NASDAQ futures are coming into the third week of November gap up about +60 after an overnight session featuring elevated range on normal volume. Price worked higher overnight, trading up into last Tuesday’s range. As we approach cash open price is hovering below the Tuesday midpoint.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

Walmart is set to report earnings Tuesday before-market-open.

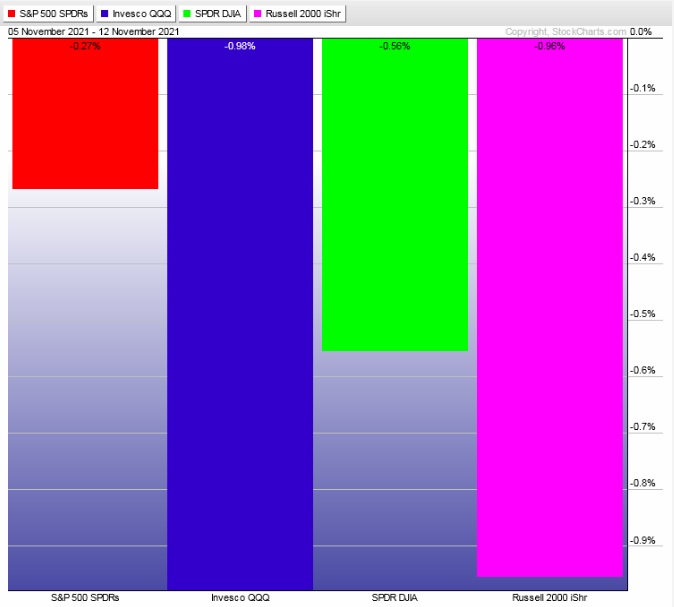

Last week stock indices topped out early Monday then sort of just of calmly drifted lower until some buyers stepped in Friday and bounced ahead of the weekend.

The last week performance of each major index is shown below:

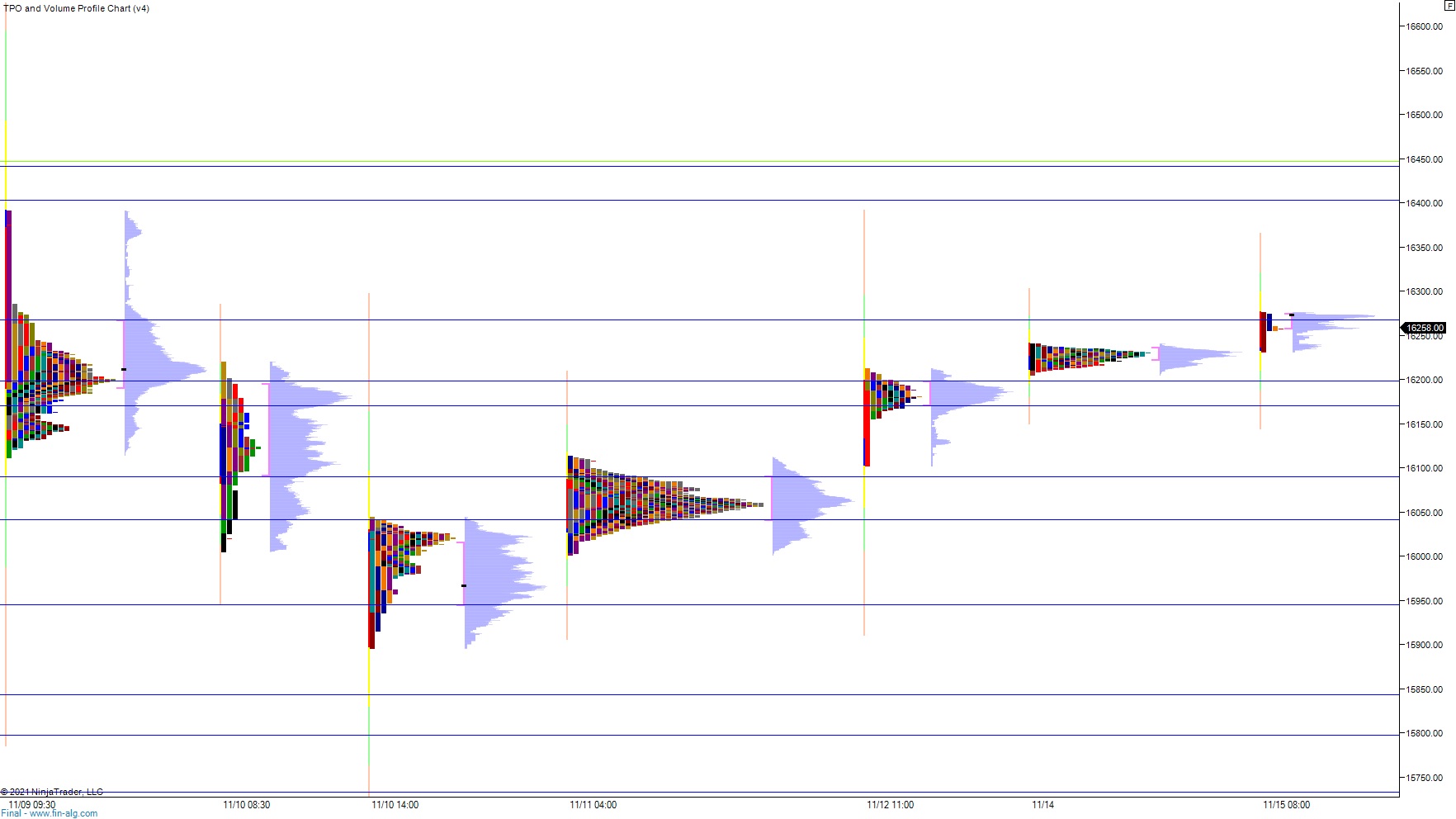

On Friday the NASDAQ printed a double distribution trend up. The day began with a gap up in range, right near the Thursday volume point of control. Sellers drove into the open, effectively closing the overnight gap and probing a few ticks below the Thursday low before failing. Then the auction sharply reversed higher, reclaiming the mid then defending it to set up a rally up through the Thursday high. Buyers continue their campaign and recaptured the Wednesday selling. We ended the day chopping along the Wednesday high.

Heading into today my primary expectation is for buyers to gap-and-go higher, tagging 16,300.

Hypo 2 stronger buyers tag 16,383.75.

Hypo 3 sellers work into overnight inventory and close the gap down to 16,195.25. Look for buyers just below and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: