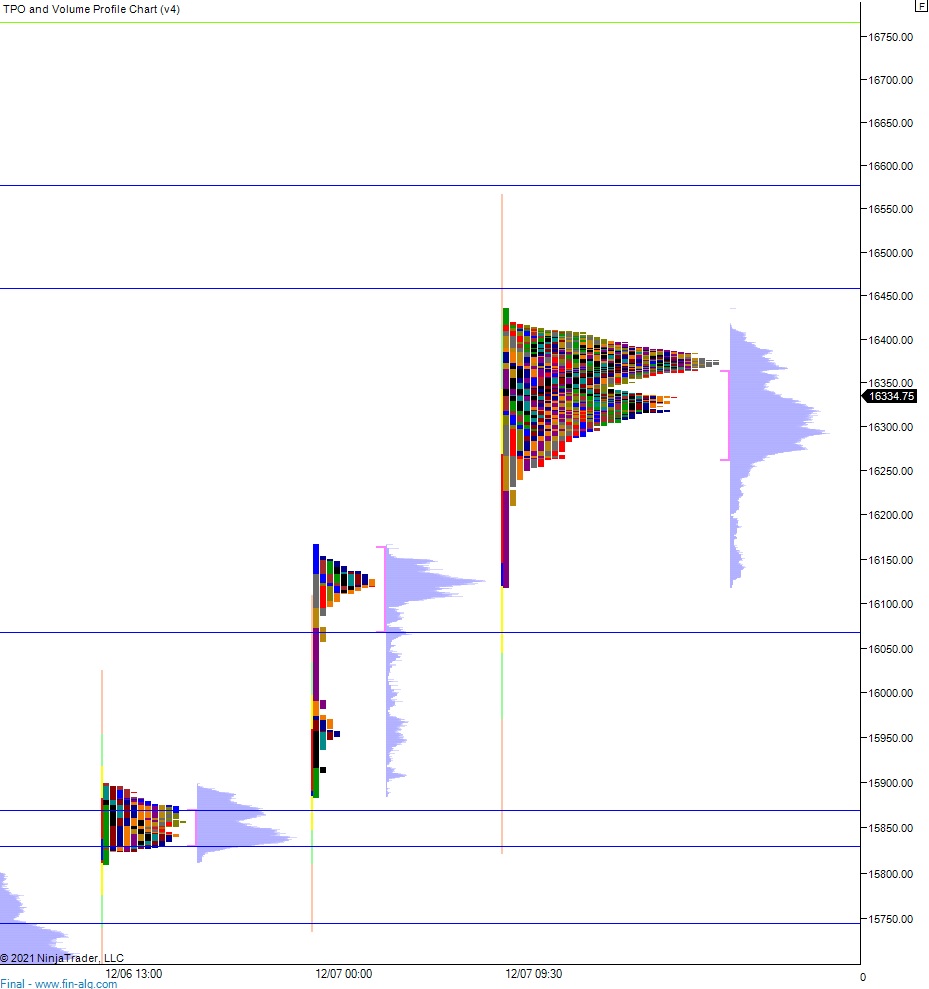

NASDAQ futures are coming into the second Thursday in December gap down after an overnight session featuring extreme range on elevated volume. Price poked up through the Wednesday high shortly after the close yesterday. Since then it has been slowly rotating lower. At 8:30am jobless claims data came out much better than expected (through seasonality factors may attribute) and as we approach cash open price is hovering along the Wednesday midpoint.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by a 30-year bond auction at 1pm.

Yesterday we printed a normal variation up. The day began with a slight gap down in range. Sellers drove lower off the open, driving down near the midpoint, then they held the mid and made a second attempt lower but failed. This set up a gap fill and poke up beyond the Tuesday high. This was met with sharp selling and price faded down through the mid. Price chopped along the bottom-side of the mid until about 11:15am but could not take out initial balance low. Instead buyers pivoted the mid during New York lunch and just before 2pm we were range extension up. There was one last check back tot he mid before a rally into the bell.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 16,381.75. From here buyers continue higher, tagging 16,459.75 before two way trade ensues.

Hypo 2 stronger buyers tag 16,500.

Hypo 3 sellers press down through Wednesday low 16,251.50 setting up a tag of 16,200.

Levels:

Volume profiles, gaps and measured moves: