Nasdaq futures caught a bit of a pop this morning right around the time European Central Bank released their rate decision which continues to be in line with expectation. About half of the fast gains have since been given back, and the sell flow began at 8:30am when ECB’s Draghi began his press conference. At the same time US Continuing and Initial Jobless Claims were released. Continuing Claims were worse than expected and Initial Claims better. The rest of the economic docket is open today aside from a 10:30am Natural Gas report energy traders will want to keep an eye on and Consumer Credit at 3pm.

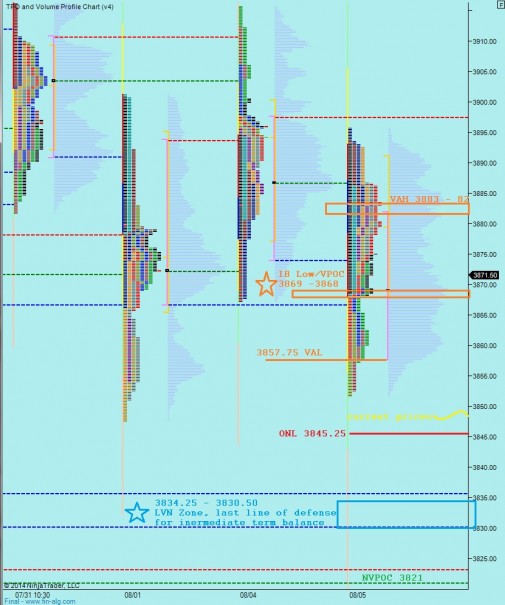

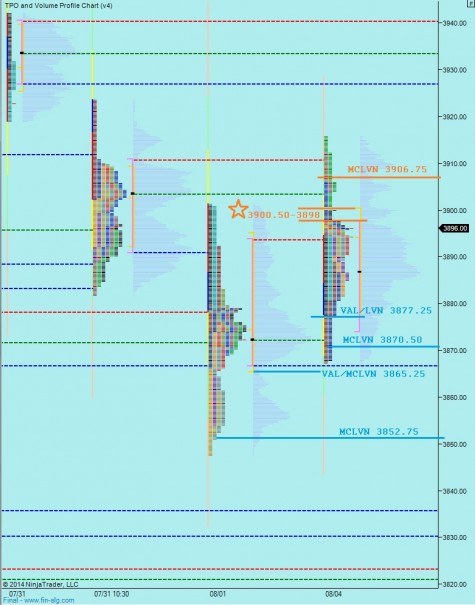

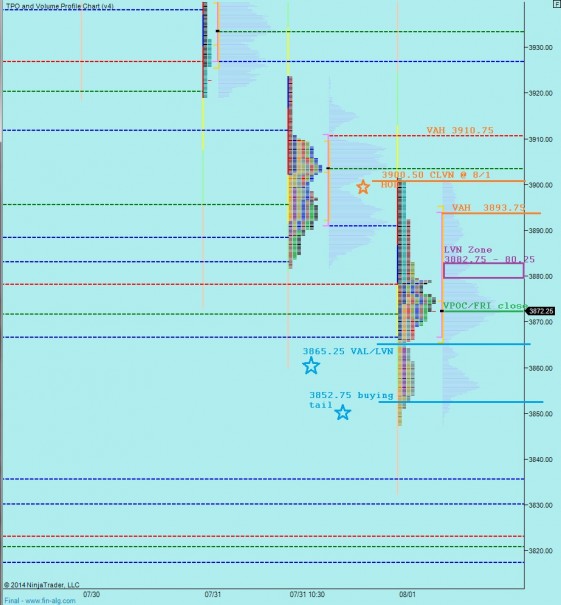

The intermediate term timeframe is flirting with the idea of going seller controlled. We are almost developing a pattern of lower highs and lower lows. To negate this developing process, buyers need to step up and establish a higher high very soon. If they can hold the LVN at 3865.25 it would be a productive start to the process. Even if they cannot press up and out today or tomorrow, by simply slowing the action down they would fortify the idea that intermediate term balance is still in place. I have highlighted key intermediate term price levels below:

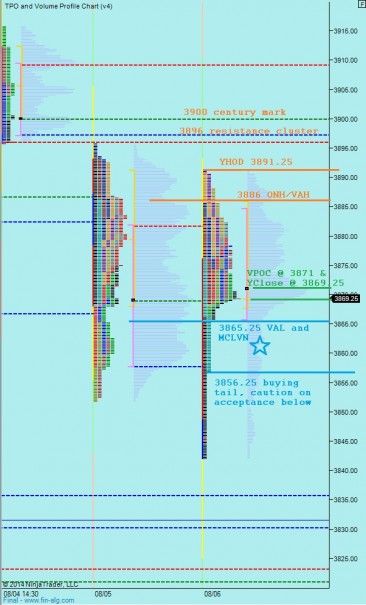

Buyers are still on their heels, and without stabilization soon we risk another acceleration of price discovery lower. The question I constantly ask when the market is working on building a swing low is, “Is the market done finding buyers?” We saw a sharp responsive buyer off the open yesterday morning and the action saw continuation into the afternoon—initiative buying coming in after the fact. Once a strong bid is established, this is what we see, the action process goes in the other direction until it is done searching out a seller. The process forms value. If the conviction buyer does not show up to defend her responsive buying yesterday morning, that could be a shift in short term sentiment. I have highlighted the key price levels I will be monitoring early on the following market profile chart:

Comments »