from credit cards, to wire transfer or ACH, and even via the exchange of physical currency (which drives governments mad). But the USA public stock markets do ‘close’ briefly, from Friday afternoon until Sunday evening. This short pause is somewhat arbitrary, and as we become more immersed in a world augmented by artificial intelligence, the way the stock market closes for 49 hour and 45 minutes every American weekend is becoming increasingly archaic.

But it does close. Therefore it makes sense to use the brief pause to strategize and plan our next actions. Hence the Sunday strategy session. It used to be written by a person I’ve never met in real life called Chessandwine [chess and wine]. As a young man I found him to be an admirable character who demonstrated a level of stock market understanding I had not yet achieved. In fact, that was the case with many of the contributors to iBankCoin back in the early days. One day Chessandwine defected from iBankCoin, completely abandoning his post as the creator of the Sunday strategy session. I had been reading the report for years. And I imagined many others did too. And it seemed like many people would be put out by this abandonment, which sucked.

I was just blogging in public forum back then, posting my research and trade ideas and doing my best to ‘put myself out there’ in hopes of learning how to be a competent trader. It was working. I found my niche trading NASDAQ futures, which I heavily supplemented with algorithmic signals. You can click here to see how my mind approaches deep understanding. Here’s a brief snippet for anyone too lazy to click:

Nothing builds confidence in an idea like statistics and probabilities. Therefore as an addendum to the weekly course, I have built out the relevant IB statistics for my product, the Nasdaq E-mini future contract. I used five years of pure IQ Feed data to compile the following stats. Some highlights:

- We break initial balance 94.75% of the time

- By 11:30 – 73.03% of the time

- By 12:00 – 81.13% of the time

- Normal IB range (69.87% frequency) is 11 – 24 points

- Normal IB volume (66% frequency) is 40k – 75k contracts

Anyhow, The Fly tapped me to take over the Sunday Strategy Session. The problem was, I had no desire to do the report. Back then it was tailored, by Chessandwine, to be a tool for people who traded individual stocks. I rarely trade those instruments. But I tend to find ways to say yes to people, so I took over the report.

For a few months it brought me great anxiety. My research was going to be broadcast out to 100s of paying iBankCoin investors and traders. It wasn’t going out to some dorks reading marketwatch or whatever, it was going to hard core, punch your fucking jaw off, iBankCoin traders. For those of you who weren’t around in 2007, this was a violent website solely dedicated to making money. Nothing else mattered. Eat what you kill and if you’re a distraction then face humiliation until you were banned and shamed out of existence.

It was truly a wonderful place for a rabid dog like me.

Anyhow, I would go to bed early Friday so I could prepare the report Saturday. It would take me 7-10 hours and I could not enjoy the weekend until it was done. The final product was my absolute best attempt at preparing a report for stock traders. Hopefully they found it useful.

It was useless to me.

At some point I snapped and made the report exclusively for me, and also for any younger humans similar to me who were in their 18th-to-22nd year of existence. What did I need to know going into the trading week?

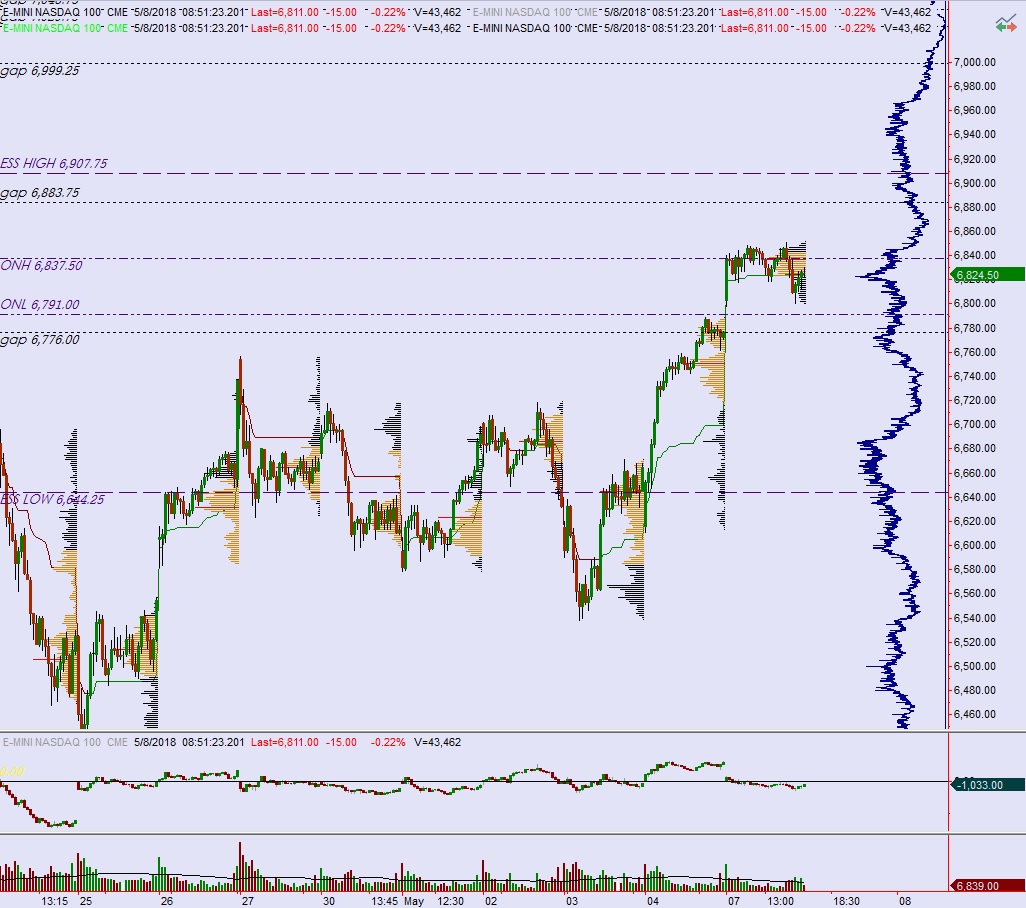

For starters, I trade equity index futures. Not stocks. And for the last four years only one instrument, front-month NASDAQ futures. The 100 largest non-financial stocks trading on the NASDAQ are market cap weighted into an index. A contract called a future is a derivative of that index that you can trade. These futures trade on the Chicago Mercantile Exchange. The NASDAQ is in New York City but in reality it exists only on the internet and in our minds. There is no physical exchange.

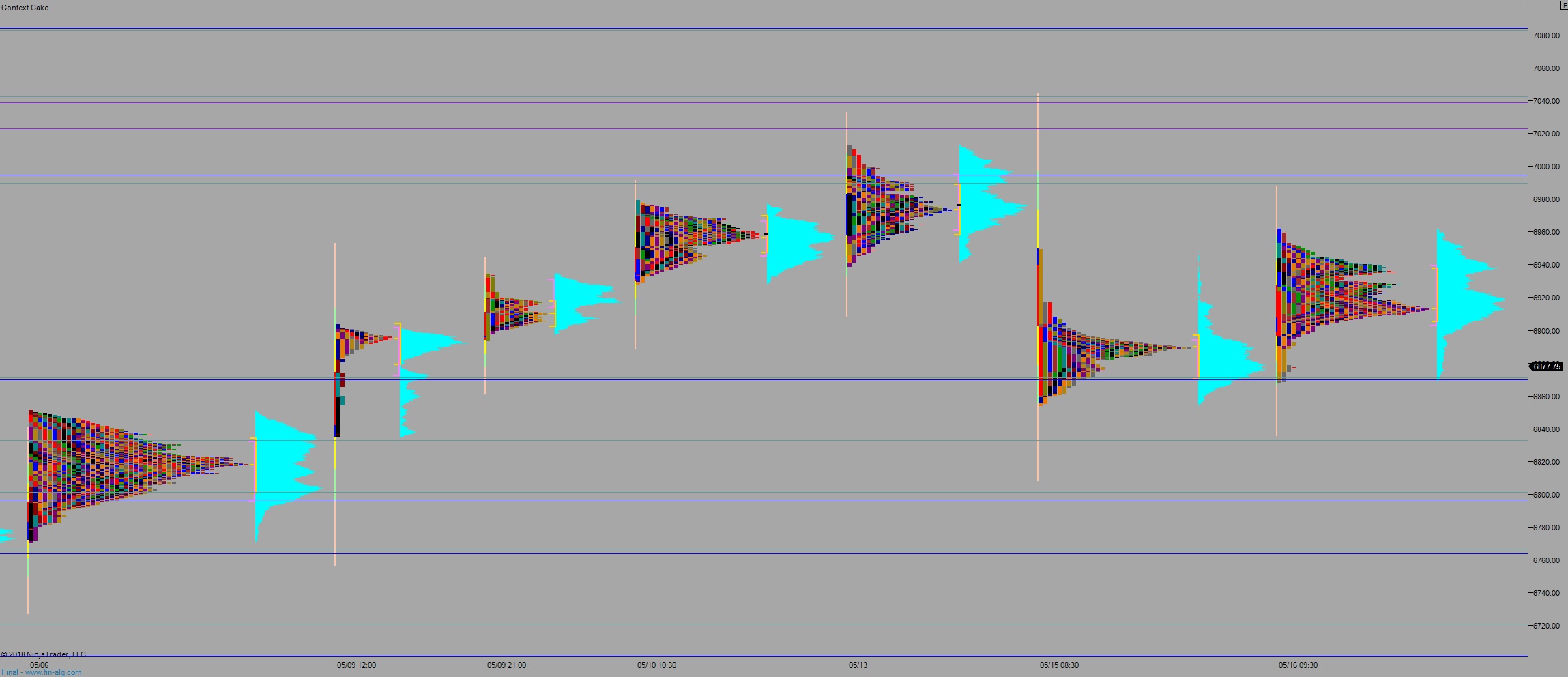

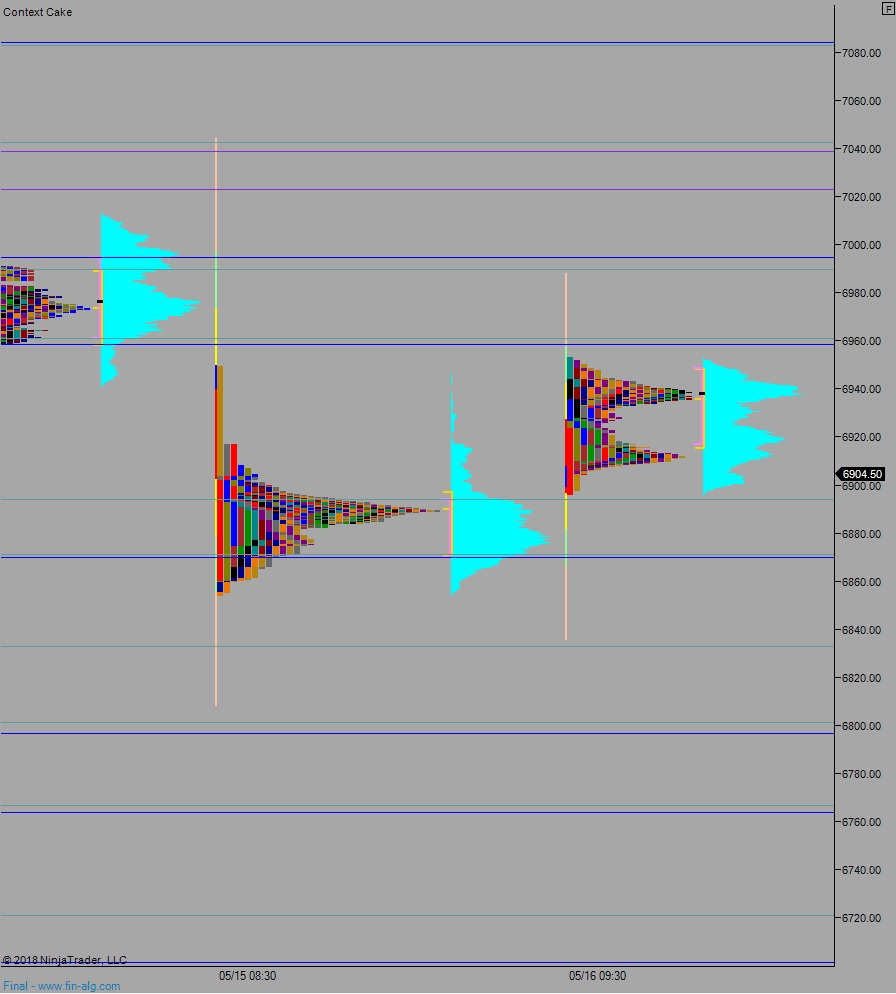

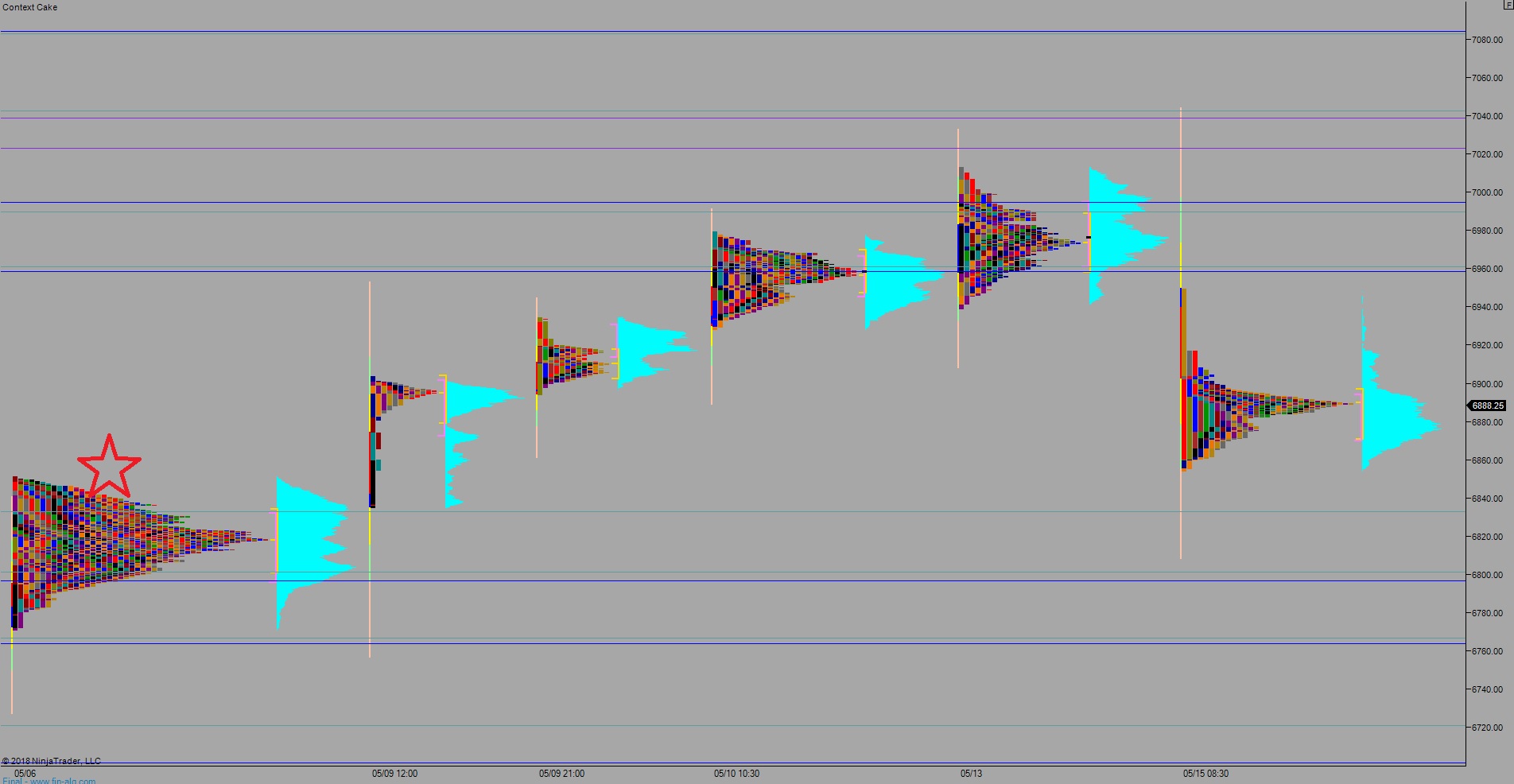

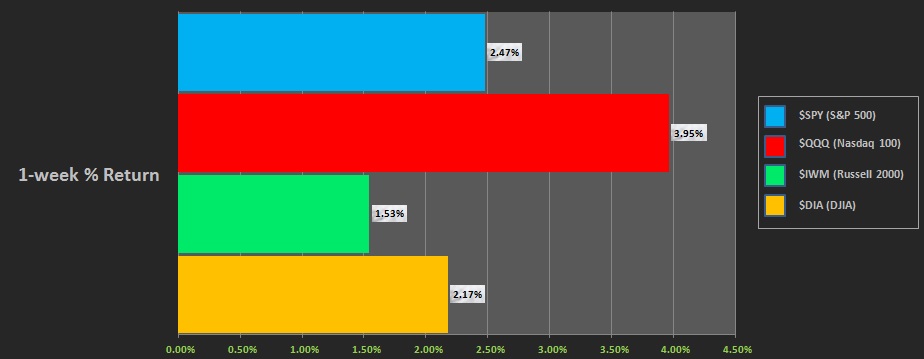

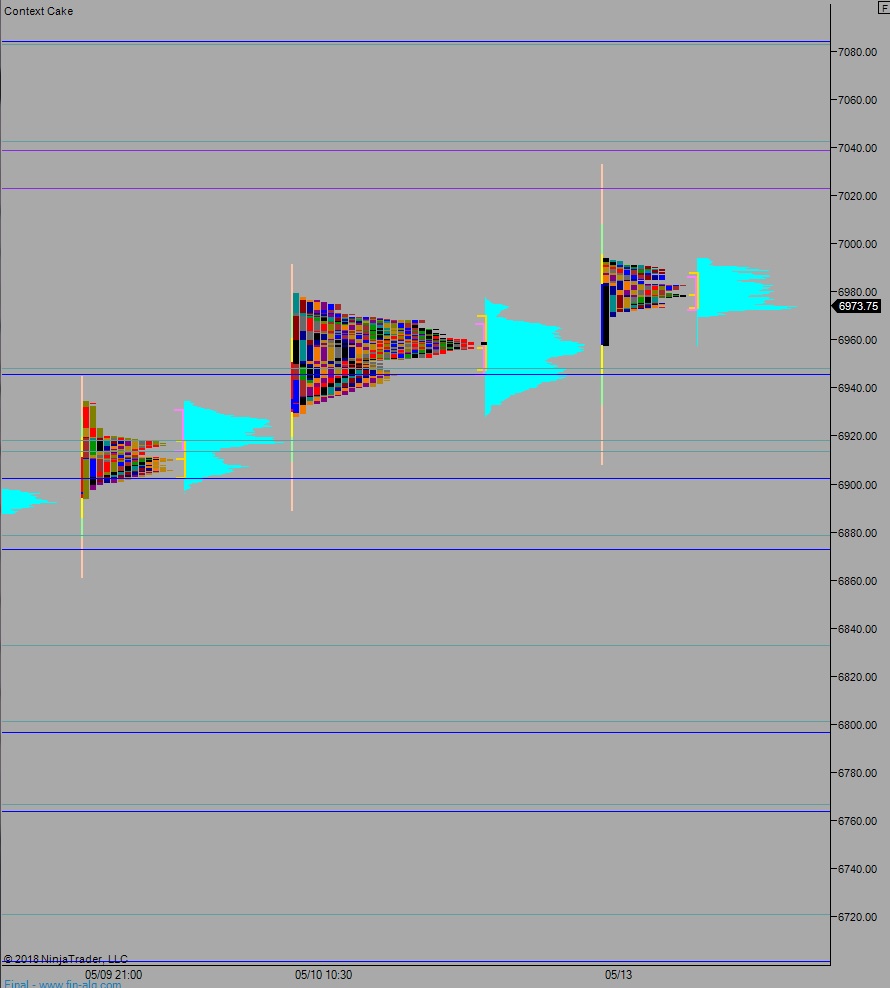

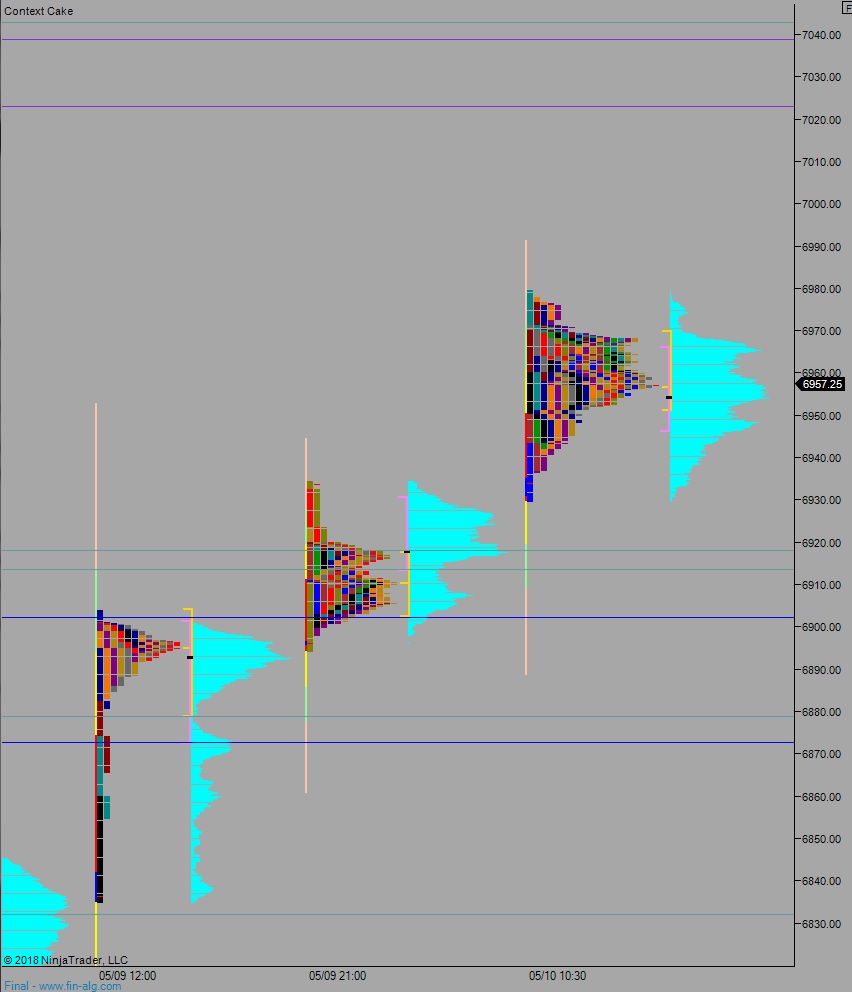

The first thing I need to know is what the stock market has done since my last report. Aka, the first of ‘the big three’ questions…what has the market done? Section II covers this as objectively as possible. We go top-down, starting with the 1-week performance of the four largest USA indices, then working down into sector performance then finally the industry level. I used to factor oil into the equation but found its behavior irrelevant to my needs. This section of the report helps identify what happened and also what the risk appetite was last week. I need to know this. It also helps to answer another big question…what is the market attempting to do?

If you are wondering where these questions come from, they come from one of the [very] few useful books on active trading called Mind Over Markets. You can find it on Amazon and one of the writers recently started a twitter account and is practicing the methods presented in the book live. You could go follow him right now but please come back and keep reading the RAUL blog:

ES Overnight inventory is short as of 8:38 AM Eastern; the odds favor a counter-action. Failure to see that counter-auction would be an indication of weakness. #ES_F #futures $spy

— Jim Dalton Trading (@daltontrading) May 17, 2018

After we answer those questions we ask the most important question of all…what is the market likely to do from here? This is where the rubber meets the road. The right edge of the chart. Everyone’s so damn good at pointing to old charts and confidently explaining what happened and why. Eventually, if you trade long enough, you’ll start to realize charts are okay, they present information well. But it can be difficult to consistently act based off of them.

The only people I see consistently acting from charts are options traders who studied under The Option Addict. They tend to buy directional bets on charts that are consolidating into tight wedges. These guys are only right like 15-20% of the time but when they are, huge huge gains.

I find statistics to be a better forecasting tool. That is what Section IV and V of the strategy session are all about. We rank things like 2-3 day trend, volume, and more, and track the outcomes when abnormal readings occur. This allows us to consistently forecast a directional bias over the next five trading days.

And that is what I need to know.

One of the signals, the bearish signal that triggered today, is called Rose Colored Sunglasses or RCS for short. It is called that because it is describing the current situation as best as I can with words. The indices paint a rosy picture, lulling everyone into complacency. Meanwhile, below the surface, Exodus sees things differently. It’s micro interpretation of over 4000 stocks and a handful of other macro components are telling a different story of bearish undertones.

If you have never worn rose colored sunglasses, just know that everythings better with rose colored sunglasses.

A directional bias means I will favor one side ‘of the tape’ while I trade the NASDAQ 100. Going into next week the model is bearish, therefore I will be aggressively shorting the NASDAQ 100 intraday. I will also put on a position trade early in the week using the SQQQ ETF and hold it until we tag ATR bracket low or the week ends. This serves as a placeholder for my bias and reminds me that I have a bias.

Want to know what trade setup will have me most aggressive and most excited? An overnight gap up, inside the prior day’s range. I will be shorting that open very aggressively until I am proven wrong or we fill the overnight gap. This is my bread and butter trade, the overnight gap in range, further stacked in my favor by the Strategy Session.

So that’s it. That’s how the Exodus Strategy Session came to be what it is today. And that is how I will trade the signal.

Sometimes after I prepare the report inside Exodus, I come out here, in public forum and discuss my directional bias in a colorful way. It’s really just an attempt to engage the reader. I think most people prefer to be entertained more than they prefer learning how I do business. But for those who do care to learn, there is the Exodus Strategy Session and the morning trading reports.

Only like 40 people read both.

Which is fine. The way my brain is required to think in order to produce the Strategy Session, and the resulting bias creation has taken me out of trading plateau I had been on for a long time. The elevation in my performance is significant. Having a bias made me a way better trader. So to me, it doesn’t matter if anyone finds it valuable. I find it valuable, and I eat what I kill.

The Strategy Session makes me a better trader. So do the levels presented on the morning report. And so does all the hard work that goes down behind the scenes.

I prefer being in my quiet little corner of the internet, misunderstood by most and left alone to make money. It took me many years to realize attention has the dangerous ability to cut right to my ego, which time-and-again is my arch enemy in trading. And in business. And in life.

The models are bearish into the last full week of May. Therefore I will be selling IN MAY.

So it is written, so it shall be.

RAUL SANTOS, May 20th, 2018

Exodus members, the 183rd edition of Strategy Session is live, go check it out!

Comments »