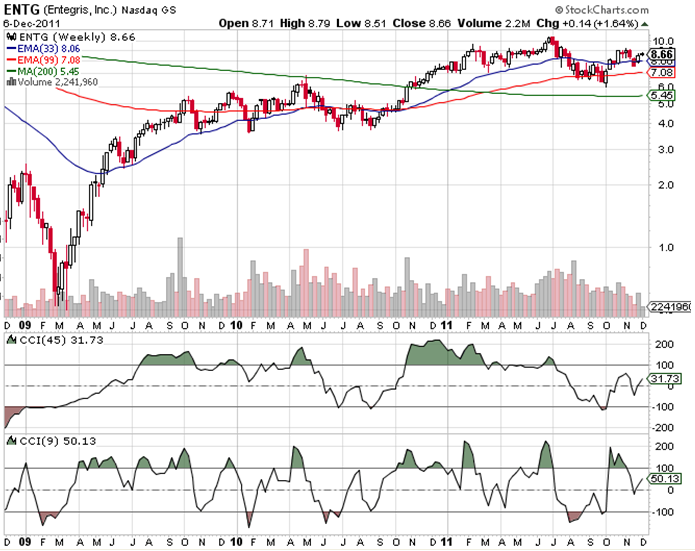

When screening for companies putting up great ROE numbers, sporting a low PEG, and having short float I came across BODY. Then I pulled up that chart and it’s a buy. The company came public near the end of 2010 and has performed well since. The stock price has appreciated rather orderly since late August and now sits near 52 week highs aka easy street investing.

If you’re looking to add retail exposure to your portfolio, I suggest BODY. They’re a low priced women’s retailer with tons of room for growth. Have you ever seen a girl tear into one of these stores? We all know who wields the retail spending pen.

My channel checks down in Florida where the company has several stores says, “never heard of it.” Her lack of recognition troubles me since she’s huge into retail. Body Central definitely hasn’t reached Free People status, nor do they have the high price points. But on paper they look like a good bet and on the charts they look like a great bet. They have several stores slated to open this year and seem to be managing their growth well.

I got about half my position on this morning, and depending on how she trades going into the close, I will look to ADD, non-attention defect style.

And for the ladies, LMFAO:

Comments »