Things are really looking up for the old equity complex. There was a distinct pressure put on by the Russell and Big Tech and those are the departments of progress.

We shot down that dang communist spy balloon over the desert. Good riddance. I am due west in a few days and the last thing I need is those tic tock drones eyeballing my anus whilst I sun it in the high desert.

That’s right folks, I am heading off the plantation for a bit. Stepping out of the proverbial fish tank so I can better see the stew I’ve been swimming inside of.

It has been too long. Yes, I’ve been to Lake Tahoe a few times, and Miami (cheesy) and Philadelphia (wonderful). But I haven’t commissioned a large vehicle to drive around the mountains and just heckin’ be left alone since before the forced lock down.

I think I really need it. I am right on the edge.

I’ve somehow found myself wrapped up in this scam where if I do not completely occupy my time with projects and tasks, other expect me to do their tasks. The fuck?

Does that sound like any way to live?

Alls I want is to hustle the opening bell, grow my dang tobaccos and corns and then sashay around town spreading cheer.

Maybe soon.

But first I bought myself eight more months of work. My dream home. I cannot wait to show you lads this beauty.

Right, anyhow, models continue to signal bullish into the first full week of February, therefore I shall be pressing risk early and often.

I pulled the trigger and out came the missiles.

Raul Santos, February 5th 2023

And now the 419th Strategy Session.

Stocklabs Strategy Session: 02/06/23 – 02/10/23

I. Executive Summary

Raul’s bias score 3.65, medium bull*. Price drifts sideways-to-higher during the first full week of February.

*extreme Rose Colored Sunglasses [e(RCS)] triggered, see Section V.

II. RECAP OF THE ACTION

Grind lower through Monday before discovering a sharp low early Tuesday and rallying throughout the day. Marked time until Wednesday afternoon Fed announcement/presser put a strong bid into equities. Spike higher continued through early Thursday before sellers stepped in and stabilized the auction into the weekend. Dow lagged.

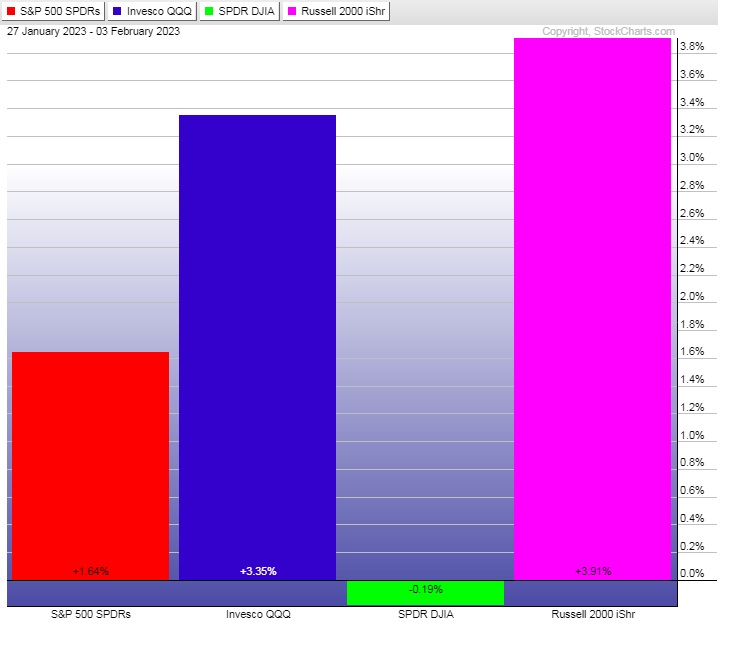

The last week performance of each major index is shown below:

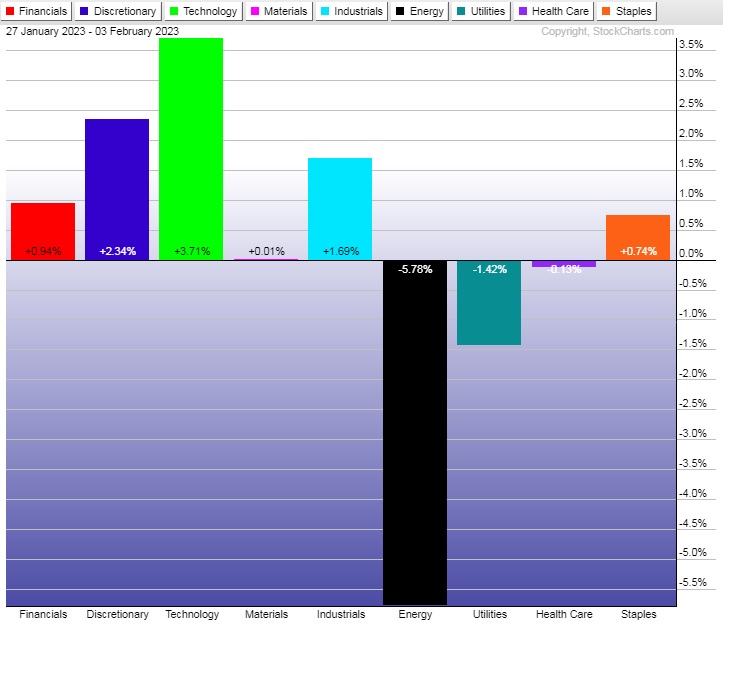

Rotational Report:

Rotations not quite as strong as two weeks back, but rallying in the key sectors is a positive.

slightly bullish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

After two weeks of heavy bullish skews, then a neutral ledger, then another strong bull skew — we saw yet another strong bullish skew last week.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Five more days of bullish signals

Pressing winners can be tough, especially with all the news flow being so dire. I find it helps to tune out as much outside influence as possible and just do what the models say.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Price drifts sideways-to-higher during the first full week of February.

Bias Book:

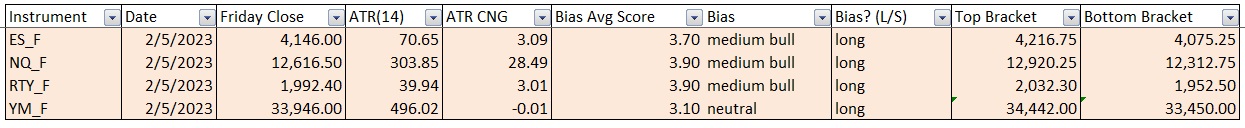

Here are the bias trades and price levels for this week:

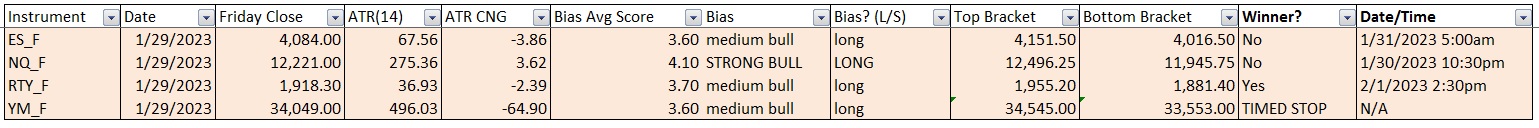

Here are last week’s bias trade results:

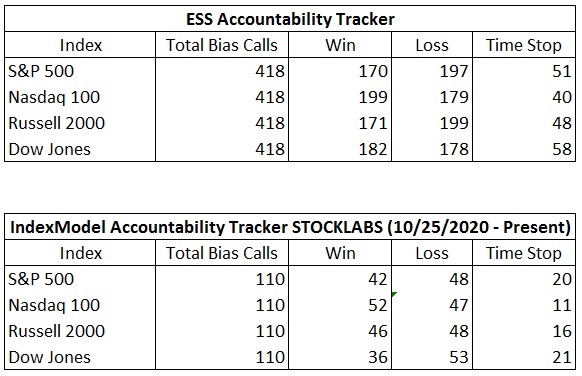

Bias Book Performance [11/17/2014-Present]:

Range breakouts

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

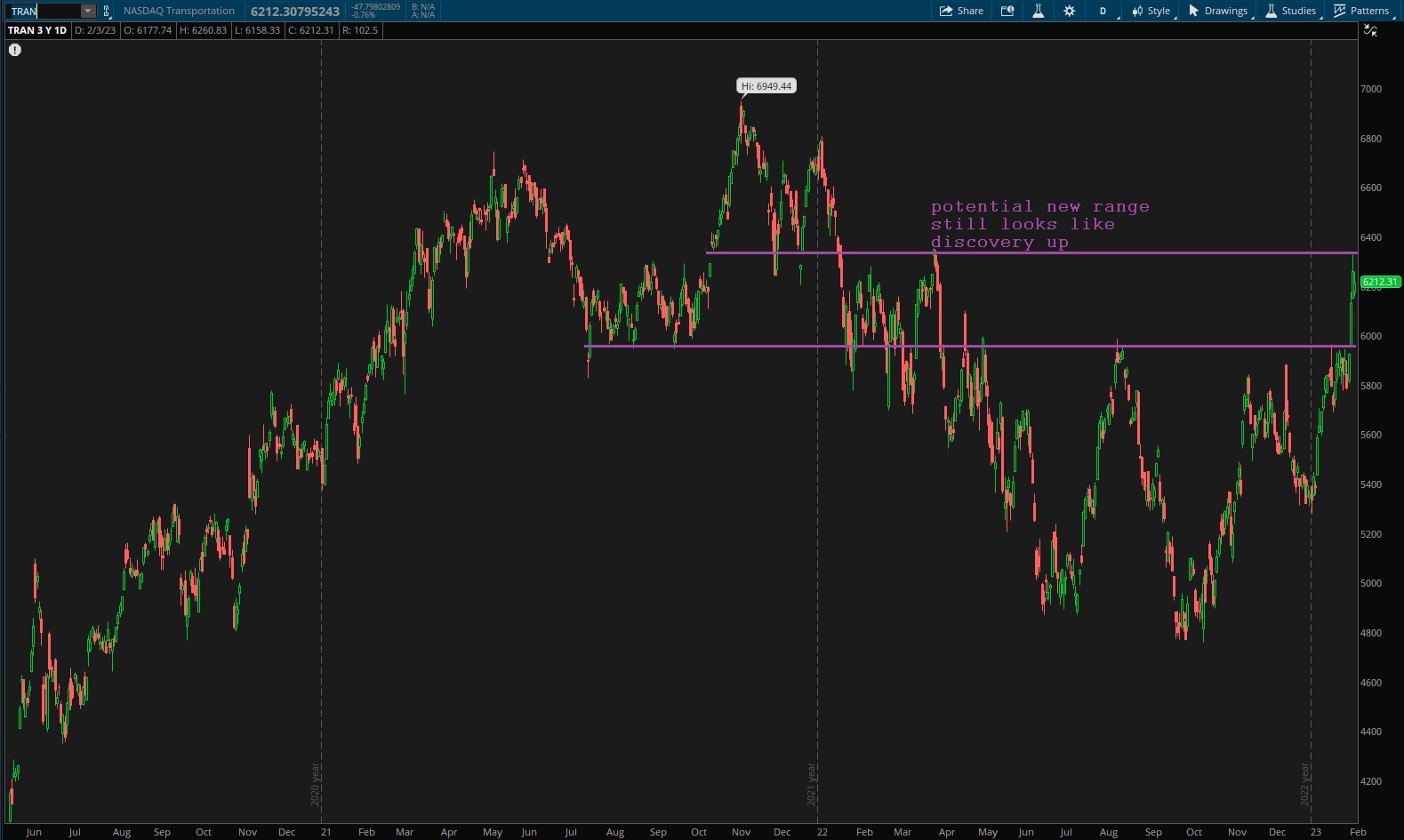

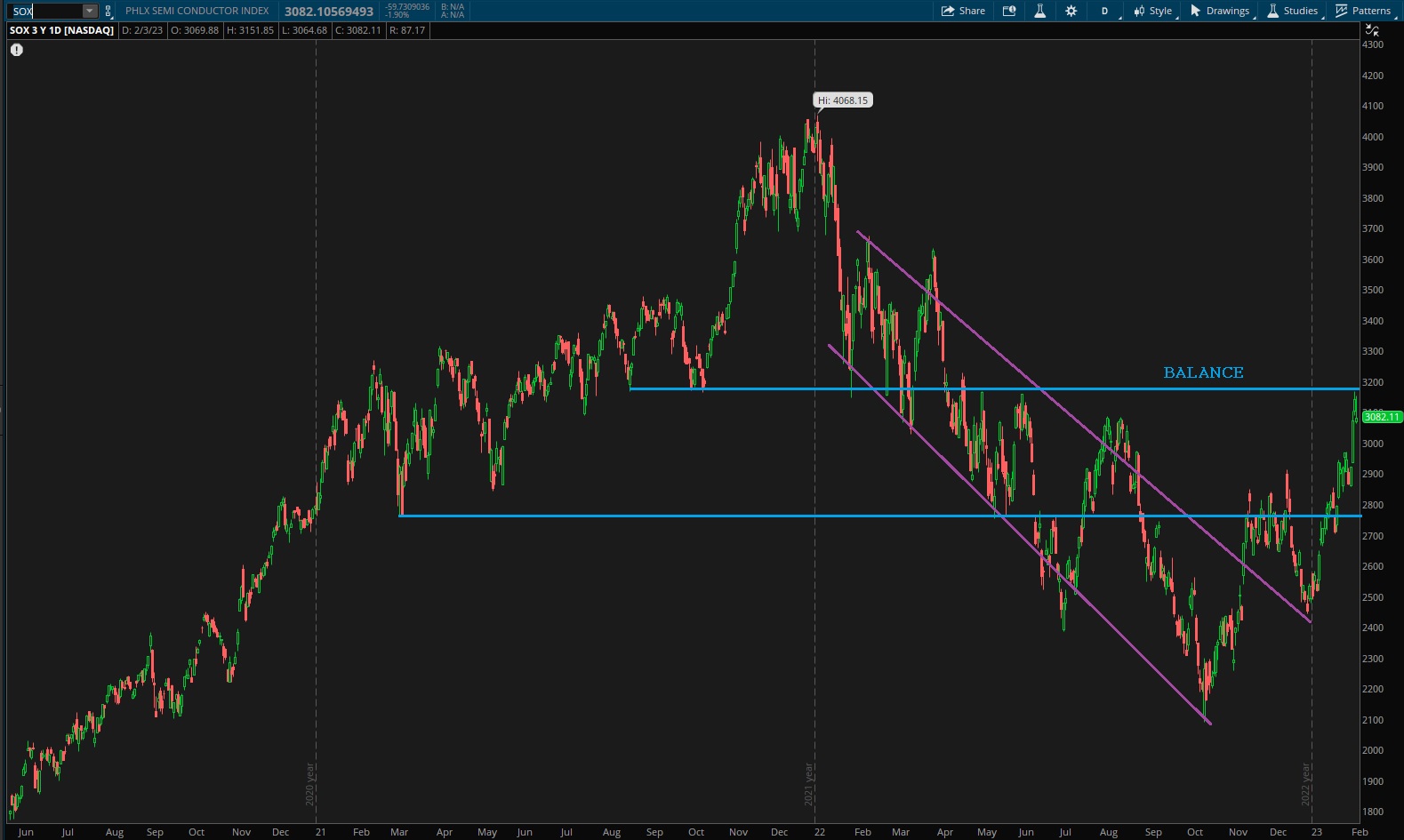

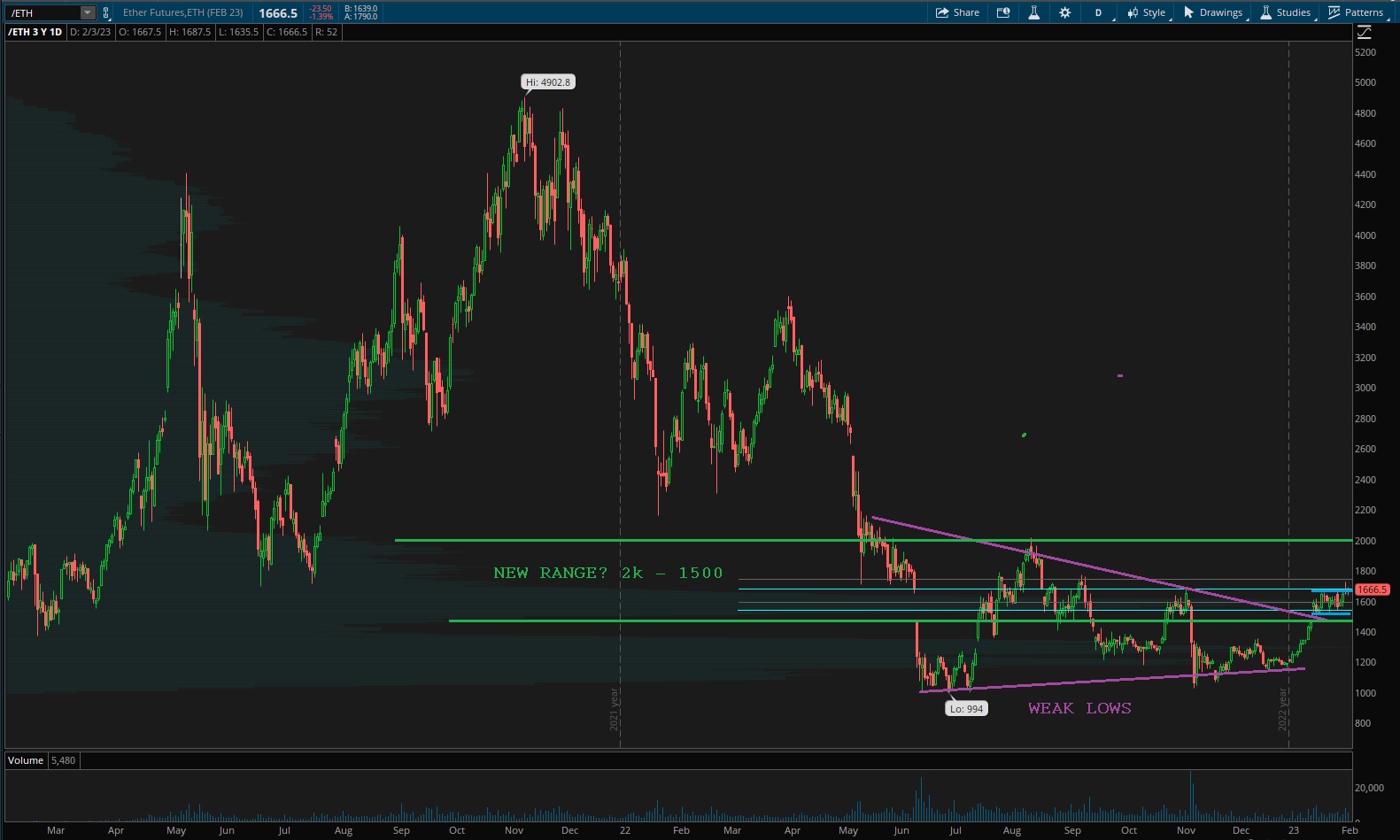

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

Transports went into discovery up last week. I sort of mapped out a potential new range, but this index appears to be in discovery up.

We don’t know.

See below:

Semiconductors made a strong move higher and away from their recent consolidation. There could be a new range forming here.

Ether has weak lows, but we’re spending a lot of time establishing a new value a bit higher than those weak lows. Nothing to be too excited about if you’re a bull.

V. INDEX MODEL

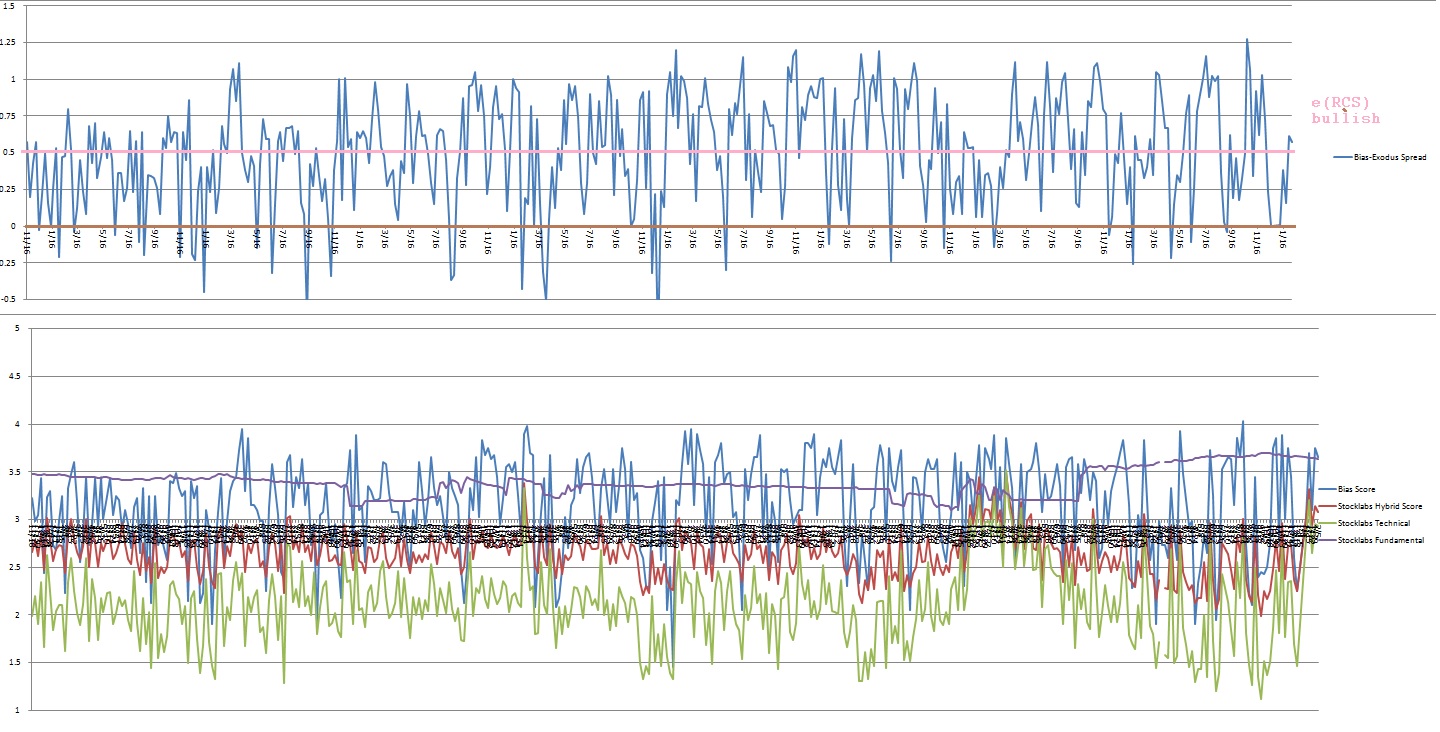

Bias model is extreme Rose Colored Sunglasses for a second week. E(RCS) calls for a calm drift, perhaps with a slight upward bias.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“Effort and courage are not enough without purpose and direction.” – John F. Kennedy

Trade simple, make a plan first

If you enjoy the content at iBankCoin, please follow us on Twitter