With the north gently easing into shorter days and bright-eyed youths worldwide preparing to descend upon institutions of higher learning, I feel it is both my moral and ethical responsibility to impart any and all wisdom I’ve gained during my years as a student of money and society. In this blog, I will address not only matters of finance but also nutrition, social networking and success.

I want to hold this entry to a higher standard than usual by limiting my swearing, so first and foremost let me state the most important thing you need to know while curbing my impulse for rage, and we’ll be good lads and choose better words going forward:

FUCK THE BANKS AND THEIR FUCKING BANKERS.

Banks offer nothing in the way of good help for the small chaps or medium lasses or even mixed-weight couples. They only exist to serve their institutional clients, client whose balance sheets became huge long before any bank was willing to help. These large institutions enjoy access to capital at wonderful rates. I used to work in corporate finance, treasury to be specific, and I’ve seen firsthand how to make good deals with bankers. It takes size lads, size we don’t have.

When I use the words credit and loan I mean numbers on a screen that can be used to take possession of goods, or screen numbers we can use to motivate someone to do a service, or numbers we can click around the internet to place a bet on the future (our favorite use). Banks will never extend credit or loans to you when they’re most desperately needed. Nope. But once you’ve had some success on your own, suddenly they flood you with offers, right? Once the brokerage account hits six figures, suddenly they want you to use their margin. That’s because they want to take the moneys you fought like a banshee to extract from the system via interest, fees, forced liquidation and other draconian punishments.

These are not helpful institutions — banks and brokerages — and they are becoming way less relevant in our budding era of digital currency and One Progressive Global Internet economy. The internet always wins and right now it is winning big leauge. So forget about the banks or any other pillars of traditional finance helping you in any way.

Okay, now that we have established that tradfi is not here to help, let’s deep dive into the most efficient ways to gain access to their numbers on the screen without going broke or becoming their slaves.

The first tool that becomes available as we reach adulthood is student loans. These are your ticket to financial freedom. Use them wisely.

Every one of yous needs to attend college. Which college you attend and how you go about it are vital to your independence. If I could do it all over again, I would have studied more of a ‘trade’ like engineering or coding instead of business finance. Finance is something you can learn on your own if you just pay attention to your money and the way society tries to take it. I’ve learned more about finance from trading and independently operating a business than I ever did from a professor.

Anyhow, going to college is critical for two reasons. The first is the longer a human brain is kept in a learning environment, the higher the likelihood that it will form strong reading comprehension and an ability to effectively communicate. These two skills are vital to your independence. The second reason to do college is it gains you access to cheap loans. Loans that are very likely to be erased from your ledger, one-way-or-another, eventually. This is a good place to transition to the next key to success:

DO NOT ACCELERATE REPAYMENT OF STUDENT LOANS. EVER.

Student loans carry some of the cheapest interest you’ll ever have access to in your entire lives. The next best will likely be via a mortgage (if you’re even able to afford real estate) and then probably auto loans.

We need to discuss the ‘how’ of ‘going to college’. If you can tolerate your elders (parents, grandparents, uncle, anyone old willing to shelter you) then find the best college nearby and commute to it. Yes, you will miss out on a tiny sliver of collegiate life — you know, shacking up with total strangers in tiny rooms and sharing toilets and sinks with them. Bummer.

The rest of the collegiate experience is social, right? This can be supplemented quite easily if you live near any major city center. Take Detroit for instance. We have a thriving scene of meetups (like the one I help organize), house parties, unsanctioned raves filled with debauchery, coffee shops with good wifi, cheap noodle shops and more. Doing these things in the nearest city to where elders will house you has multiple benefits, but the biggest benefit is the relationships you form here could last a lifetime. Since you’ll probably live there forever, this network can collectively play the game of extracting dollars and building business in a place you deeply understand. This is an edge that will baffle your peers when they ‘move back home’ after college.

These urban centers also offer the chance, if needed, to find a few roommates and spread your wings via independent living. Sure.

Either way you’re going to need to learn to cook. Nutrition is the key to health and with only a few inputs and tools you can build a strong body and mind. A microwave, the biggest wok you can handle (ideally a gas stove but electric works), an electric water boiler, a knife and cutting board, a rice cooker and some Pyrex containers will have you well on your way to healthy living.

You don’t really need a fridge/freezer if you have a good grocery store nearby. You do the european model of buying only the groceries for the next 24-48 hours. That said, freezing some veggie burgers and refrigerating leftover for tomorrow’s lunch is nice.

In terms of food, you need to keep your cost per meal down. Breakfast should be a staple and an honored daily routine. Quality bread (I like Dave’s prison bread), eggs, and peanut butter can keep you fueled until at least mid afternoon. Add some flavor with Morningstar patties, ketchup (hot sauce) and jellies (bonus points if you make your own preserves!).

Pretty much any vegetable can be cut into small pieces and made delicious in a wok. Put the wok on high heat, drop two glugs of olive oil in the pan, sprinkle some red pepper flakes in the oil and wait for them to sizzle. When the red pepper is sizzling but before the oil is smoking is your window for adding the veggies. Mix and match and stir it a bunch until some carbon builds up (carbon equals flavor, some health nuts will say this is cancerous, but it makes me feel great). Vegetables are cheap and colorful and packed with nutrition. Mix and match spices and serve it over rice. I eat tons of broccoli because it has the vitamins and minerals I’m not getting from animal flesh.

Keep at least three Soylant bottles on hand at all times. Some days there won’t be time for one of your meals, and at about $3.25 per bottle Soylant is a great meal replacement.

Okay so we have our entire diet covered cheaply. Feel free to add in caffeine and beer and if you’re feeling a bit overwhelmed by life add in some reefer. But be careful with the reefer. The brain is still developing well into your 20s, and the more THC you flood your receptors with, the more it is likely you’ll start using pronouns in your bio and trying to unionize burrito shops.

Exercise will do wonders for your mind. It does not have to be in the morning or always the same thing. I like lifting weights after my morning intellectual work if I don’t plan on toiling outside in the afternoon. I also enjoy throwing the frisbee, riding the kayak, hot yoga, skateboarding or biking or walking and so on.

Most universities will have community colleges that they will accept credits from. These are good classes filled with more people living real adult lives and are much cheaper.

EARN AS MANY CREDITS AS POSSIBLE FROM COMMUNITY COLLEGE.

It is not super important that you obtain a degree from all your time spent in college. It may bring you peace if you do take home that piece of paper, knowing you can fall back on some entry-level job as a corporate or municipal servant if it turns out you cannot hack it as an independent operator.

Okay we’ve covered how to do college to my satisfaction, now let’s get into why we do all this austere shit. We want to take, lads. We want to take as many student loans as they offer. We want all the student loans. But, we do not want to spend that money on our education. No. We want to do much, much bigger things with those dollars.

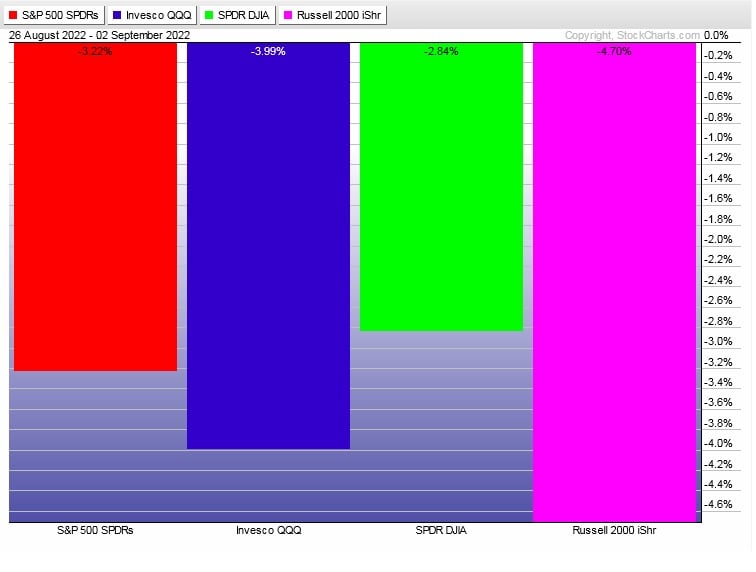

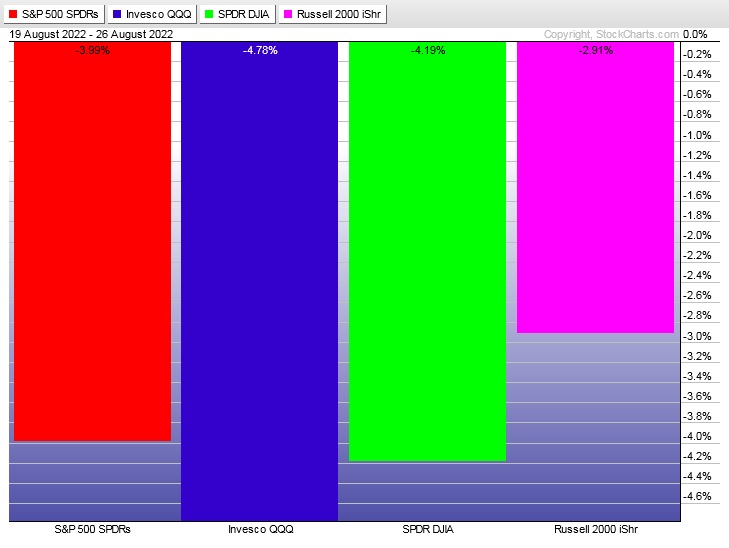

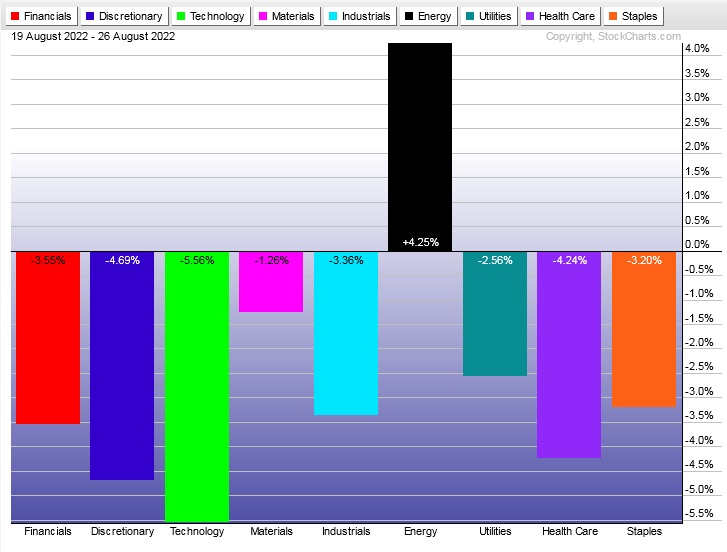

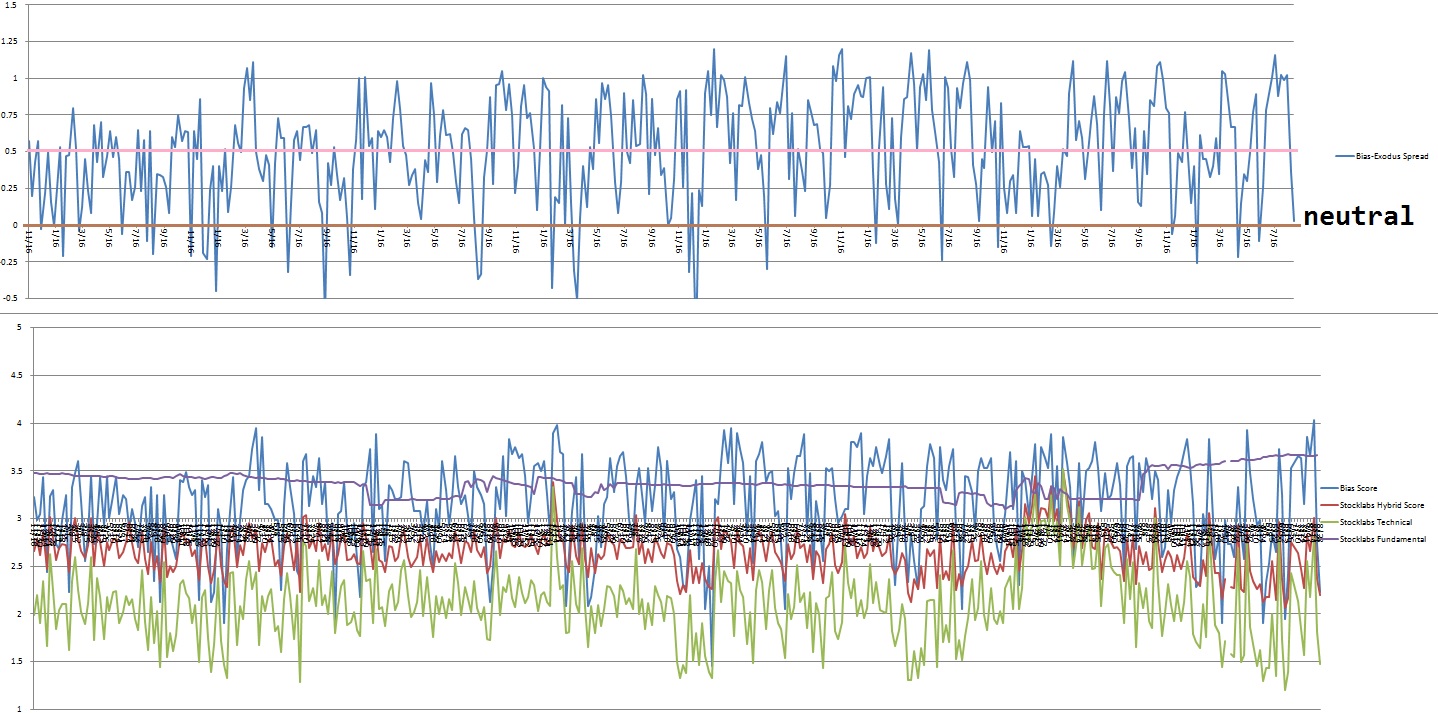

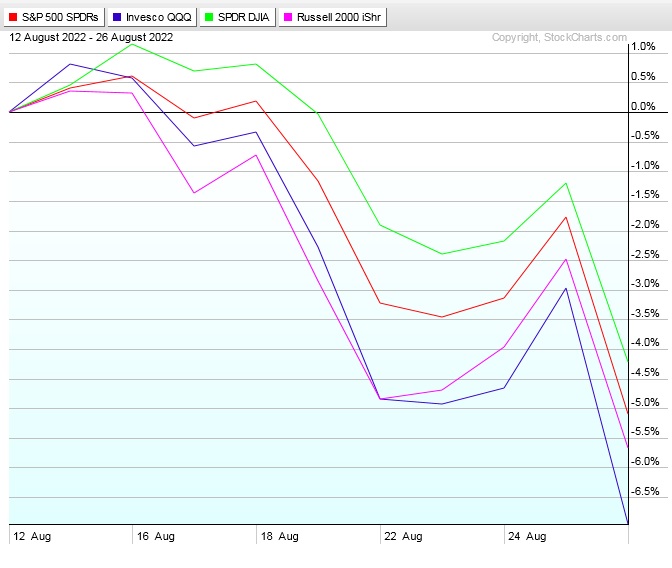

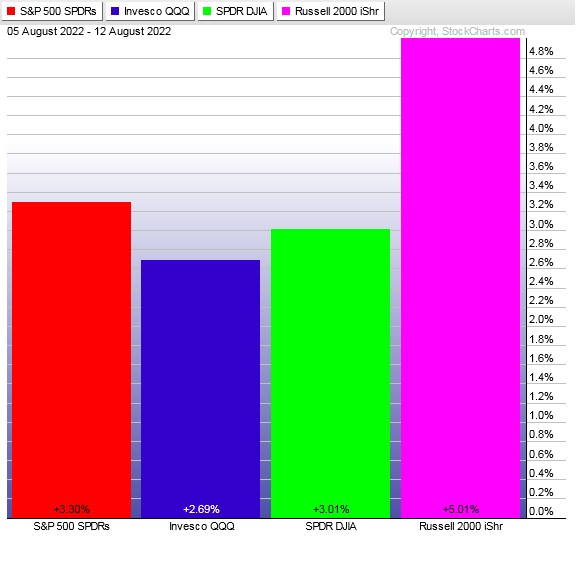

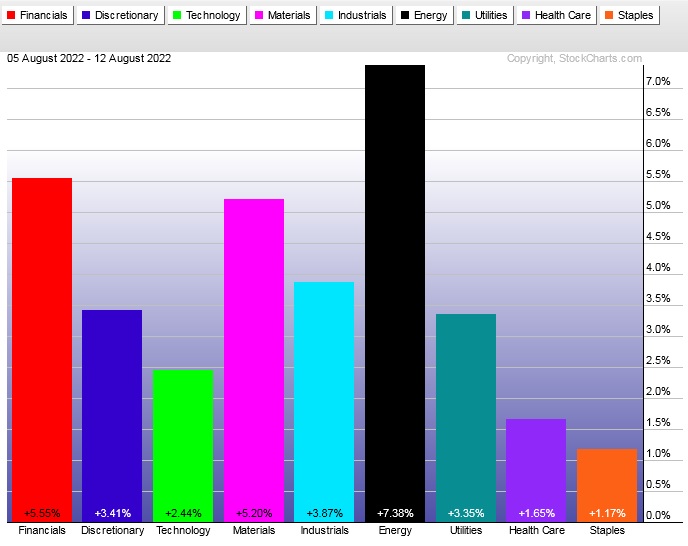

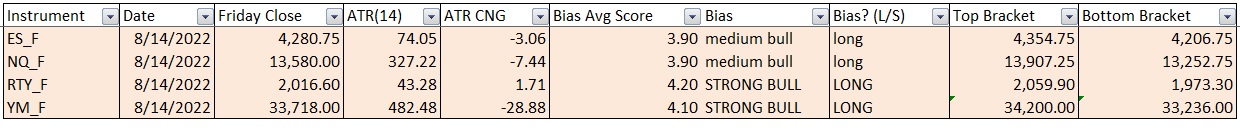

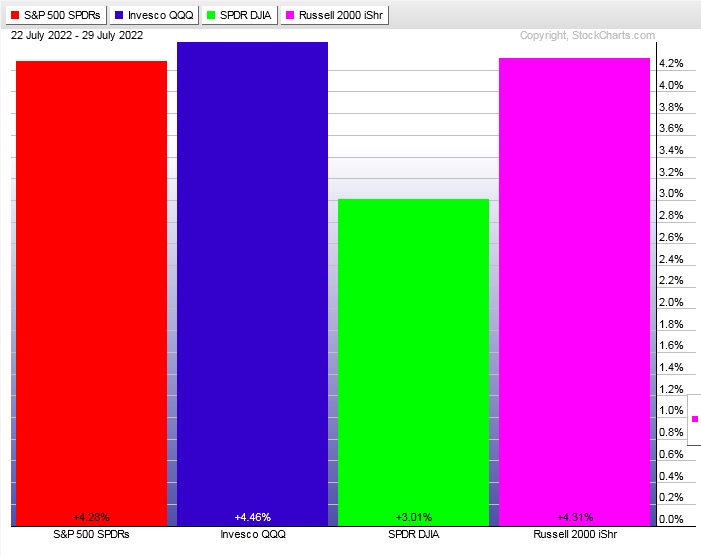

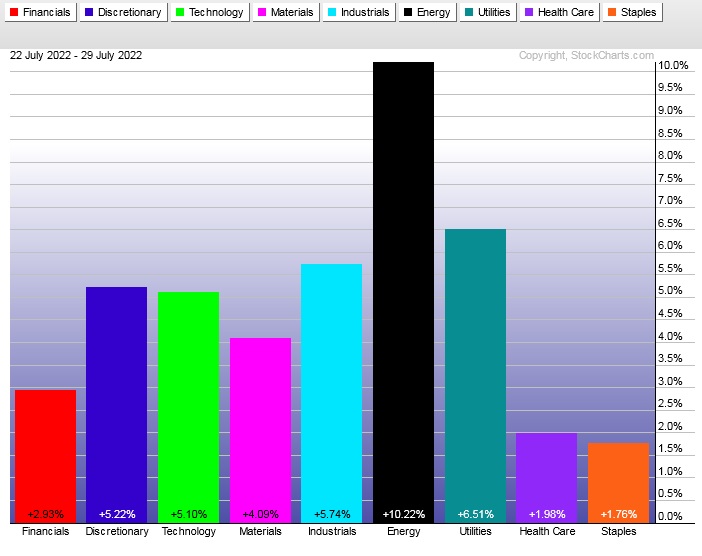

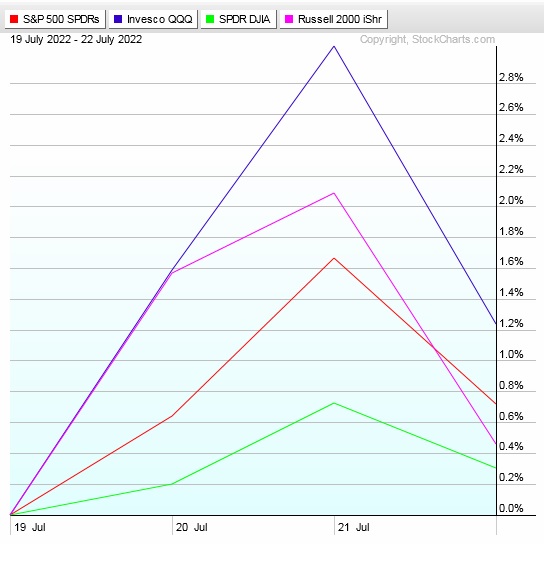

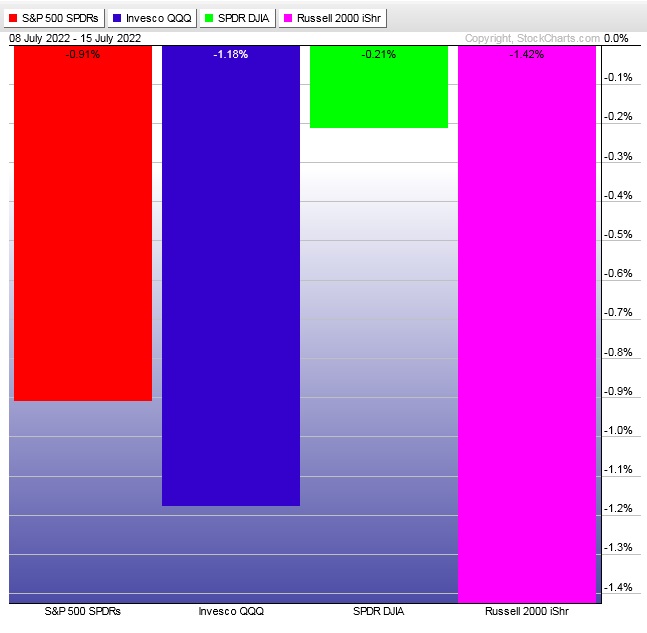

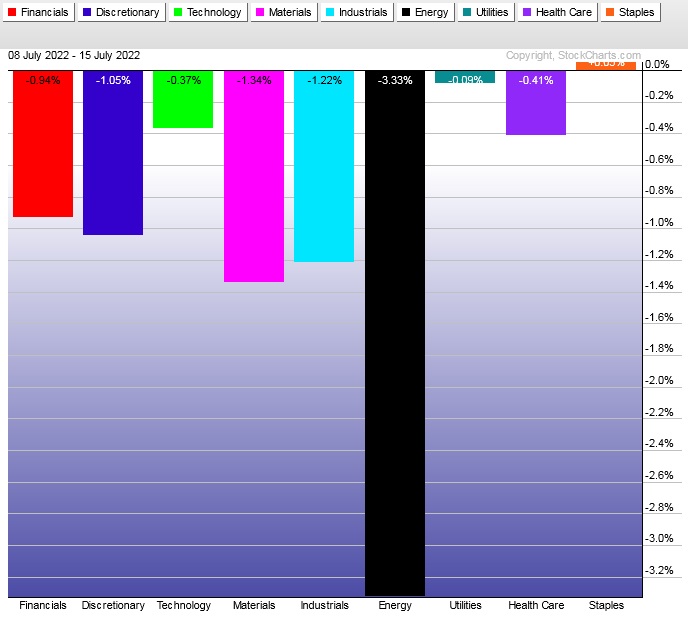

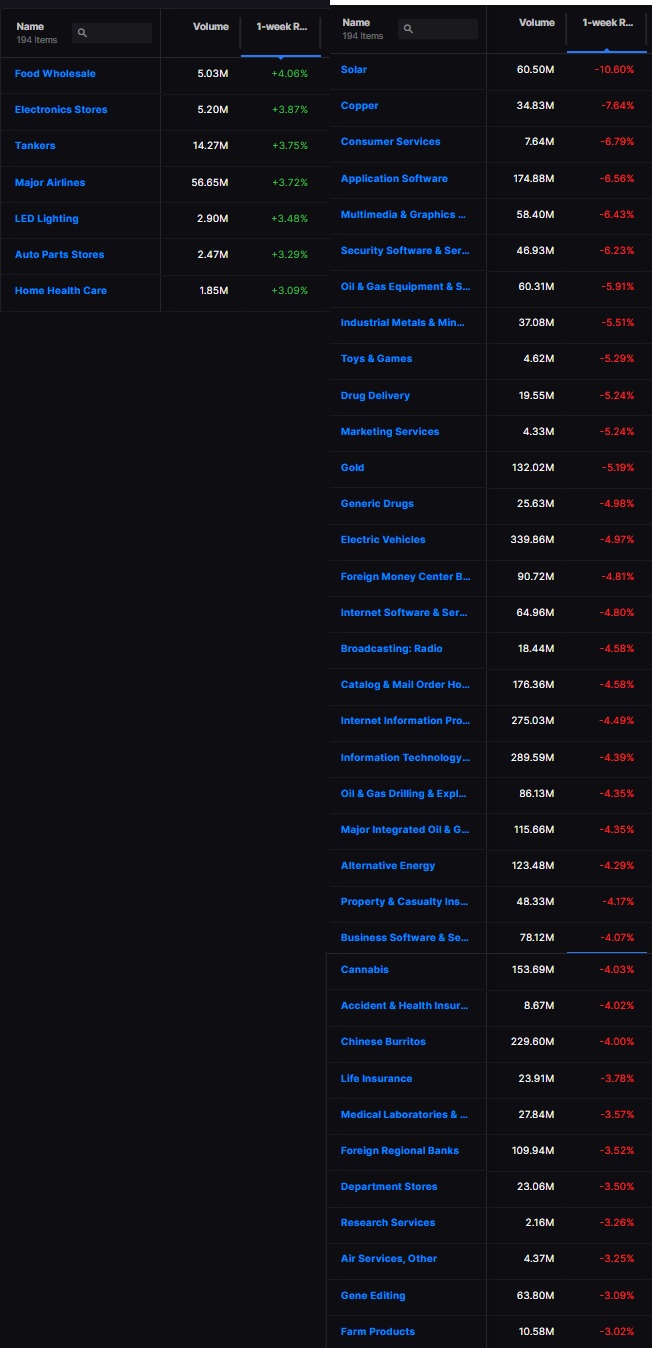

As many of those dollars as you can possibly set aside need to be parked in the betting markets. Not casinos or lotto tickets or sport gambling. Those are addictive traps of the lower-middle class. You need to participate in the big show, equity markets, the greatest gamble of all. How risky you decide to be here is a matter of personal tolerance. I’d recommend at least 50% of that money be put into a very boring mix of $QQQ $TLT. Another 20% should be concentrated into one-or-two Big Tech tickers you believe will be around and thriving long after you’re dead. For me, all those years ago when I was still a youth full of piss and vigor, that was $TSLA. Today it is still $TSLA lol.

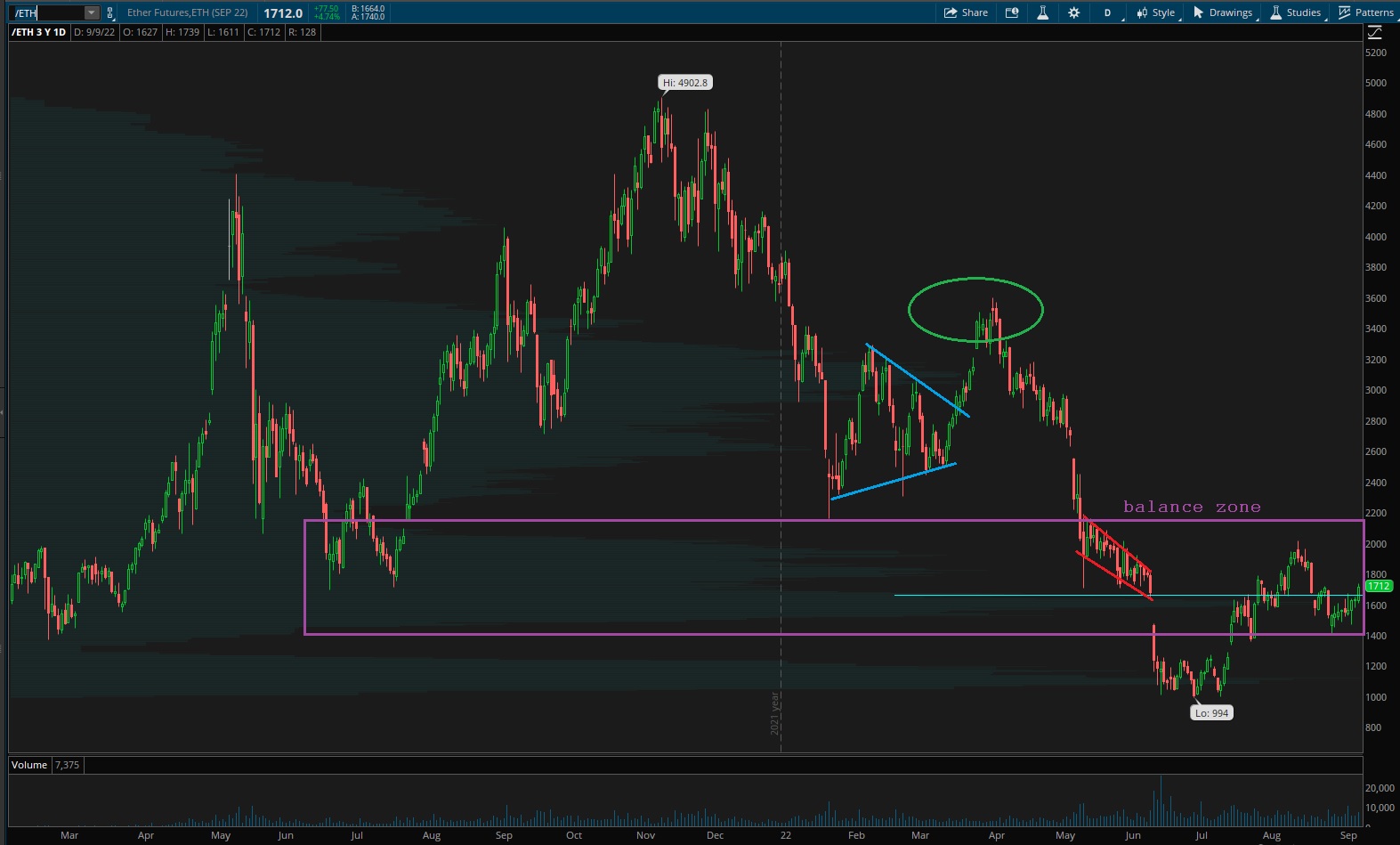

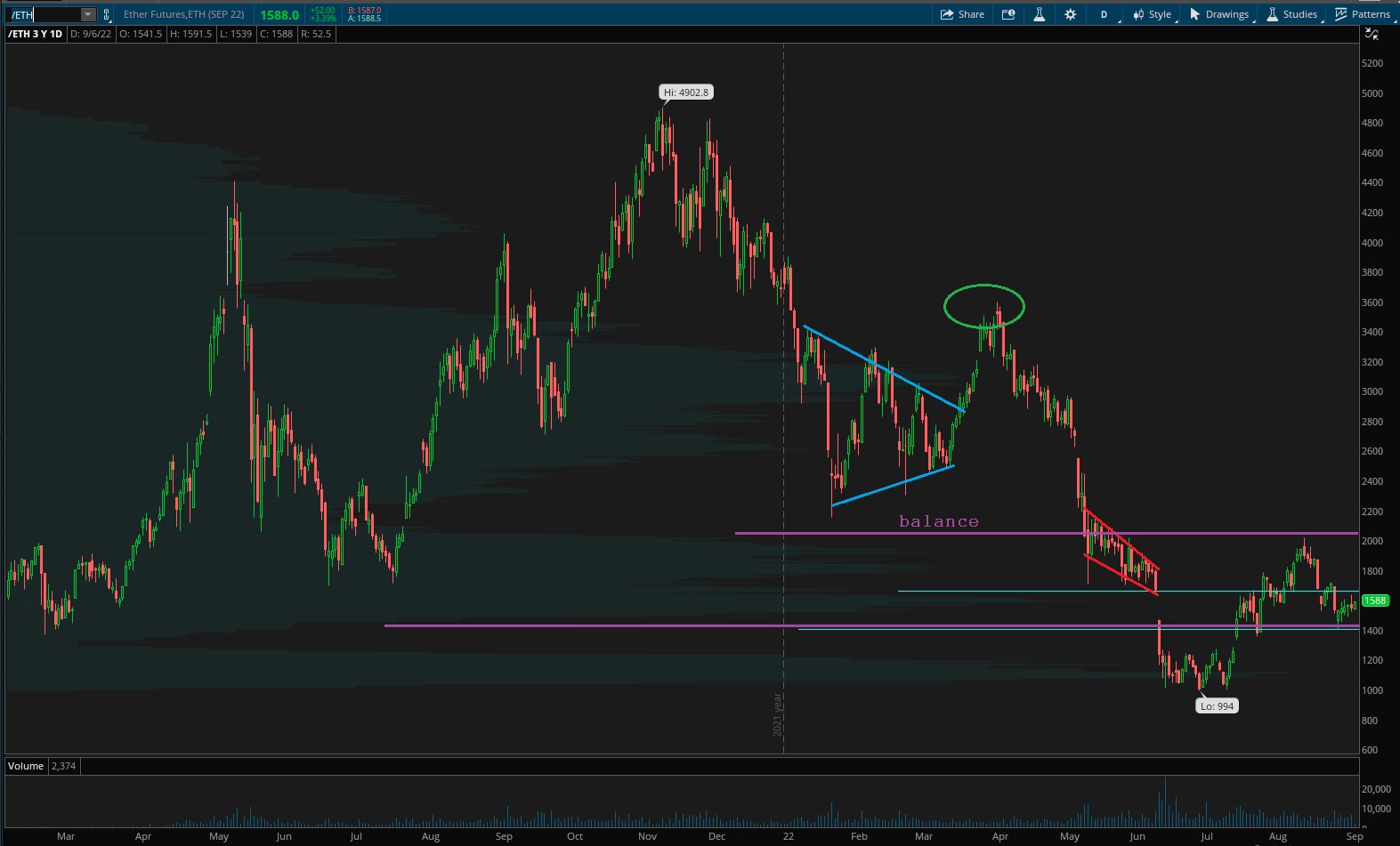

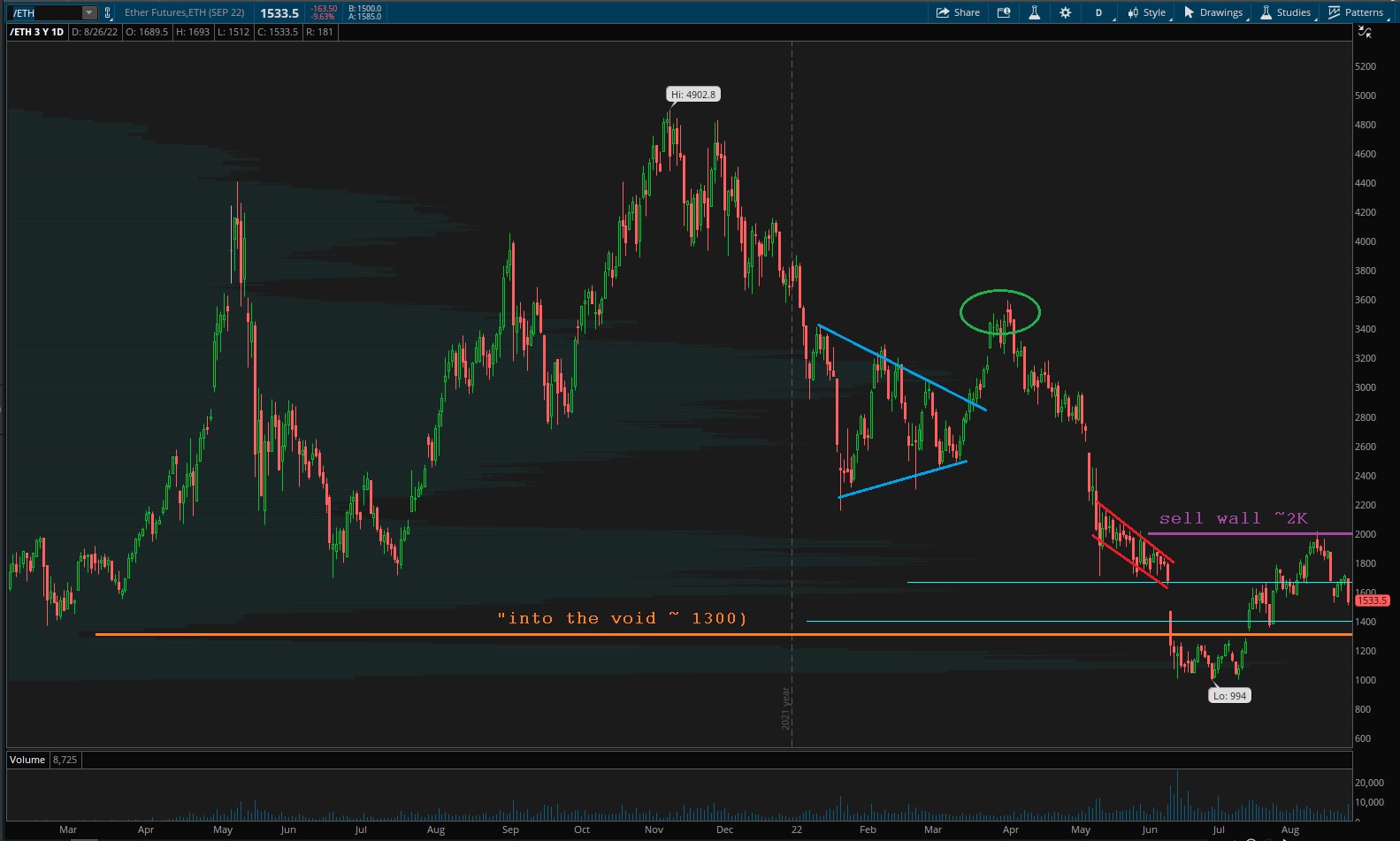

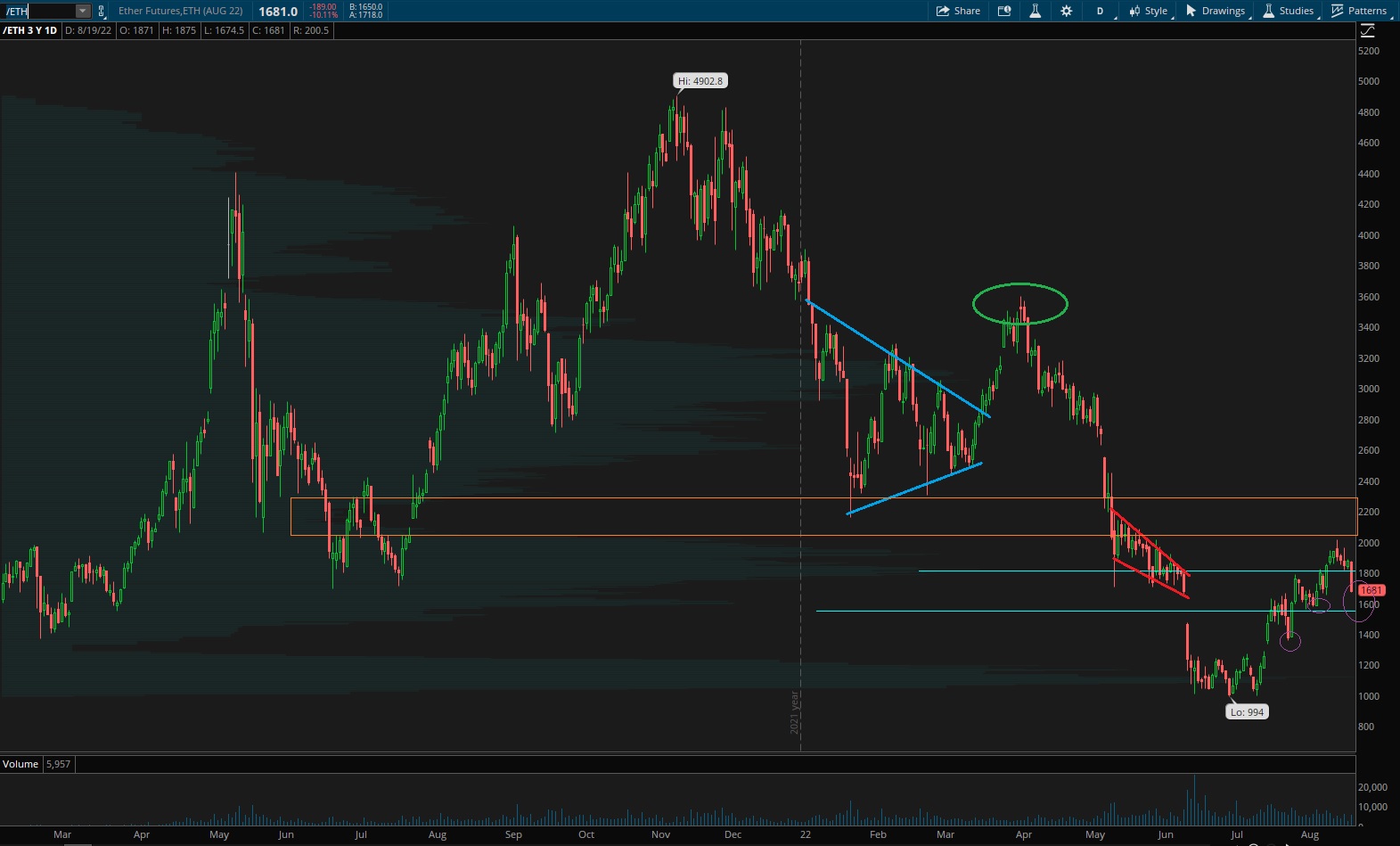

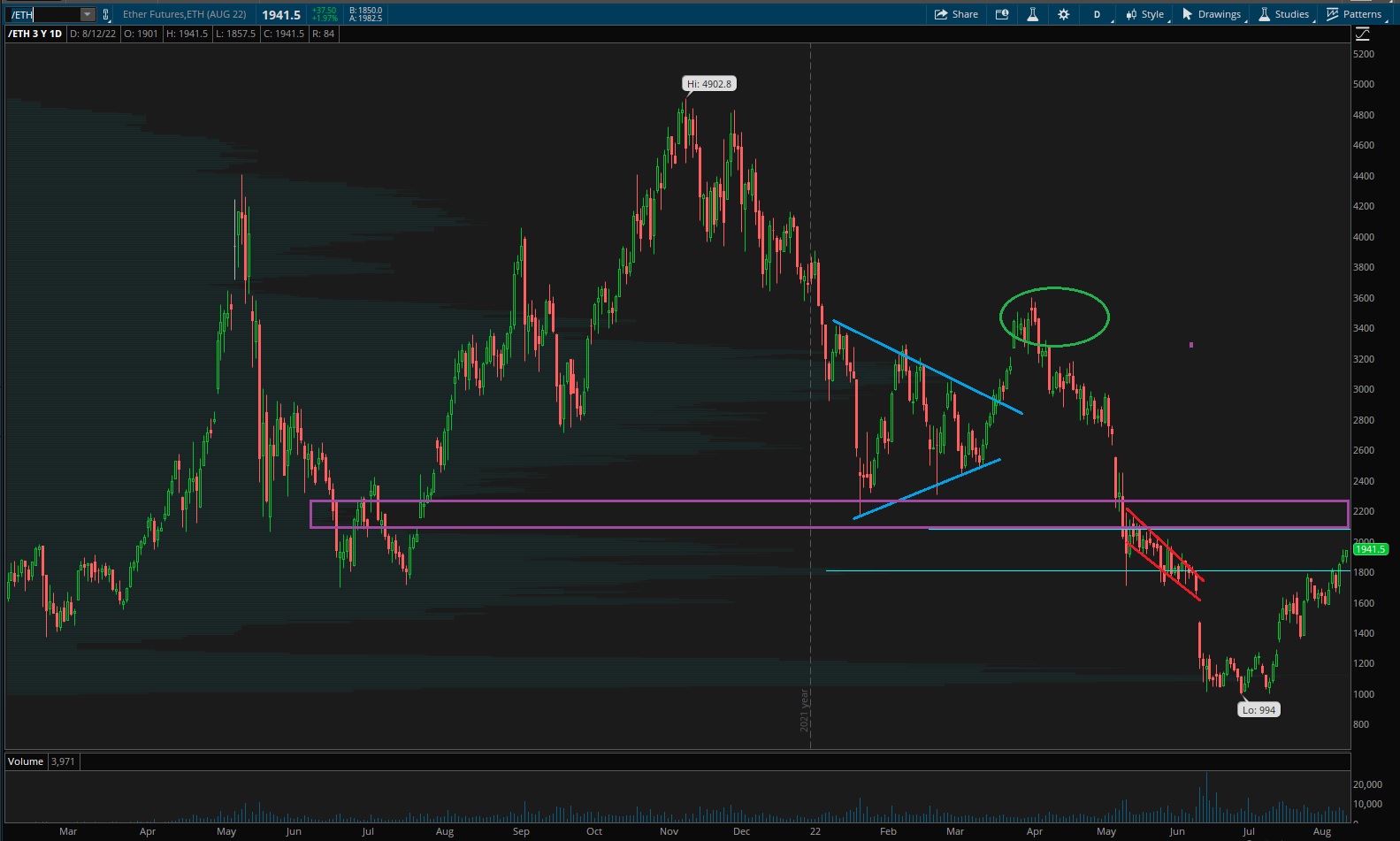

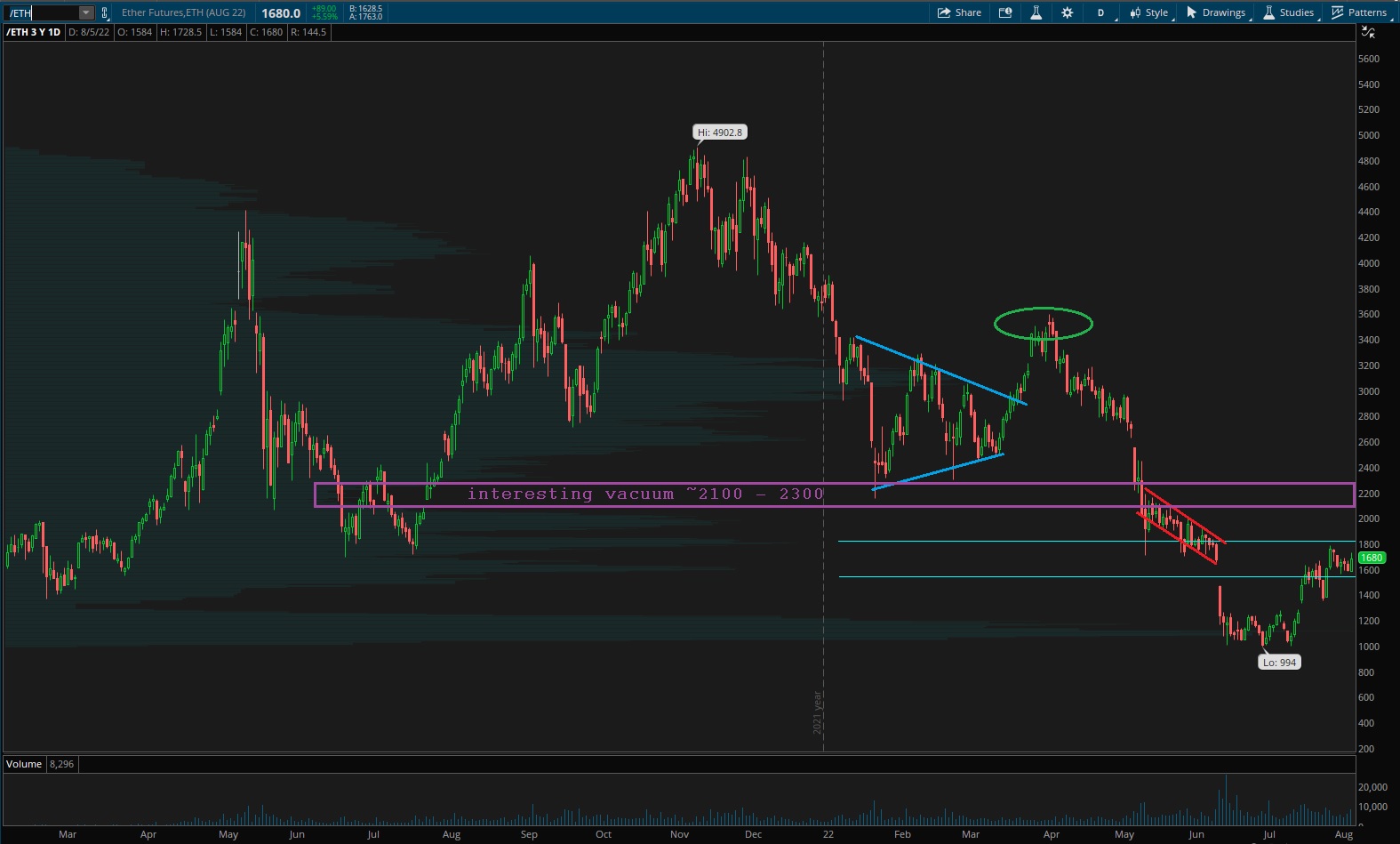

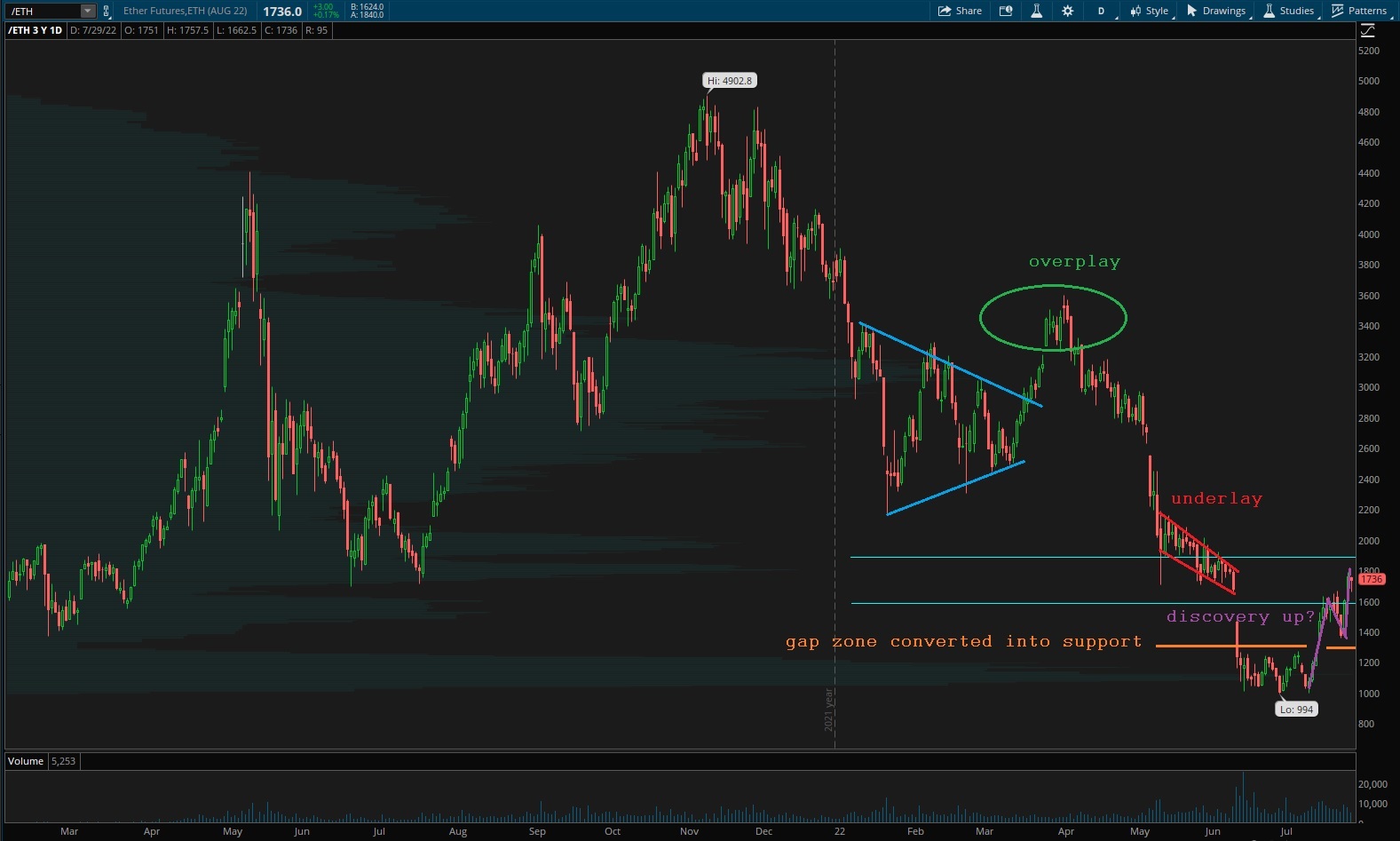

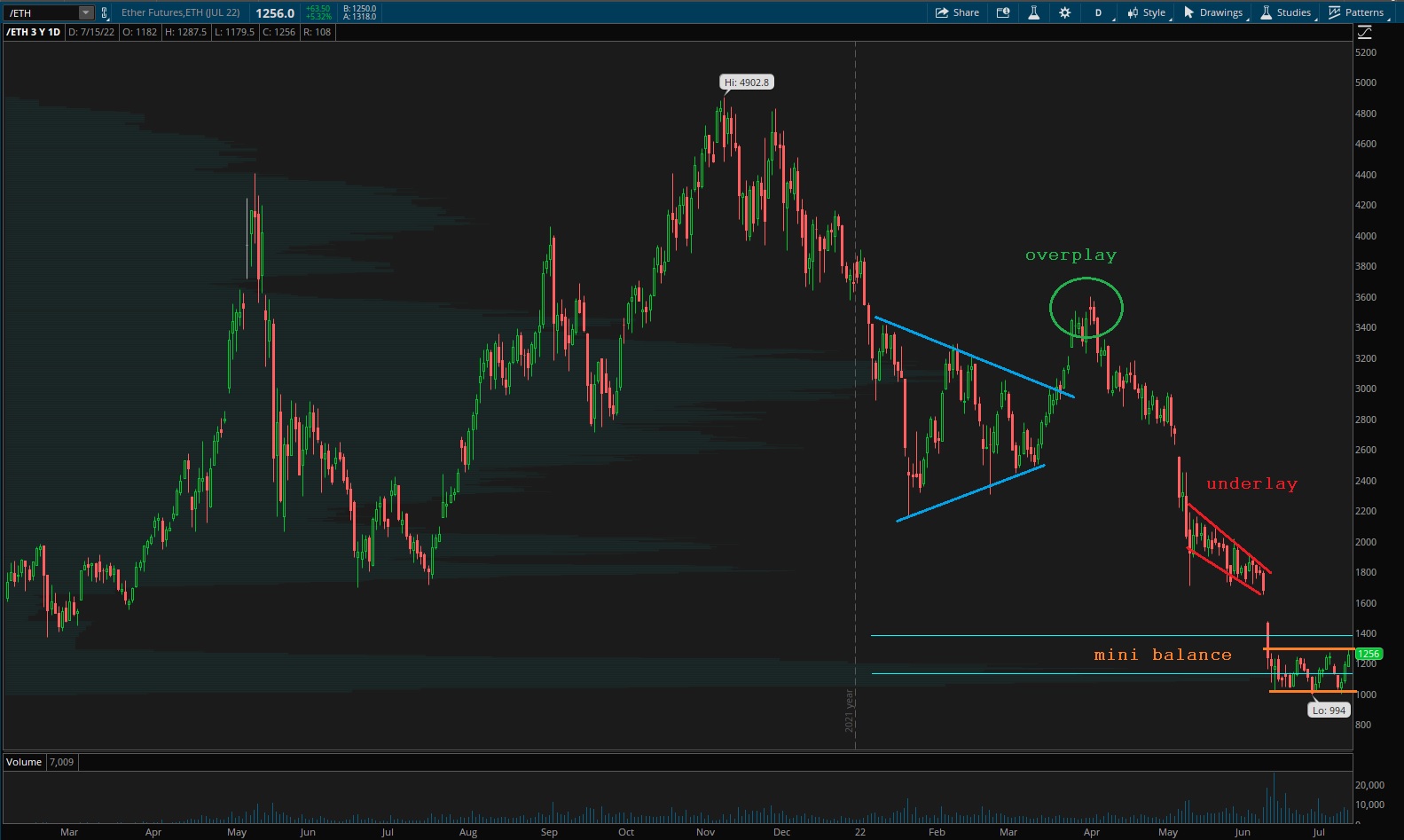

The rest needs, ***NEEDS*** to be in cryptocurrency. In some way or another. My brothers and sisters, this is so vital. Do your homework. Go down the rabbit hole. I cannot say which projects will win. Okay fine, ethereum. It is pretty incredible. But it is an entire ecosystem. Within it are many roads and yous’d better do your homework. Heck, I’m debating going back to school to become a Solidity expert because the more I study the ether the more it seems I don’t know.

Now just because you’re in college doesn’t mean you shouldn’t be working. Work will accelerate your learning, no matter what type of work it is. You CAN work and study. Use that youthful energy people. Burn the candle at both ends. Take whatever chemicals you need to to squeeze life’s apple until it bleeds wealth. There are so many apps out there now that have breathed life into the gig economy. So if you don’t feel like being obligated to work for some organization, then download Amazon Flex, or Wayfair Service Pro, or deliver groceries or gather and recharge Bird scooters. The moneys out there. Go get it.

Those earned wages should never be used to ‘get ahead’ on paying student loans. First of all they don’t make you pay student loans while you’re still taking x amount of credit hours. I’m not sure the exact credit hours needed to defer loans but use that rule to avoid paying for as long as possible. Then when it is time to pay, pay the absolute minimum to avoid fees. Don’t worry about the interest, that’s good cheap interest. If some global event occurs and they allow you to freeze payments, by golly freeze the bastids. You do not want to pay these loans off. Ever. You want them to be on your personal ledger for as long as it takes. Eventually they will be forgiven. Even if you went to law school and you’re staring down the barrel of six figures worth of debt. Worry not. These numbers will eventually go away. So it is written, so it shall be.

The cats out of the bag lads. The progressives have found the ultimate political hack — they can make the bad numbers go away. And they will, every two-to-four years, in perpetuity, as long as they have your loyalty in the voting box.

SWALLOW YOUR PRIDE AND VOTE FOR THE PROGRESSIVES.

Is it sustainable? Honestly, we dunno. Historically most empires peacefully exist for about 175 years. But we are in a new era of instant communication and One World thinking. Right now, as we speak, thousands of Big Tech millionaires are pooping in buckets and exchanging trinkets in the middle of the desert at their Burning Man. These are your world leaders. The days of lines on maps drawn by the privileged humans reigning supreme are numbered. Prepare for revolution however you see fit. Definitely don’t have anxiety about it. If you’re feeling anxiety maybe head to your nearest national forest and take a mushroom and have a long talk with the gods about how silly it all is.

Three of the biggest threats to your personal finance are insurance chiselers, telecommunication fees and automobiles. These are three areas where you would be wise to milk your elders for as long as possible. Stay on their insurance, their family cellphone plan and take a hand-me-down junker if possible. If not, then keep your taxable income low and maximize how much Obamacare you can receive. Fight the damn phone companies every three-to-six months for lower rates and move to a city where you can walk or bike around.

BE PATIENT AND KIND.

Well that’s about it. Do these things and watch your independence grow. There will be a few moments in your life lasting anywhere from a few weeks to a year-or-so where all the stars will align and the numbers on the screen attached to your name will explode in value, changing EVERYTHING. Just be patient. The good times will come. But if you’re some chooch, twisted up by pride into thinking you need to be some debt-free idiot with a modest salary and all the trimming society perceives as success, you’ll miss these moments and be cucked into servitude for your entire life.

Keep learning, keep gaming student loans, work, and be a little bit more kind. Then enjoy your freedom.

I am sure I missed a few keys to keeping folks away from yer lucky charms. Feel free to comment below with any techniques or risks I may have overlooked. And be sure to share this entry with all your youths and perhaps your neighbor’s youths.

Comments »