Here we are a gain lads, back in a Bunker Buster.

Not much to say here — Neel cash and carry was delighted to see us selling off in the aftermath of Jackson Hole.

The Fed wants lower.

Who are we to fight them?

Optimists and dreamers.

The realists are probably doing normal things like enjoying their boats a few more times before winter. Sending their kiddos off to school. I don’t know — having garage sales or something.

But we’re out here punching data into spreadsheets and complying with what the models tell us.

The models tell us this week is time to add to long-term positions by buying more risk assets.

But not just yet. First they want to see a real plunge into the abyss.

Therefore I shall sit here a bit, with my tools sharpened, guns oiled and office cleaned — awaiting some panic.

Then I will step in and buy the good goods. Stuff like ether, GOOGL, BRK.B. Who knows I might eff around and buy some META. You see Mark last week? Punching and kicking that poor lad? Somethings brewing at Meta.

Shit might could even pick up a little Tesla.

Might need to auction off an organ first.

Alright lads that’s the call. To be patient. To let the enemy press deep into our lines, then we attack.

We are lions.

Raul Santos, September 5th 2022

Happy Labor Day.

Here’s the 399th Strategy Session:

Stocklabs Strategy Session: 09/05/22 – 09/09/22

I. Executive Summary

Raul’s bias score 2.10, medium bear*. Volatility increases early Tuesday with prices accelerating to the downside. Eventually look for a sharp and excessive low to form, perhaps after the Beige Book Wedneday afternoon or after Fed Chairman Powell speaks Thursday morning. This could mark a tradable low into the coming weeks.

*Indexmodel is signaling the Bunker Buster, see Section V

II. RECAP OF THE ACTION

Choppy Monday with price grinding into the prior Friday’s heavy selling. More heavy selling early Tuesday (pre-market). Grind lower Wednesday. Bit of a rally Thursday afternoon and into about Friday lunch time. Then heavy selling Friday afternoon saw the Dow make a new low on the week while the other indices stayed above.

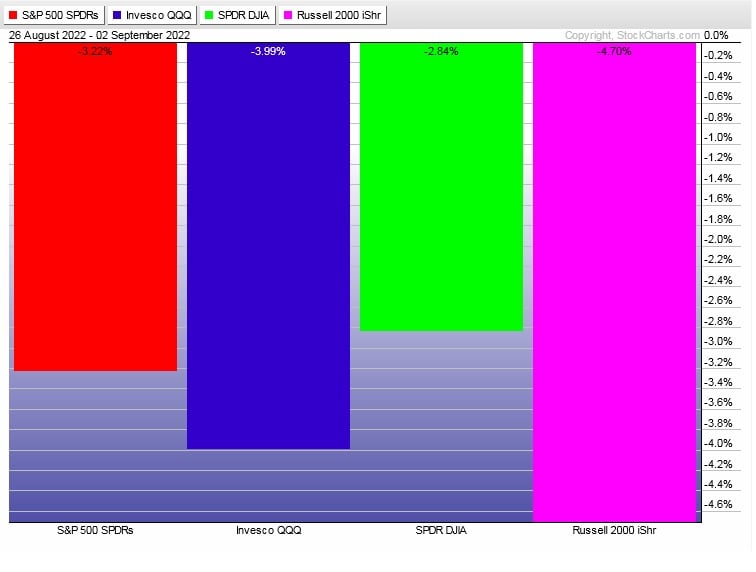

The last week performance of each major index is shown below:

Rotational Report:

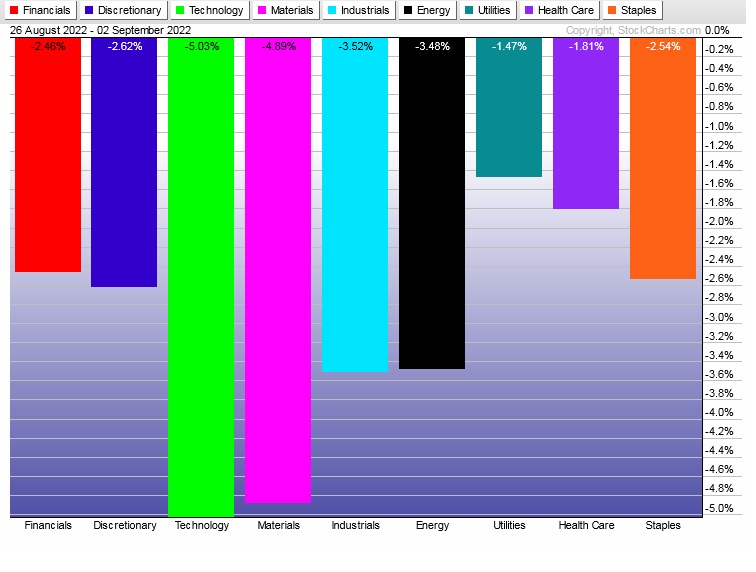

A second week of full on risk off rotation away from equities. This time not even the Energy sector was sprared. Tech leading lower.

bearish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Money flows skewed heavily to the sell side for a second week, this time with major sell flows hitting the tape, much strong than the prior weeks.

bearish

Here are this week’s results:

III. Stocklabs ACADEMY

Another Bunker Buster

The biggest change this report has seen in 2022 is the frequency of Bunker Busters. For many years, this signal only fired a few times a year. 2022 has just printed its fourth.

The most recent one was mid-June and did well to mark the lows. One could argue that today’s signal might also stick. If you zoom out to the daily charts, most major indices are still well above the June lows, and this could be considered a reasonable pull-back after that June-to-mid-July rally.

The contextual challenge is we have a hawkish Fed that is primarily focused on combating inflation. The talk out of Jackson Hole two weeks back was greeted with heavy selling and Fed banker Neel Kashkari went on one of the most popular podcasts in finance (Bloomberg’s Odd Lots) and said he was happy markets sold off.

Don’t fight the Fed has been a cautionary axiom for as long as I’ve been trading (about 17 years) and it has been one to heed.

All this to say yes, we have the ingredients for a rally quantitatively and technically, but we have a powerful actor arguably working to make it not happen.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Volatility increases early Tuesday with prices accelerating to the downside. Eventually look for a sharp and excessive low to form, perhaps after the Beige Book Wedneday afternoon or after Fed Chairman Powell speaks Thursday morning. This could mark a tradable low into the coming weeks.

Bias Book:

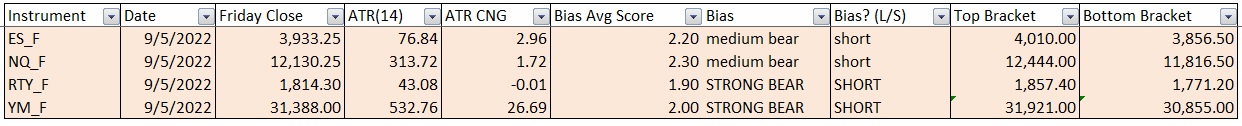

Here are the bias trades and price levels for this week:

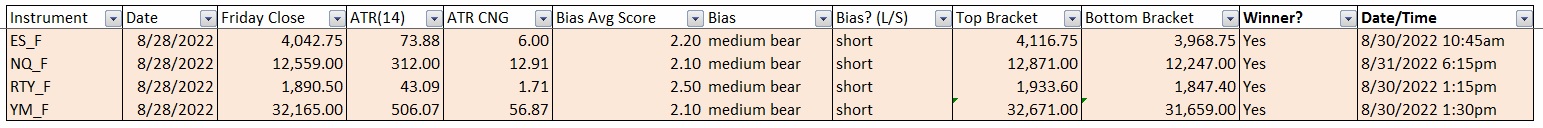

Here are last week’s bias trade results:

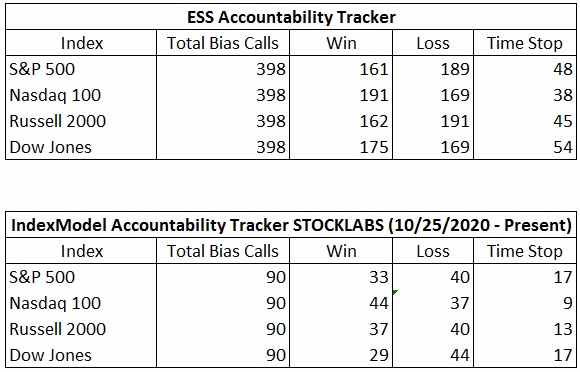

Bias Book Performance [11/17/2014-Present]:

Semiconductors blew out the bottom of our suspected range

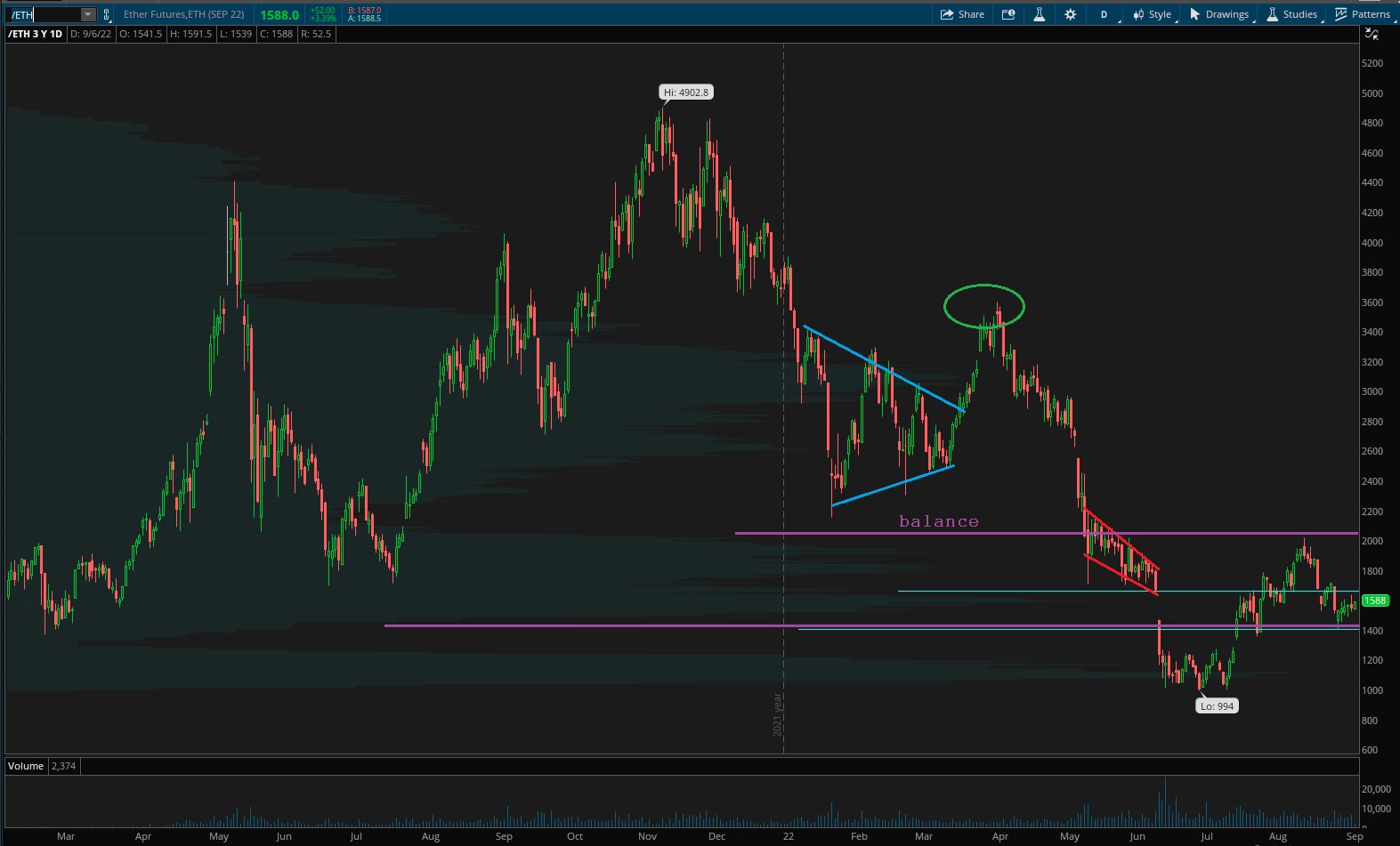

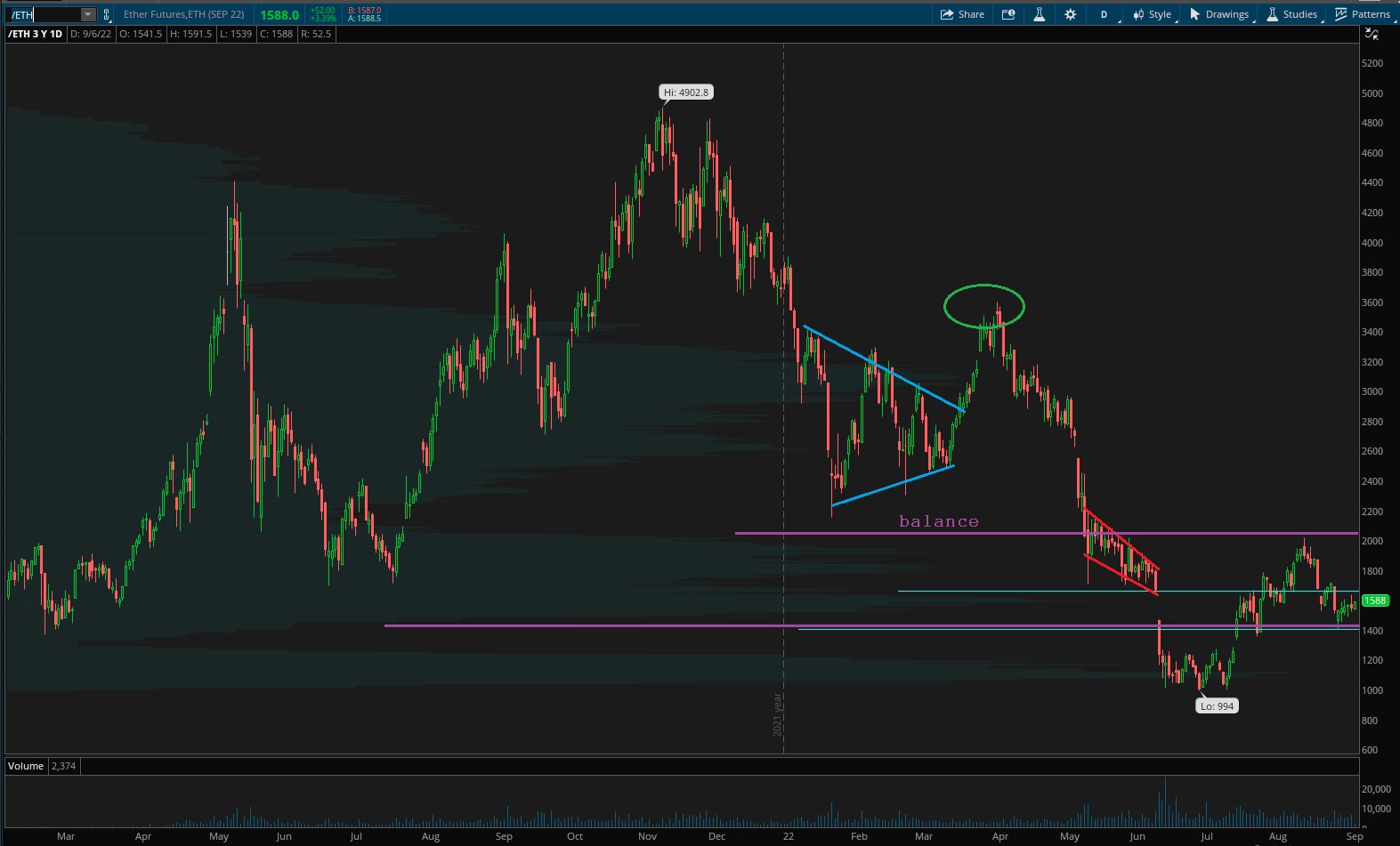

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

Leaving this note up until something changes: That weak low on Transports irks me. We’ve rallied far from it, that we’re likely to encounter support ahead of any retest of the lows, but it poses a risk to a sustainable low.

Transports do seem to be holding their new range for now.

See below:

Semiconductors pressed down through recent range. There could be a new, lower range setting up or perhaps another leg lower in discovery down.

Ether could be coming into balance between these two huge volume pockets.

V. INDEX MODEL

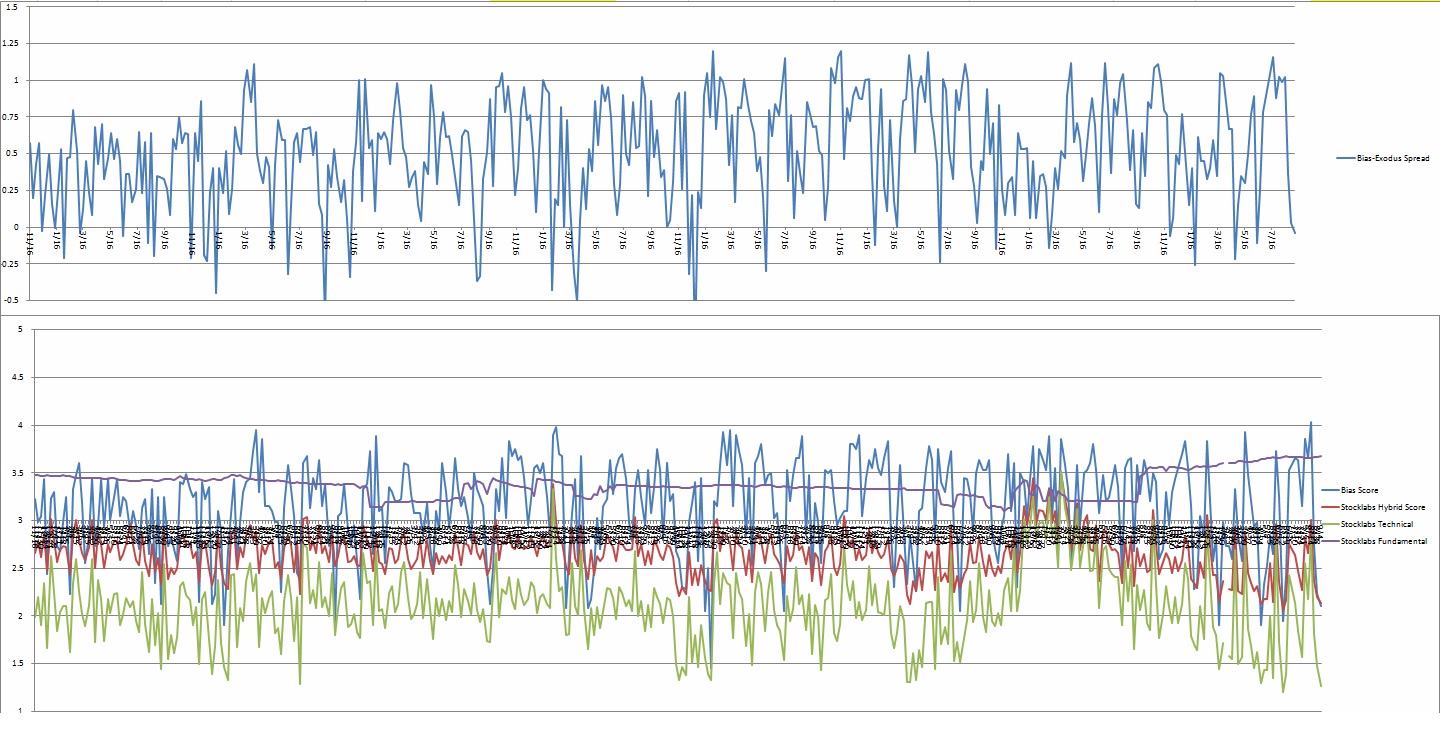

Bias model is signaling Bunker Buster. This signal calls for an acceleration to the downside. Eventually we could see a sharp, tradable low form. Overall expectation is for volatility to increase.

There were four Bunker Busters in recent history — nine weeks back, sixteen weeks ago, twenty-nine reports back and a third thirty-seven reports back.

This week’s report is the fifth (fourth in 2022).

Here is the current spread:

VI. QUOTE OF THE WEEK:

“He is most powerful who has power over himself.” – Seneca

Trade simple, reign in any impulses

If you enjoy the content at iBankCoin, please follow us on Twitter