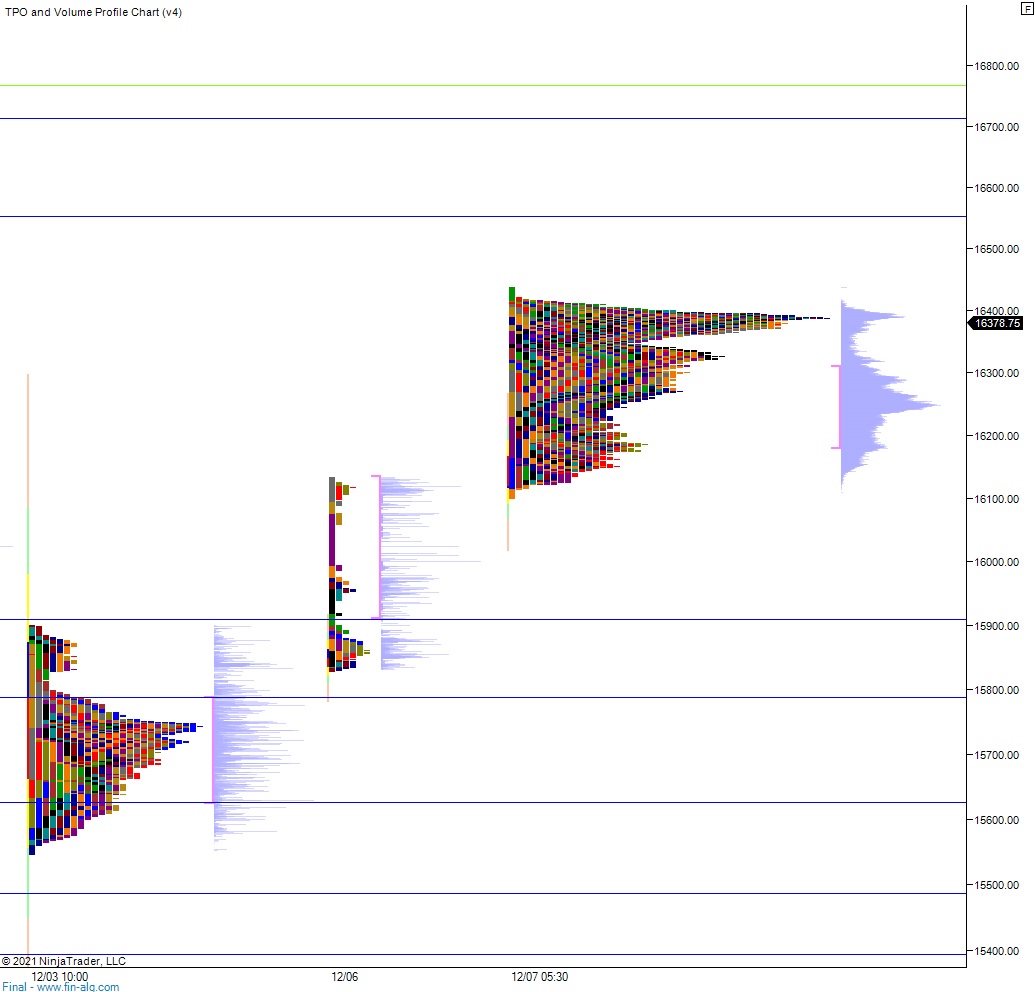

NASDAQ futures are coming into the second full week of December with a slight gap up after an overnight session featuring extreme range on elevated volume. Price worked higher overnight, trading up up near last week’s high but not quite taking it out. As we approach cash open price is hovering in last Thursday’s upper quadrant.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

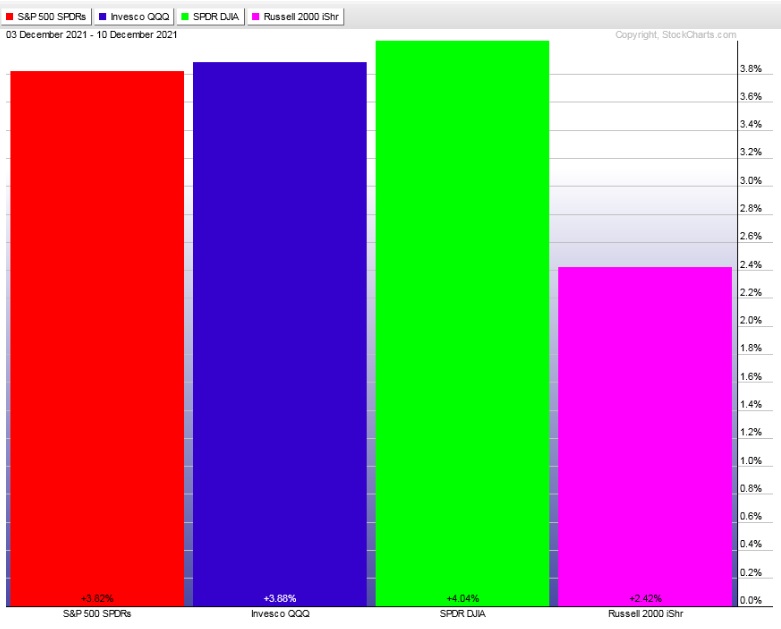

Last week was choppy and flat early Monday before a late-day rally. Then we had a pro gap up Tuesday. Most everything held the pro gap for the rest of the week, closing on a strong note, except for the Russell which faded into the weekend.

The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral extreme up. The day began with a gap up in range. A brief test higher at the open tagged the Thursday volume point of control before sellers stepped in and began working a gap fill. Buyers stepped in ahead of the gap fill and shot price up through the midpoint, only to be rejected by sellers who soon pushed into an early range extension down on their way to filling the overnight gap. That would be the end of the day’s selling. Sellers could not take out Thursday low despite being so close. Buyers reclaimed the mid by lunch and we spent most the rest of the session chopping above it befoer a late-day ramp pushed us into a neutral print.

Heading into today my primary expectation is for buyers to press up through overnight high 16,413 setting up a run to 16,500.

Hypo 2 stronger buyers trade up to 16,552.25 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 16,320.75. Look for buyers down at 16,300 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: