I never know if any of you are paying attention so very quickly let me update my stance on equities from a long term perspective down to intra-day oscillation. I believe we are entering a period of economic prosperity the likes of which no living human has ever seen. A throwback to the roaring ’20s, only this time the drivers are semiconductors and AI. As nation-states and religions continue to lose their grip to science and the internet, I expect this expansionary period to be longer than anyone can reasonably fathom. We will likely never see another recession in my mortal life (current age: 34).

That stated, the equity complex will succumb to intermediate term corrections. There is only one way of forecasting these events and that is by interpreting years-and-years of raw stock market data—interactions between buyer and sellers of all rank. This data tells a story and from it we can build probabilities. These probabilities are our most objective method of taking action without being selfish or arrogant.

There are very few stocks worth owning, ever, even if you’re just a ‘trader’. Stocks should only be bought with a 10-20 year intended holding period and to own a share of a corporation that long is the closest thing to faith any living human should ever subject themselves to. Tesla is a cult. It just so happens to have the sexiest and most confident Leader in the world and a mission that The People Who Matter believe in. This is an important concept—The People Who Matter. These are people who actually have money to invest into long-term strategies. They have real wealth and can deploy it for a cause. Think Bill and Melinda Gates.

These are people who can read reports on the climate and mortality and other things and make rational, objective decisions based off of them. Then, armed with scientific facts, they go about using their resources to effect change.

These people, like most humans, tend to fear death the most. Therefore they invest in ways to thwart death, both biologically (CRISPR) and species-wide (SpaceX, Tesla, and so on). They like their rich life and aren’t ready to abandon it for the ethereal plane. They don’t run out of money and they always need places to invest, even if (shocker) the equity markets are in a correction.

Even if the United States is losing world dominance to China and their one party political system. Even if fiat currency, The Grande Illusion, is starting to fail.

Our job as ruthless speculators, profiteers of the highest rank, is to take advantage of any and all situations. To seek out shipwrecks and pick up the flotsam and sell it. To be ahead of herd migrations, to set up kiosks that sell important wares at a nice profit margin. To borrow things, sell them, then buy them back cheaper in a few days.

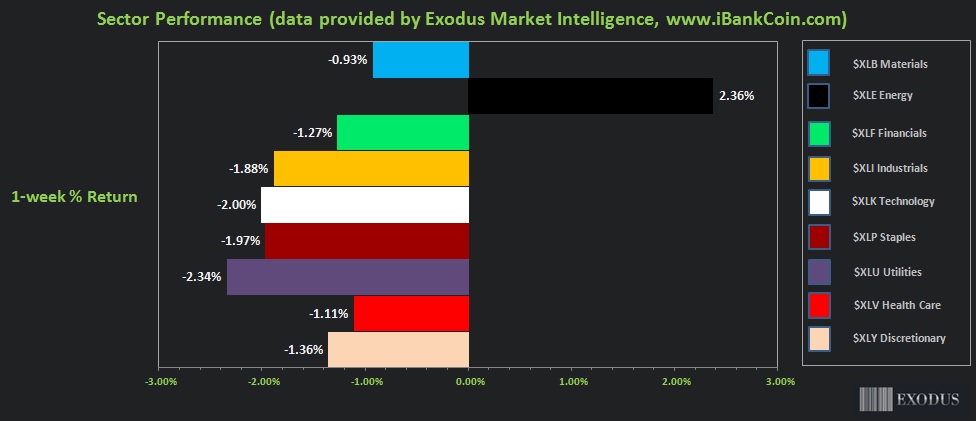

The most effective way to do these activities successfully is with a set of tools that short-circuit the human ego, allowing us to consistently do our job with as little personal offense or self-aggrandizement as possible. My set of tools is signalling bearish for the second week in row.

The other data I take into consideration every Sunday is not as clearly bearish as it was last Sunday. Last Sunday the deck was fully stacked in the favor of the bears. This week, not quite as much. But two bear signals in a row, that is not common, so I got to looking back at other repeating occurrences.

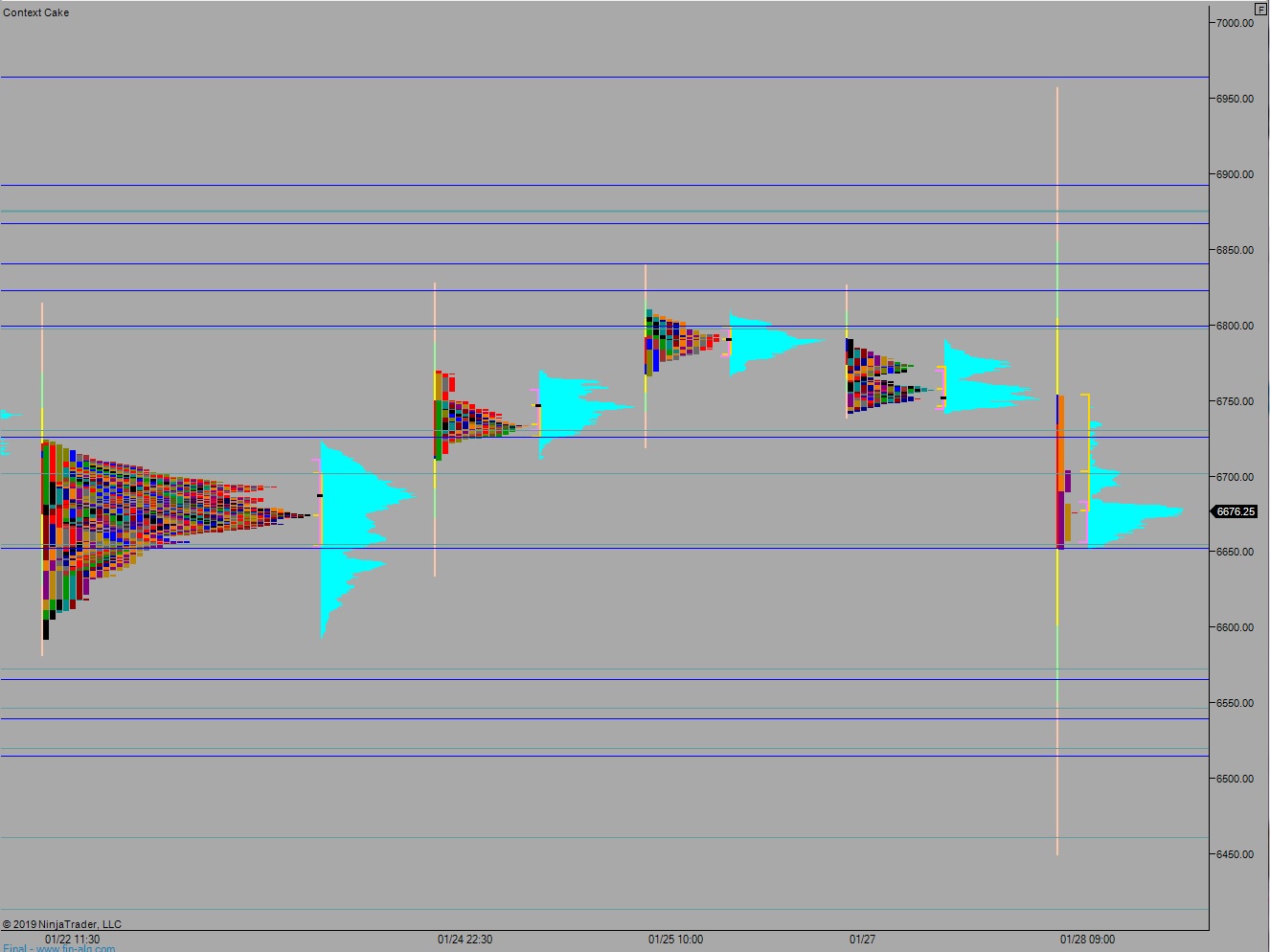

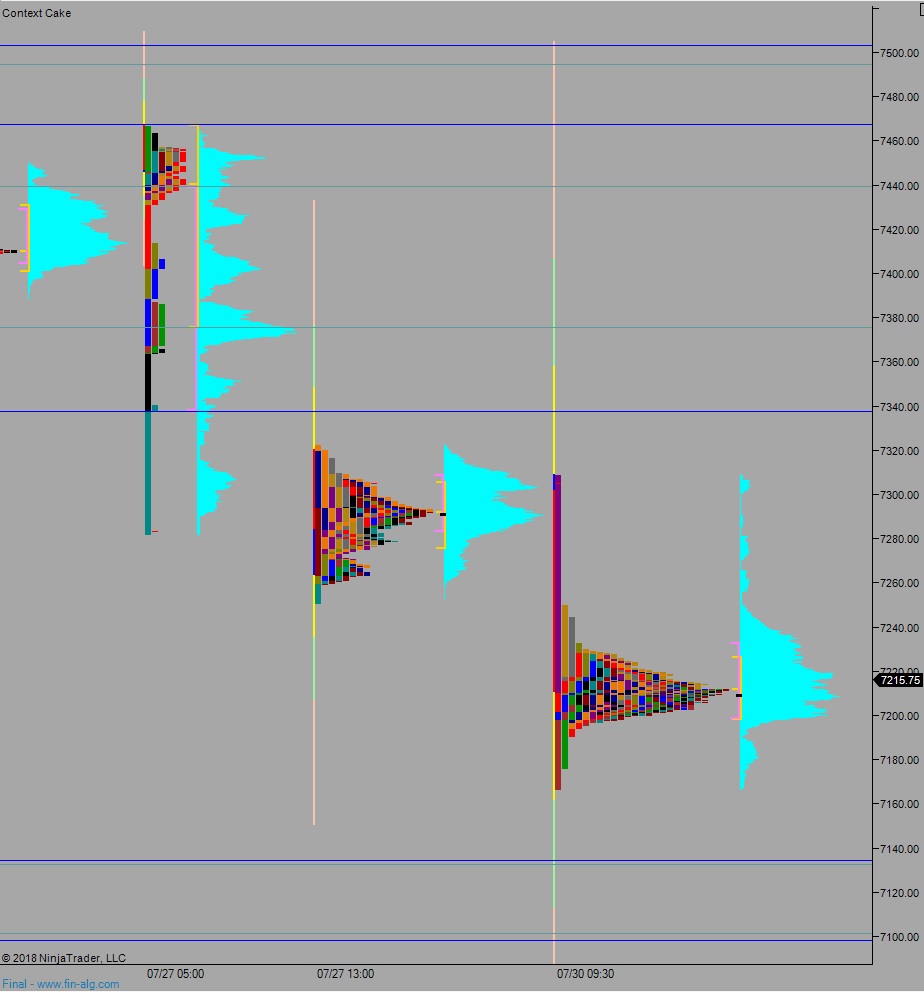

My data set only has one—back on July 30th, 2017. Dust off your charts and peer back to then, and you will see we entered a two-month-long-time-based correction. Basically we marked time, in a tight range, across the entire equity complex.

Now a lesser interpreter of data would take this observation and run with it, decreeing from far and wide that the next correction is neigh! But your old pal RAUL doesn’t carelessly write such predictions with a data set of one. I need at least 50 samples before considering something to be statistically significant.

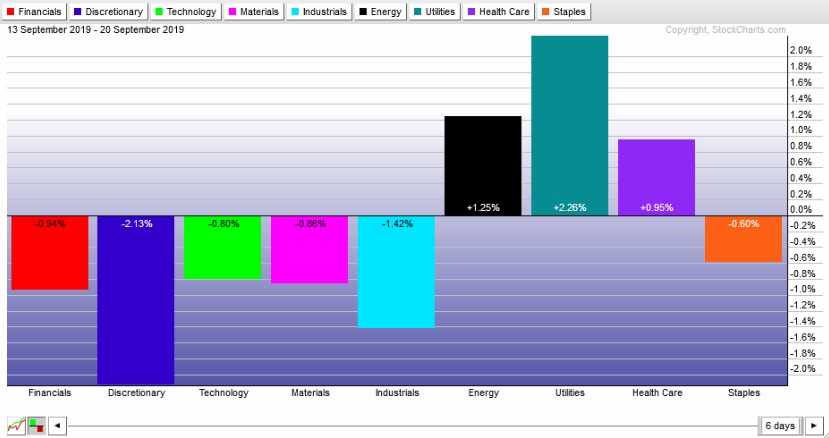

Nevertheless, the price action on the PHLX semiconductor index is troubling. And if you recall, a few hundred words up I noted that our entire rally is predicated on semiconductors. So this requires our attention. IOTS screwed the pooch two weeks back, last week it was MU. There is a downside gap that we are accelerating down into and that selling is likely to continue.

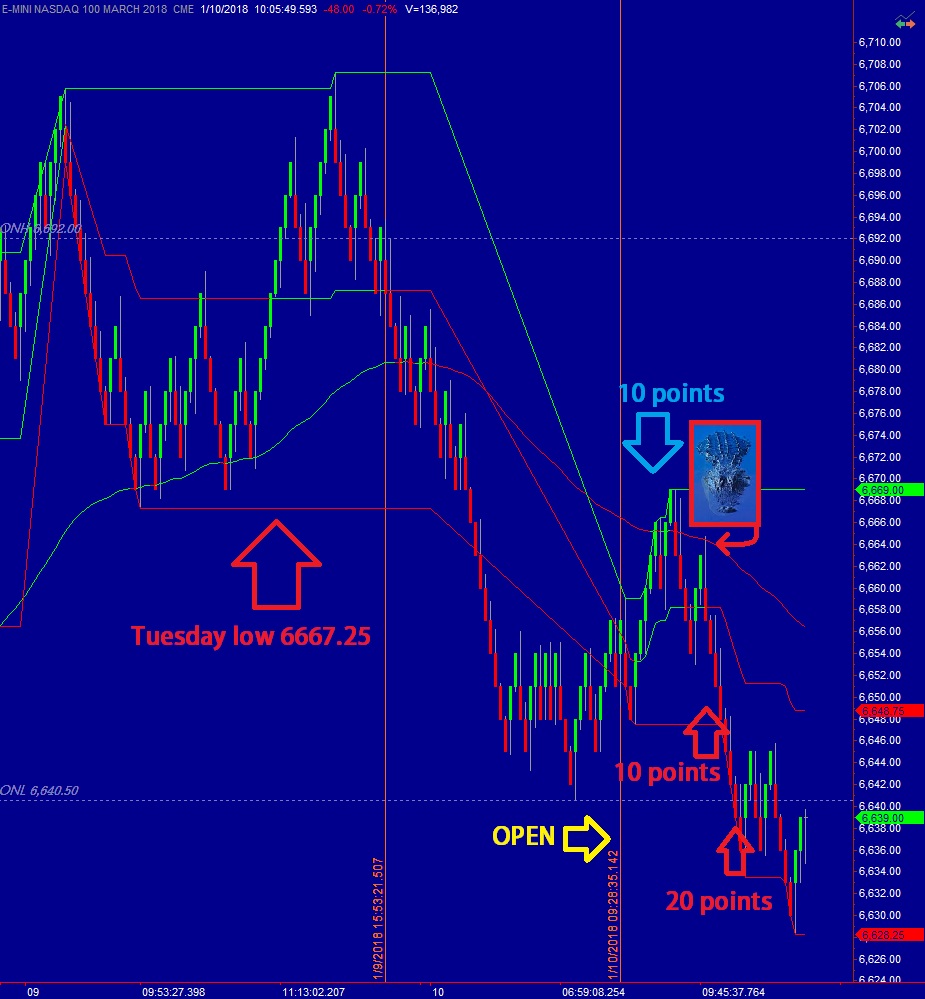

Therefore I will set out early next week to establish a short position trade against the NASDAQ via SQQQ. I will also be only working the short side of the tape via NASDAQ futures. That means shorting gap ups inside the prior days range, ‘going with’ crosses down through the daily mid as long as an overnight or initial balance stat is in play, and shorting the levels highlighted during the morning trading reports.

One of my key cues throughout the week, as to whether I should continue working the short side is NVDA. I watch that ticker like a hawk. I also bear in mind where were are trading relative to the weekly ATR band, on both the Russell and the NASDAQ.

So there you have it. Long-term bullish on tech and bearish on nations and fiat, short term bearish on equities with a laser focus on semiconductors.

That’s all I’ve got.

Raul Santos, September 29th, 2019

Exodus members, the 254th edition of Strategy Session is live, go check it out!

Comments »

“As the profile begins to mature, it is taking on a lowercase letter b shape which is sometimes indicative of a long liquidation, a short term phenomenon that sometimes occurs near the bottom of a down move.”

“As the profile begins to mature, it is taking on a lowercase letter b shape which is sometimes indicative of a long liquidation, a short term phenomenon that sometimes occurs near the bottom of a down move.”