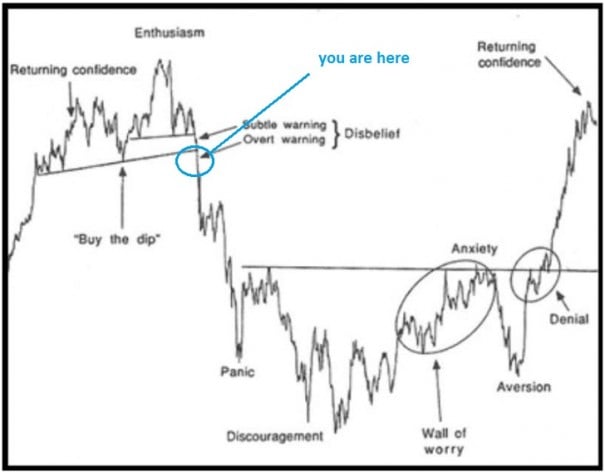

One of the qualities we often strive to achieve as traders is objectivity in our analysis. Consistently evaluating a price chart or market profile in an objective manner is invaluable to the trader mentality.

I was bullish on TSLA into earnings. The truth behind my bullish bias is so obtuse your average analyst would scoff my person. Your stellar analyst would get hung up on interest rates, obscene valuations, and excessive sentiment and never participate. But my bias is simple: I booked 7% gains on ½ my position and had a 10% buffer on my holding into earnings. I bought TSLA last week for one hundred and fifty eight dollars, do you see how nice a good entry is!?

It helps keep my objective.

TSLA is going to trade down for a while. If we are lucky, it will come to terms with reality and really panic out the weak hands. I would forego a beach vacation to acquire TSLA at 137 and I live under the eternal cloak of Michigan grey skies.

In sum, I am a buyer of weakness in TSLA, may it be extra bloody.

Moving on to more pressing matters, why is my chicken failing to arise? I must evoke the voodoo of large numbers this evening, perhaps by offering sacrifice. Sometimes it comes to that.

I noticed everyone is chilled out on the whole LED industry. This makes me a happy person. I put my gentleman’s size back on, nearly a full position, in CREE today. It was my only portfolio adjustment on the day. This will pair nicely with my RVLT (earnings on deck)and VECO longs. Those goombas running VECO crack me up. Goombas I tell ya!

I bought the swing low in BALT last week, it is official. This entry has afforded me the opportunity to participate in earnings much like I did TSLA, with little to risk but my hard-fought market gains.

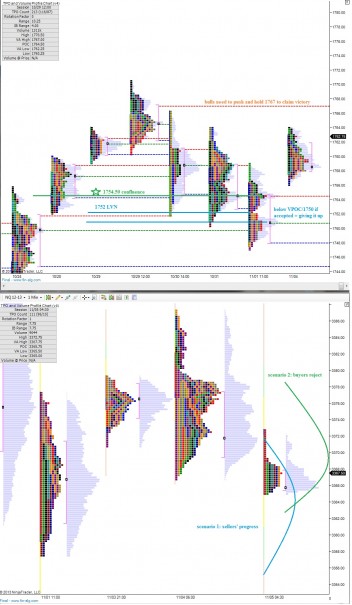

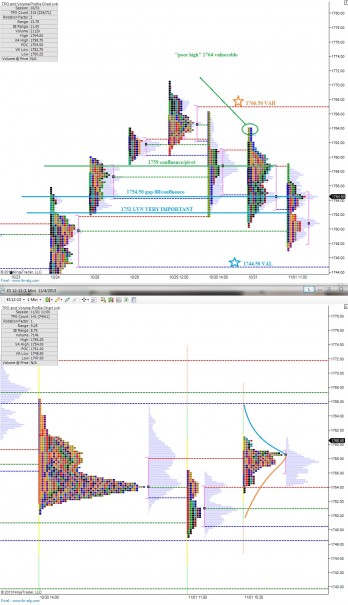

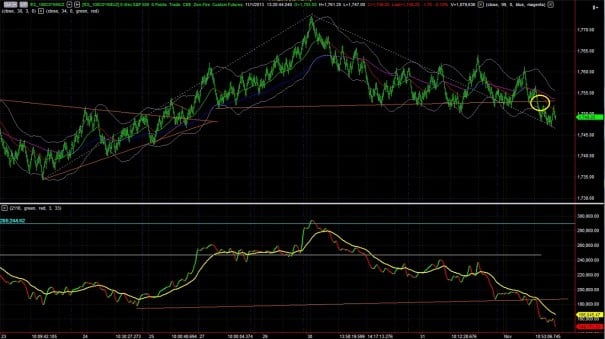

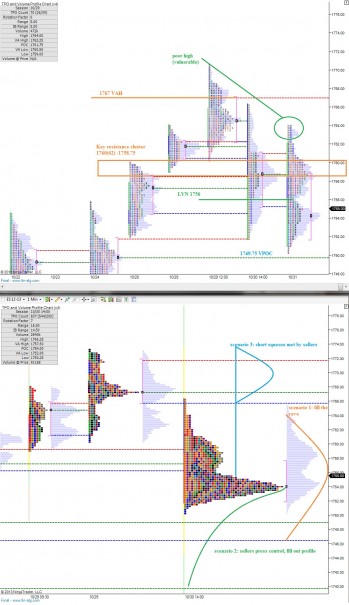

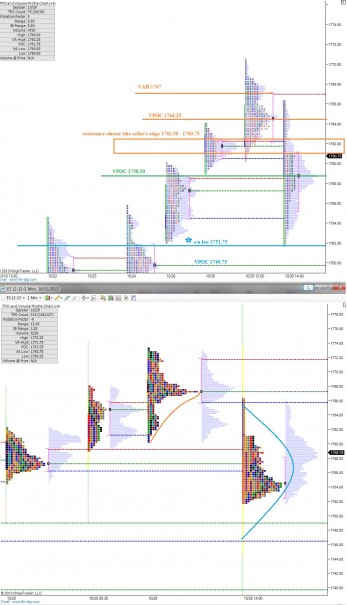

I traded the /NQ futures well, but took a loser in the /ES. I was still green today, and all trades were fantastically in adherence to my trading plan. I liked the day structure right up to the close where sellers piled on the bid again. There are very aggressive, active sellers at the open and close. Who are these maniacs and will they win their trade? Stay tuned to find out.

I have many good positions, and I am 90% long. I was flat on the day. I need to generate some alpha soon so I can continue living the champagne lifestyle.

I’m off to stand on my head for a few hours.

Comments »