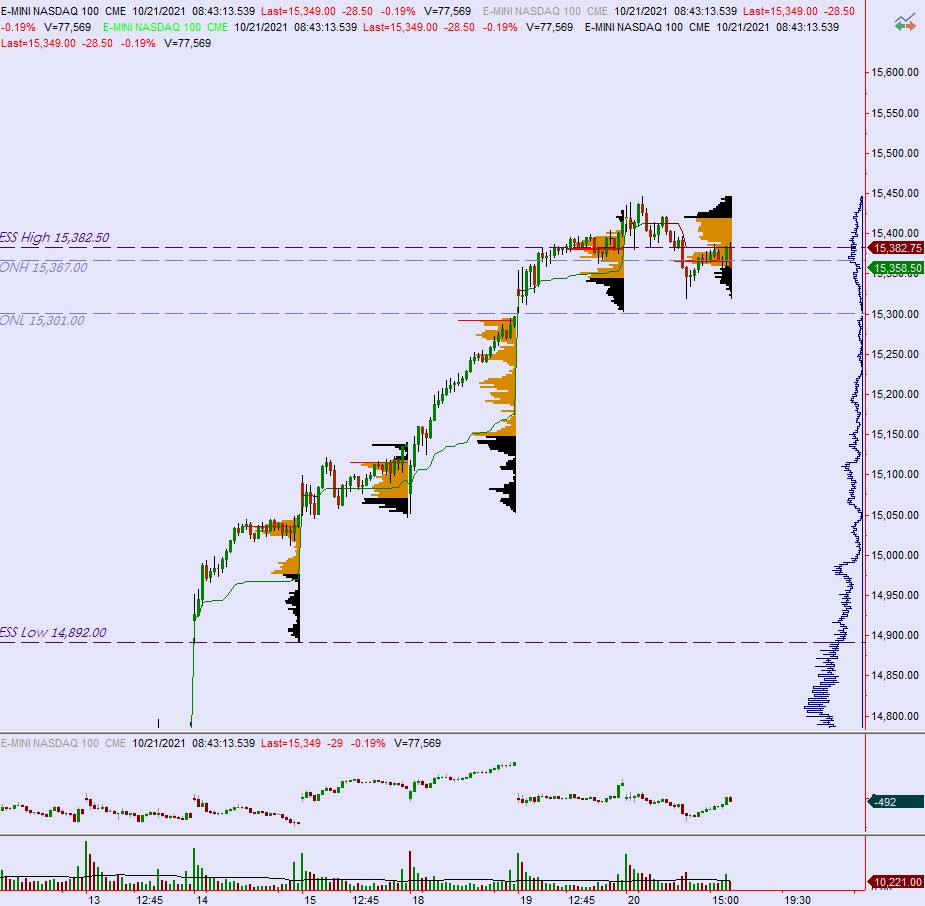

NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring normal range and elevated volume. Price was balanced overnight, bouncing along the lows of Wednesday and briefly probing below them. As we approach cash open price is hovering inside the Wednesday lows.

Also on the economic calendar today we have existing home sales at 10am followed by 4- and 8-week T-bill auctions at 11:30am. There is also a 5-year TIPS auction at 1pm.

Yesterday major robotics company and NASDAQ component Tesla reported stronger-than-expected earnings, posting a third quarter profit of $1.62 per share vs $1.58 expectations. TSLA shares are about -1.4% in premarket trade.

After the bell today Intel is set to report earnings.

Yesterday we printed a normal variation down. The case could be made that it was a neutral day, but only on a slight technicality. Price did briefly go range extension up just after 10:30am. Very briefly. Soon after sellers took control of the midpoint and from noon onward they defended it, eventually pushing us into a range extension down that push down near (but did not exceed) the Tuesday low. Price sort of chopped along the bottom-side of the midpoint after that and into settlement.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 15,358.50. Look for sellers up at 15,400 and for two way trade to ensue.

Hypo 2 stronger buyers push up through Wednesday high 15,446.50 and tag 15,450 before two way trade ensues.

Hypo 3 sellers push down through overnight low 15,301 before two way trade ensues.

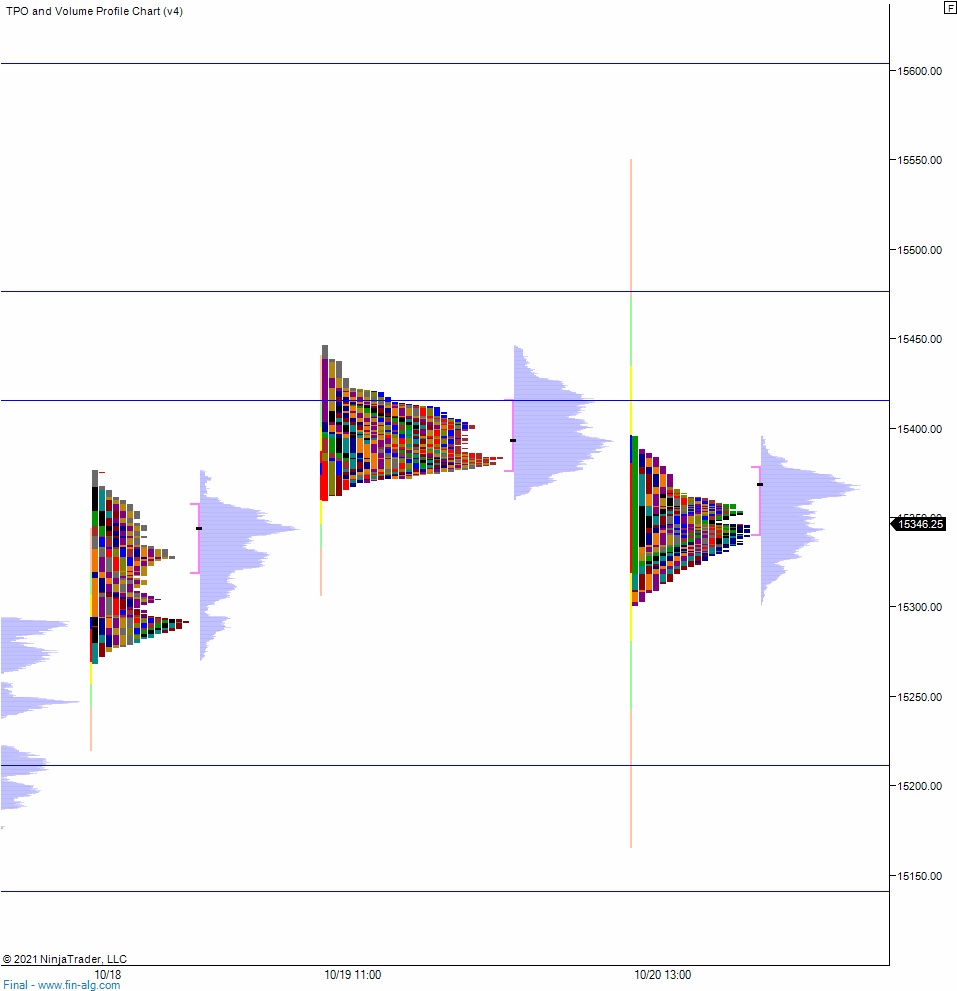

Levels:

Volume profiles, gaps and measured moves: