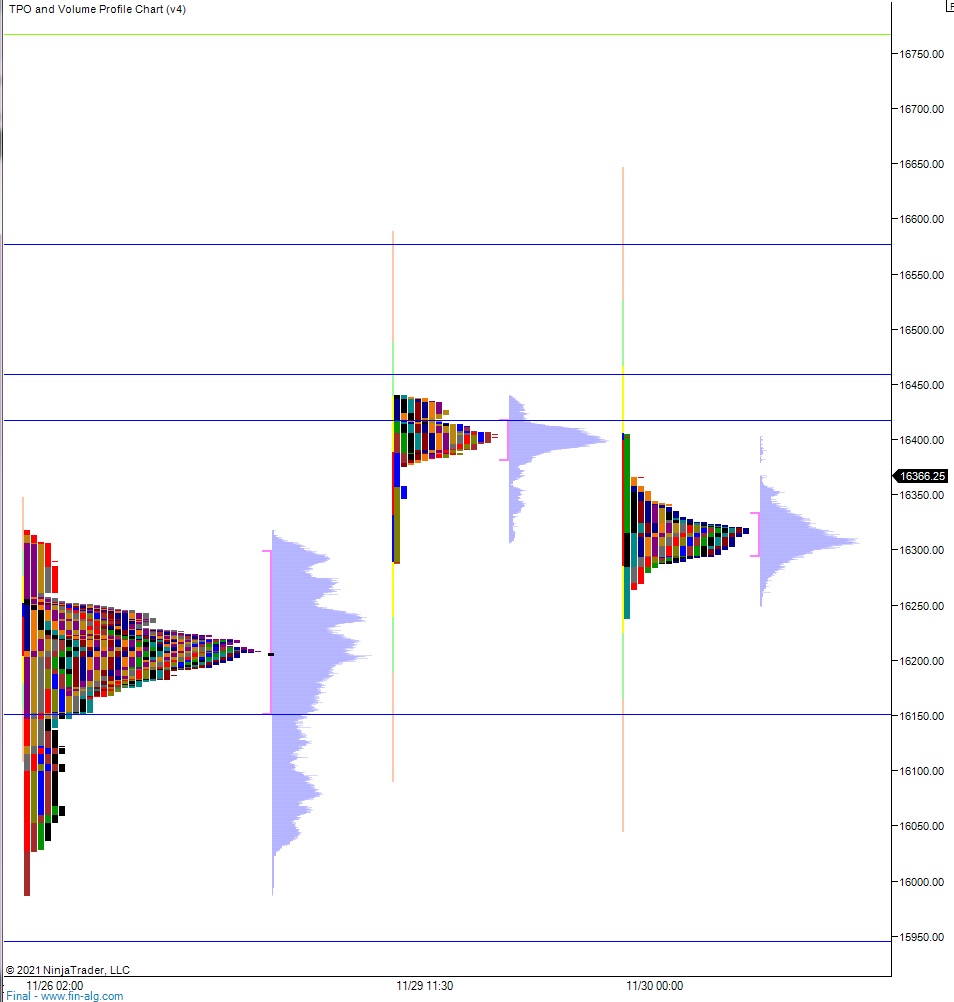

NASDAQ futures are coming into the final day of November gap down in range after an overnight session featuring extreme range and volume. Price ticked up beyond the Monday high around 9:30pm New York Monday evening and then fell down through the Monday midpoint on heavy selling that lasted until about 1am. Sellers weren’t able to take out the Monday low, instead price stablized after returing to the Monday midpoint. Around 4:30am Fed fund futures over at the cme indicated that participants were no longer expecting a July 2022 rate hike, pushing the expectation of a 25 basis point hike out to September:

U.S. MONEY MARKETS PUSH BACK FED RATE HIKE EXPECTATIONS, NOW FULLY PRICE A 25 BPS RISE IN SEPT 2022 VS JULY LAST WEEK

U.S. 30-YEAR TREASURY YIELD FALLS 6 BASIS POINTS TO 3-WEEK LOW AT 1.812%

— *Walter Bloomberg (@DeItaone) November 30, 2021

At 9am case shiller home price index came out in line with expectations, and as we approach cash open price is hovering above the Monday midpoint.

Also on the economic calendar today we have Chicago PMI at 9:45am and then consumer confidence at 10am. Also at 10am Fed Chairman Powell is set to speak. Then at 11:30am there is a 52-week T-bill auction.

Yesterday we printed a double distribution trend up. The day began with a gap up near the Friday high, leaving some of the panic of Friday down in the hole. There was a two-way battle for the first few hours. Buyers made an early surge towards the Friday high and stalled just before taking it out. Price fell down through the mid but could not go range extension down. Instead buyers heaved price to a range extension up and out of the Friday range. This triggered a rally that checked back to the scene of the omicron news, paused then continued higher, trading up beyond last Tuesday’s high as we chopped along the high into the close.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 16,402.25. From here buyers continue higher, taking out overnight high 16,441. Look for sellers up at 16,459 and for two way trade to ensue.

Hypo 2 stronger buyers trade up to 16,500 before two way trade ensues.

Hypo 3 sellers press down through overnight low 16,238.50 setting up a move down to 16,200.

Levels:

Volume profiles, gaps and measured moves: