I had an interesting month, to say very little, trading hot potatoes with plastic explosives nestled inside the spuds. Some of you are very obsessed with instant gratification. I get that. I appreciate a good “fix” myself. However, trading is a process I enjoy more than nearly every other modern endeavor. I am figuring this game out, gregariously, because I refuse to pay someone to teach me.

For the month, I earned 20 basis points (paid for my lunches, essentially) in my swing portfolio after commissions. I have been buying and selling options this month, and getting a feel for the way they move. They certainly are curious little instruments. About 8 trading sessions ago, I was up 8 percent on the month. The selloff corrected that early lead. One of the biggest regrets I have on the month was talking up a TZA hedge with the traders in 12631 at literally the perfect moment but never executing. I don’t dwell on these types of events. I only reiterate it to cement it into my experience directory. Remember, this blog is more important to me than it is to you, the reader class.

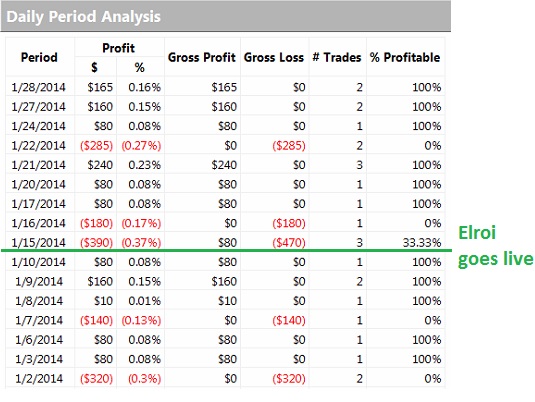

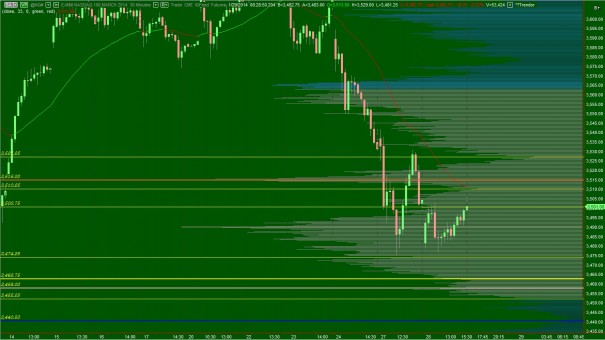

Elroi was turned live on 01/15 after a power coding session and optimization. He was turned on and immediately began a drawdown period. Such is life my friends. His monthly statistics are weak, losing one hundred dollars. Since going live, he has lost only fifty, however. This was a trial period of sorts, where he was fed only one contract. After commissions, the next project has cost me one hundred and fifty dollars. Here are the daily statistics:

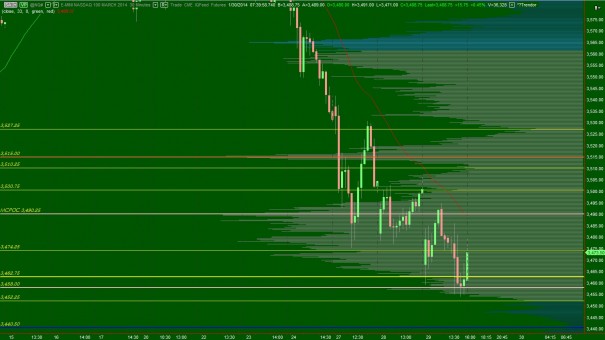

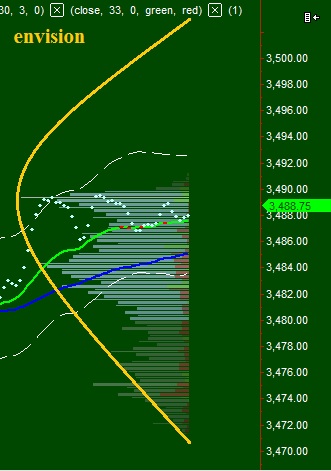

What may seem like a waste of time has actually been one of the most insightful endeavors into the futures market since I began trading them last year. While I watch along, waiting for Elroi to fire, I began noticing nuances in the tape that I never saw before. I am getting a very clear vision of order flow. My scalping game is about to get serious. Remember the game where you have to spot the difference between two cartoon pictures in a newspaper? Six or seven little nuances, I see them now and rapidly process them. The volatility in the NASDAQ futures is a tremendous opportunity for a trader to earn a nut.

Should the market continue “getting jiggy” I will be increasing my day trading beyond algorithmic.

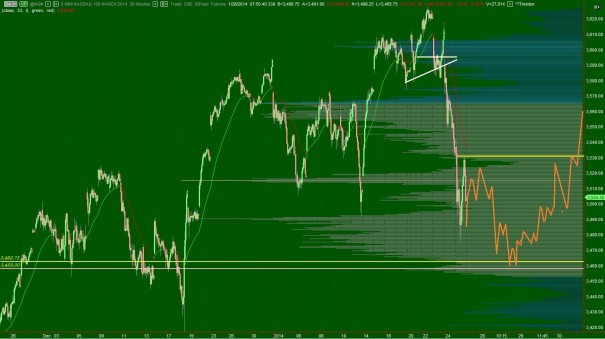

My book went out of the week long, very long in fact. I have been buying the whole way down. The correction road map pretty much nailed the weekly low, nailed this morning’s buy the dip opportunity, and has now assumed the proper pouncing position. If we rally Monday, like the plan calls for, I will have completely forecasted five days of stock market activity. That would be some sage stock market prowess (no impala).

I own all the names I like but one. I sold BALT yesterday into a chart I perceived to be bear flagging. Now the chart looks wonderful with ten trading days until earnings. Do you know how much money I can make in ten trading days? Sometimes we just lose interest and patience. Nevertheless, I intend to make a great sum of money in February simply by eating tacos and pumping iron with my personal trainer.

http://youtu.be/8YSq7KiT3_c

Comments »