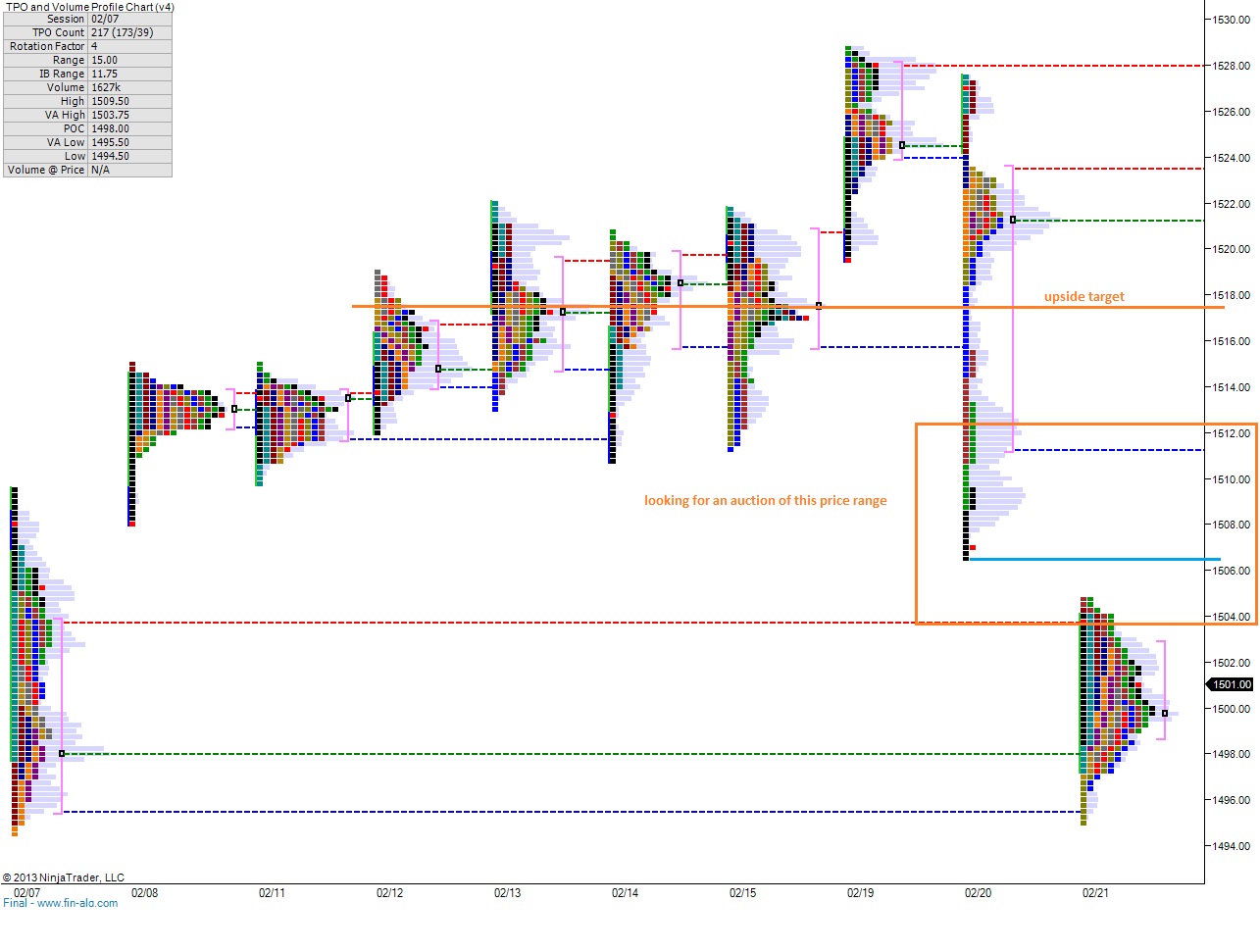

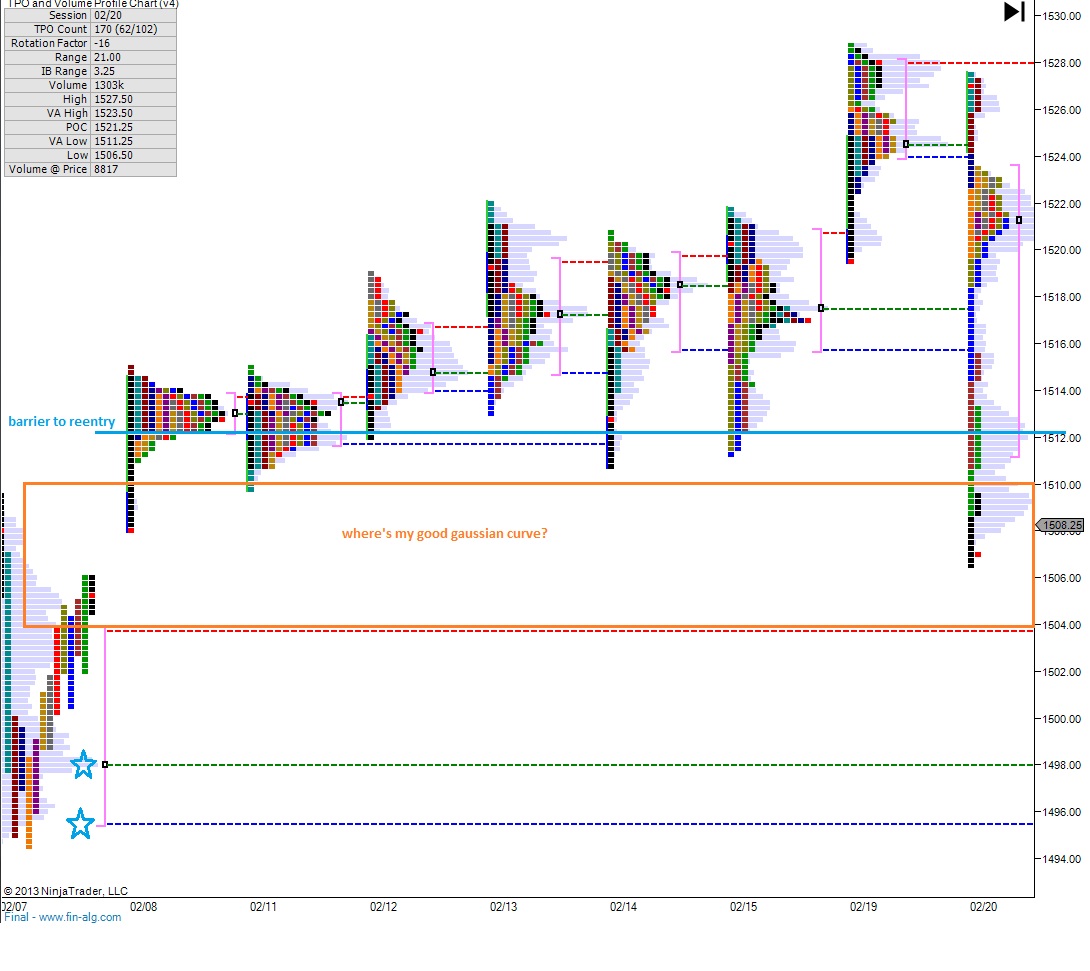

If we are going to stage a low volume lift to new highs this week, you want to be in the names that stand to benefit from such a move. You want to be in the charts with the best risk profiles and potential upside.

With that in mind I sold TSLA when it was met by sellers this morning. I didn’t want to over stay my welcome at casa de Musk. I booked the gain and refocused the funds into a higher probability setup. Today, that setup is FSLR. Solar has been hot this year, but last week offered us discount pricing on the premium we’ve been dealing with in solar. I bought First Solar in size.

ANGI and CREE are getting sold today and I couldn’t be more excited about this. I need more of both. I have a legacy ANGI position from before earnings, and I dipped my beak back into CREE Friday after selling my initial beak dip for a 12% gain. I’m ready to buy these names on the cheap, stay tuned.

I locked in some of this massive ZNGA win again too. Still holding about a 3/5 sized position.

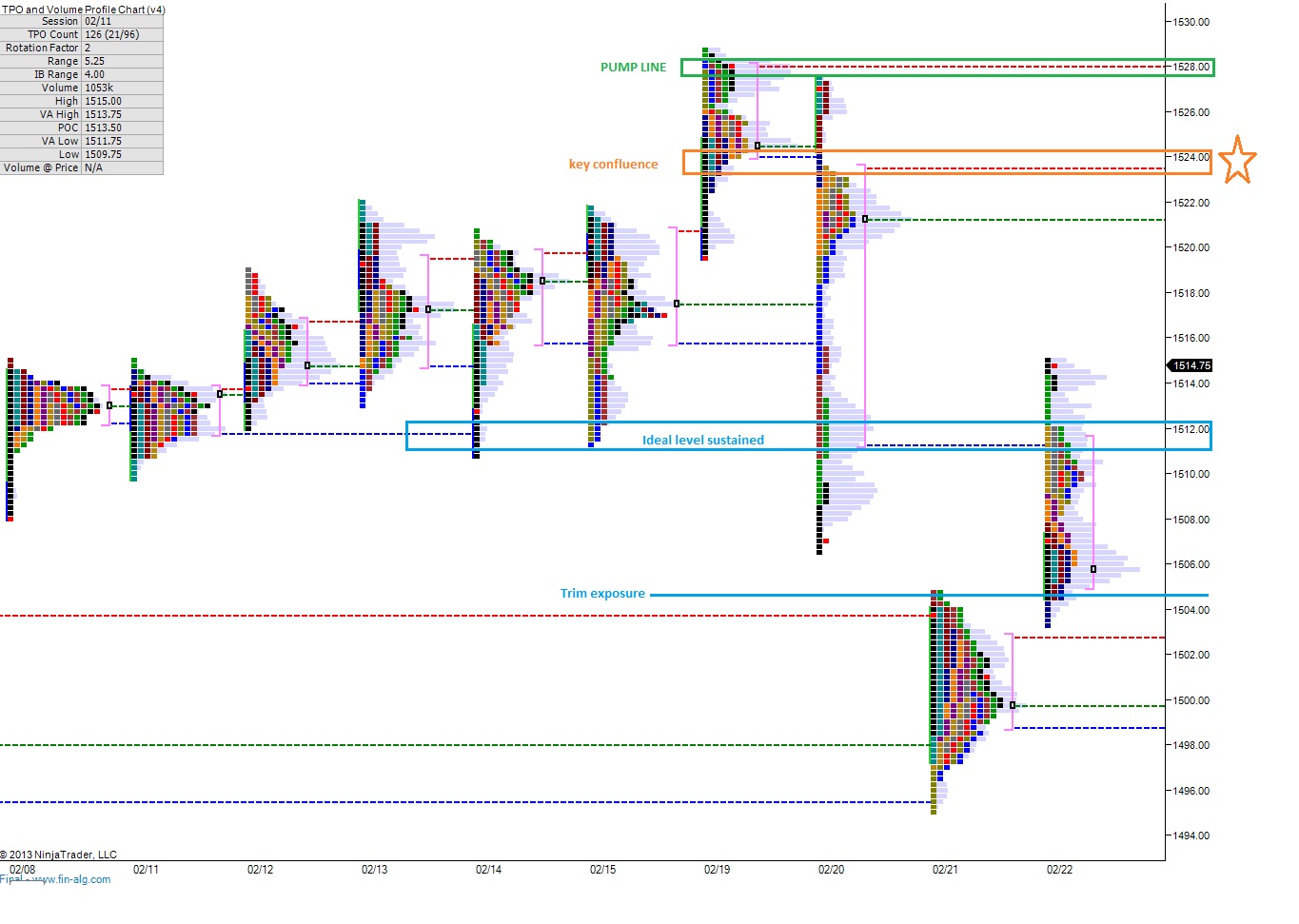

Find your location and position for the pump. If we dive instead, you should have your risk defined. Take your loss like a pro and move on.

Comments »