“Everyone has a plan until they get punched in the face.” – Mike Tyson

In many ways I feel like my accumulation of degenerate OTB names is a result of two events that occurred earlier this week. First was my showcase of the alcohol sector with a spotlight on BF-B, CEDC, and BEAM. I’ve been watching CEDC run like a Romanian goat higher unable to buy the name. Second was Tuesday morning. I saw all the signs of accumulation and a big run higher coming, so I put over 10% of my portfolio into SKS and SHLD only to watch them sit the massive pump out, opting instead to trade sideways then down. Thus concludes my recap of time wasted. Mostly I want to remember to stick to the plan so I thought an iteration would serve me well.

What matters now and tomorrow is how we’re going to pirate coin from the market.

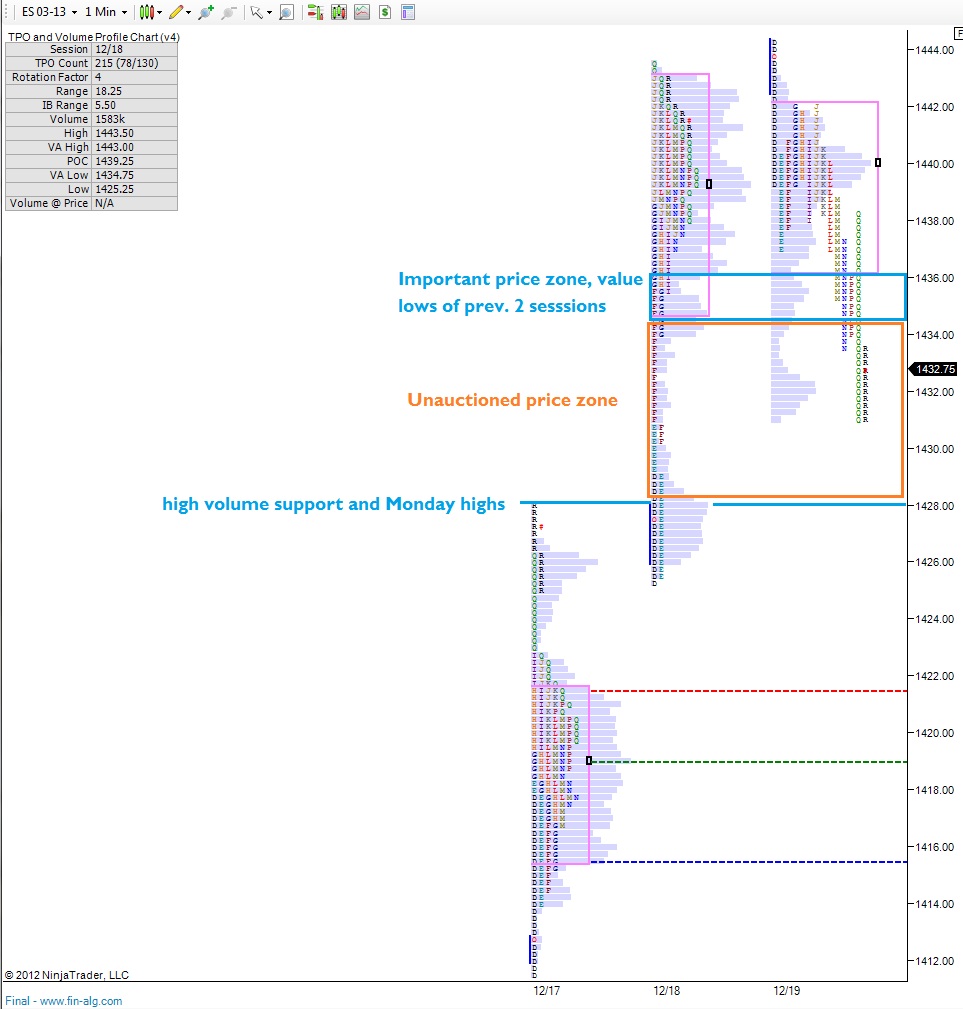

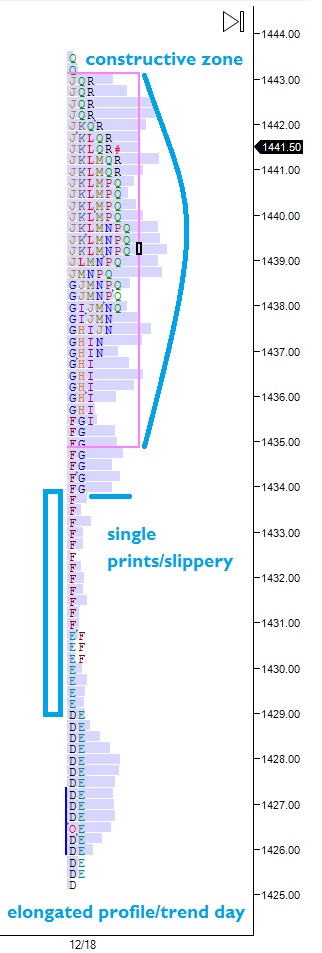

We shall see how she looks in the morning. I see little reason to turn to the profile at this hour because there’s plenty of overnight action ahead. Let it play out and we’ll take a look bright and early. I have a feeling I’ll be cutting a few names in the AM, but I will certainly exude patience and let the morning develop.

One important caveat to this unexpected action is receiving no accolades after making a near-perfect top call. Our good friend The PPT flagged hybrid overbought on the close Tuesday. Chalk up another win for the algos.

See you in the morning.

Comments »