I love the Chinese mentality right now. It could maybe make me sad that when I travel outside the United States, other world citizens will identify me alongside the ideologies of my President, but let’s just not talk about it. The whole idea of nations is a flimsy social construct. Some rules written on pieces of paper. The only human fantasy worth associating with are the public markets. If it weren’t for electronic futures, like if we re-enter the Cold War only this time everyone ignites their new bombs and these bombs knock electronic futures offline alongside all other computer stuff—hell I’ll take to trading alpacas and pirated diesel fuel. I don’t care.

Put me anywhere and I will do my best to create a market in-and-around something. “You want to buy? I have this for you today only, best price. Oh, you meant to sell? Let me know about how’d much you’re thinking to charge okay maybe I buy.”

China is playing long-term like thirty human generations out and we’re still trying to keep the baby boomers afloat. My China correspondent, ROBERTO BREGANTE, informed me that this is the message being parroted by top executives from the Far East:

Chinese economy like sea, not a pond…when the storm comes the pond disappear, but when the storm leaves, the sea is calm and eternal.

Don’t bet against companies, religions, people, nations, who have proven an ability to think long-term and execute their vision. Companies like Tesla and Google come to mind. Religions like Scientology and Jehovah Witness. People like Elon Musk or Genghis Khan. No nation comes to mind. It’s a flimsy construct. But does any of this really matter?

No, not really. The andromeda galaxy will collide with ours soon no matter how big any person or cognitive bias grows.

I suppose all that matters is enjoying your blip of time here on Spaceship Earth, taking a shot at intergalactic travel if you have the opportunity, and being kind.

That’s it, and remember, JUNE IS RAUL’S MONTH.

Raul Santos, June 9th, 2019

PS – still bullish

Comments »

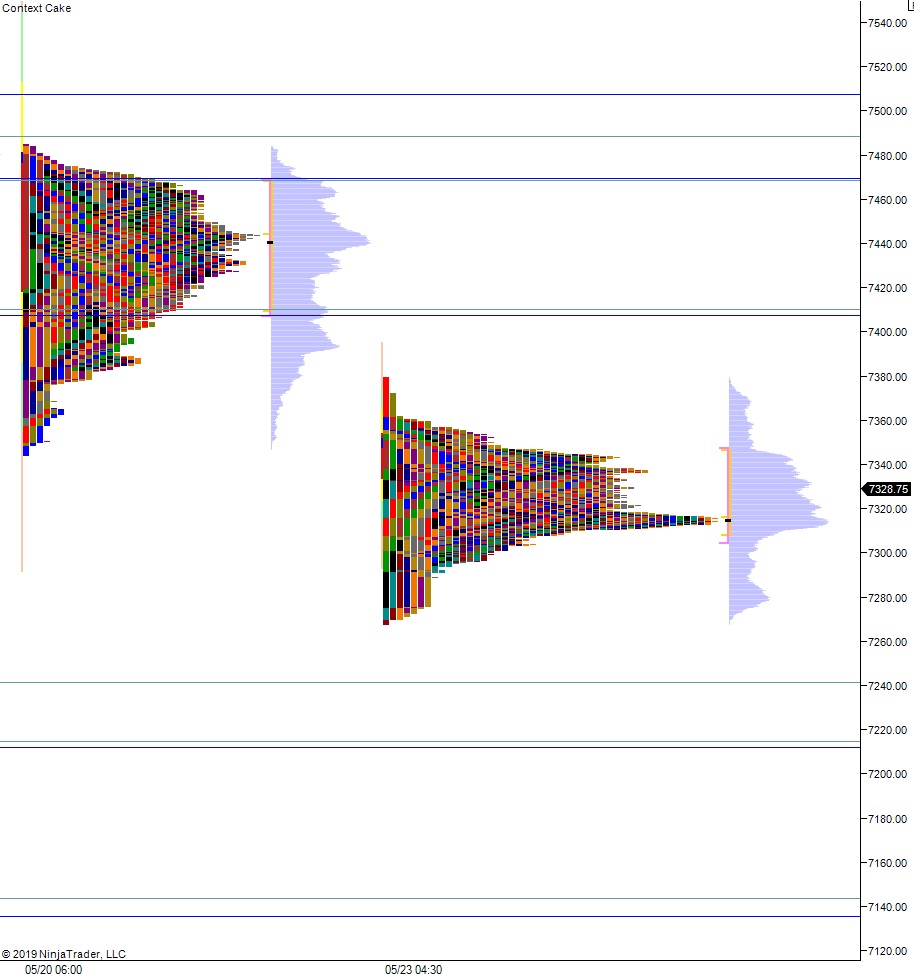

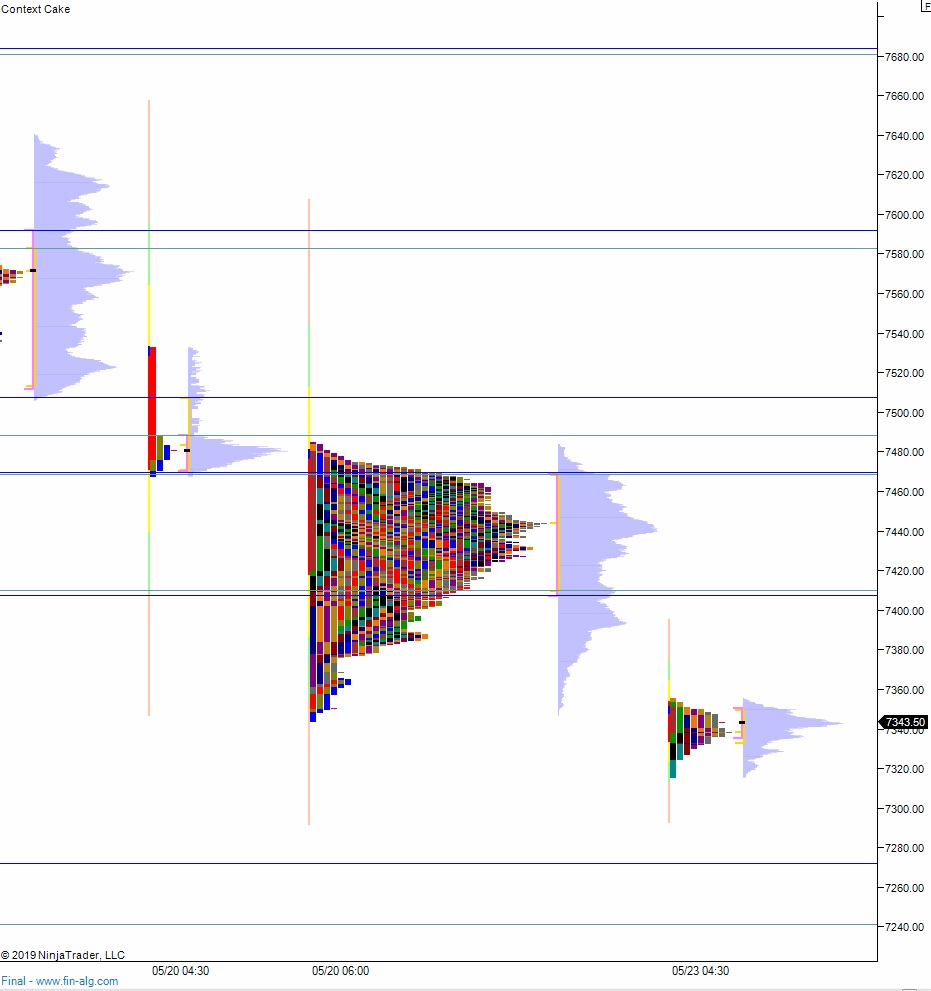

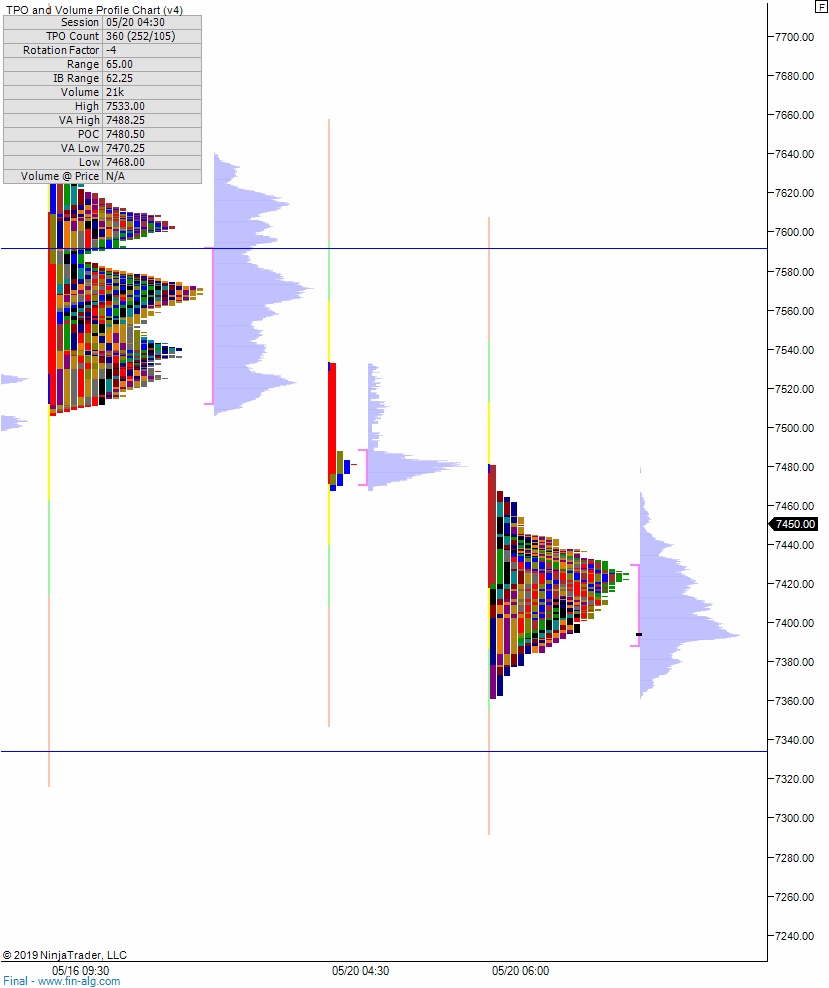

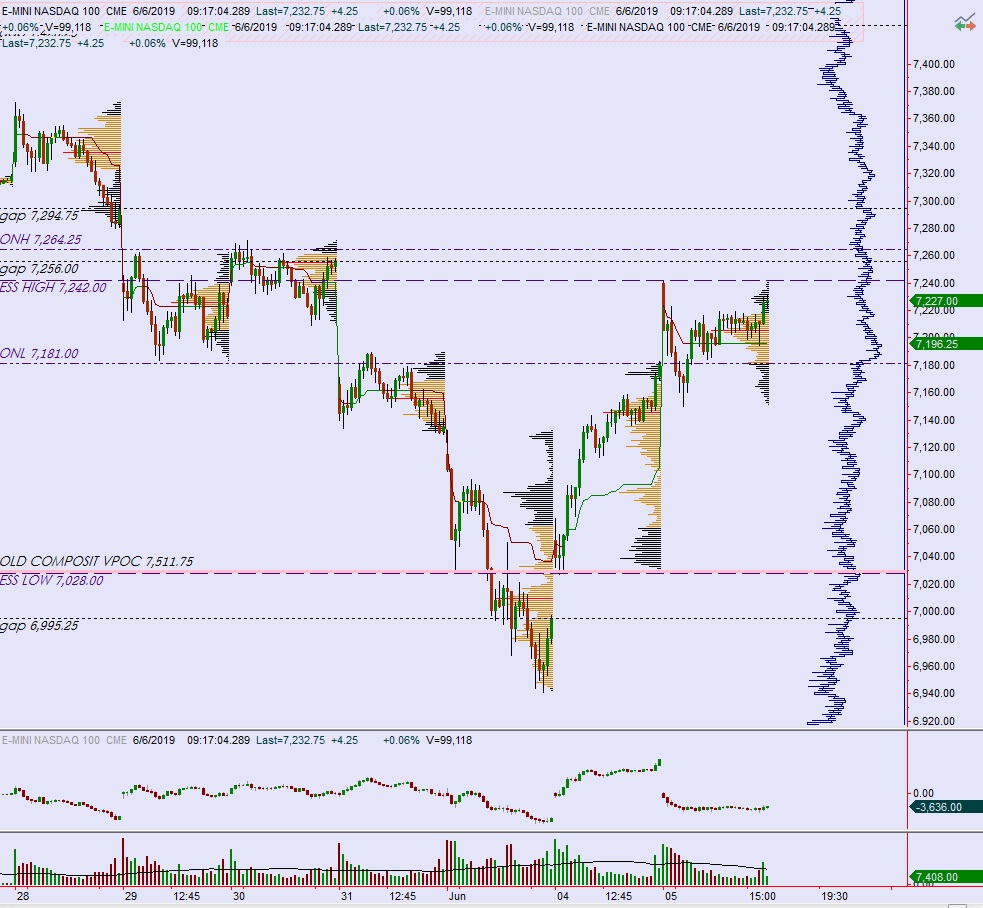

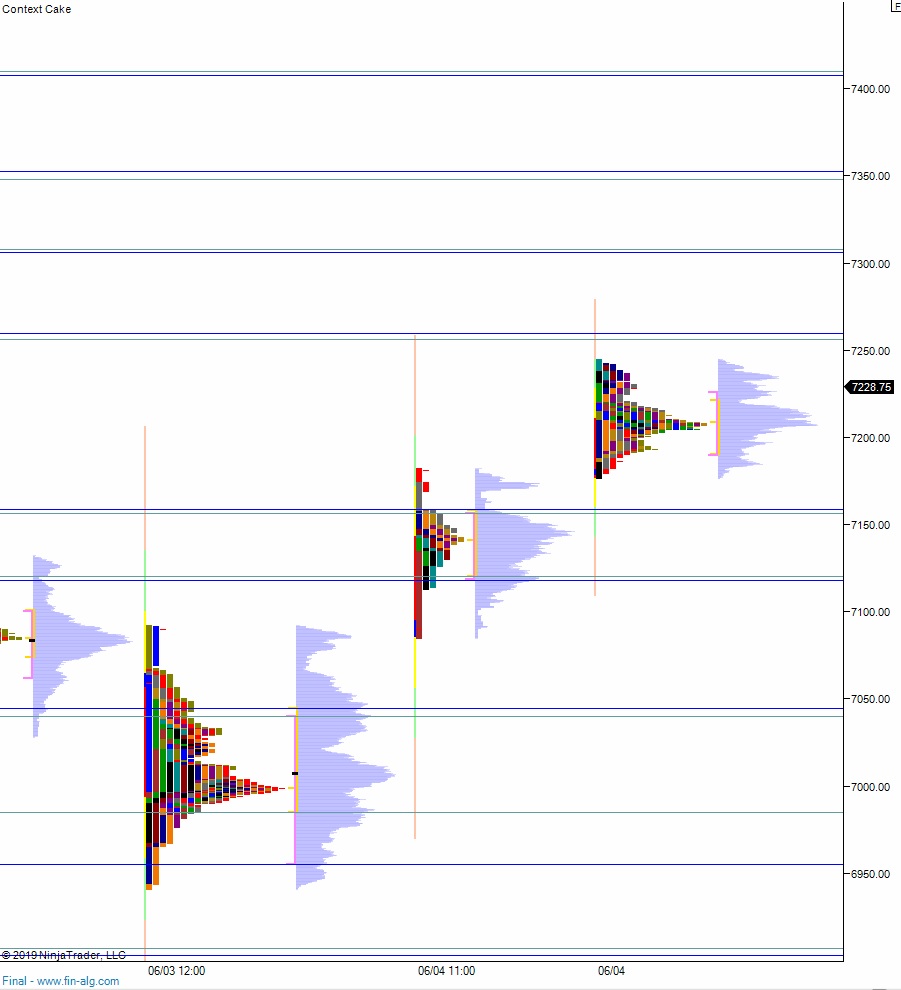

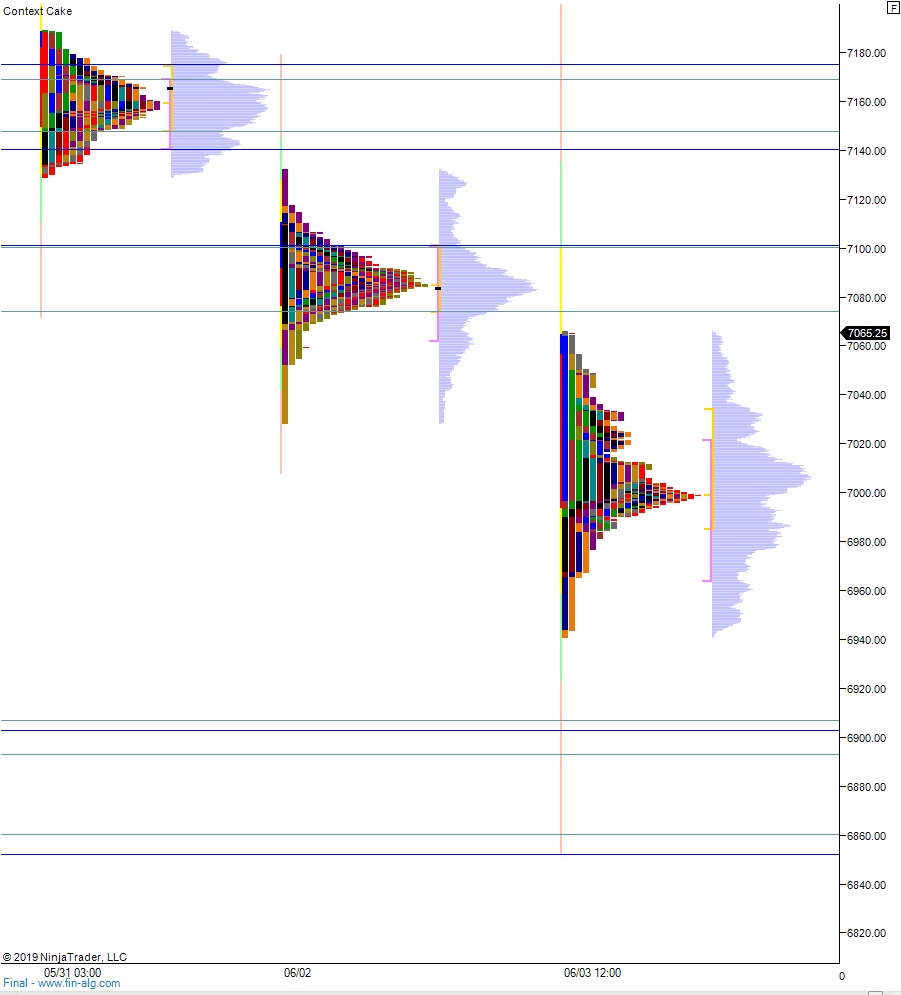

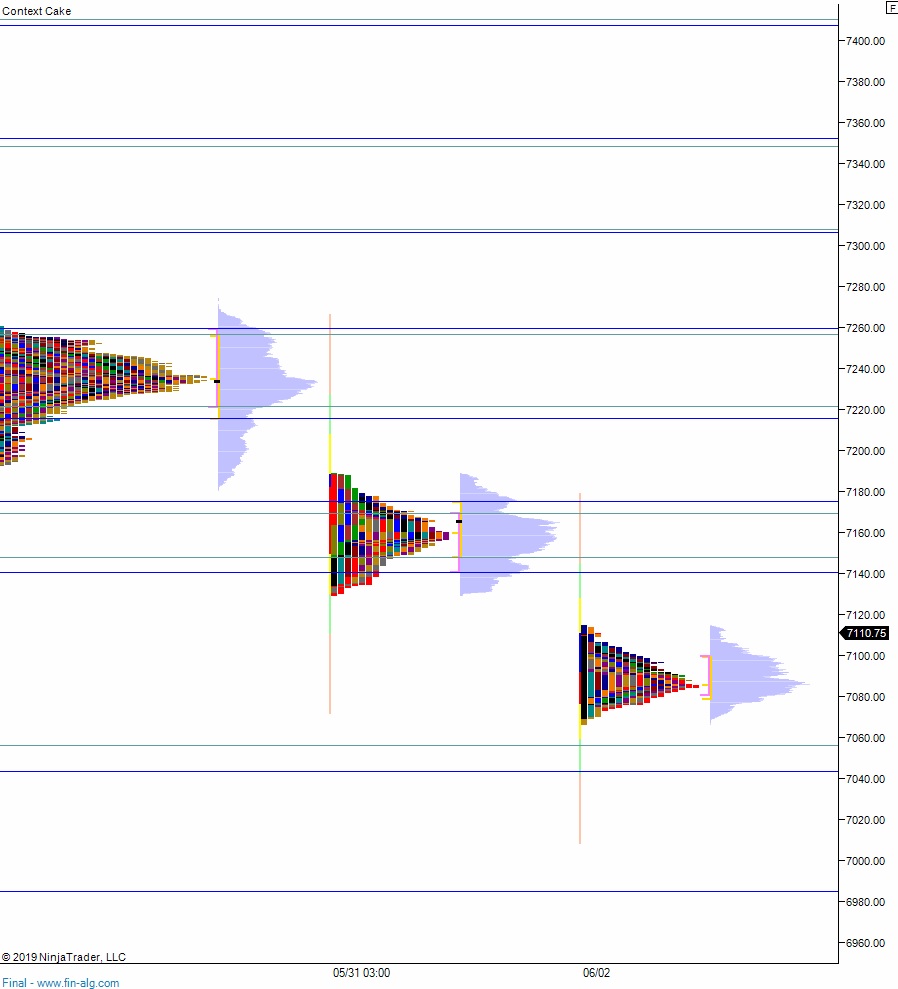

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up above Thursday’s range. An early attempt higher discovered responsive sellers inside last Monday’s range. Said sellers reclaimed the Thursday range and made short work of closing the overnight gap before price worked back up to kiss the midpoint, find initiative sellers, and we eventually closed back down at low-of-day, right near the Thursday close.

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up above Thursday’s range. An early attempt higher discovered responsive sellers inside last Monday’s range. Said sellers reclaimed the Thursday range and made short work of closing the overnight gap before price worked back up to kiss the midpoint, find initiative sellers, and we eventually closed back down at low-of-day, right near the Thursday close.