Alright the good news is Stocklabs is alive and well and as useful as ever. I was able to put together a research report that I have about 80% confidence in which is better than nothing.

I still need to resolve this premium data fiasco if I am to power my market profile charts. That means I likely will not be actively trading NASDAQ futures Monday. But I put some emails out over the weekend, and I expect to be up-and-running by week’s end.

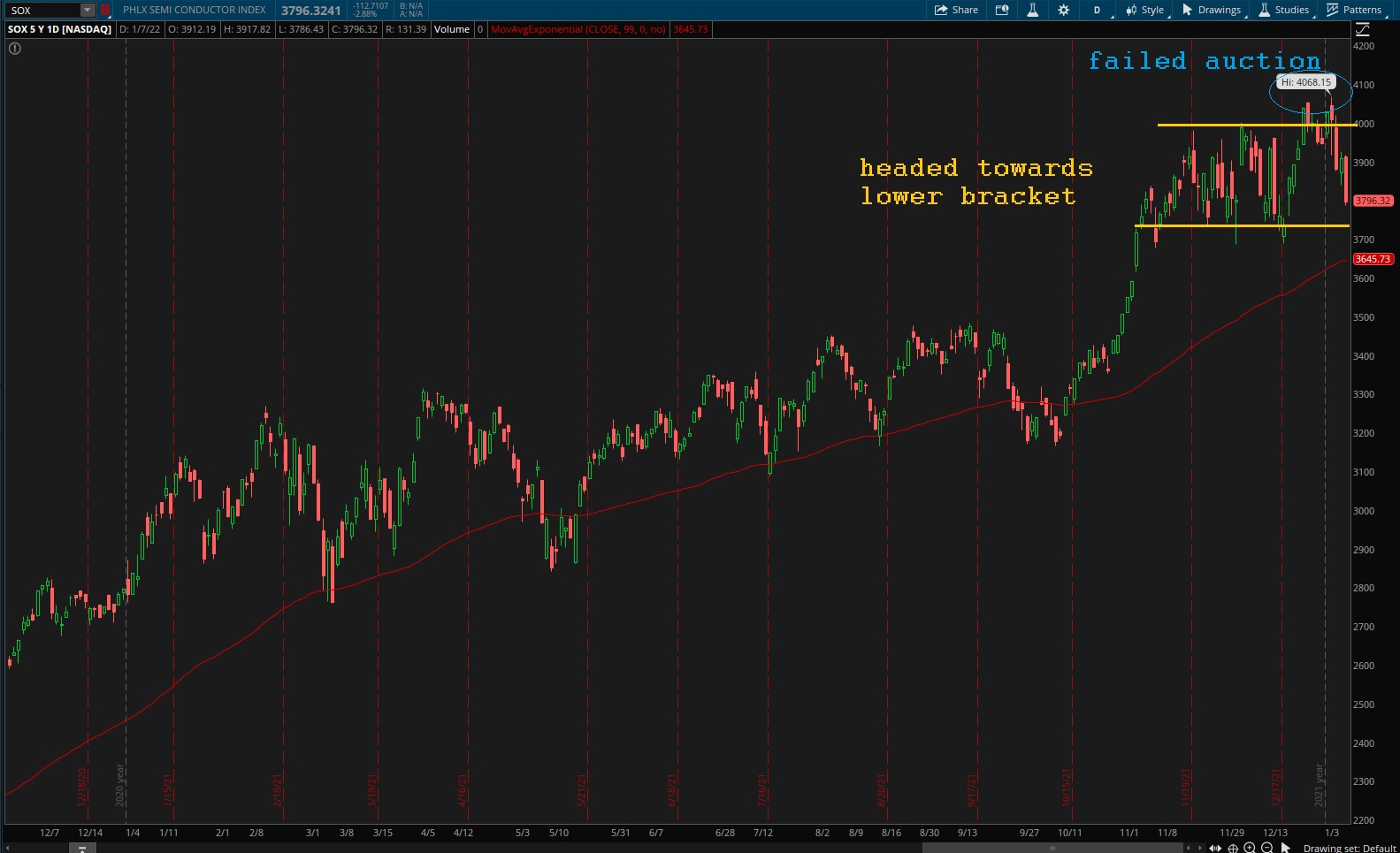

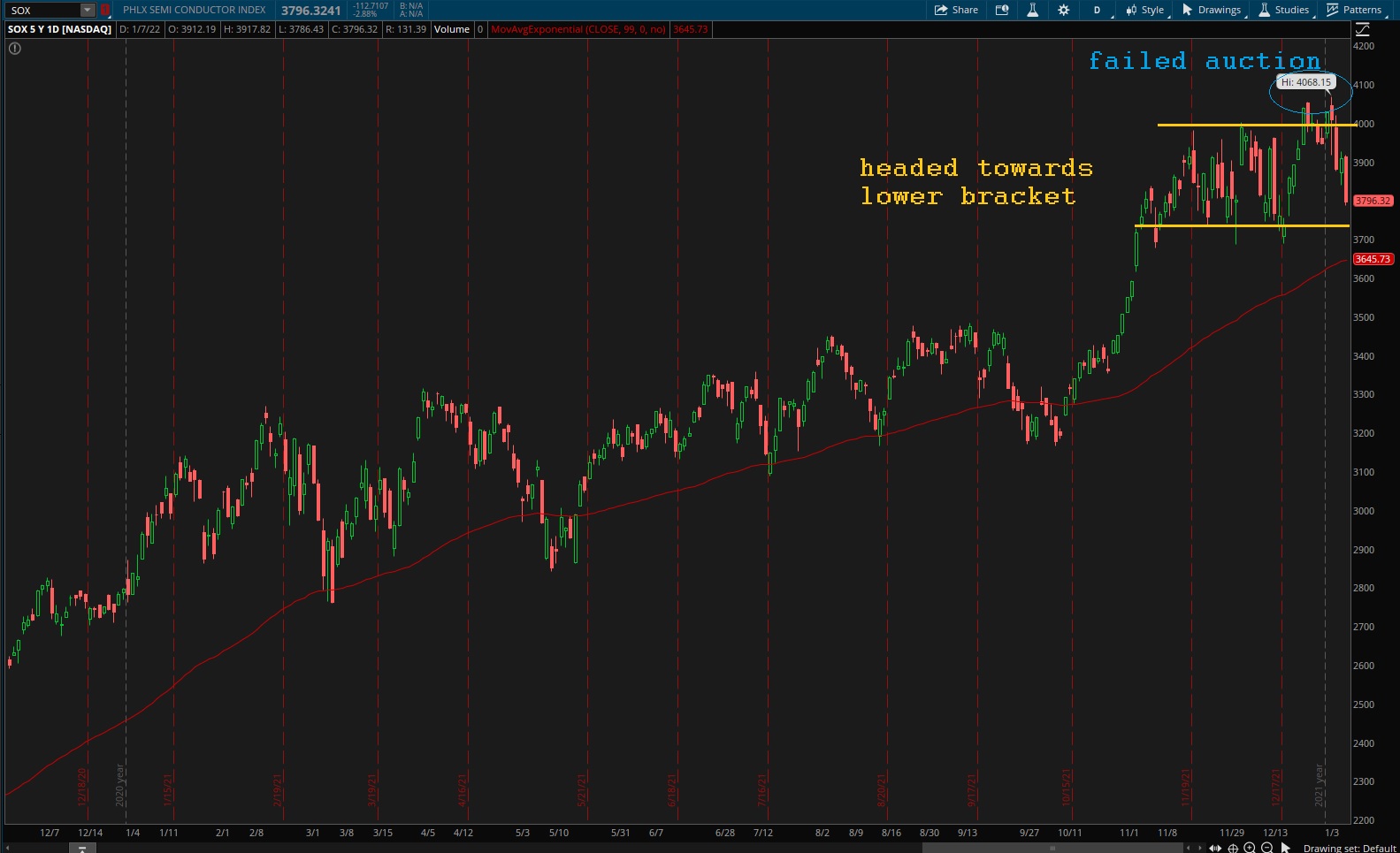

Some red flags jumped out, and while we may be temped to turn to popular Twitter accounts or to watch the television doom screen, the entire situation can be responsibly managed by keeping the PHLX semiconductor index pulled up on one of your screens at all times.

One of the market’s favorite behaviors is to test beyond a prior swing level, fail and sharply reverse. We call them failed auctions. Often it means our next course of action is to return to the midpoint of whatever balance we attempted to escape, and then the next move is a test of the opposite edge of balance.

Semiconductors are vital to the secular bull these we carried into the new decade. This could be the beginning of a meaningful correction. As always, we don’t know. But we have earning out of major component $TSM Thursday before the open and that may give us some clarity on whether semiconductors will continue to hold this big-ugly-year-long balance or begin to trend lower.

Another micro economic factor to keep on our radar re: semiconductors is the deal NVIDIA is perusing to acquire Arm Holdings. It is being held up by an FTC suit and E.U. investigation. The outcome would likely put some movement into the PHLX also. Elevated risk.

Any other seemingly meaningful “news” can likely be tuned out. It’s not going to help us find the clarity we need to work the tape well.

Okay for now, yes? We’ll take things as they come.

Raul Santos, January 9th, 2022

And now the 371st edition of Strategy Session. She’s a little dodgy, but enjoy:

Stocklabs Strategy Session: 01/10/22 – 01/14/22

I. Executive Summary

Raul’s bias score 2.58, medium bear. Sellers continue to pressure the tape lower through Tuesday morning. Then the action could become choppy with Fed’s Powell set to speak Tuesday at 10am. Keep an eye on the PHLX semiconductor index. It looks set up to probe the low-end of recent range. The behavior of the key index is likely to drive broad equity prices. Earnings out of Taiwan semiconductor Thursday morning are likely to provide visibility on direction heading into the end of the week.

II. RECAP OF THE ACTION

Some strength Monday to start the year. The Dow continued higher through Tuesday but stalled and formed a failed auction after making new record highs. Heavy selling Wednesday and grind lower for the rest of the week.

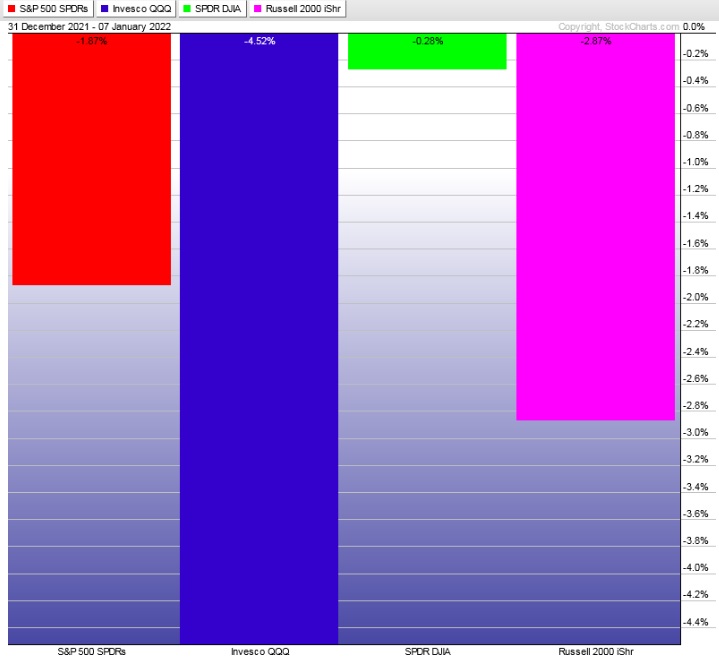

The last week performance of each major index is shown below:

Rotational Report:

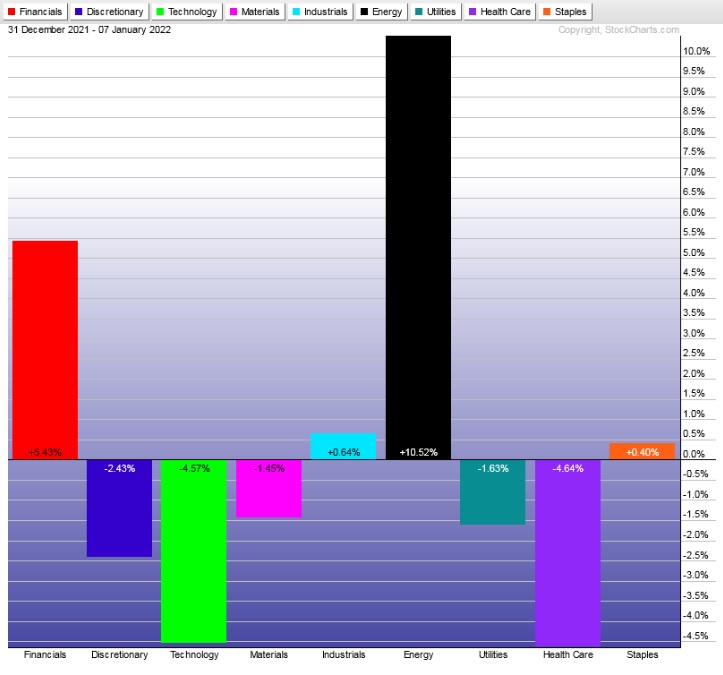

Discretionary and Tech once again under pressure along with Healthcare. Financials were strong, perhaps with investors positioning themselves early for the expected rate hikes later this year.

Energy continues to trade in its own world, vulnerable to geopolitical risk. The most recent risk is associated with violent protests and calls for removal of the current government in Kazakhstan.

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

The selling skews over the last eight weeks have been dominated by sellers. Last week’s skew was slightly to the negative side.

slightly bearish

Here are this week’s results:

III. Stocklabs ACADEMY

New year new volatility

Price calmly drifted into year end. As long as you were positioned with the biggest and best, it was a decent close to the year. Volatility returned during the first week of trade, even hitting Big Tech.

This environment has been kind on Financials though. I don’t particularly care for the sector, but I have been a big fan of Berkshire Hathaway, especially due to their recent commitment to diversity in the c-suite.

Investors carry guilt by nature. To have the ability to invest is a privilege, and then to make capital gains from doing nothing more than assuming risk can make one feel they’ve done something wrong.

That is why I look for investments into places that ease those troubles. Berkshire fits the bill and Buffet is the stuff of American folk lore.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Sellers continue to pressure the tape lower through Tuesday morning. Then the action could become choppy with Fed’s Powell set to speak Tuesday at 10am. Keep an eye on the PHLX semiconductor index. It looks set up to probe the low-end of recent range. The behavior of the key index is likely to drive broad equity prices. Earnings out of Taiwan semiconductor Thursday morning are likely to provide visibility on direction heading into the end of the week.

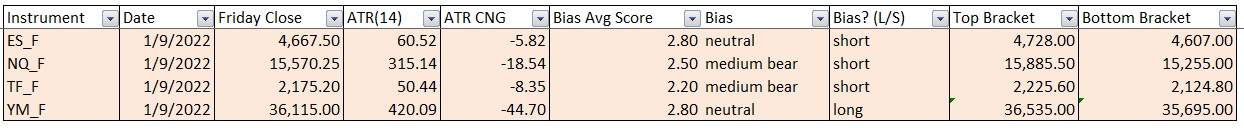

Bias Book:

Here are the bias trades and price levels for this week:

PHLX failed auction is a huge red flag

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

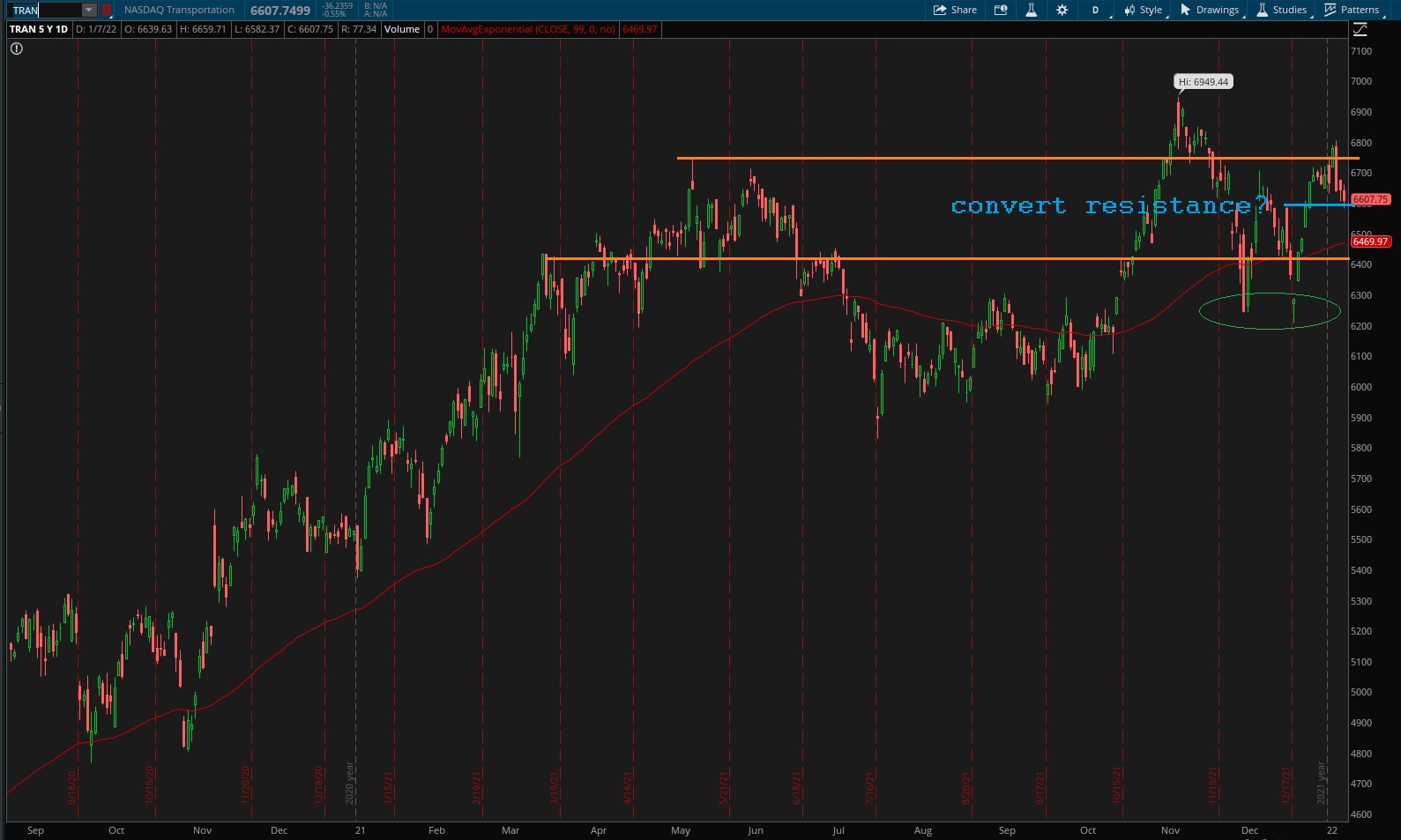

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index. Readers are encouraged to apply these techniques to all markets.

Transports made a strong move a few weeks back and have since retraced a portion of it. Buyers may come into the week intending to convert recent resistance around 6606 into support. Unlike semiconductors, transports have a mini failed auction below, which may help keep prices elevated. Earnings out of Delta Thursday morning might provide some clarity to this chart.

See below:

Semiconductors broke out from balance, made a new high, the auction stalled and failed and now we are back in range. This is a troubling set-up for bulls and is likely to lead to a test of the bottom of the recent range. It could lead to a much larger sell-off.

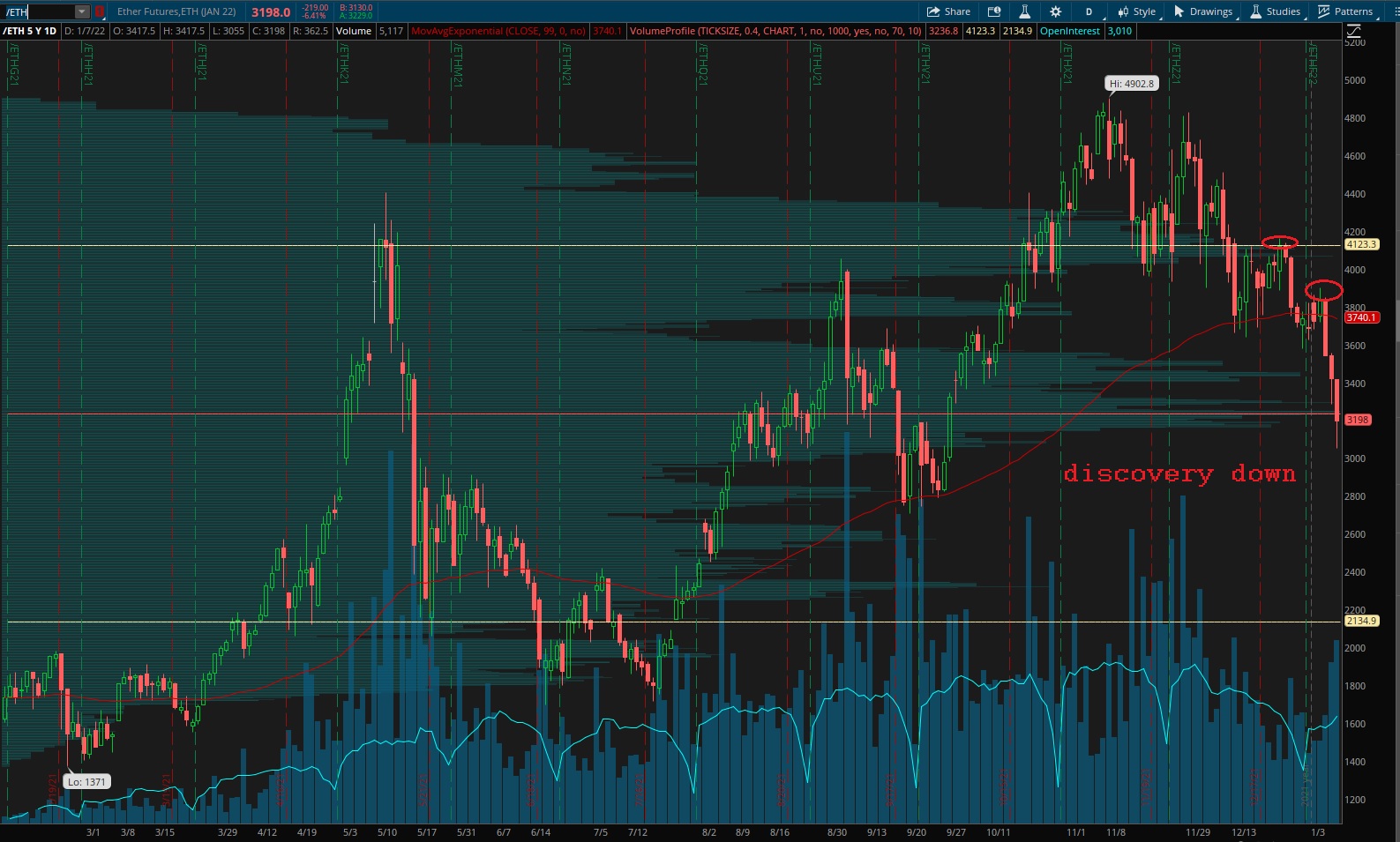

Ether will be monitored going forward as a third contextual component. The ethereum network currently has a market cap just under $500B. The PHLX is about $3.5T. Therefore while we analyze ether alongside semiconductors, we ought to give more contextual weight to semiconductors than ethereum.

Ethereum appears to be in a discovery down phase. Buyers have been defending the 3,000 millennial mark over the weekend, but there is no sign of clear balance yet. This chart is discovery down heading into week two of the year.

V. INDEX MODEL

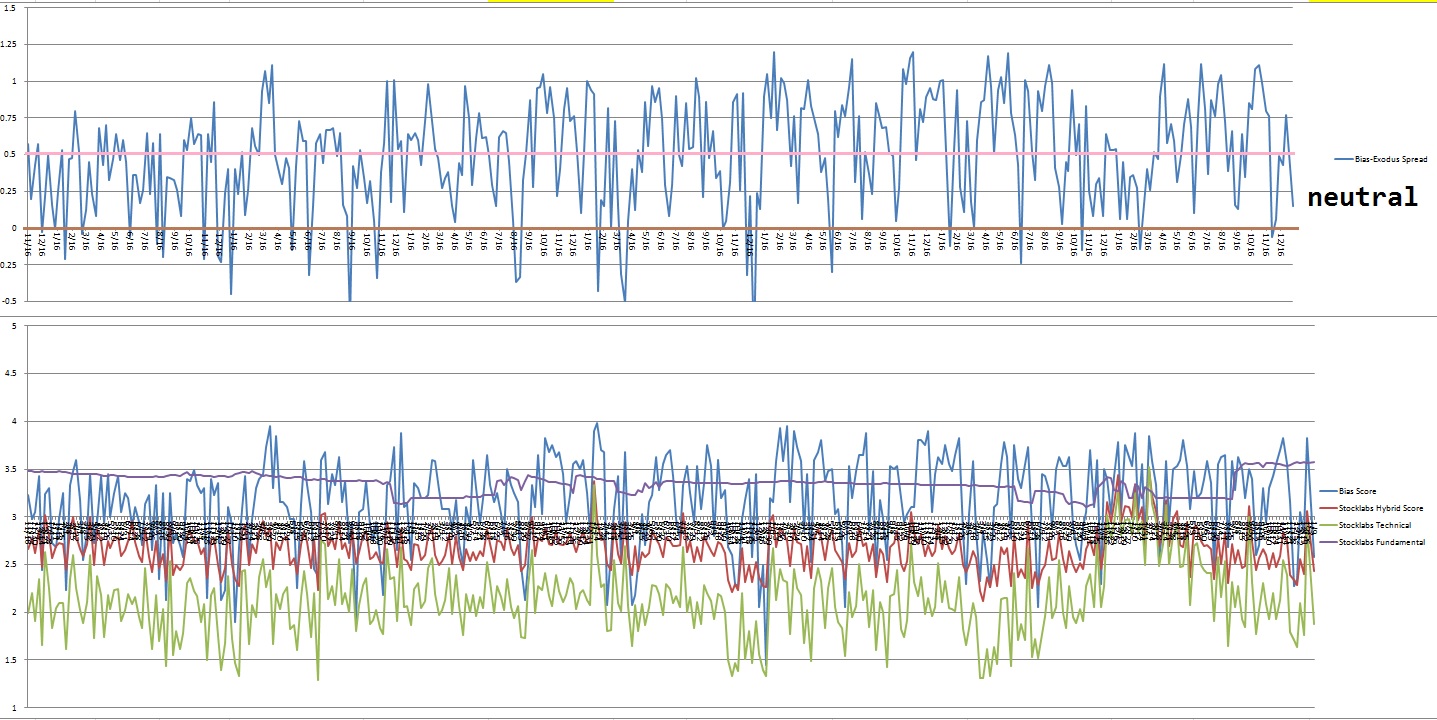

Bias model is neutral heading into the second week of 2022. Mode printed a Bunker Buster signal six reports back. The Bunker Buster before the most recent one was forty five weeks ago.

No bias heading into the week.

Here is the current spread:

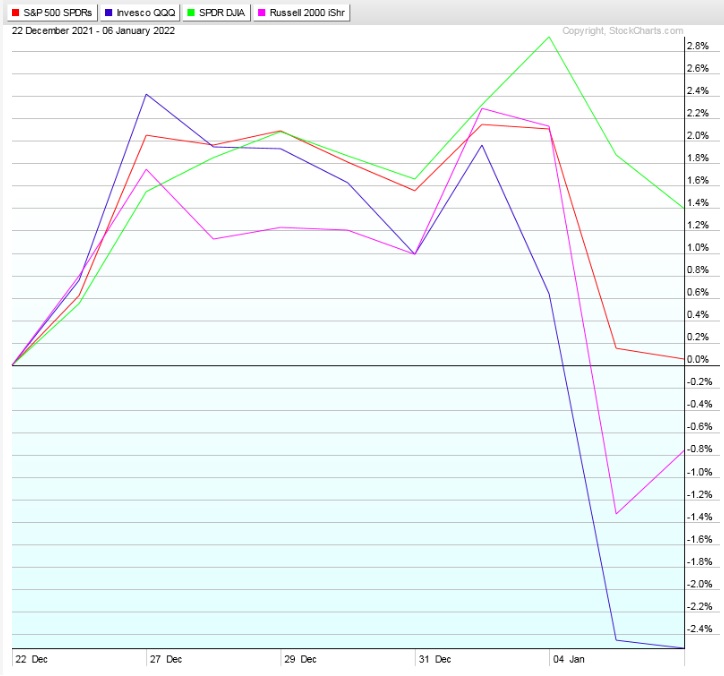

VI. 3 month Hybrid Overbought

On Wednesday, December 22nd Stocklabs went hybrid overbought on the 3-month algo. This happened right as the prior signal ended, thus generating a fresh 10-day cycle. This is a bullish cycle that ends Thursday, January 6th end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“I have observed that those who have accomplished the greatest results are those who “keep under the body”; are those who never grow excited or lose self-control, but are always calm, self-possessed, patient, and polite.” – Booker T. Washington

Trade simple, kindly

If you enjoy the content at iBankCoin, please follow us on Twitter