The primary goal of America is to secure an estate as best as possible before becoming too oldt to work. There are risks all along the way, from the moment one enters the labor pool till the bitter end when day time teevee commercials try to scare you into usurious lending and insurance schemes. Play your cards right and in fifty years or so you can lay claim to many acres of productive land and a sturdy set of structures for keeping your little empire warm and fed and safu.

But for a select few America, and by extension western culture, is a high stakes game of monopoly. There are very few rules except that he who has the most tends to win. This is a hardt life and I do not envy those who take to playing it. A giant target is printed on them, and the assults come in every form—seduction (lechery), latch ons (leechery), angry mobs of socialist plebs, the no dang good fourth estate, the archaic nation states and ultimately the fellow players of the game.

Everyone’s approach is different. From Donald’s ascent through real estate to politics, to Elon’s internet banking schemes pivoted into manufacturing and software, to Bezos’s putting boxes out, to Sam’s altruistic (autistic?) games of speculative risk with a whole new monetary system.

Anyone whose played Monopoly knows only one person wins.

I’d rather play estate building. Lots of folks win that game here in America all the time.

THAT BEING SAID. My job is quite simple. To extract as much fiat as possible from the global financial complex. To keep my bullshit meter calibrated. To then use said funds to buy estate assets like LANDT, STEEL, MACHINES, quality machines that help me be left alone. Big strong borders of shrubs and thorns and trenches. Greenhouses and irrigation systems and strong vegetable genetics.

Goats and chickens and the infrastructure to keep them healthy.

A nice strong woman who can pull a plow and hold a room’s attention.

So I do all this research. And now that winter is here I will work on getting back to active trading.

The research this week says to press longs full plum into option expiration week. This carrys us into the lovely Thanksdgiving, the wretched Blackened Friday, and then right into month-end.

So maybe we press clean through year end. We dunno.

As always, we’ll take it one week at a time. And with any luck, I’ll build out my trading systems again and we’ll go back to taking it one morning at a time.

I work hardt for myself and for the good folks of the interwebs. For estate! For the robots! Ole!

Raul Santos, November 13th, 2022

And now the 410th edition of Strategy Session.

Stocklabs Strategy Session: 11/14/22 – 11/18/22

I. Executive Summary

Raul’s bias score 3.88*, medium bull. Markets drift higher through option expiration. Watch for earnings out of Walmart (Tuesday before-market-open) and Nvidia (Wednesday after-market-close) to add some choppiness to the action.

*extreme Rose Colored Sunglasses bullish bias triggered, see Section V.

II. RECAP OF THE ACTION

Choppy through early Tuesday, then a bit of selling pressure through Wednesday. Very strong upside reaction to CPI data Thursday with come continuation higher Friday and into the weekend.

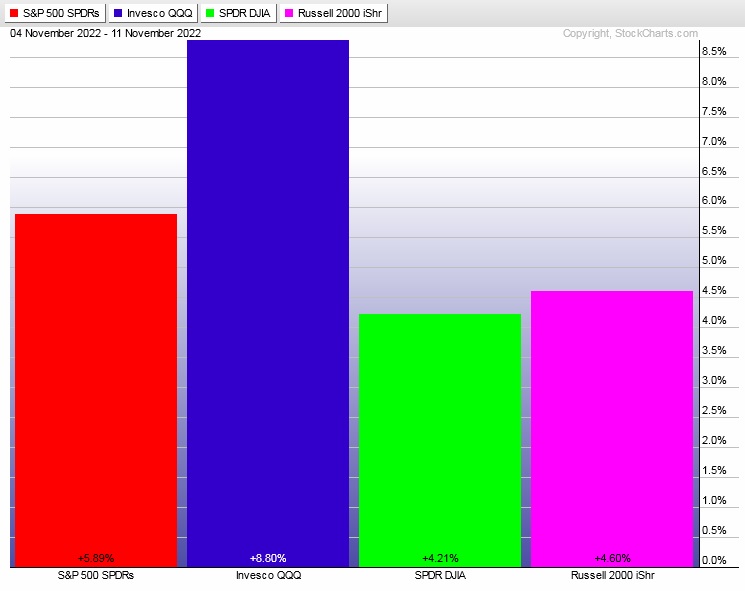

The last week performance of each major index is shown below:

Rotational Report:

Rotations flipped to ideal bullish last week.

bullish

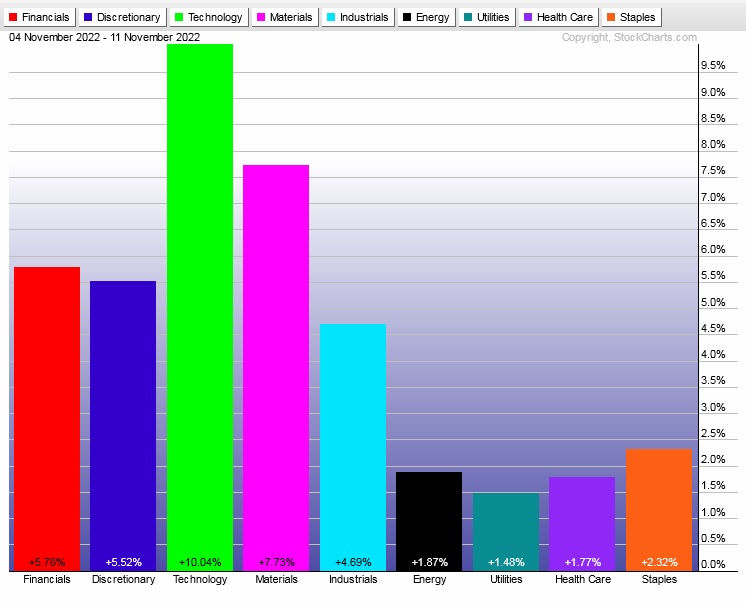

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Money flows broke balance to the buy side, led by key industry drivers like semiconductors.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Ether stays decoupled, only now it’s the most bearish (and a note on overbought signal)

Ethereum was independently bullish two weeks back, and then last week it was independently bearish. A big part of that was news that major crypto brokerage FTX fucked up client funds, comingling them with the proprietary trading desk and being pushed (rather rapidly) into bankruptcy.

Seeing risk assets behave independent of one another is a good sign for investors. It could signal the end of a broad corrective environment in all risk assets.

***

When it comes to Stocklabs signals, you want to dig into the intelligence to see what has happened historically. If you look at one year of data on the six month overbought signal, you will see it statistically resulted in lower prices of the 10 days that followed. However that sample set is small.

Any serious stat head will look for at least fifty samples to consider a data set significant. To that end, one must expand the signal out to five years. And when you go out to five years, the six month overbought signal has been bullish.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Markets drift higher through option expiration. Watch for earnings out of Walmart (Tuesday before-market-open) and Nvidia (Wednesday after-market-close) to add some choppiness to the action.

Bias Book:

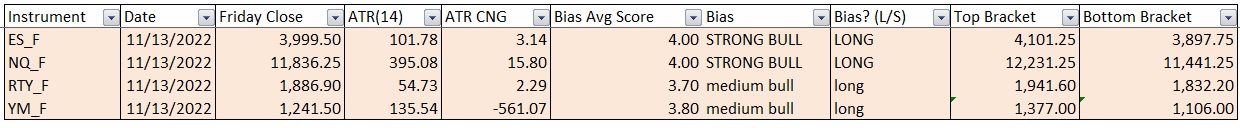

Here are the bias trades and price levels for this week:

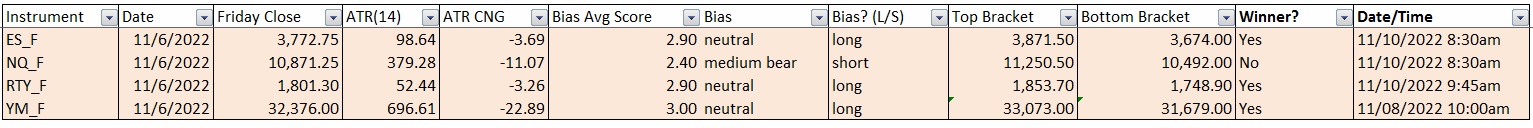

Here are last week’s bias trade results:

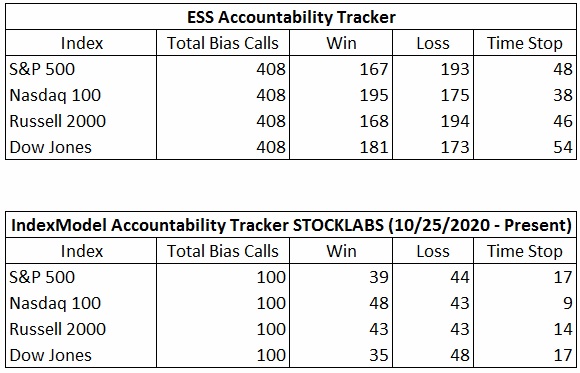

Bias Book Performance [11/17/2014-Present]:

Room inside balance for some, weakness in ether

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

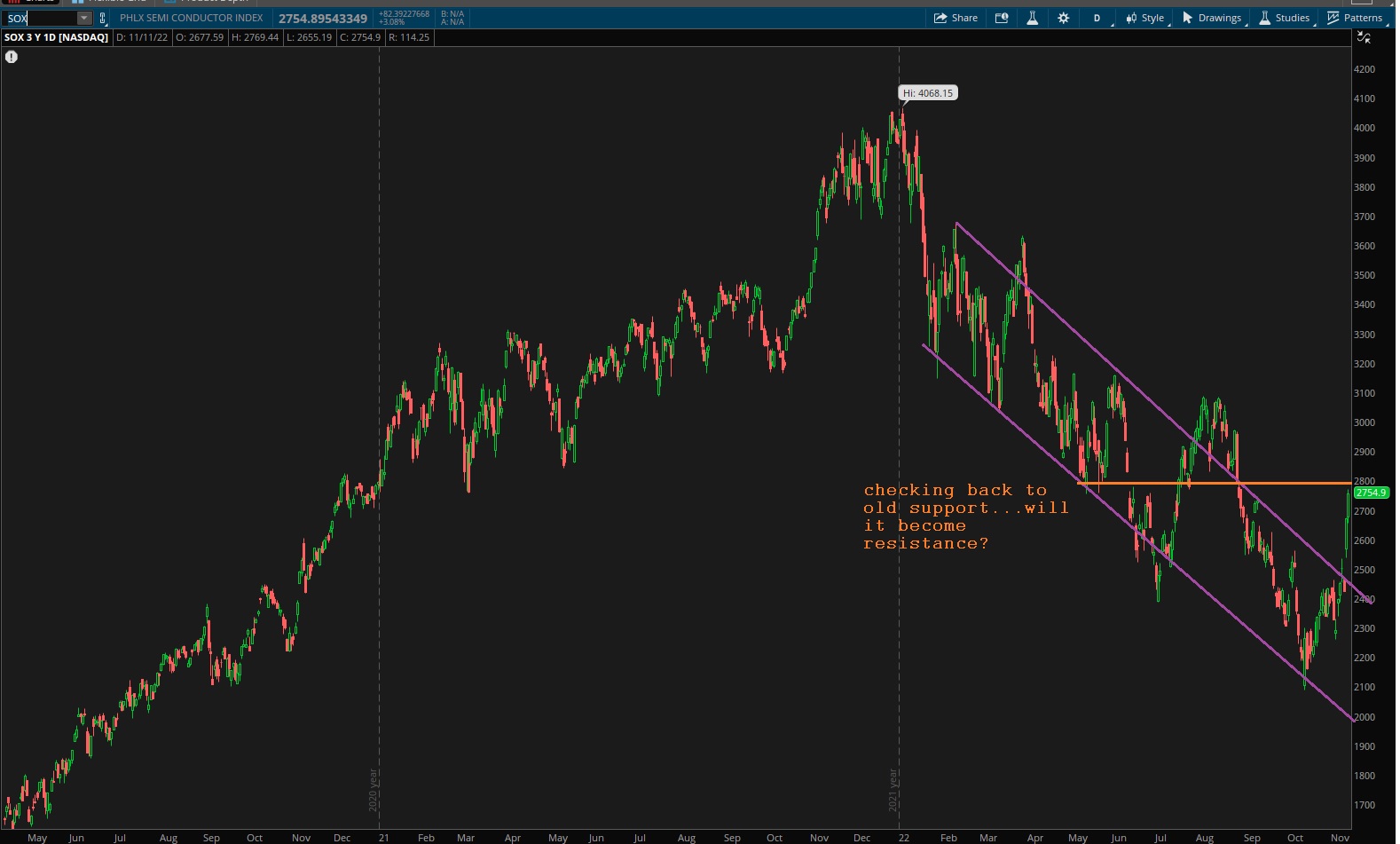

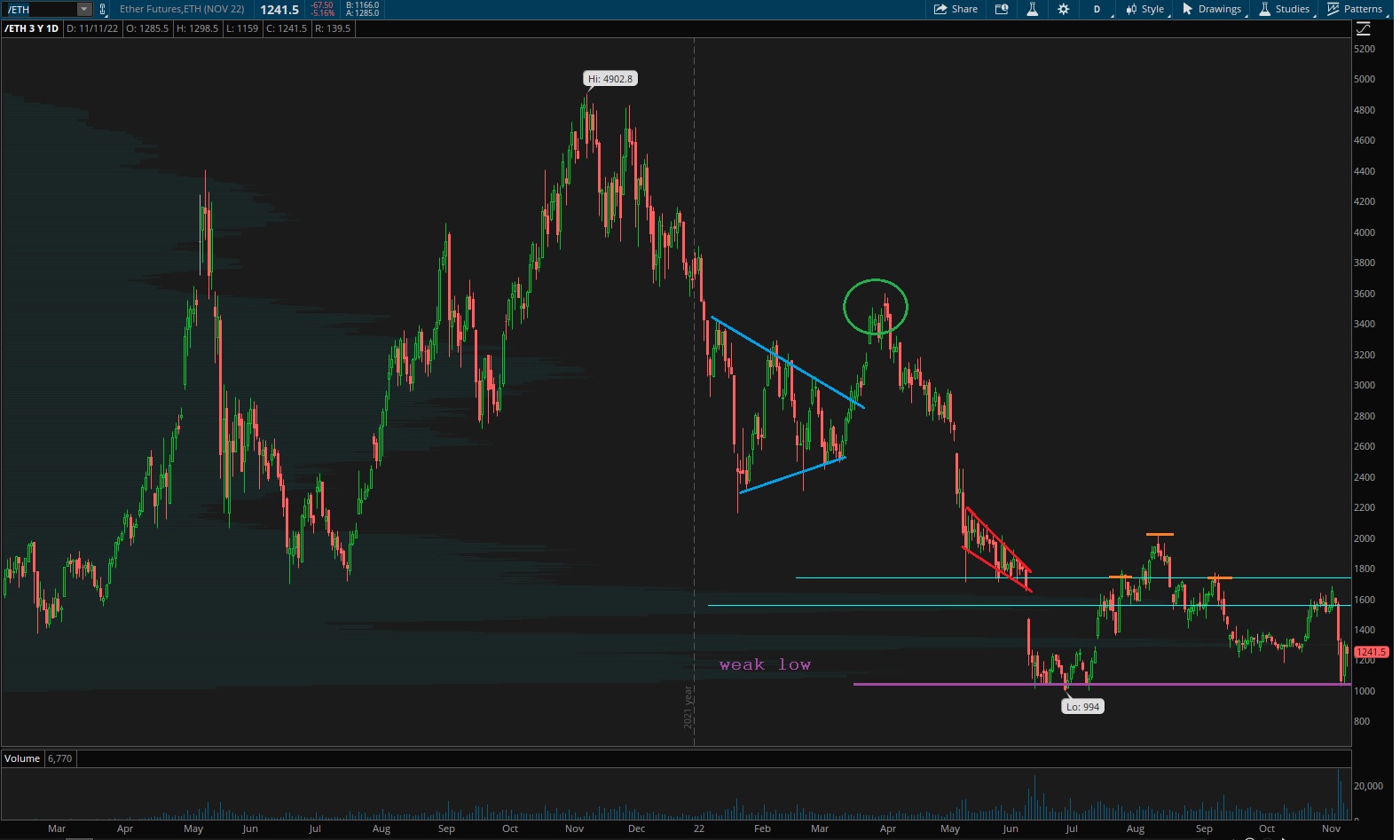

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

Transports are probing the top-side of a range that is sort of being established. A bit more headroom perhaps.

See below:

Semiconductors broke their trend channel and have a bit more room to the upside before coming into an old support zone. One of the markets favorite pastimes is converting old support into resistance and vice versa, effectively trapping counter parties.

We had ether on a path to 1700. It stalled out at 1682 on the CME before the FTX news hit. Since then it has nearly taken out recent lows. That bounce just above what was already a kinda bummy looking low has made the current swing low look even weaker.

V. INDEX MODEL

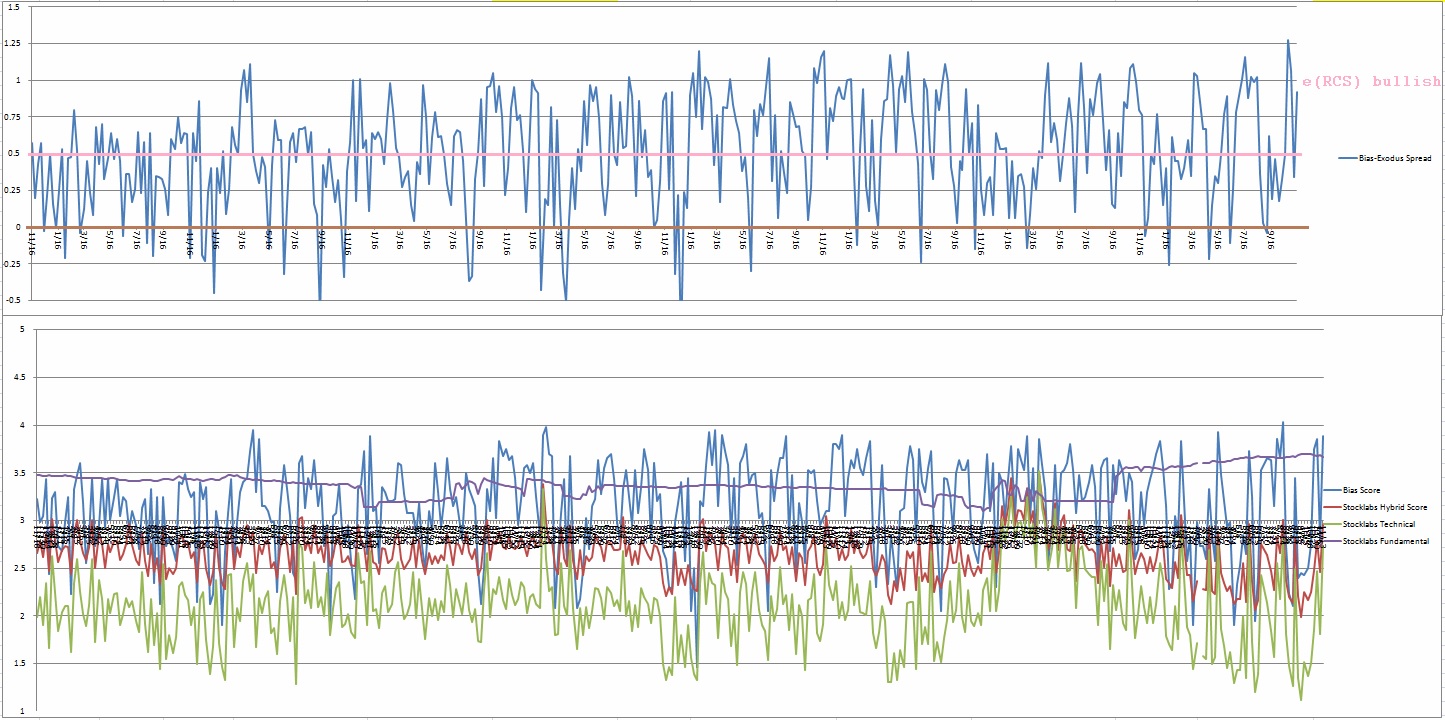

Bias model is once again extreme rose colored sunglasses bullish after two neutral weeks. Before all this we had two consecutive weeks of extreme Rose Colored Sunglasses (e[RCS]) bullishness.

So the count is at three e[RCS] in recent history.

There were five Bunker Busters in recent history — ten weeks ago, nineteen weeks back, twenty-six weeks ago, thirty-nine reports back and forty-one reports back.

Here is the current spread:

VI. Six month hybrid overbought

On Friday, November 11th Stocklabs went technical and hybrid overbought on the six month algo. This is a bullish cycle that runs through Monday, November 28th . It runs a bit longer due to a trading holiday for Thanksgiving.

VII. QUOTE OF THE WEEK:

“The best defense is a good offense.” – Dan Gable

Trade simple, press your edge

If you enjoy the content at iBankCoin, please follow us on Twitter