Woke up early this Sunday, day of the witch. My powers grow stronger every day as we cruise through harvest season, pulling lumps out of the dirt and hustling them into fiat american dollars and then hustling those dollars into stuff that’s actually valuable. Things like machines and tools and equities. Bought some dang bitcoin this morning.

I know I’m fighting the Fed and I expect to be ‘wrong’ for a long time. But maybe that is the difference between me and your average american football and nacho consumer. My work has only begun. At 5am I rise without an alarm, cockstrong, the dang thing practically heaving me off the bed.

Then I go to work because why not? I’m awake.

I’ve been a vegetarian for nearly seven years now and it’s really starting to pay dividends. I have the vigor of ten men and the kindness of Manjushri.

Yep things sure are going well for your dear and gentle pal Raul. And as such I am buying this dip.

I couldn’t care less about the constant threats of the fear dealers on teevee and the interwebs. The progressive agenda has advanced so far into enemy territory that I am shielded from those country road flag flyers. I am amongst the bandits and they are to be respected, but by no means feared. If they ever make a move on me it will be a miserable day for their families. For them it will simply be the end and that’s not so bad.

My powers grow.

With every 10 degree drop in temperature my inner fire grows hotter. I cannot imagine doing stimulants like adderall or crack rock when I already pace around this derelict outpost for 15 hours a day. Sitting here to pen this blog entry is a great challenge as all I want to do is make to kill.

So if you’re too old to holdt for ten years whilst using your mind and muscles to go out and secure moar monies, than sure, be afraid. Your entire focus is wealth preservation. But I am on a warpath of CREATION.

Raul Santos, September 25th 2022

And now the 402nd Strategy Session

Stocklabs Strategy Session: 09/26/22 – 09/30/22

I. Executive Summary

Raul’s bias score 2.45, medium bear. Expecting sellers to attempt some follow through downward action early in the week. Then a rally into month-end.

II. RECAP OF THE ACTION

Rally Monday. Sustained gains through Wednesday until the FOMC meeting. Price action resolved lower after a down-up-down reaction. Sellers dominated the tape late into Friday trading before a bit of a ramp into the weekend.

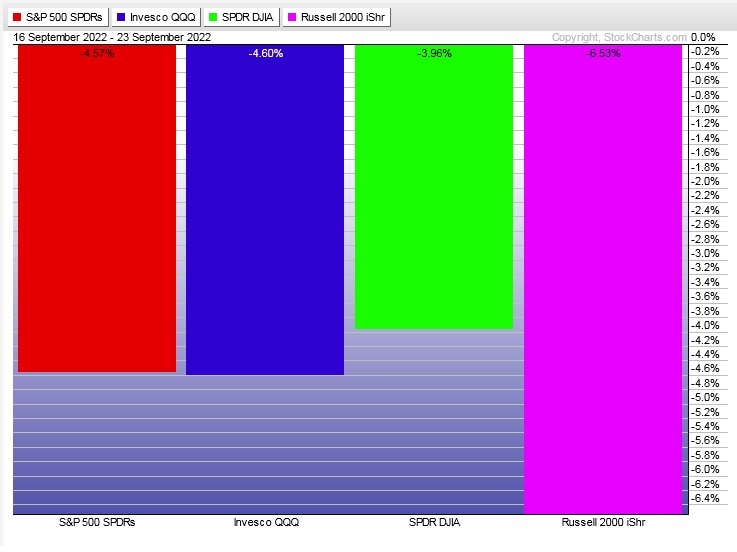

The last week performance of each major index is shown below:

Rotational Report:

Recall we had two weeks of full risk off rotations, then a strong risk on rotation. Then another major risk-off rotation on the prior report.

And then again on this report a strong risk-off rotation.

bearish

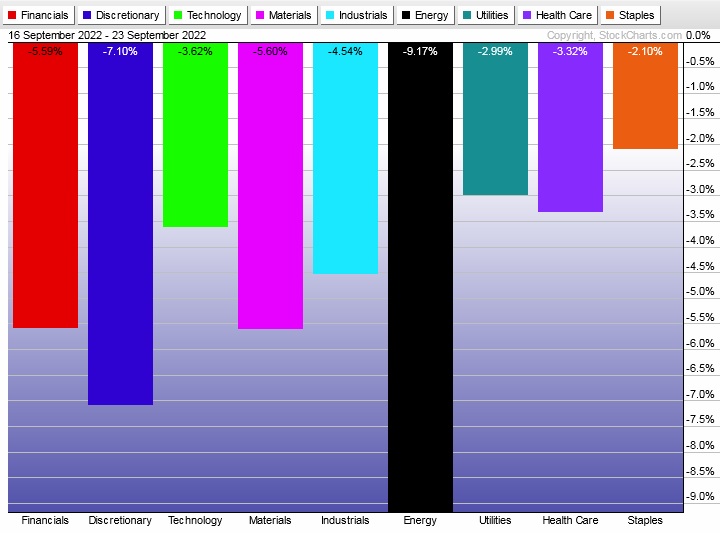

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Money flows skewed heavily to the sell side for a second consecutive week.

bearish

Here are this week’s results:

III. Stocklabs ACADEMY

Fed up

For the first time I am seeing genuine anger from investors. They are angry with the Fed for their hawkish reaction to inflation while simultaneously angry about home and food prices.

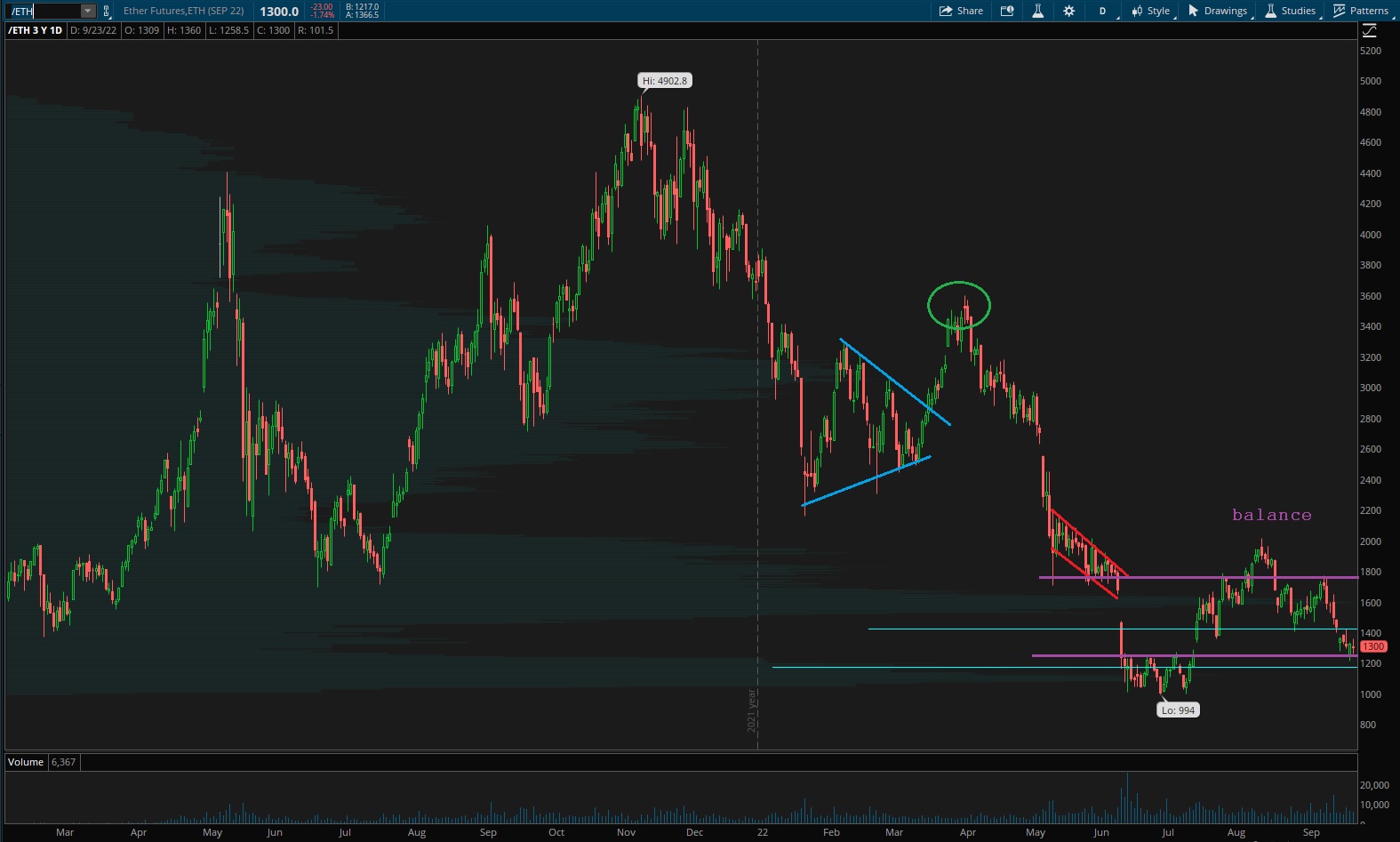

I don’t think most investors, especially those who focus primarily on equities and/or bonds, fully grasp the situation facing the U.S. dollar. Our fiat currency, along with the nation it represents were called into question during the lockdown. What rose to prominence during this time were various crypto currencies. These internet coins have become legitimate tender.

Ether has become a massive commodity that users accumulate and use.

These so called inflation hedges did not behave as intended. They did not hedge anything. In reality they served to *exacerbate* inflation. And now the Fed has no choice but to flex until the almighty U.S. dollar regains total, undisputed dominance.

It’s working.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Expecting sellers to attempt some follow through downward action early in the week. Then a rally into month-end.

Bias Book:

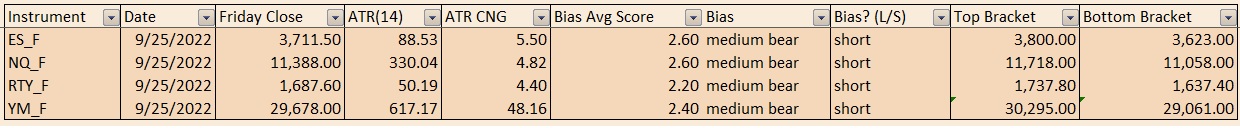

Here are the bias trades and price levels for this week:

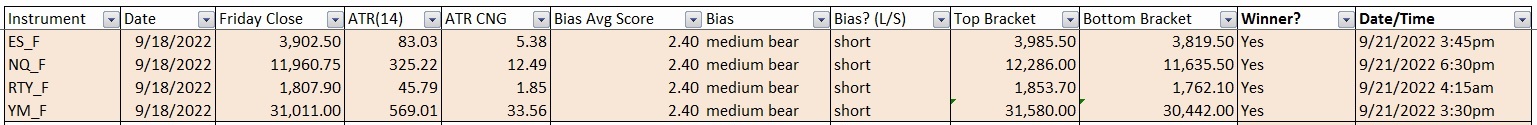

Here are last week’s bias trade results:

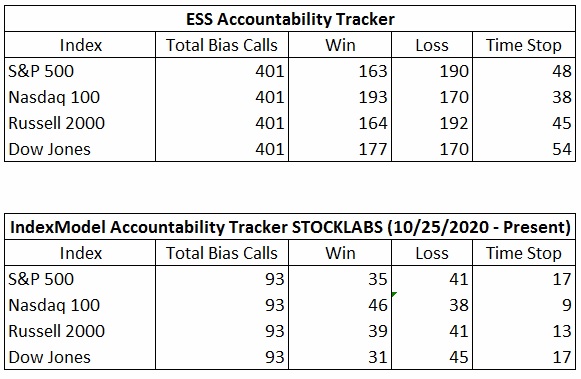

Bias Book Performance [11/17/2014-Present]:

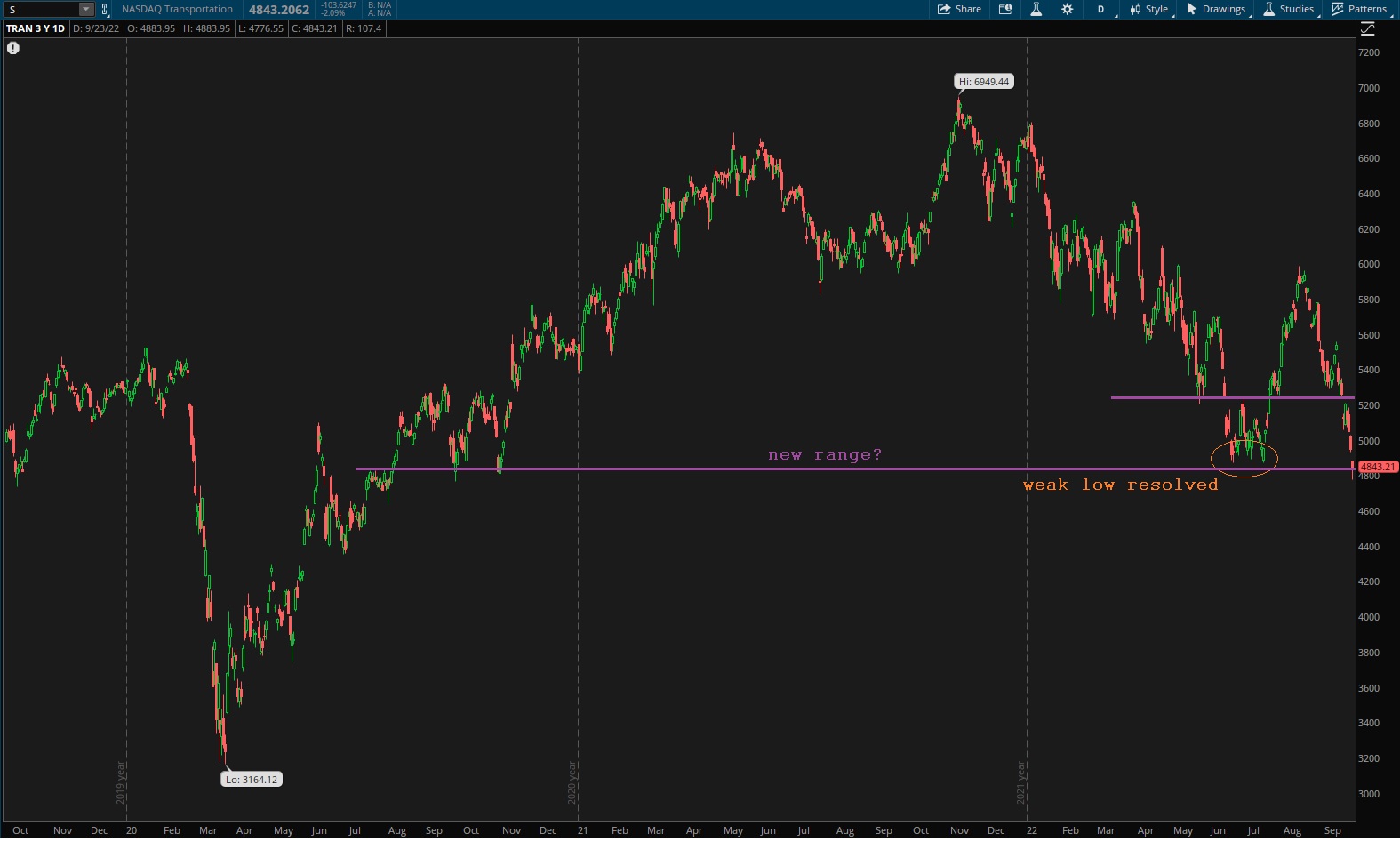

Transports resolve weak low

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

We can finally remove the note about the weak low on Transports. That being resolved, perhaps this index can go to work forming a more sturdy low.

This could be range low right around here—we don’t know.

See below:

Semiconductors appear to be outside of range. Could be in discovery down. Or the range could assert force and suck price higher. We don’t know.

Ether looks more balanced than the other two contextual indices.

V.INDEX MODEL

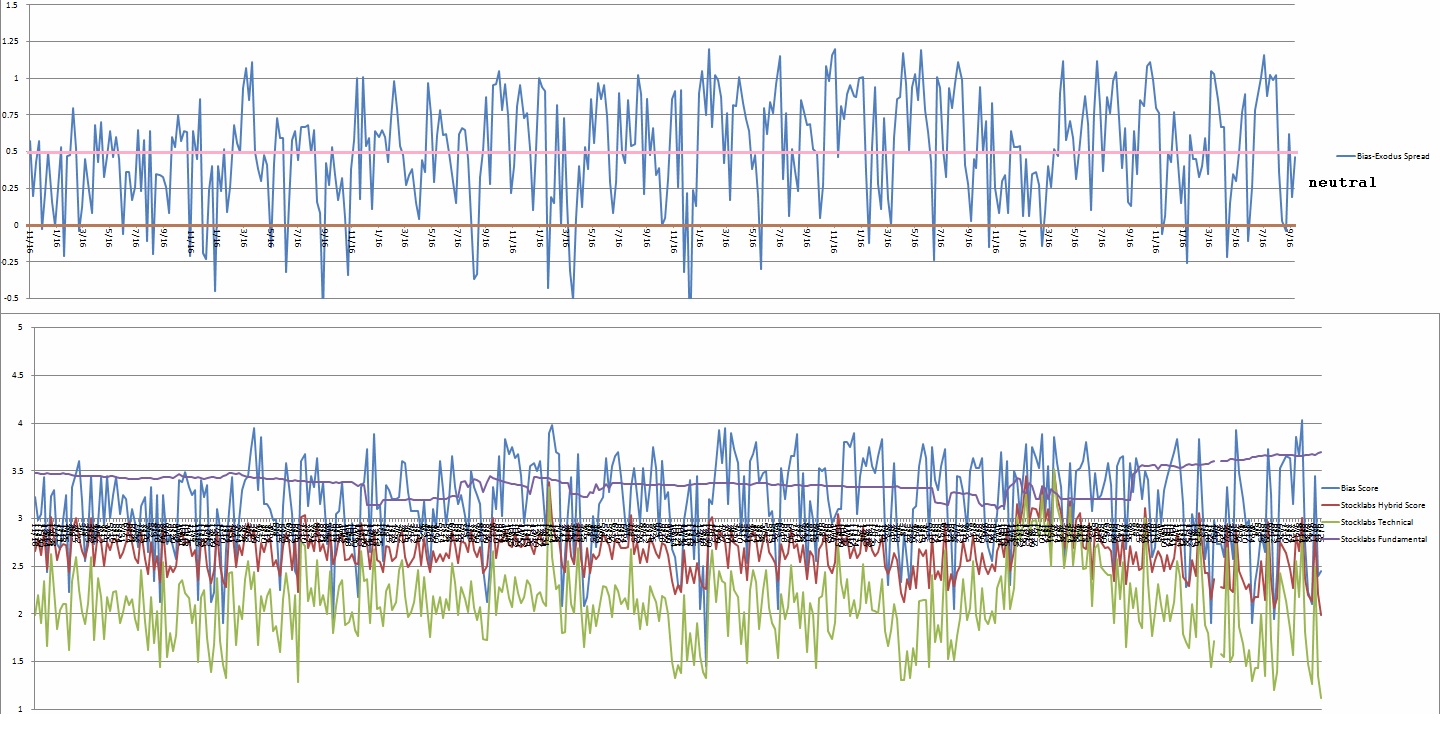

Bias model is neutral heading into the final week of September. The second consecutive neutral reading. No bias.

There were five Bunker Busters in recent history — three weeks ago, twelve weeks back, nineteen weeks ago, thirty-two reports back and a third fourty reports back.

Here is the current spread:

VI. 12 month hybrid oversold

On Friday, September 23rd Stocklabs went hybrid oversold on the 12 month algo. This is a bullish cycle that runs through October 7th, end of day.

VII. QUOTE OF THE WEEK:

“it has always been easy to hate and destroy. To build an to cherish is much more difficult.” – Queen Elizabeth II

Trade simple, stay cool daddy-o

If you enjoy the content at iBankCoin, please follow us on Twitter