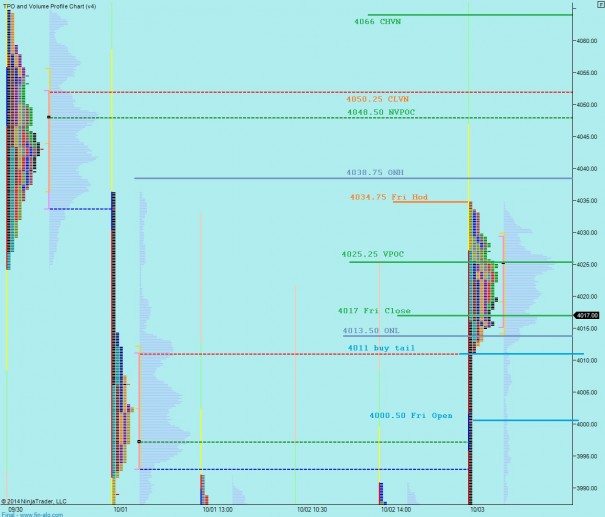

Trade volume is high overnight in the Nasdaq futures after we printed a 3rd standard deviation range during yesterday’s session. The session range overnight is within the realm of normal even under the high volume circumstances. Prices managed to take out yesterday’s high of the session before finding sellers and the selling accelerated just before we heard from the Bank of England who released in-line Asset Purchases and Target Rate Decision. Initial and Continuing claims were released at 8:30am the claims were lower than expected suggesting the labor market is improving. The initial reaction to the jobs data is a slight bounce. Mario Dragi is set to speak at 11am which has the ability to move markets.

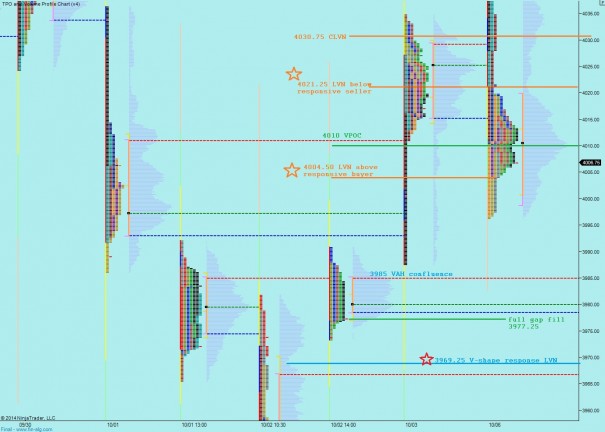

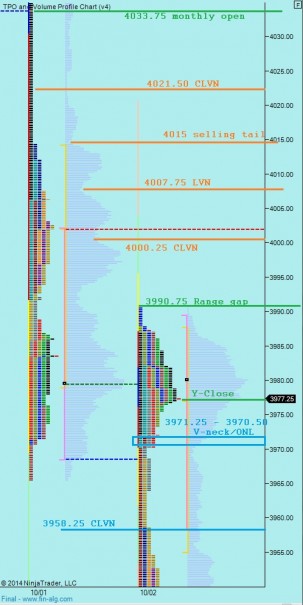

Yesterday’s move was large enough to consider returning the intermediate term timeframe to balance. Thus I have added a profile to the left of the chart which encompasses the range of recent balance and also gives us a good view of the auction taking place. I have noted the key price levels on the following chart:

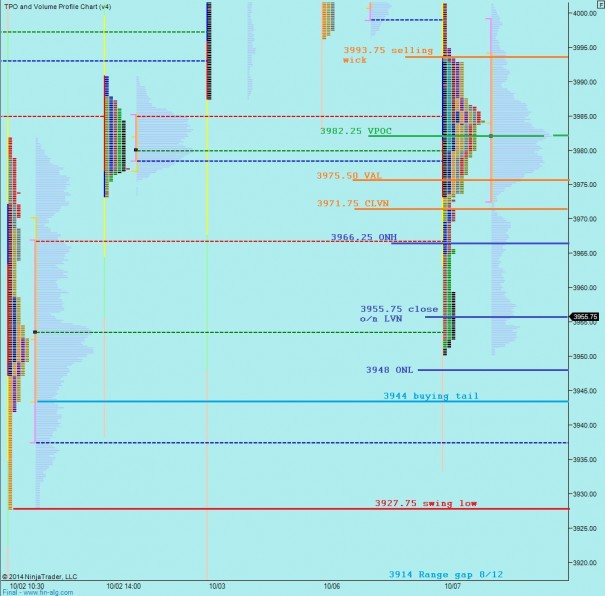

On the short term we can see how elongated the market profile became during yesterday’s large move. This type of structure suggests buyers sharply rejected lowers prices with a strong response. Whether they have the conviction to defend their progress today will be key because the expectation is they will, at least for a day or two. I have noted the key price levels I will be observing on the following market profile chart:

Comments »